Automating Trading Strategies in MQL5 (Part 25): Trendline Trader with Least Squares Fit and Dynamic Signal Generation

In this article, we develop a trendline trader program that uses least squares fit to detect support and resistance trendlines, generating dynamic buy and sell signals based on price touches and open positions based on generated signals.

Information Storage and View

The article deals with convenient and efficient methods of information storage and viewing. Alternatives to the terminal standard log file and the Comment() function are considered here.

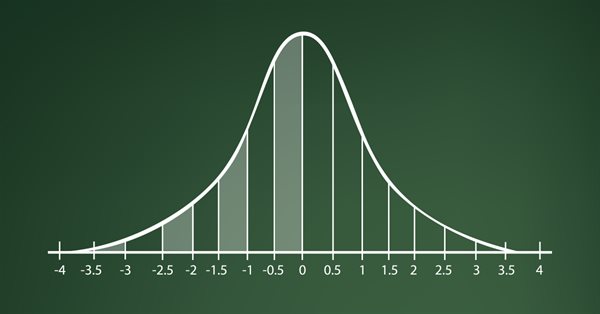

Learn how to design a trading system by Standard Deviation

Here is a new article in our series about how to design a trading system by the most popular technical indicators in MetaTrader 5 trading platform. In this new article, we will learn how to design a trading system by Standard Deviation indicator.

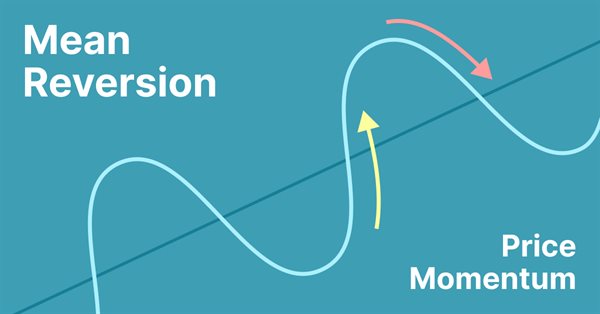

Simple Mean Reversion Trading Strategy

Mean reversion is a type of contrarian trading where the trader expects the price to return to some form of equilibrium which is generally measured by a mean or another central tendency statistic.

Automating Trading Strategies in MQL5 (Part 24): London Session Breakout System with Risk Management and Trailing Stops

In this article, we develop a London Session Breakout System that identifies pre-London range breakouts and places pending orders with customizable trade types and risk settings. We incorporate features like trailing stops, risk-to-reward ratios, maximum drawdown limits, and a control panel for real-time monitoring and management.

The Inverse Fair Value Gap Trading Strategy

An inverse fair value gap(IFVG) occurs when price returns to a previously identified fair value gap and, instead of showing the expected supportive or resistive reaction, fails to respect it. This failure can signal a potential shift in market direction and offer a contrarian trading edge. In this article, I'm going to introduce my self-developed approach to quantifying and utilizing inverse fair value gap as a strategy for MetaTrader 5 expert advisors.

Econometric Approach to Analysis of Charts

This article describes the econometric methods of analysis, the autocorrelation analysis and the analysis of conditional variance in particular. What is the benefit of the approach described here? Use of the non-linear GARCH models allows representing the analyzed series formally from the mathematical point of view and creating a forecast for a specified number of steps.

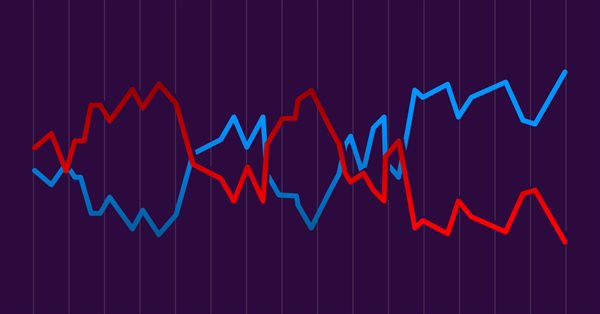

Pair trading

In this article, we will consider pair trading, namely what its principles are and if there are any prospects for its practical application. We will also try to create a pair trading strategy.

Combinatorics and probability for trading (Part IV): Bernoulli Logic

In this article, I decided to highlight the well-known Bernoulli scheme and to show how it can be used to describe trading-related data arrays. All this will then be used to create a self-adapting trading system. We will also look for a more generic algorithm, a special case of which is the Bernoulli formula, and will find an application for it.

Developing Zone Recovery Martingale strategy in MQL5

The article discusses, in a detailed perspective, the steps that need to be implemented towards the creation of an expert advisor based on the Zone Recovery trading algorithm. This helps aotomate the system saving time for algotraders.

Learn how to design a trading system by Williams PR

A new article in our series about learning how to design a trading system by the most popular technical indicators by MQL5 to be used in the MetaTrader 5. In this article, we will learn how to design a trading system by the Williams' %R indicator.

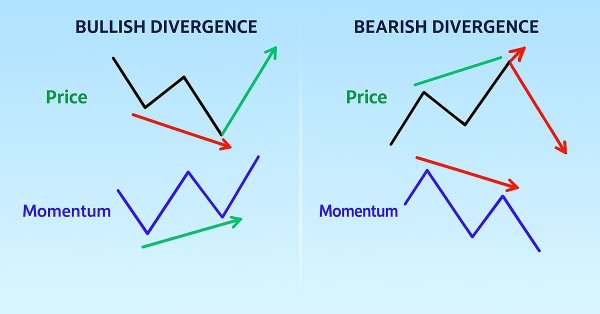

Automating Trading Strategies in MQL5 (Part 37): Regular RSI Divergence Convergence with Visual Indicators

In this article, we build an MQL5 EA that detects regular RSI divergences using swing points with strength, bar limits, and tolerance checks. It executes trades on bullish or bearish signals with fixed lots, SL/TP in pips, and optional trailing stops. Visuals include colored lines on charts and labeled swings for better strategy insights.

How to deal with lines using MQL5

In this article, you will find your way to deal with the most important lines like trendlines, support, and resistance by MQL5.

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

Combinatorics and probability theory for trading (Part II): Universal fractal

In this article, we will continue to study fractals and will pay special attention to summarizing all the material. To do this, I will try to bring all earlier developments into a compact form which would be convenient and understandable for practical application in trading.

Controlling the Slope of Balance Curve During Work of an Expert Advisor

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Somehow, you need to correct the operation of the Expert Advisor as it accumulates the results of trading. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve.

Learn how to design a trading system by OBV

This is a new article to continue our series for beginners about how to design a trading system based on some of the popular indicators. We will learn a new indicator that is On Balance Volume (OBV), and we will learn how we can use it and design a trading system based on it.

On the Long Way to Be a Successful Trader - The Two Very First Steps

The main point of this article is to show a practical way to implement an effective MM. This can be achieved only by using a certain kind of strategies that we need to identify and describe first. In the following we’ll cover the basic concepts of how to build such a strategy and we’ll point out the common mistakes which always end up in draining a trader’s account.

Developing a trading Expert Advisor from scratch (Part 19): New order system (II)

In this article, we will develop a graphical order system of the "look what happens" type. Please note that we are not starting from scratch this time, but we will modify the existing system by adding more objects and events on the chart of the asset we are trading.

MQL5 Cookbook: Handling BookEvent

This article considers BookEvent - a Depth of Market event, and the principle of its processing. An MQL program, handling states of Depth of Market, serves as an example. It is written using the object-oriented approach. Results of handling are displayed on the screen as a panel and Depth of Market levels.

Learn how to design a trading system by Accelerator Oscillator

A new article from our series about how to create simple trading systems by the most popular technical indicators. We will learn about a new one which is the Accelerator Oscillator indicator and we will learn how to design a trading system using it.

Swaps (Part I): Locking and Synthetic Positions

In this article I will try to expand the classic concept of swap trading methods. I will explain why I have come to the conclusion that this concept deserves special attention and is absolutely recommended for study.

An Example of Developing a Spread Strategy for Moscow Exchange Futures

The MetaTrader 5 platform allows developing and testing trading robots that simultaneously trade multiple financial instruments. The built-in Strategy Tester automatically downloads required tick history from the broker's server taking into account contract specifications, so the developer does not need to do anything manually. This makes it possible to easily and reliably reproduce trading environment conditions, including even millisecond intervals between the arrival of ticks on different symbols. In this article we will demonstrate the development and testing of a spread strategy on two Moscow Exchange futures.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

Installing MetaTrader 5 and Other MetaQuotes Apps on HarmonyOS NEXT

Easily install MetaTrader 5 and other MetaQuotes apps on HarmonyOS NEXT devices using DroiTong. A detailed step-by-step guide for your phone or laptop.

Neural networks made easy (Part 26): Reinforcement Learning

We continue to study machine learning methods. With this article, we begin another big topic, Reinforcement Learning. This approach allows the models to set up certain strategies for solving the problems. We can expect that this property of reinforcement learning will open up new horizons for building trading strategies.

The Liquidity Grab Trading Strategy

The liquidity grab trading strategy is a key component of Smart Money Concepts (SMC), which seeks to identify and exploit the actions of institutional players in the market. It involves targeting areas of high liquidity, such as support or resistance zones, where large orders can trigger price movements before the market resumes its trend. This article explains the concept of liquidity grab in detail and outlines the development process of the liquidity grab trading strategy Expert Advisor in MQL5.

Combinatorics and probability for trading (Part V): Curve analysis

In this article, I decided to conduct a study related to the possibility of reducing multiple states to double-state systems. The main purpose of the article is to analyze and to come to useful conclusions that may help in the further development of scalable trading algorithms based on the probability theory. Of course, this topic involves mathematics. However, given the experience of previous articles, I see that generalized information is more useful than details.

Automating Trading Strategies in MQL5 (Part 3): The Zone Recovery RSI System for Dynamic Trade Management

In this article, we create a Zone Recovery RSI EA System in MQL5, using RSI signals to trigger trades and a recovery strategy to manage losses. We implement a "ZoneRecovery" class to automate trade entries, recovery logic, and position management. The article concludes with backtesting insights to optimize performance and enhance the EA’s effectiveness.

Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

In this article, we automate the Head and Shoulders pattern in MQL5. We analyze its architecture, implement an EA to detect and trade it, and backtest the results. The process reveals a practical trading algorithm with room for refinement.

Everything you need to learn about the MQL5 program structure

Any Program in any programming language has a specific structure. In this article, you will learn essential parts of the MQL5 program structure by understanding the programming basics of every part of the MQL5 program structure that can be very helpful when creating our MQL5 trading system or trading tool that can be executable in the MetaTrader 5.

Advantages of MQL5 Signals

Trading Signals service recently introduced in MetaTrader 5 allows traders to copy trading operations of any signals provider. Users can select any signal, subscribe to it and all deals will be copied at their accounts. Signals providers can set their subscription prices and receive a fixed monthly fee from their subscribers.

Checking the Myth: The Whole Day Trading Depends on How the Asian Session Is Traded

In this article we will check the well-known statement that "The whole day trading depends on how the Asian session is traded".

Multiple indicators on one chart (Part 04): Advancing to an Expert Advisor

In my previous articles, I have explained how to create an indicator with multiple subwindows, which becomes interesting when using custom indicators. This time we will see how to add multiple windows to an Expert Advisor.

Building and testing Keltner Channel trading systems

In this article, we will try to provide trading systems using a very important concept in the financial market which is volatility. We will provide a trading system based on the Keltner Channel indicator after understanding it and how we can code it and how we can create a trading system based on a simple trading strategy and then test it on different assets.