Developing a cross-platform Expert Advisor to set StopLoss and TakeProfit based on risk settings

Introduction

As you probably know, following of money management rules is highly recommended for any trading. It means that one is not recommended to enter a trade in which more than N% of deposit can be lost.

N is chosen by the trader. In order to comply with this rule, one should correctly calculate the trading lot value.

At relevant master classes, presenters usually show a ready Excel file, which includes relevant lot calculation formulas for each symbol. And thus they obtain the required lot value by "simply entering" their stop loss value.

Is this really that "simple"? The lot calculation operation can take a minute or more. So when you finally determine the lot size, the price

can move very far from the intended entry point. Moreover, this requires from you performing of extra operations. Another disadvantage of

this method, is that manual calculations often increase the chance of making an error.

So let's try make this process really simple. To do this, we will create an Expert Advisor for setting the opening and Stop Loss prices in the

visual mode. Based on these parameters and your risk value, the EA will set the appropriate lot value and will open a position in the relevant

direction.

Task definition

We have outlined the first task.

Another task that will be performed by our Expert Advisor is setting a Take Profit price based on the preferred TP to SL ratio.

Gerchik and other successful traders recommend to use a Take Profit, which is at least 3 times your Stop Loss. That is, if you use Stop Loss of 40 points, then Take Profit should be at least 120 points. If there are not many chances for the price to reach this level, you should better abstain from entering the trade.

For a more convenient statistics calculation, it is desirable to use the same SL to TP ratio. For example, enter trades with a TP to SL ratio of 3 to 1, 4 to 1, etc. You should choose the specific ratio for yourself based on your trading objectives.

The question is the following: how to place Take Profit without wasting time? Is Excel the only possible solution? Or should we try to guess the approximate position on the chart?

This possibility will be implemented in Expert Advisor settings. A special parameter will be provided for entering the Take Profit to Stop

Loss ratio. For example, the value of 4 means that the ratio is 4 to 1. The EA then will set the Take Profit which is 4 times the Stop Loss value.

Expert Advisor format. Before proceeding to the EA development, we need to decide on its operation mode. This is probably the most difficult task.

I have been using a similar EA for more than a year. Since its emergence, the EA has greatly changed.

In its first version, a dialog window was shown after the EA launch: it allowed to change any of the new position opening parameters. These settings were automatically saved and were used during further EA launches. And this was the main advantage of this method. Very often you configure desired settings once and keep using them in the future.

However the dialog window with the settings has a big disadvantage: it takes up almost the entire chart window space. Price movement cannot be tracked due to this window. Since the dialog window is no longer used after the first setup, the window hinders the chart view without providing any benefits.

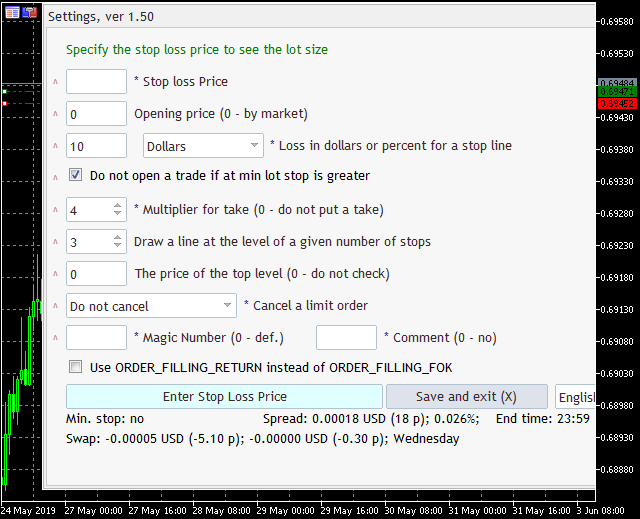

Here is an example of a chart and a dialog window with the width of 640 pixels:

Fig.1. Expert Advisor version with a dialog window

As you can see, the window does not even completely fit on the screen.

In an attempt to solve this problem, I created 2 more EA versions.

In the first version the settings window was hidden by default and could be opened by clicking on the Settings button. This EA is still available in the MetaTrader 5 Market.

The second version does not have any settings window. All EA settings are given in input parameters. This eliminates the use of a dialog window. However this involves one of the following troubles:

- the need to configure the EA anew during each launch

- the need to upload settings from a SET file during each launch

- the need to change default settings in the EA code and to recompile it

Being programmers, I hope you would choose the third option. In this article, we will create a simplified clone of the second EA version. Here is how the EA operation will look like:

Fig.2. Expert Advisor version without a dialog window

Input parameters

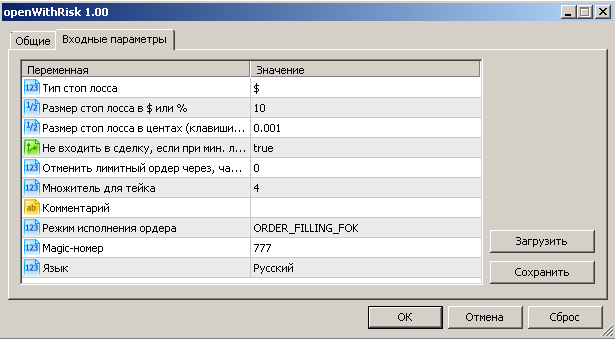

For a netter understanding of the entire scope of work, let's look at the EA input parameters:

Fig.3. Expert Advisor input parameters

The trading activity will be governed by Stop Loss. Therefore let us pay attention to the first two parameters: " Stop Loss type" and "Stop Loss value in $ or %".

The value is set in dollars by default, which is indicated in the "Stop Loss type" parameter. The Stop Loss can also

be set as percentage of your balance. If the Stop Loss as a percentage is selected, the specified value cannot exceed 5% of the deposit. This is

done to avoid errors when setting the EA parameters.

Parameter "Stop Loss value in $ or %" indicates the amount which you can afford losing in case of Stop Loss.

Stop Loss value in cents (keys 7 and 8). Another Stop Loss related parameter is: "Stop Loss value in cents (keys 7 and 8)".

Next, let us implement a set of shortcut keys, using which we can set the desired Stop Loss with one click. For example, if you always use a stop loss of 7 cents in trading, then you only need to press the 7 key on the keyboard, and the Stop Loss will be set at the specified distance from the current price. We will discuss this in detail later.

Please note that this parameter determines not the amount which you will lose in case of Stop Loss, but it is the distance between the open price and the Stop Loss trigger price.

No deal entry if with min. lot the risk is greater than specified. Since the trade entry lot value is calculated automatically based on the " Stop Loss value in $ or %" parameter, a situation may occur when the minimum allowed lot would lead to a risk per trade higher than the specified value.

In this case you can enter a trade with the minimum lot and ignore the risk, or you can cancel deal opening. The appropriate behavior is defined in this parameter.

By default, the EA prevents from market entry in case if an increased risk.

Cancel limit order after, hours. In addition to market entry, the EA supports placing of limit orders based on the specified price. This parameter allows limiting the order lifetime.

The lifetime is set in hours. For example, if the lifetime is set to 2 hours and the limit order does not trigger within 2 hours, such an order shall be deleted.

Tale Profit multiplier. If you are trading with a specific Take Profit to Stop Loss ratio, this parameter can be used to configure the automatic Take Profit setting in accordance with your rule.

The default value is 4. It means that the Take Profit will be set at such a price that the profit in case of Take Profit will be 4 times of possible loss.

Other parameters. You can also:

- change the Magic number for the EA orders

- set a comment to orders

- select the interface language: English or Russian (default)

Position opening function

Since we are writing a cross-platform Expert Advisor, it should work in both MetaTrader 4 and MetaTrader 5. However, different EA versions have different position opening functions. To enable the EA operation in two platforms, we will use conditional compilation.

I already mentioned this type of compilation in my articles. For example, in the article Developing a cross-platform grider EA.

In short, the conditional compilation code is as follows:

#ifdef __MQL5__ //MQL5 code #else //MQL4 code #endif

In this article, we will use the conditional compilation possibilities 3 times, to of which concern the position opening function. The rest of the code can work both in MetaTrader 4 and MetaTrader 5.

The position opening function was already developed in the article Developing a cross-platform grider EA. Therefore let us use a ready solution. We need to add to it functionality for setting the limit order lifetime:

// Possible order types for the position opening function enum TypeOfPos { MY_BUY, MY_SELL, MY_BUYSTOP, MY_BUYLIMIT, MY_SELLSTOP, MY_SELLLIMIT, MY_BUYSLTP, MY_SELLSLTP, }; // Selecting deal filling type for MT5 #ifdef __MQL5__ enum TypeOfFilling //Deal filling type { FOK,//ORDER_FILLING_FOK RETURN,// ORDER_FILLING_RETURN IOC,//ORDER_FILLING_IOC }; input TypeOfFilling useORDER_FILLING_RETURN=FOK; //Order filling mode #endif /* Position opening or limit order placing function */ bool pdxSendOrder(TypeOfPos mytype, double price, double sl, double tp, double volume, ulong position=0, string comment="", string sym="", datetime expiration=0){ if( !StringLen(sym) ){ sym=_Symbol; } int curDigits=(int) SymbolInfoInteger(sym, SYMBOL_DIGITS); if(sl>0){ sl=NormalizeDouble(sl,curDigits); } if(tp>0){ tp=NormalizeDouble(tp,curDigits); } if(price>0){ price=NormalizeDouble(price,curDigits); }else{ #ifdef __MQL5__ #else MqlTick latest_price; SymbolInfoTick(sym,latest_price); if( mytype == MY_SELL ){ price=latest_price.ask; }else if( mytype == MY_BUY ){ price=latest_price.bid; } #endif } #ifdef __MQL5__ ENUM_TRADE_REQUEST_ACTIONS action=TRADE_ACTION_DEAL; ENUM_ORDER_TYPE type=ORDER_TYPE_BUY; switch(mytype){ case MY_BUY: action=TRADE_ACTION_DEAL; type=ORDER_TYPE_BUY; break; case MY_BUYSLTP: action=TRADE_ACTION_SLTP; type=ORDER_TYPE_BUY; break; case MY_BUYSTOP: action=TRADE_ACTION_PENDING; type=ORDER_TYPE_BUY_STOP; break; case MY_BUYLIMIT: action=TRADE_ACTION_PENDING; type=ORDER_TYPE_BUY_LIMIT; break; case MY_SELL: action=TRADE_ACTION_DEAL; type=ORDER_TYPE_SELL; break; case MY_SELLSLTP: action=TRADE_ACTION_SLTP; type=ORDER_TYPE_SELL; break; case MY_SELLSTOP: action=TRADE_ACTION_PENDING; type=ORDER_TYPE_SELL_STOP; break; case MY_SELLLIMIT: action=TRADE_ACTION_PENDING; type=ORDER_TYPE_SELL_LIMIT; break; } MqlTradeRequest mrequest; MqlTradeResult mresult; ZeroMemory(mrequest); mrequest.action = action; mrequest.sl = sl; mrequest.tp = tp; mrequest.symbol = sym; if(expiration>0){ mrequest.type_time = ORDER_TIME_SPECIFIED_DAY; mrequest.expiration = expiration; } if(position>0){ mrequest.position = position; } if(StringLen(comment)){ mrequest.comment=comment; } if(action!=TRADE_ACTION_SLTP){ if(price>0){ mrequest.price = price; } if(volume>0){ mrequest.volume = volume; } mrequest.type = type; mrequest.magic = EA_Magic; switch(useORDER_FILLING_RETURN){ case FOK: mrequest.type_filling = ORDER_FILLING_FOK; break; case RETURN: mrequest.type_filling = ORDER_FILLING_RETURN; break; case IOC: mrequest.type_filling = ORDER_FILLING_IOC; break; } mrequest.deviation=100; } if(OrderSend(mrequest,mresult)){ if(mresult.retcode==10009 || mresult.retcode==10008){ if(action!=TRADE_ACTION_SLTP){ switch(type){ case ORDER_TYPE_BUY: // Alert("Order Buy #:",mresult.order," sl",sl," tp",tp," p",price," !!"); break; case ORDER_TYPE_SELL: // Alert("Order Sell #:",mresult.order," sl",sl," tp",tp," p",price," !!"); break; } }else{ // Alert("Order Modify SL #:",mresult.order," sl",sl," tp",tp," !!"); } return true; }else{ msgErr(GetLastError(), mresult.retcode); } } #else int type=OP_BUY; switch(mytype){ case MY_BUY: type=OP_BUY; break; case MY_BUYSTOP: type=OP_BUYSTOP; break; case MY_BUYLIMIT: type=OP_BUYLIMIT; break; case MY_SELL: type=OP_SELL; break; case MY_SELLSTOP: type=OP_SELLSTOP; break; case MY_SELLLIMIT: type=OP_SELLLIMIT; break; } if(OrderSend(sym, type, volume, price, 100, sl, tp, comment, EA_Magic, expiration)<0){ msgErr(GetLastError()); }else{ switch(type){ case OP_BUY: Alert("Order Buy sl",sl," tp",tp," p",price," !!"); break; case OP_SELL: Alert("Order Sell sl",sl," tp",tp," p",price," !!"); break; } return true; } #endif return false; }

In MetaTrader 5, position fill type should be selected when opening a position. Therefore, add one more input for MetaTrader 5: " Order fill

mode".

Different brokers support different order filling types. The most popular one among brokers is ORDER_FILLING_FOK. Therefore it is selected by

default. If your broker does not support this mode, you can select any other desired mode.

EA localization

Another mechanism, which was earlier described in Developing a cross-platform grider

EA, is the possibility to localize text messages produced by the Expert Advisor. Therefore, we will not consider it again. Please read

the mentioned article for more details concerning the EA operation format.

Programming the EA Interface

In this article, we will not consider EA development from scratch. It is also assumed that the reader has at least the basic MQL knowledge.

In this article we will look at how the main EA parts are implemented. This will help you implement additional functionality if

necessary.

Let's start with the EA interface.

The following interface elements will be created at the EA launch:

- a comment will contain current spread in dollars, points and percent of price, as well as symbol session closing time;

- a horizontal line will be displayed at the spread distance from the current price, using which the stop loss will be placed;

- "Show (0) open price line" button will be added, which will show a green horizontal line at the order open price;

- another button is needed to open an order with specified parameters.

Thus, to create an order with the needed parameters (which are set using the EA inputs), it is necessary to move the red line to the price at which the Stop Loss should be set.

If the red line is moved above the current price, a short position is opened. If the red line is moved below the current price, a long position is opened.

The open position volume will be calculated automatically so that in case of Stop Loss you would lose the amount close to the one specified in EA parameters. All you need to do is click the position opening button. A position at the market price will be opened after that.

If you want to place a limit order, you should additionally click "Show (0) open price line" and move the appeared green line to the price at which you want to open a limit order. The limit order type and direction will be determined automatically based on the positions of the Stop Loss and Take Profit lines (is Stop Loss is above or below the open price).

Basically, it is not necessary to click "Show (0) open price line" button. Once you move the red Stop Loss line to the

desired level, the button will be automatically pressed and a green open price line will appear. If you move this line, it will set a limit

order. If you leave the line where it is, a market position will be opened.

We have analyzed the operating principle. Now we can move on to programming.

Working with the chart comment. The standard Comment function is used for working with chart comments. Therefore, we need to prepare a string which will be shown on a chart via the Comment function. For this purpose, let us create a custom function getmespread:

/* Showing data on spread and session closing time in a chart comment */ void getmespread(){ string msg=""; // Get spread in the symbol currency curSpread=lastme.ask-lastme.bid; // If the market is not closed, show spread info if( !isClosed ){ if(curSpread>0){ StringAdd(msg, langs.Label1_spread+": "+(string) DoubleToString(curSpread, (int) SymbolInfoInteger(_Symbol, SYMBOL_DIGITS))+" "+currencyS+" ("+DoubleToString(curSpread/curPoint, 0)+langs.lbl_point+")"); StringAdd(msg, "; "+DoubleToString(((curSpread)/lastme.bid)*100, 3)+"%"); }else{ StringAdd(msg, langs.Label1_spread+": "+langs.lblNo); } StringAdd(msg, "; "); } // Show market closing time if we could determine it if(StringLen(time_info)){ StringAdd(msg, " "+time_info); } Comment(msg); }

The getmespread function will be called during EA initialization (OnInit) and at each new tick (OnTick).

In getmespread, we use five global EA variables: lastme, isClosed, time_info, currencyS, curPoint.

The lastme variable stores data on the Ask, Bid and Last prices. The variable contents are updated in the OnInit and OnTick functions using the following command:

SymbolInfoTick(_Symbol,lastme);

Other variables are initialized in the OnInit function. isClosed and time_info are initialized as follows:

isClosed=false; // Get the current date TimeToStruct(TimeCurrent(), curDay); // Get symbol trading time for today if(SymbolInfoSessionTrade(_Symbol, (ENUM_DAY_OF_WEEK) curDay.day_of_week, 0, dfrom, dto)){ time_info=""; TimeToStruct(dto, curEndTime); TimeToStruct(dfrom, curStartTime); isEndTime=true; string tmpmsg=""; tmp_val=curEndTime.hour; if(tmp_val<10){ StringAdd(tmpmsg, "0"); } StringAdd(tmpmsg, (string) tmp_val+":"); tmp_val=curEndTime.min; if(tmp_val<10){ StringAdd(tmpmsg, "0"); } StringAdd(tmpmsg, (string) tmp_val); if(curEndTime.hour==curDay.hour){ if(tmp_val>curDay.min){ }else{ isClosed=true; } }else{ if(curEndTime.hour==0){ }else{ if( curEndTime.hour>1 && (curDay.hour>curEndTime.hour || curDay.hour==0)){ StringAdd(time_info, " ("+langs.lbl_close+")"); isClosed=true; }else if(curDay.hour<curStartTime.hour ){ StringAdd(time_info, " ("+langs.lbl_close+")"); isEndTime=false; isClosed=true; }else if(curDay.hour==curStartTime.hour && curDay.min<curStartTime.min ){ StringAdd(time_info, " ("+langs.lbl_close+")"); isEndTime=false; isClosed=true; } } } if(isEndTime){ StringAdd(time_info, langs.lblshow_TIME+": "+tmpmsg+time_info); }else{ StringAdd(time_info, langs.lblshow_TIME2+": "+tmpmsg+time_info); } }

The currencyS variable will store the currency used for profit calculation for the current financial instrument. The currency can be obtained using the following command:

currencyS=SymbolInfoString(_Symbol, SYMBOL_CURRENCY_PROFIT);

The symbol's point size will be stored in the curPoint variable:

curPoint=SymbolInfoDouble(_Symbol, SYMBOL_POINT);

Stop Loss line. Only one line is shown on the chart upon EA launch: the red line for placing Stop Loss.

Similar to buttons, the line will be plotted in the OnInit function. Before drawing the line, we need to check whether there is already such a line on the chart. If there is a line, do not create a new line and other UI elements. Instead, add the following data to global variables: the price of the current line level and the price of the deal open line (if there is any on the chart):

// if there are Stop Loss and open price lines on the chart // add the appropriate prices to variables if(ObjectFind(0, exprefix+"_stop")>=0){ draw_stop=ObjectGetDouble(0, exprefix+"_stop", OBJPROP_PRICE); if(ObjectFind(0, exprefix+"_open")>=0){ draw_open=ObjectGetDouble(0, exprefix+"_open", OBJPROP_PRICE); } // otherwise create the entire Expert Advisor UI }else{ draw_open=lastme.bid; draw_stop=draw_open-(SymbolInfoInteger(_Symbol, SYMBOL_SPREAD)*curPoint); ObjectCreate(0, exprefix+"_stop", OBJ_HLINE, 0, 0, draw_stop); ObjectSetInteger(0,exprefix+"_stop",OBJPROP_SELECTABLE,1); ObjectSetInteger(0,exprefix+"_stop",OBJPROP_SELECTED,1); ObjectSetInteger(0,exprefix+"_stop",OBJPROP_STYLE,STYLE_DASHDOTDOT); ObjectSetInteger(0,exprefix+"_stop",OBJPROP_ANCHOR,ANCHOR_TOP); // other UI elements }

Is it generally possible that a chart already has UI elements?

If you do not implement the code, which deletes all created user interface elements when closing the EA, appropriate elements will be definitely left on the chart. Even if this code is implemented, an error in the EA operation can occur due to which the EA will be closed but the created elements will be left on the chart. Therefore, always check whether such an element exists on the chart before creating it.

Thus we have created a red line. Moreover, we set it as selected by default. Therefore you do not need to double click on the line to select it. You

simply need to move it to the desired price. However, if you now move the red line, nothing will happen. The code which performs appropriate

actions has not yet been implemented.

Any interaction with the UI elements is performed in the standard OnChartEvent function. Moving of interface

elements generates an event with the ID

CHARTEVENT_OBJECT_DRAG. Thus, in order to implement movement on the chart, the OnChartEvent function must

intercept this event, check which element has called it and if the element belongs to the EA, the required code should be executed:

void OnChartEvent(const int id, // event ID const long& lparam, // event parameter of the long type const double& dparam, // event parameter of the double type const string& sparam) // event parameter of the string type { switch(id){ case CHARTEVENT_OBJECT_DRAG: if(sparam==exprefix+"_stop"){ setstopbyline(); showOpenLine(); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_STATE, true); } break; } }

After moving the red line, the setstopbyline function will be started, which remembers the Stop Loss level for the future order:

/* "Remembers" the Stop Loss levels for the future order */ void setstopbyline(){ // Receive the price in which the Stop Loss line is located double curprice=ObjectGetDouble(0, exprefix+"_stop", OBJPROP_PRICE); // If the price is different from the one in which the Stop Loss line was positioned at the EA launch, if( curprice>0 && curprice != draw_stop ){ double tmp_double=SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE); if( tmp_double>0 && tmp_double!=1 ){ if(tmp_double<1){ resval=DoubleToString(curprice/tmp_double, 8); if( StringFind(resval, ".00000000")>0 ){}else{ curprice=MathFloor(curprice)+MathFloor((curprice-MathFloor(curprice))/tmp_double)*tmp_double; } }else{ if( MathMod(curprice,tmp_double) ){ curprice= MathFloor(curprice/tmp_double)*tmp_double; } } } draw_stop=STOPLOSS_PRICE=curprice; updatebuttontext(); ChartRedraw(0); } }

In addition to the setstopbyline function, moving of the red line causes the appearance of the open price line on the chart (the showOpenLine function) and the change of the "Show (0) open price line" button state.

Open line and button. The "Show (0) open price line" button is also created during EA initialization:

if(ObjectFind(0, exprefix+"_openbtn")<0){ ObjectCreate(0, exprefix+"_openbtn", OBJ_BUTTON, 0, 0, 0); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_XDISTANCE,0); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_YDISTANCE,33); ObjectSetString(0,exprefix+"_openbtn",OBJPROP_TEXT, langs.btnShowOpenLine); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_XSIZE,333); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_FONTSIZE, 8); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_YSIZE,25); }

As mentioned above, any interaction with the interface elements is processed within the standard OnChartEvent function. This includes button pressing. The event with the ID CHARTEVENT_OBJECT_CLICK is responsible for that. We need to intercept this event, check the event source and perform appropriate actions. For this, let's add the additional case in the switch operator of the OnChartEvent function:

case CHARTEVENT_OBJECT_CLICK: if (sparam==exprefix+"_openbtn"){ updateOpenLine(); } break;

The updateOpenLine function which is called upon a click on button "Show (0) open price line", is a small wrapper for the main showOpenLine function call. This function simply shows the open price on the chart:

void showOpenLine(){ if(ObjectFind(0, exprefix+"_open")<0){ draw_open=lastme.bid; ObjectCreate(0, exprefix+"_open", OBJ_HLINE, 0, 0, draw_open); ObjectSetInteger(0,exprefix+"_open",OBJPROP_SELECTABLE,1); ObjectSetInteger(0,exprefix+"_open",OBJPROP_SELECTED,1); ObjectSetInteger(0,exprefix+"_open",OBJPROP_STYLE,STYLE_DASHDOTDOT); ObjectSetInteger(0,exprefix+"_open",OBJPROP_ANCHOR,ANCHOR_TOP); ObjectSetInteger(0,exprefix+"_open",OBJPROP_COLOR,clrGreen); } }

Now we need to re-write the CHARTEVENT_OBJECT_DRAG event handler so that it could react to the moving of the Stop Loss line and of the open price line:

case CHARTEVENT_OBJECT_DRAG: if(sparam==exprefix+"_stop"){ setstopbyline(); showOpenLine(); ObjectSetInteger(0,exprefix+"_openbtn",OBJPROP_STATE, true); }else if(sparam==exprefix+"_open"){ curprice=ObjectGetDouble(0, exprefix+"_open", OBJPROP_PRICE); if( curprice>0 && curprice != draw_open ){ double tmp_double=SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE); if( tmp_double>0 && tmp_double!=1 ){ if(tmp_double<1){ resval=DoubleToString(curprice/tmp_double, 8); if( StringFind(resval, ".00000000")>0 ){}else{ curprice=MathFloor(curprice)+MathFloor((curprice-MathFloor(curprice))/tmp_double)*tmp_double; } }else{ if( MathMod(curprice,tmp_double) ){ curprice= MathFloor(curprice/tmp_double)*tmp_double; } } } draw_open=open=OPEN_PRICE=curprice; updatebuttontext(); ObjectSetString(0,exprefix+"Edit3",OBJPROP_TEXT,0, (string) NormalizeDouble(draw_open, _Digits)); ChartRedraw(0); } } break;

Take Profit line. In addition to the red and green lines, we need to implement a dotted line. It will appear after you move the red Stop Loss line to the desired price level. The dotted line will show the price of the deal Take Profit level:

Fig.4. Stop Loss, open price and Take Profit lines

Position open button. The position open button is drawn similarly to button "Show (0) open price line".

The CHARTEVENT_OBJECT_CLICK event will be generated upon a click on this button. Processing of this event was considered earlier. As a result of pressing of the position open button, the startPosition function will be performed:

case CHARTEVENT_OBJECT_CLICK: if (sparam==exprefix+"_send"){ startPosition(); }else if (sparam==exprefix+"_openbtn"){ updateOpenLine(); } break;

Deleting UI elements upon EA operation completion. Do not forget about the proper deletion of interface elements after the completion of the Expert Advisor operation. If you do not do this, all elements will be left on the chart.

To perform any commands during EA operation completion, add it inside the standard OnDeinit function:

void OnDeinit(const int reason) { if(reason!=REASON_CHARTCHANGE){ ObjectsDeleteAll(0, exprefix); Comment(""); } }

The reason variable contains information about reasons for completing the EA operation. Now the only important reason for us is the change of the timeframe ( REASON_CHARTCHANGE). By default, a change in the timeframe leads to EA operation completion and its relaunch. This is not the most acceptable behavior for us. In case of timeframe change, all set Stop Loss and open price levels will be reset.

Therefore, in OnDeinit we should check if the reason for the EA closing is the timeframe change. And only if the reason for

closing is different, we should delete all elements and clear the comment to the chart.

Implementing Expert Advisor shortcuts

We considered order placing using a mouse. However, sometimes fast operation using keys can be really useful.

Pressing of keyboard keys also refers to the interaction with the Expert Advisor UI elements. Namely, it refers to the entire chart on which the EA is running. Keystrokes should be intercepted in the OnChartEvent function.

The CHARTEVENT_KEYDOWN event is generated whenever a key is pressed. The code of the pressed key is added to the sparam

parameter. This data is quite enough to start keystroke processing:

void OnChartEvent(const int id, // event ID const long& lparam, // event parameter of the long type const double& dparam, // event parameter of the double type const string& sparam) // event parameter of the string type { string text=""; double curprice=0; switch(id){ case CHARTEVENT_OBJECT_CLICK: // Pressing of buttons on the chart break; case CHARTEVENT_OBJECT_DRAG: // Moving lines break; case CHARTEVENT_KEYDOWN: switch((int) sparam){ // Terminate EA operation without placing an order case 45: //x closeNotSave(); break; // Place an order and complete EA operation case 31: //s startPosition(); break; // Set minimum possible Stop Loss to open a Buy position case 22: //u setMinStopBuy(); break; // Set minimum possible Stop Loss to open a Sell position case 38: //l setMinStopSell(); break; // Cancel the set open price case 44: //z setZero(); ChartRedraw(); break; // Set Stop Loss at 0.2% from the current price to open a Long position case 3: //2 set02StopBuy(); break; // Set Stop Loss at 0.2% from the current price to open a Short position case 4: //3 set02StopSell(); break; // Set Stop Loss to 7 cents from the current price (the CENT_STOP parameter) // To open a Long position case 8: //7 set7StopBuy(); break; // Set Stop Loss to 7 cents from the current price (the CENT_STOP parameter) // To open a Short position case 9: //8 set7StopSell(); break; } break; } }

Thus, if you set a fixed Stop Loss equal to the minimum possible size, i.e. 0.2% or in cents, then you do not even need to use the mouse. Start the EA, press key " 2" to set Stop Loss at 0.2% from the price in the Long direction, press key "S" and an appropriate position will be opened.

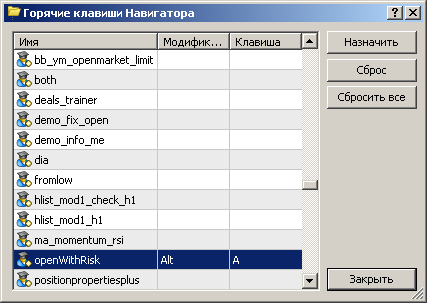

And if you are using MetaTrader 5, then you can even start the EA from the keyboard by using assigned hot keys. In the Navigator window, call your EA context menu, click Set hotkey and enjoy fast access:

Fig.5. Assigning hotkeys to Expert Advisors

Calculating appropriate deal volume

Now let us consider the position opening function startPosition. There is almost nothing interesting in it. We simply check the availability of all the data we need: Stop Loss price, position open price and EA settings. After that the EA calculates the entry lot value in accordance with you risk settings. Then the earlier mentioned function pdxSendOrder is called.

The most interesting of all is the deal volume calculation mechanism.

First, we need to calculate potential loss in case of a Stop Loss, with the minimum possible volumes. This functionality implementation in MQL5 differs from that in MQL4.

MQL5 has a special OrderCalcProfit function which allows calculating the size of potential profit that can be obtained if the symbol price reaches the specified level. This function allows calculating potential profit as well as potential loss.

A more complicated loss calculation formula is used in MQL4.

Here is the resulting function:

double getMyProfit(double fPrice, double fSL, double fLot, bool forLong=true){ double fProfit=0; fPrice=NormalizeDouble(fPrice,_Digits); fSL=NormalizeDouble(fSL,_Digits); #ifdef __MQL5__ if( forLong ){ if(OrderCalcProfit(ORDER_TYPE_BUY, _Symbol, fLot, fPrice, fSL, fProfit)){}; }else{ if(OrderCalcProfit(ORDER_TYPE_SELL, _Symbol, fLot, fPrice, fSL, fProfit)){}; } #else if( forLong ){ fProfit=(fPrice-fSL)*fLot* (1 / MarketInfo(_Symbol, MODE_POINT)) * MarketInfo(_Symbol, MODE_TICKVALUE); }else{ fProfit=(fSL-fPrice)*fLot* (1 / MarketInfo(_Symbol, MODE_POINT)) * MarketInfo(_Symbol, MODE_TICKVALUE); } #endif if( fProfit!=0 ){ fProfit=MathAbs(fProfit); } return fProfit; }

Thus we have calculated loss amount with the minimum volume. Now we need to determine the deal volume with which the loss will not increase the specified risk settings:

profit=getMyProfit(open, STOPLOSS_PRICE, lot); if( profit!=0 ){ // If loss with the minimum lot is less than your risks, // calculate appropriate deal volume if( profit<stopin_value ){ // get the desired deal volume lot*=(stopin_value/profit); // adjust the volume if it does not correspond to the minimum allowed step // for this trading instrument if( SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_STEP)==0.01 ){ lot=(floor(lot*100))/100; }else if( SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_STEP)==0.1 ){ lot=(floor(lot*10))/10; }else{ lot=floor(lot); } // If loss with the minimum lot is greater than your risks, // cancel position opening if this option is set in EA parameters }else if( profit>stopin_value && EXIT_IF_MORE ){ Alert(langs.wrnEXIT_IF_MORE1+": "+(string) lot+" "+langs.wrnEXIT_IF_MORE2+": "+(string) profit+" "+AccountInfoString(ACCOUNT_CURRENCY)+" ("+(string) stopin_value+" "+AccountInfoString(ACCOUNT_CURRENCY)+")!"); return; } }

Entry restrictions

The Expert Advisor checks certain conditions in order not to open deals whee opening is not allowed.

For example, during initialization, the EA checks the minimum allowable lot volume for the current instrument. And if this value is 0, the EA will not start. Because it will not be able to open a position for such a symbol:

if(SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN)==0){ Alert(langs.wrnMinVolume); ExpertRemove(); }

It also checks of symbol trading is allowed. If symbol trading is prohibited or only closing of previously opened trades is allowed, the EA

will not be launched:

if(SymbolInfoInteger(_Symbol, SYMBOL_TRADE_MODE)==SYMBOL_TRADE_MODE_DISABLED || SymbolInfoInteger(_Symbol, SYMBOL_TRADE_MODE)==SYMBOL_TRADE_MODE_CLOSEONLY ){ Alert(langs.wrnOnlyClose); ExpertRemove(); }

When opening a position, the EA checks correctness of the opening price and of the Stop Loss level. For example, if the minimum price step is 0.25 and your stop loss is set at 23.29, the broker will not accept your order. Generally the EA can automatically adjust the price to a proper value (and the Stop Loss price will be set to 23.25 or 23.5). Thus indication of an invalid price is not possible. However, an additional check is also performed:

if( SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE)>0 && SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE)!=1 ){ resval=DoubleToString(STOPLOSS_PRICE/SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE), 8); if( StringFind(resval, ".00000000")>0 ){}else{ Alert(langs.wrnSYMBOL_TRADE_TICK_SIZE+" "+(string) SymbolInfoDouble(_Symbol, SYMBOL_TRADE_TICK_SIZE)+"! "+langs.wrnSYMBOL_TRADE_TICK_SIZE_end); return; } }

Conclusions

In this article we have implemented only the basic order placing features. But even these possibilities can be of great assistance to those

who trade Gerchik levels or any other levels.

I hope this will save you from using Excel tables. This will increase your trading speed and accuracy. And thus your profit can ultimately grow.

Any EA improvements are welcome.

If you do not have enough programming skills but you need any specific functionality, feel free to contact me. However, this might require some fee.

Please check the functionality of the extended versions of this Expert Advisor in the Market:

Perhaps your required functionality is already available.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/6986

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Arranging a mailing campaign by means of Google services

Arranging a mailing campaign by means of Google services

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use