Alpha Swing Reversal Signals

- Indicatori

- Andreas Smigadis

- Versione: 2.0

- Aggiornato: 14 gennaio 2026

- Attivazioni: 10

Overview

Alpha Swing Reversal Signals is an MT4 indicator that marks potential swing reversal candles with arrows.

Signals are evaluated on closed candles using candle structure (wick-to-range), swing high/low detection, and an ATR-based volatility filter.

An optional EMA trend filter can be enabled to align signals with a broader directional bias.

Optional alerts can notify you when a new signal is confirmed on the last closed candle.

What the Indicator Does

The indicator scans historical and newly closed candles for reversal-style structures near local extremes.

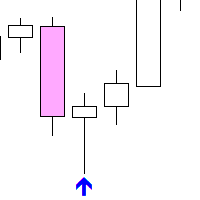

A sell signal can be marked when a swing high is detected and the candle shows a relatively large upper wick.

A buy signal can be marked when a swing low is detected and the candle shows a relatively large lower wick.

A volatility condition compares candle range to ATR to help filter very small candles during low activity.

If enabled, the EMA filter applies a directional condition to reduce signals against the selected bias.

Signals are plotted as arrows directly on the chart for visual review.

Key Features

-

Buy/sell arrows plotted on the chart

-

Swing high/low detection with configurable lookback

-

Wick percentage filter for reversal-style candles

-

ATR-based volatility filter to reduce low-range signals

-

Optional EMA trend filter (on/off)

-

Optional alerts when a new signal is confirmed

Risk Management & Safety Notes

This indicator provides visual signals only and does not place trades.

Trading involves risk, and losses are possible.

Signals can occur during volatile periods where spread, slippage, or gaps may affect execution.

No indicator can account for all market conditions or sudden news-driven price moves.

Use position sizing and protective orders that match your risk tolerance.

Test settings on your broker’s data before relying on them in a live environment.

Inputs

Signal Detection

-

Swing Lookback Period (InpLookback): bars used to confirm swing highs/lows

-

Minimum Wick Percentage (InpWickPercent): wick-to-range threshold (0.0–1.0)

-

Arrow Offset (if available): distance above/below candle for visibility

Volatility Filter (ATR)

-

ATR Period (InpAtrPeriod): ATR calculation length

-

ATR Multiplier (InpAtrMult): minimum candle range relative to ATR

-

Volatility Filter On/Off (if available): enable/disable the ATR condition

Trend Filter (EMA)

-

Use Trend Filter (UseTrendFilter): enable/disable EMA condition

-

EMA Period (InpEmaPeriod): EMA length

-

Trend Rule (if available): buy above EMA / sell below EMA

Alerts

-

Show Alerts (ShowAlerts): alert on newly confirmed signal

-

Alert Types (if available): pop-up / sound / push

-

Alert Frequency (if available): limit repeated alerts per bar

Setup

-

Copy the indicator file to MQL4/Indicators and restart MT4 (or refresh the Navigator).

-

Attach Alpha Swing Reversal Signals to a chart.

-

Select your symbol and timeframe.

-

Set InpLookback and InpWickPercent to match the symbol’s price behavior.

-

Configure ATR period/multiplier to control how strict the volatility filter is.

-

Enable/disable the EMA trend filter and set the EMA period if needed.

-

Turn alerts on/off as desired.

Recommended Evaluation

Review signals on historical charts by scrolling left and checking how arrows align with swing points and wick structures.

Try different settings per symbol and timeframe, because volatility and session behavior differ between markets.

Observe how the ATR multiplier affects signal frequency during quiet vs. active periods.

If you use alerts, confirm they trigger only after the bar closes (last closed candle).

Practice your full decision process on a demo account, including risk controls and execution rules.

Keep notes of the settings used and the market conditions where signals were more or less frequent.

Compatibility

Platform: MetaTrader 4 (indicator for the chart window).

Timeframes: works on any timeframe (commonly used on M15–H1, depending on the symbol).

Symbols: any broker-provided instruments supported by MT4.

Signals are calculated from price history; results can differ across brokers due to data and symbol specifications.

FAQ

Q: Does it repaint?

A: Signals are calculated on closed candles, and arrows are plotted after the candle closes. Display may vary if broker history updates.

Q: When is a signal confirmed?

A: After the candle closes; the most recent confirmed bar is the last closed candle.

Q: What does wick percentage mean?

A: It defines how large the wick must be relative to the candle’s full range to qualify.

Q: What does the ATR multiplier do?

A: It filters out small candles by requiring the candle range to meet a minimum size relative to ATR.

Q: Should I use the EMA trend filter?

A: It can reduce counter-bias signals by applying a directional condition. You can disable it to see all swing signals.

Q: How do I get support?

A: Support is provided via MQL5 comments or MQL5 messages only.

Changelog

v1.00

Initial release: swing reversal arrows with wick filter, ATR volatility filter, optional EMA trend filter, and alerts.