RSI Ultimate MTF

- Indicators

- Quang Huy Quach

- Version: 1.5

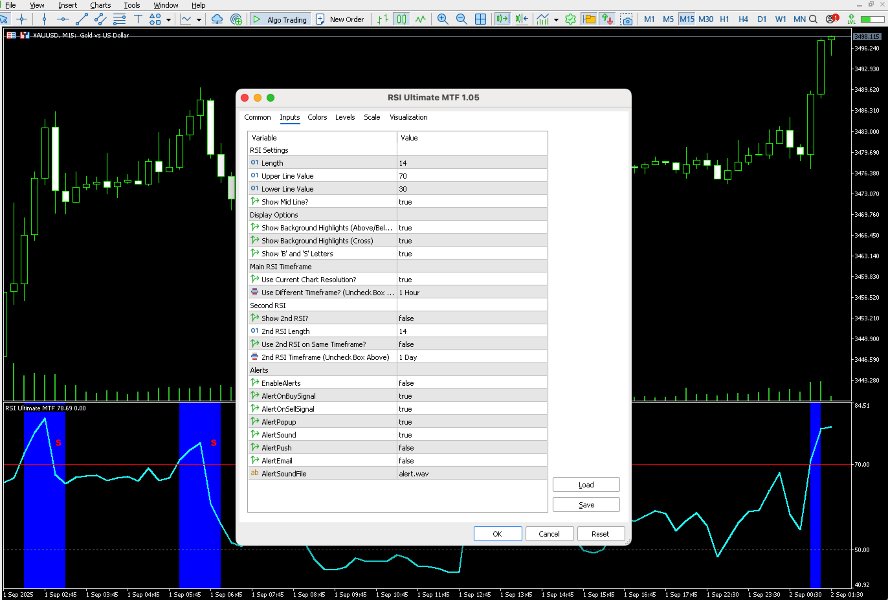

1. Introduction

The CM_Ultimate_RSI_MTF is a powerful and versatile custom indicator for MetaTrader 5, designed to enhance your Relative Strength Index (RSI) analysis. It provides multi-timeframe (MTF) capabilities, visual signals, and customizable alerts, making it an invaluable tool for traders seeking to identify overbought/oversold conditions, trend strength, and potential entry/exit points across various timeframes.

2. Key Features

- Multi-Timeframe (MTF) Analysis: Allows you to view RSI from a different timeframe directly on your current chart.

- Dual RSI Plots: Option to display a second RSI with its own customizable settings and timeframe.

- Visual Overbought/Oversold Highlights: Background coloring to easily identify when RSI is above the Upper Line or below the Lower Line.

- Cross Highlights: Visual cues when RSI crosses the Upper or Lower Lines.

- Buy/Sell Signal Letters: Clear 'B' (Buy) and 'S' (Sell) letters plotted on the indicator window for cross signals.

- Customizable Alerts: Receive notifications (popup, sound, push, email) when RSI generates a cross signal.

3. How it Works

The indicator calculates the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100. Traditionally, readings above 70 indicate overbought conditions, and readings below 30 indicate oversold conditions.

- Multi-Timeframe Functionality: The core strength of this indicator lies in its ability to display RSI from a timeframe different from your current chart. This allows for higher-timeframe trend confirmation or lower-timeframe entry timing without switching charts.

- Signal Generation:

- Overbought/Oversold: When the main RSI crosses above the UpperLine (e.g., 70) or below the LowerLine (e.g., 30), the background of the indicator window changes color, indicating potential overbought or oversold conditions.

- Cross Signals: When the main RSI crosses down through the UpperLine or up through the LowerLine , an 'S' (Sell) or 'B' (Buy) letter is plotted, respectively. These crosses also trigger background highlights and customizable alerts.

4. Input Parameters

The CM_Ultimate_RSI_MTF indicator offers extensive customization through its input parameters:

RSI Settings

- RsiLength : The period used for the main RSI calculation (default: 14).

- UpperLine : The upper threshold value for RSI (default: 70).

- LowerLine : The lower threshold value for RSI (default: 30).

- ShowMidLine : Enable/disable the display of the 50-level midline (default: true).

Display Options

- ShowBGHighlights : Enable/disable background highlights for overbought/oversold conditions (default: true).

- ShowCrossHighlights : Enable/disable background highlights when RSI crosses the Upper/Lower Lines (default: true).

- ShowSignalLetters : Enable/disable the 'B' and 'S' signal letters (default: true).

Main RSI Timeframe

- UseCurrentTF : If true, the main RSI will use the current chart's timeframe. If false, CustomTF will be used (default: true).

- CustomTF : Allows you to select a specific timeframe for the main RSI if UseCurrentTF is false (default: PERIOD_H1 - 1 Hour).

Second RSI

- ShowSecondRSI : Enable/disable the display of a second RSI plot (default: false).

- RsiLength2 : The period for the second RSI calculation (default: 14).

- UseCurrentTF2 : If true, the second RSI will use the current chart's timeframe. If false, CustomTF2 will be used (default: false).

- CustomTF2 : Allows you to select a specific timeframe for the second RSI if UseCurrentTF2 is false (default: PERIOD_D1 - 1 Day).

Alerts

- EnableAlerts : Master switch to enable/disable all alerts (default: false).

- AlertOnBuySignal : Enable/disable alerts for Buy signals (RSI crosses up Lower Line) (default: true).

- AlertOnSellSignal : Enable/disable alerts for Sell signals (RSI crosses down Upper Line) (default: true).

- AlertPopup : Enable/disable popup alerts (default: true).

- AlertSound : Enable/disable sound alerts (default: true).

- AlertPush : Enable/disable push notifications to your mobile device (requires MetaTrader mobile app setup) (default: false).

- AlertEmail : Enable/disable email alerts (requires MetaTrader email setup) (default: false).

- AlertSoundFile : The sound file to play for alerts (e.g., "alert.wav") (default: "alert.wav").

5. How to Use in Trading

The CM_Ultimate_RSI_MTF indicator is a versatile tool that can be integrated into various trading strategies. Here are some common applications:

-

Identifying Overbought/Oversold Conditions:

- When RSI enters the overbought zone (above UpperLine ), it suggests that the asset may be due for a price correction or reversal downwards.

- When RSI enters the oversold zone (below LowerLine ), it suggests that the asset may be due for a price correction or reversal upwards.

- Application: Look for 'S' signals (RSI crossing down from overbought) for potential sell opportunities, and 'B' signals (RSI crossing up from oversold) for potential buy opportunities.

-

Trend Confirmation (using MTF):

- Use the main RSI on your trading timeframe (e.g., H1) and the second RSI on a higher timeframe (e.g., H4 or Daily).

- Application: In an uptrend, ensure the higher timeframe RSI is also showing bullish momentum (e.g., above 50 or rising) before taking buy signals on the lower timeframe. Conversely, in a downtrend, ensure the higher timeframe RSI is bearish before taking sell signals.

-

Entry/Exit Signals:

- Buy Signal: A 'B' letter appears when RSI crosses up through the LowerLine . This can be used as a potential entry point for long positions.

- Sell Signal: An 'S' letter appears when RSI crosses down through the UpperLine . This can be used as a potential entry point for short positions or an exit point for long positions.

- Refinement: Combine these signals with price action, support/resistance levels, or other indicators for higher probability setups.

-

Filtering Signals:

- If the main RSI is in an overbought zone, you might choose to ignore buy signals and only look for sell signals.

- If the main RSI is in an oversold zone, you might choose to ignore sell signals and only look for buy signals.

6. Important Disclaimer

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

The CM_Ultimate_RSI_MTF indicator is an analytical tool designed to assist in market analysis and decision-making. It does not guarantee profits or predict future market movements with certainty. All trading decisions remain solely your responsibility. Past performance is not indicative of future results.