Wall Street Scalper

- Experts

- Wilna Barnard

- Versione: 2.2

- Aggiornato: 10 ottobre 2025

- Attivazioni: 20

Limited-Time Promotion – Price Increases on 1 January

Take advantage of this special offer before the price returns to $199. 5 Days left before the Price reverts back ...

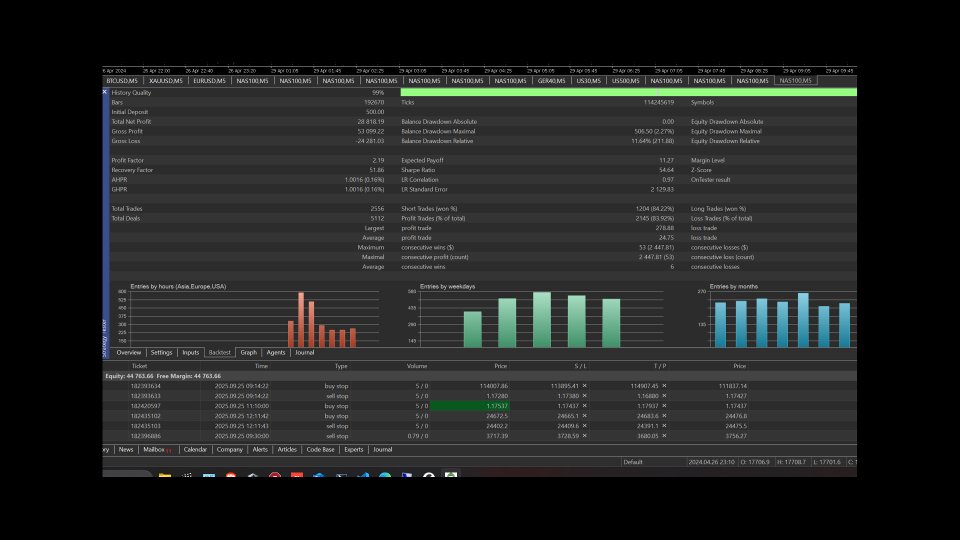

Wallstreet Scalper (US30 · US500 · US100 · M5)

Overview

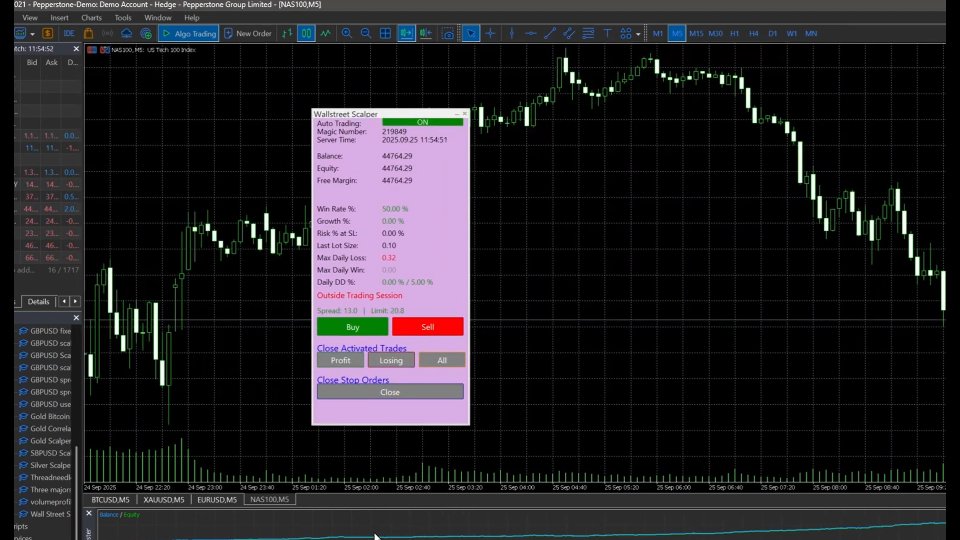

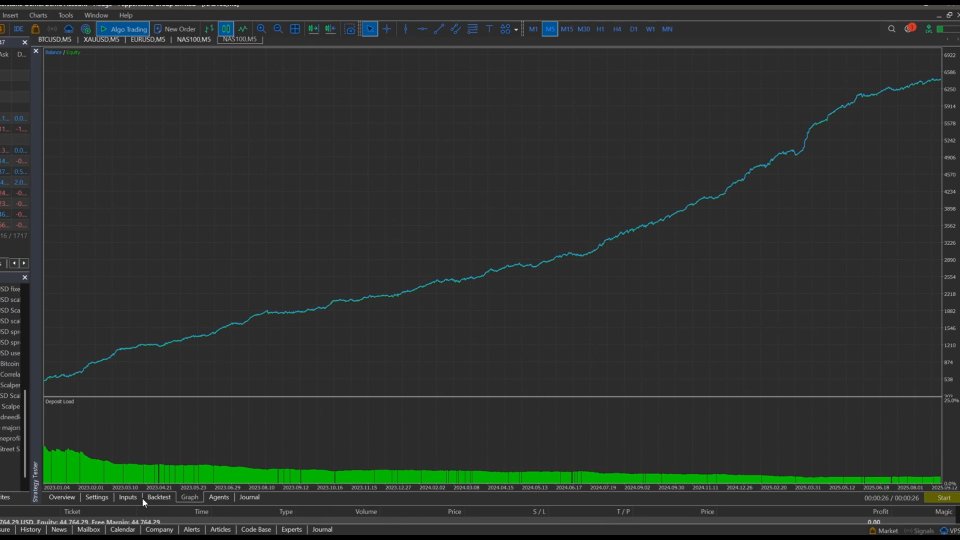

Wallstreet Scalper is a breakout-style Expert Advisor built for U.S. indices (US30, US500, US100) on the M5 timeframe. The EA seeks to capture momentum when price breaks out of recent highs or lows, while applying layered protective mechanisms to keep risk under control. It is optimized for both personal trading and prop-firm challenges, with a unique ATR-based system that adapts all key distances to market volatility.

Core Strategy

-

Breakout Entries: Pending Buy/Sell Stop orders are placed just beyond recent support and resistance levels.

-

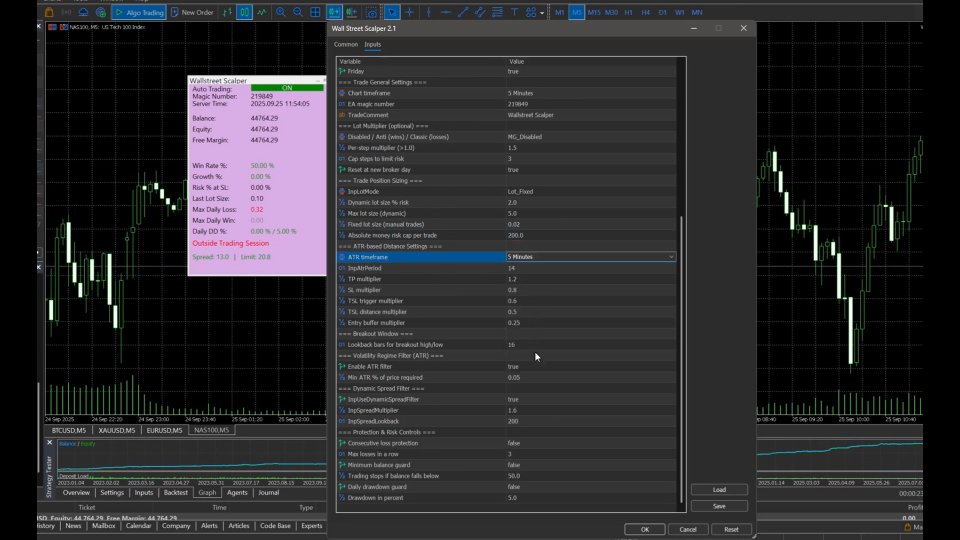

Volatility-Adaptive Distances (ATR Based): Unlike classic “fixed points” systems, all distances—Stop Loss, Take Profit, Trailing Stop, and even order placement buffers—are multiples of the Average True Range (ATR). This ensures the EA scales dynamically with current market conditions, widening during volatile sessions and tightening when the market is calmer.

-

Momentum Confirmation: An optional ATR filter blocks trades if volatility is below a configurable threshold.

How ATR-Based Inputs Work

Instead of entering raw pip values, you set multipliers of the ATR. For example:

-

TP Multiplier (InpTpAtrMult = 1.20): Take Profit is set at 1.2 × ATR.

-

SL Multiplier (InpSlAtrMult = 0.80): Stop Loss is 0.8 × ATR.

-

Trailing Stop Trigger (InpTslTriggerAtrMult = 0.60): Trailing only activates once price moves 0.6 × ATR in profit.

-

Trailing Distance (InpTslAtrMult = 0.50): Stop follows price at half an ATR behind.

-

Order Buffer (InpOrderDistAtrMult = 0.25): Buy/Sell Stops are placed 0.25 × ATR beyond the breakout level.

This makes the system self-adjusting: during quiet sessions it keeps trades tight, and during volatile conditions it gives them room to breathe.

Built-In Protections

-

ATR Volatility Filter – Blocks entries when volatility is too low.

-

Dynamic Spread Filter – Learns the average spread and halts entries when spreads spike.

-

Consecutive Loss Limiter – Suspends new trades after a user-defined number of losing trades.

-

Daily Drawdown Guard – Trading stops if daily equity loss exceeds the set % threshold.

-

Balance Guard – Halts trading if account balance falls below a safe minimum.

-

Broker-Safe Execution – Respects min/max lot size, freeze levels, and step size automatically.

Position Sizing & Risk

-

Risk-Based Lot Sizing: Automatically calculates lot size based on % of balance at risk.

-

Fixed Lot Mode: For traders who prefer manual lot control.

-

Absolute Risk Cap: Maximum money risk per trade can be hard-capped.

Optional Martingale System

-

Modes: Disabled, Anti-Martingale (increase on wins), or Classic Martingale (increase on losses).

-

Multiplier & Step Limit: Fully adjustable to control growth.

-

Daily Reset Option: Automatically resets the progression each new broker day.

-

Safety Net: All martingale logic works within the broader account protection system.

Additional Features

-

Trading Panel: Manual Buy/Sell buttons and position management (optional, can be hidden during backtests).

-

Session & Day Scheduling: Restrict trading to U.S. hours or specific weekdays.

-

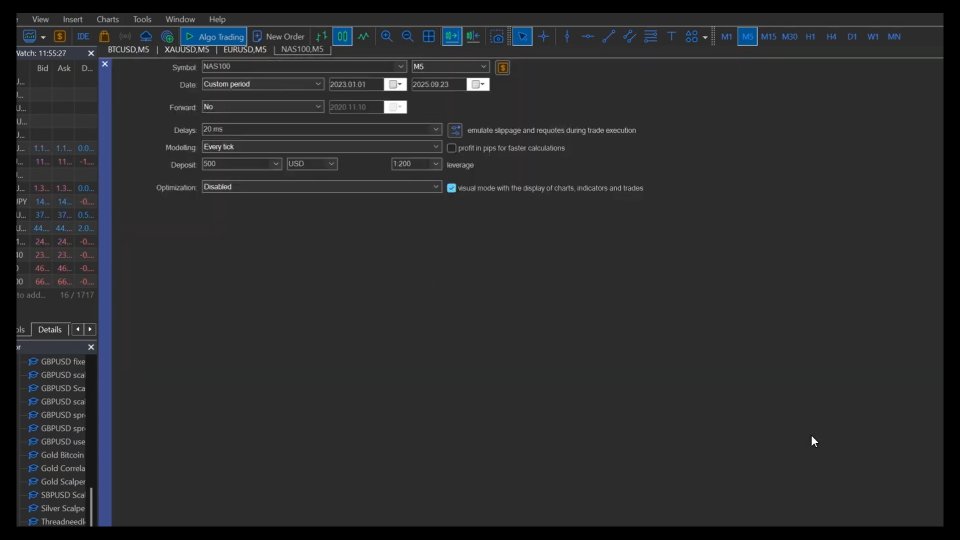

Backtest-Optimized: Designed to run accurately with quality tick data.

Important Disclaimer

Trading involves risk. Past performance does not guarantee future results. Always test the EA on a demo account first and adjust settings to your broker’s conditions.

Buy EA Today . coming soon for Next update 🙂