You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

S&P 500 - bounced from 55-SMA/200-SMA reversal area to above for the bullish to be continuing (based on the article)

==========

The chart was made on MT5 with standard indicators of Metatrader 5

This is NFP today -

AUD/USD Intra-Day Fundamentals: Australia Trade Balance and range price movement

2018-05-07 02:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

From official report :

==========

AUD/USD M5: range price movement by Australia Trade Balance news event

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

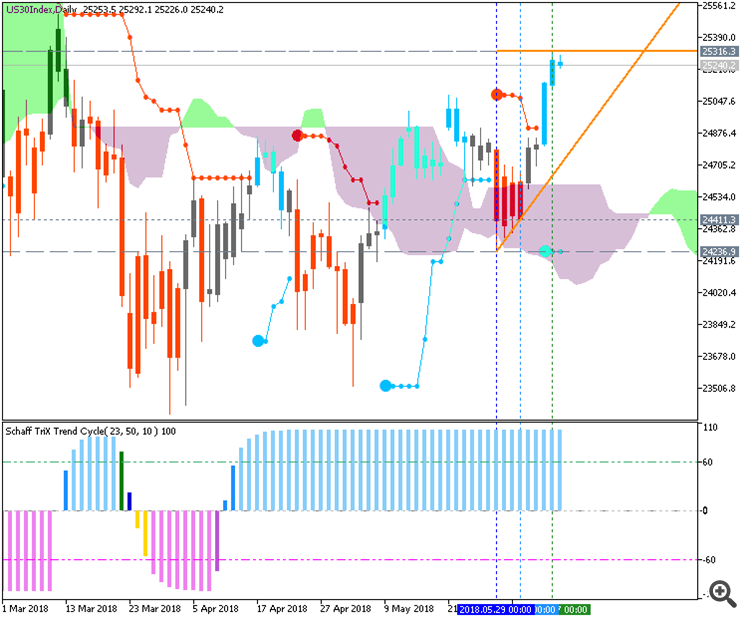

Dow Jones Industrial Average - daily bullish breakout; 25,316 is the key (based on the article)

==========

The chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

USD/CNH Intra-Day Fundamentals: China Trade Balance and range price movement

2018-05-08 04:15 GMT | [CNY - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month.

==========

From forexlive article :

==========

USD/CNH M5: range price movement by China Trade Balance news event

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

GBP/USD: daily bear market rally, weekly correction (based on the article)

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

EUR/USD: Daily Bear Market Rally (based on the article)

============

The chart was made on Metatrader 5 using HWAFM tool pattern tool from this post.

GBP/USD Intra-Day Fundamentals: U.K. Factory production and range price movement

2018-06-11 09:30 GMT | [GBP - Manufacturing Production]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Factory production news event

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Hang Seng Index (HSI) - G7, Central Banks and US Fed; daily correction to the bearish reversal (adapted from the article)

Daily price is on secondary correction within the primary bullish matket condition: the price is breaking support level at 29,964 to below for the bearish reversal to be started.

==========

The chart was made on MT5 with standard indicators of Metatrader 5 together with the following custom indicator:

EUR/USD - daily bearish to be continuing; 1.1616 is the key (adapted from the article)

Daily price broke 55-SMA/200-SMA rangingg reversal area for the primary bearish market condition: the price is testing the support level at 1.1616 to below for the bearish trend to be continuing.

==========

The chart was made on MT5 with standard indicators of Metatrader 5 together with the following custom indicator: