Dr. Tradelove or How I Stopped Worrying and Created a Self-Training Expert Advisor

Just over a year ago joo, in his article "Genetic Algorithms - It's Easy!", gave us a tool for implementation of the genetic algorithm in MQL5. Now utilizing the tool we will create an Expert Advisor that will genetically optimize its own parameters upon certain boundary conditions...

Combinatorics and probability theory for trading (Part III): The first mathematical model

A logical continuation of the earlier discussed topic would be the development of multifunctional mathematical models for trading tasks. In this article, I will describe the entire process related to the development of the first mathematical model describing fractals, from scratch. This model should become an important building block and be multifunctional and universal. It will build up our theoretical basis for further development of this idea.

Learn how to design a trading system by Parabolic SAR

In this article, we will continue our series about how to design a trading system using the most popular indicators. In this article, we will learn about the Parabolic SAR indicator in detail and how we can design a trading system to be used in MetaTrader 5 using some simple strategies.

Gradient Boosting (CatBoost) in the development of trading systems. A naive approach

Training the CatBoost classifier in Python and exporting the model to mql5, as well as parsing the model parameters and a custom strategy tester. The Python language and the MetaTrader 5 library are used for preparing the data and for training the model.

Developing multi-module Expert Advisors

MQL programming language allows implementing the concept of modular development of trading strategies. The article shows an example of developing a multi-module Expert Advisor consisting of separately compiled file modules.

How to Prepare MetaTrader 5 Quotes for Other Applications

The article describes the examples of creating directories, copying data, filing, working with the symbols in Market Watch or the common list, as well as the examples of handling errors, etc. All these elements can eventually be gathered in a single script for filing the data in a user-defined format.

Automating Trading Strategies in MQL5 (Part 7): Building a Grid Trading EA with Dynamic Lot Scaling

In this article, we build a grid trading expert advisor in MQL5 that uses dynamic lot scaling. We cover the strategy design, code implementation, and backtesting process. Finally, we share key insights and best practices for optimizing the automated trading system.

Developing a Trading Strategy: The Butterfly Oscillator Method

In this article, we demonstrated how the fascinating mathematical concept of the Butterfly Curve can be transformed into a practical trading tool. We constructed the Butterfly Oscillator and built a foundational trading strategy around it. The strategy effectively combines the oscillator's unique cyclical signals with traditional trend confirmation from moving averages, creating a systematic approach for identifying potential market entries.

Automating Trading Strategies in MQL5 (Part 5): Developing the Adaptive Crossover RSI Trading Suite Strategy

In this article, we develop the Adaptive Crossover RSI Trading Suite System, which uses 14- and 50-period moving average crossovers for signals, confirmed by a 14-period RSI filter. The system includes a trading day filter, signal arrows with annotations, and a real-time dashboard for monitoring. This approach ensures precision and adaptability in automated trading.

Econometric Approach to Analysis of Charts

This article describes the econometric methods of analysis, the autocorrelation analysis and the analysis of conditional variance in particular. What is the benefit of the approach described here? Use of the non-linear GARCH models allows representing the analyzed series formally from the mathematical point of view and creating a forecast for a specified number of steps.

Creating an Interactive Graphical User Interface in MQL5 (Part 1): Making the Panel

This article explores the fundamental steps in crafting and implementing a Graphical User Interface (GUI) panel using MetaQuotes Language 5 (MQL5). Custom utility panels enhance user interaction in trading by simplifying common tasks and visualizing essential trading information. By creating custom panels, traders can streamline their workflow and save time during trading operations.

Combinatorics and probability for trading (Part IV): Bernoulli Logic

In this article, I decided to highlight the well-known Bernoulli scheme and to show how it can be used to describe trading-related data arrays. All this will then be used to create a self-adapting trading system. We will also look for a more generic algorithm, a special case of which is the Bernoulli formula, and will find an application for it.

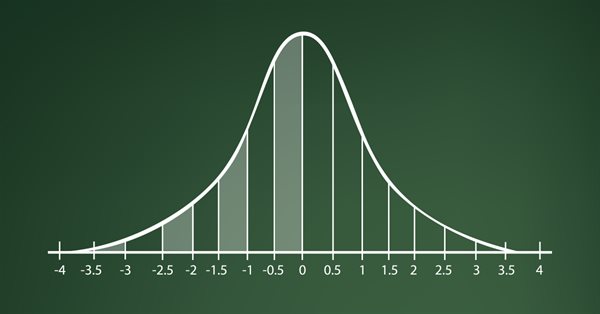

Learn how to design a trading system by Standard Deviation

Here is a new article in our series about how to design a trading system by the most popular technical indicators in MetaTrader 5 trading platform. In this new article, we will learn how to design a trading system by Standard Deviation indicator.

Decoding Opening Range Breakout Intraday Trading Strategies

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Pair trading

In this article, we will consider pair trading, namely what its principles are and if there are any prospects for its practical application. We will also try to create a pair trading strategy.

Implementing a Bollinger Bands Trading Strategy with MQL5: A Step-by-Step Guide

A step-by-step guide to implementing an automated trading algorithm in MQL5 based on the Bollinger Bands trading strategy. A detailed tutorial based on creating an Expert Advisor that can be useful for traders.

Learn how to design a trading system by Williams PR

A new article in our series about learning how to design a trading system by the most popular technical indicators by MQL5 to be used in the MetaTrader 5. In this article, we will learn how to design a trading system by the Williams' %R indicator.

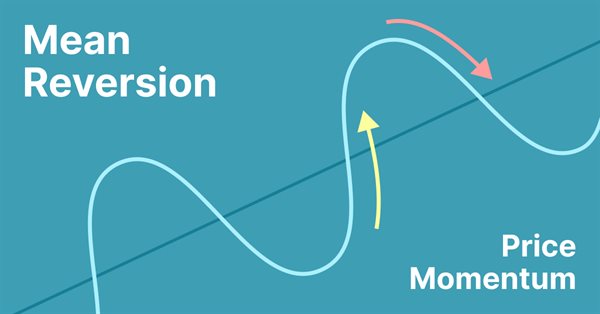

Simple Mean Reversion Trading Strategy

Mean reversion is a type of contrarian trading where the trader expects the price to return to some form of equilibrium which is generally measured by a mean or another central tendency statistic.

Automating Trading Strategies in MQL5 (Part 25): Trendline Trader with Least Squares Fit and Dynamic Signal Generation

In this article, we develop a trendline trader program that uses least squares fit to detect support and resistance trendlines, generating dynamic buy and sell signals based on price touches and open positions based on generated signals.

Controlling the Slope of Balance Curve During Work of an Expert Advisor

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Somehow, you need to correct the operation of the Expert Advisor as it accumulates the results of trading. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve.

Developing a trading Expert Advisor from scratch (Part 19): New order system (II)

In this article, we will develop a graphical order system of the "look what happens" type. Please note that we are not starting from scratch this time, but we will modify the existing system by adding more objects and events on the chart of the asset we are trading.

How to deal with lines using MQL5

In this article, you will find your way to deal with the most important lines like trendlines, support, and resistance by MQL5.

Automating Trading Strategies in MQL5 (Part 24): London Session Breakout System with Risk Management and Trailing Stops

In this article, we develop a London Session Breakout System that identifies pre-London range breakouts and places pending orders with customizable trade types and risk settings. We incorporate features like trailing stops, risk-to-reward ratios, maximum drawdown limits, and a control panel for real-time monitoring and management.

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

Learn how to design a trading system by OBV

This is a new article to continue our series for beginners about how to design a trading system based on some of the popular indicators. We will learn a new indicator that is On Balance Volume (OBV), and we will learn how we can use it and design a trading system based on it.

MQL5 Cookbook: Handling BookEvent

This article considers BookEvent - a Depth of Market event, and the principle of its processing. An MQL program, handling states of Depth of Market, serves as an example. It is written using the object-oriented approach. Results of handling are displayed on the screen as a panel and Depth of Market levels.

An Example of Developing a Spread Strategy for Moscow Exchange Futures

The MetaTrader 5 platform allows developing and testing trading robots that simultaneously trade multiple financial instruments. The built-in Strategy Tester automatically downloads required tick history from the broker's server taking into account contract specifications, so the developer does not need to do anything manually. This makes it possible to easily and reliably reproduce trading environment conditions, including even millisecond intervals between the arrival of ticks on different symbols. In this article we will demonstrate the development and testing of a spread strategy on two Moscow Exchange futures.

Swaps (Part I): Locking and Synthetic Positions

In this article I will try to expand the classic concept of swap trading methods. I will explain why I have come to the conclusion that this concept deserves special attention and is absolutely recommended for study.

Learn how to design a trading system by Accelerator Oscillator

A new article from our series about how to create simple trading systems by the most popular technical indicators. We will learn about a new one which is the Accelerator Oscillator indicator and we will learn how to design a trading system using it.

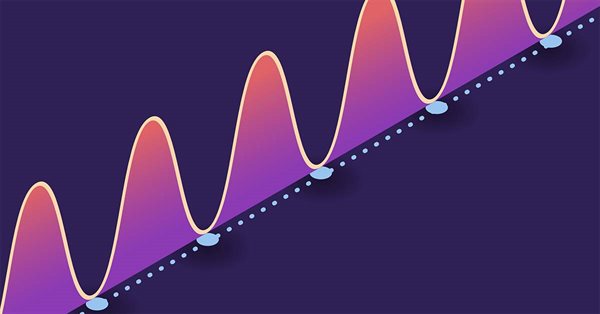

Combinatorics and probability theory for trading (Part II): Universal fractal

In this article, we will continue to study fractals and will pay special attention to summarizing all the material. To do this, I will try to bring all earlier developments into a compact form which would be convenient and understandable for practical application in trading.

Developing Zone Recovery Martingale strategy in MQL5

The article discusses, in a detailed perspective, the steps that need to be implemented towards the creation of an expert advisor based on the Zone Recovery trading algorithm. This helps aotomate the system saving time for algotraders.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

The Inverse Fair Value Gap Trading Strategy

An inverse fair value gap(IFVG) occurs when price returns to a previously identified fair value gap and, instead of showing the expected supportive or resistive reaction, fails to respect it. This failure can signal a potential shift in market direction and offer a contrarian trading edge. In this article, I'm going to introduce my self-developed approach to quantifying and utilizing inverse fair value gap as a strategy for MetaTrader 5 expert advisors.

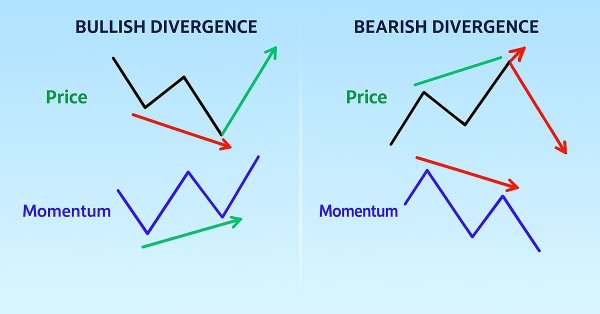

Automating Trading Strategies in MQL5 (Part 37): Regular RSI Divergence Convergence with Visual Indicators

In this article, we build an MQL5 EA that detects regular RSI divergences using swing points with strength, bar limits, and tolerance checks. It executes trades on bullish or bearish signals with fixed lots, SL/TP in pips, and optional trailing stops. Visuals include colored lines on charts and labeled swings for better strategy insights.

Combinatorics and probability for trading (Part V): Curve analysis

In this article, I decided to conduct a study related to the possibility of reducing multiple states to double-state systems. The main purpose of the article is to analyze and to come to useful conclusions that may help in the further development of scalable trading algorithms based on the probability theory. Of course, this topic involves mathematics. However, given the experience of previous articles, I see that generalized information is more useful than details.

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

Neural networks made easy (Part 26): Reinforcement Learning

We continue to study machine learning methods. With this article, we begin another big topic, Reinforcement Learning. This approach allows the models to set up certain strategies for solving the problems. We can expect that this property of reinforcement learning will open up new horizons for building trading strategies.

Advantages of MQL5 Signals

Trading Signals service recently introduced in MetaTrader 5 allows traders to copy trading operations of any signals provider. Users can select any signal, subscribe to it and all deals will be copied at their accounts. Signals providers can set their subscription prices and receive a fixed monthly fee from their subscribers.