Library for easy and quick development of MetaTrader programs (part XXIX): Pending trading requests - request object classes

In the previous articles, we checked the concept of pending trading requests. A pending request is, in fact, a common trading order executed by a certain condition. In this article, we are going to create full-fledged classes of pending request objects — a base request object and its descendants.

Building an Automatic News Trader

This is the continuation of Another MQL5 OOP class article which showed you how to build a simple OO EA from scratch and gave you some tips on object-oriented programming. Today I am showing you the technical basics needed to develop an EA able to trade the news. My goal is to keep on giving you ideas about OOP and also cover a new topic in this series of articles, working with the file system.

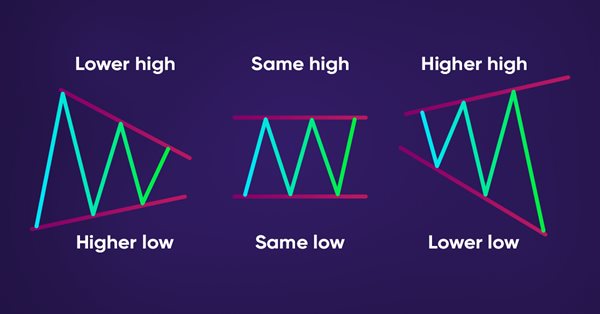

How to detect trends and chart patterns using MQL5

In this article, we will provide a method to detect price actions patterns automatically by MQL5, like trends (Uptrend, Downtrend, Sideways), Chart patterns (Double Tops, Double Bottoms).

Library for easy and quick development of MetaTrader programs (part V): Classes and collection of trading events, sending events to the program

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the fourth part, we tested tracking trading events on the account. In this article, we will develop trading event classes and place them to the event collections. From there, they will be sent to the base object of the Engine library and the control program chart.

Developing a trading Expert Advisor from scratch

In this article, we will discuss how to develop a trading robot with minimum programming. Of course, MetaTrader 5 provides a high level of control over trading positions. However, using only the manual ability to place orders can be quite difficult and risky for less experienced users.

Library for easy and quick development of MetaTrader programs (part XXVI): Working with pending trading requests - first implementation (opening positions)

In this article, we are going to store some data in the value of the orders and positions magic number and start the implementation of pending requests. To check the concept, let's create the first test pending request for opening market positions when receiving a server error requiring waiting and sending a repeated request.

Order Strategies. Multi-Purpose Expert Advisor

This article centers around strategies that actively use pending orders, a metalanguage that can be created to formally describe such strategies and the use of a multi-purpose Expert Advisor whose operation is based on those descriptions

Understanding order placement in MQL5

When creating any trading system, there is a task we need to deal with effectively. This task is order placement or to let the created trading system deal with orders automatically because it is crucial in any trading system. So, you will find in this article most of the topics that you need to understand about this task to create your trading system in terms of order placement effectively.

Developing a self-adapting algorithm (Part I): Finding a basic pattern

In the upcoming series of articles, I will demonstrate the development of self-adapting algorithms considering most market factors, as well as show how to systematize these situations, describe them in logic and take them into account in your trading activity. I will start with a very simple algorithm that will gradually acquire theory and evolve into a very complex project.

Testing currency pair patterns: Practical application and real trading perspectives. Part IV

This article concludes the series devoted to trading currency pair baskets. Here we test the remaining pattern and discuss applying the entire method in real trading. Market entries and exits, searching for patterns and analyzing them, complex use of combined indicators are considered.

Learn how to design a trading system by ATR

In this article, we will learn a new technical tool that can be used in trading, as a continuation within the series in which we learn how to design simple trading systems. This time we will work with another popular technical indicator: Average True Range (ATR).

Trading signals module using the system by Bill Williams

The article describes the rules of the trading system by Bill Williams, the procedure of application for a developed MQL5 module to search and mark patterns of this system on the chart, automated trading with found patterns, and also presents the results of testing on various trading instruments.

Developing a cross-platform grider EA

In this article, we will learn how to create Expert Advisors (EAs) working both in MetaTrader 4 and MetaTrader 5. To do this, we are going to develop an EA constructing order grids. Griders are EAs that place several limit orders above the current price and the same number of limit orders below it simultaneously.

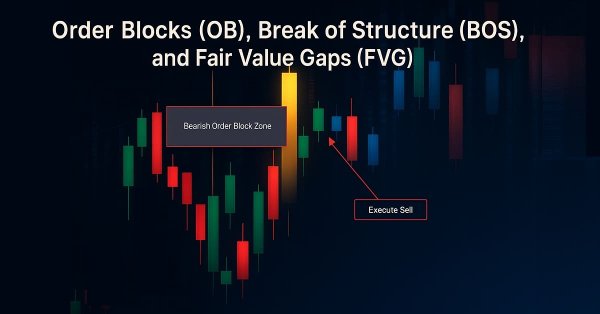

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

Mathematics in trading: Sharpe and Sortino ratios

Return on investments is the most obvious indicator which investors and novice traders use for the analysis of trading efficiency. Professional traders use more reliable tools to analyze strategies, such as Sharpe and Sortino ratios, among others.

A DLL for MQL5 in 10 Minutes (Part II): Creating with Visual Studio 2017

The original basic article has not lost its relevance and thus if you are interested in this topic, be sure to read the first article. However much time has passed since then, so the current Visual Studio 2017 features an updated interface. The MetaTrader 5 platform has also acquired new features. The article provides a description of dll project development stages, as well as DLL setup and interaction with MetaTrader 5 tools.

Elevate Your Trading With Smart Money Concepts (SMC): OB, BOS, and FVG

Elevate your trading with Smart Money Concepts (SMC) by combining Order Blocks (OB), Break of Structure (BOS), and Fair Value Gaps (FVG) into one powerful EA. Choose automatic strategy execution or focus on any individual SMC concept for flexible and precise trading.

Library for easy and quick development of MetaTrader programs (part XXI): Trading classes - Base cross-platform trading object

In this article, we will start the development of the new library section - trading classes. Besides, we will consider the development of a unified base trading object for MetaTrader 5 and MetaTrader 4 platforms. When sending a request to the server, such a trading object implies that verified and correct trading request parameters are passed to it.

Library for easy and quick development of MetaTrader programs (part XXXI): Pending trading requests - opening positions under certain conditions

Starting with this article, we are going to develop a functionality allowing users to trade using pending requests under certain conditions, for example, when reaching a certain time limit, exceeding a specified profit or closing a position by stop loss.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Automating Trading Strategies in MQL5 (Part 47): Nick Rypock Trailing Reverse (NRTR) with Hedging Features

In this article, we develop a Nick Rypock Trailing Reverse (NRTR) trading system in MQL5 that uses channel indicators for reversal signals, enabling trend-following entries with hedging support for buys and sells. We incorporate risk management features like auto lot sizing based on equity or balance, fixed or dynamic stop-loss and take-profit levels using ATR multipliers, and position limits.

Practical application of neural networks in trading. Python (Part I)

In this article, we will analyze the step-by-step implementation of a trading system based on the programming of deep neural networks in Python. This will be performed using the TensorFlow machine learning library developed by Google. We will also use the Keras library for describing neural networks.

Patterns available when trading currency baskets

Following up our previous article on the currency baskets trading principles, here we are going to analyze the patterns traders can detect. We will also consider the advantages and the drawbacks of each pattern and provide some recommendations on their use. The indicators based on Williams' oscillator will be used as analysis tools.

Library for easy and quick development of MetaTrader programs (part XIII): Account object events

The article considers working with account events for tracking important changes in account properties affecting the automated trading. We have already implemented some functionality for tracking account events in the previous article when developing the account object collection.

Econometric approach to finding market patterns: Autocorrelation, Heat Maps and Scatter Plots

The article presents an extended study of seasonal characteristics: autocorrelation heat maps and scatter plots. The purpose of the article is to show that "market memory" is of seasonal nature, which is expressed through maximized correlation of increments of arbitrary order.

Money-Making Algorithms Employing Trailing Stop

This article's objective is to study profitability of algorithms with different entries into trades and exits using trailing stop. Entry types to be used are random entry and reverse entry. Stop orders to be used are trailing stop and trailing take. The article demonstrates money-making algorithms with a profitability of about 30% per annum.

Advanced EA constructor for MetaTrader - botbrains.app

In this article, we demonstrate features of botbrains.app - a no-code platform for trading robots development. To create a trading robot you don't need to write any code - just drag and drop the necessary blocks onto the scheme, set their parameters, and establish connections between them.

Forecasting Time Series (Part 2): Least-Square Support-Vector Machine (LS-SVM)

This article deals with the theory and practical application of the algorithm for forecasting time series, based on support-vector method. It also proposes its implementation in MQL and provides test indicators and Expert Advisors. This technology has not been implemented in MQL yet. But first, we have to get to know math for it.

Learn how to design a trading system by ADX

In this article, we will continue our series about designing a trading system using the most popular indicators and we will talk about the average directional index (ADX) indicator. We will learn this indicator in detail to understand it well and we will learn how we to use it through a simple strategy. By learning something deeply we can get more insights and we can use it better.

Universal Expert Advisor: Trading Modes of Strategies (Part 1)

Any Expert Advisor developer, regardless of programming skills, is daily confronted with the same trading tasks and algorithmic problems, which should be solved to organize a reliable trading process. The article describes the possibilities of the CStrategy trading engine that can undertake the solution of these tasks and provide a user with convenient mechanism for describing a custom trading idea.

Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average

This article presents Pivot Mean Oscillator (PMO), an implementation of the cumulative moving average (CMA) as a trading indicator for the MetaTrader platforms. In particular, we first introduce Pivot Mean (PM) as a normalization index for timeseries that computes the fraction between any data point and the CMA. We then build PMO as the difference between the moving averages applied to two PM signals. Some preliminary experiments carried out on the EURUSD symbol to test the efficacy of the proposed indicator are also reported, leaving ample space for further considerations and improvements.

Library for easy and quick development of MetaTrader programs (part XIV): Symbol object

In this article, we will create the class of a symbol object that is to be the basic object for creating the symbol collection. The class will allow us to obtain data on the necessary symbols for their further analysis and comparison.

Machine learning in Grid and Martingale trading systems. Would you bet on it?

This article describes the machine learning technique applied to grid and martingale trading. Surprisingly, this approach has little to no coverage in the global network. After reading the article, you will be able to create your own trading bots.

Developing a cross-platform grid EA (Last part): Diversification as a way to increase profitability

In previous articles within this series, we tried various methods for creating a more or less profitable grid Expert Advisor. Now we will try to increase the EA profitability through diversification. Our ultimate goal is to reach 100% profit per year with the maximum balance drawdown no more than 20%.

Applying Monte Carlo method in reinforcement learning

In the article, we will apply Reinforcement learning to develop self-learning Expert Advisors. In the previous article, we considered the Random Decision Forest algorithm and wrote a simple self-learning EA based on Reinforcement learning. The main advantages of such an approach (trading algorithm development simplicity and high "training" speed) were outlined. Reinforcement learning (RL) is easily incorporated into any trading EA and speeds up its optimization.

How to master Machine Learning

Check out this selection of useful materials which can assist traders in improving their algorithmic trading knowledge. The era of simple algorithms is passing, and it is becoming harder to succeed without the use of Machine Learning techniques and Neural Networks.

The NRTR indicator and trading modules based on NRTR for the MQL5 Wizard

In this article we are going to analyze the NRTR indicator and create a trading system based on this indicator. We are going to develop a module of trading signals that can be used in creating strategies based on a combination of NRTR with additional trend confirmation indicators.

Using indicators for optimizing Expert Advisors in real time

Efficiency of any trading robot depends on the correct selection of its parameters (optimization). However, parameters that are considered optimal for one time interval may not retain their effectiveness in another period of trading history. Besides, EAs showing profit during tests turn out to be loss-making in real time. The issue of continuous optimization comes to the fore here. When facing plenty of routine work, humans always look for ways to automate it. In this article, I propose a non-standard approach to solving this issue.

Multiple Regression Analysis. Strategy Generator and Tester in One

The article gives a description of ways of use of the multiple regression analysis for development of trading systems. It demonstrates the use of the regression analysis for strategy search automation. A regression equation generated and integrated in an EA without requiring high proficiency in programming is given as an example.

Use MQL5.community channels and group chats

The MQL5.com website brings together traders from all over the world. Users publish articles, share free codes, sell products in the Market, perform Freelance orders and copy trading signals. You can communicate with them on the Forum, in trader chats and in MetaTrader channels.