How to Become a Successful Signal Provider on MQL5.com

Table of Contents

- Background

- The Context

- Studying Other Successful Signal Providers

- Finding a Promising Trading Strategy

- Testing and Optimizing your Trading Strategy

- Main Aspects of a Successful Signal

- Writing a Good Signal Description

- Publishing your Signal

- Promoting your Signal

- Staying Informed

- Posting News Updates

- Answering Private Messages from Subscribers

- The First Signs that Something is Going Wrong

- And Now What?

1. Background

Forex is the largest financial market, with a worldwide daily turnover of over $6 trillion, making it irresistible to those familiar with trading. Trading forex can be both highly profitable and risky, as anyone who has spent a few hours or days trading can attest. The differentiating factor between winners and losers lies in their ability to identify good entry points, establish well-structured profit and loss boundaries, and maintain discipline. Winners consistently secure a small portion of that $6 trillion pie each day before turning off their computers, while losers often succumb to the desire for more, leading to failure. The objective of a successful signal provider is to discover a robust and profitable strategy that allows them to capture a small portion of that pie daily, broadcasting it to a large number of subscribers simultaneously.

2. The Context

When you first visit MQL5.com, you observe its great potential. There's the Market, where you can purchase various expert advisors, indicators, or utilities to assist your trading. The Codebase offers a plethora of useful free tools, while the Freelance section allows you to transform your ideas or strategies into functioning trading systems for a few dollars. Let's not forget the Forum, where you can find answers to your questions, troubleshoot coding issues, or seek support for any problems you encounter. However, the section that intrigued me the most is the Signals section, showcasing thousands of signals to attract potential subscribers.

Before you embark on creating your own signal, it can be highly beneficial to subscribe to a few signals yourself. This way, you can observe how they operate, their trading styles, and how they handle abnormal market conditions or unexpected events. In my early years, I lost a significant amount of money by following signals without fully comprehending their vulnerable strategies until they failed. However, I consider these losses as part of my education in forex and signals. It wasn't until later that I realized one of the primary reasons popular signals fail is due to the pressure signal providers face from numerous anxious subscribers. I will delve into this topic in more detail later.

3. Studying Other Successful Signal Providers

Whenever I set out to achieve something, I remind myself of the phrase used by Anthony Hopkins in the movie 'The Edge' when he was striving to survive after a plane crash: 'What a man can do, another can do.' I repeat this phrase in my mind to stay motivated and continue studying and working hard to reach my goals. One traditional approach to achieving success is studying the competition or individuals who have accomplished the same thing in the past, understanding the methods they employed, their work processes, and what they avoided. You can apply this approach to top signal providers on MQL5.com before publishing your own signal. In order to progress, you must climb each step, and in the signals business, there are several steps to consider.

By studying other top signals, you will notice that many of them employ traditional yet risky techniques such as martingale, grid, or no stop-loss strategies. All three techniques come with inherent risks that are generally known to those with trading experience. While martingale may work most of the time, a single failure can devastate your account. Some traders employ variations of martingale with lower multiplication factors and strict step limits, but it is rare to find a strategy that completely avoids destruction. Grid strategies perform well in ranging markets but can result in account blow-ups during trending periods. Similarly, strategies that lack stop-loss orders, commonly referred to as 'hold and pray,' are susceptible to ruin when encountering a significant trend.

Based on my experience, very few signal providers employ truly long-term and sustainable trading methods that incorporate thorough technical and fundamental analysis, consistent use of stop-loss orders, and sound money management. These providers tend to demonstrate smaller yet steady monthly growth with an acceptable maximum drawdown (under 20-30%), which should be appealing to subscribers. However, it comes as no surprise that such approaches often fail to attract attention because most individuals are seeking ways to quickly amass wealth in a matter of weeks or months, rather than aiming for a reliable and steady income. Bearing this in mind, you can focus on bridging the gap between these two worlds: achieving impressive and intriguing results while maintaining controllable risks and an acceptable drawdown.

4. Finding a Promising Trading Strategy

In order to attract subscribers, you need to find a solid trading strategy that will yield interesting results with an acceptable level of risk. There is another aspect that I haven't mentioned in this guide so far, and that is the factor of luck. If this element is absent, even the best strategy can struggle to produce satisfactory results over an extended period, resulting in short-lived experiences.

Many traders and subscribers seek a consistently profitable trading strategy with minimal drawdowns, often favoring scalping strategies. In forex trading, there are various patterns that have captured the attention of day traders, such as the London market opening effect. Frequently, overnight extremes in different currency pairs are reversed during the early hours of the London market, which can serve as an intriguing idea for a scalping strategy.

Ideally, you should aim to automate your trading strategy to eliminate personal biases and emotions from the decision-making process. You can explore EAs (Expert Advisors) in the MQL5.com Market that can execute trading decisions on your behalf, or you can even order a customized Expert Advisor through the Freelance section to cater to your specific requirements. Finding a reliable trading partner to automate your manual trading doesn't have to be excessively expensive.

5. Testing and Optimizing your Trading Strategy

Buying an EA is one thing, but testing it, optimizing it, and finding the ideal settings that will yield the desired results is another challenge. Therefore, it can be highly beneficial to dedicate several months to analyze past results, conduct backtesting, and optimize various setups in order to identify the configuration that can deliver the desired outcomes. Nothing comes easy, so the belief that you will find a 'magic' expert advisor that will handle all the work while you sit back and enjoy the results is a myth, at least based on my knowledge. Even the best EAs require fine-tuning, optimization, and periodic adjustments to adapt to the ever-changing market conditions, particularly in times like these when nothing remains static for more than a few hours. We are currently living in an era characterized by lightning-fast changes in every aspect of our lives.

Your objective should be to discover the settings that can generate the desired results with the lowest possible maximum drawdown. The best approach to achieve this is by optimizing your EA based on the most recent 12-month period to ensure better responsiveness to the current market conditions. From my experience, testing your strategy for more than 2-3 years back is not very useful, as market and trading conditions are constantly evolving.

If you employ a high-risk strategy, it is important to remember the well-known proverb 'don't put all your eggs in one basket.' For such cases, I utilize an interesting money management plan that involves using only a portion of my available capital. To explain briefly, I divide my capital into four parts and trade with only 1/4 of it. Then, on a weekly or monthly basis, I divide my capital, including any profits, into four parts again, commencing the next week's trading with the new 1/4 allocation. This approach allows me to keep 3/4 of my capital safeguarded from market risks and exposure. Keep in mind that this is just an example, and you can tailor your own plan to better suit your individual needs and strategy.

6. Main Aspects of a Successful Signal

Before I even published my first signal, whether during my time as a subscriber or later when studying other top signals, I always maintained a list of key aspects that a good signal should possess. While this list evolved, its core remained consistent. Therefore, my criteria for an attractive signal are as follows:

- A profitable strategy with a favorable risk/reward ratio. A signal that carries a much larger risk than potential reward per trade exposes itself to danger or eventual destruction.

- Consistent use of stop loss in every trade. It is better to incur small losses and move on than to suffer a single catastrophic loss.

- Intraday positions that risk only a small portion of the available capital. The ideal rule is not to risk more than 2-3% per trade, or a maximum of 5% for high-risk strategies.

- Maintaining no more than 2-3 open positions at a time. The precise number depends on the predetermined risk percentage per trade.

- A maximum drawdown of less than 30%-35%. Most potential subscribers use this threshold to select their preferred signal.

- Utilization of a well-known and widely-used broker to ensure optimal signal copying conditions and to avoid slippage issues for the majority of subscribers.

- Setting a signal subscription price that reflects performance and is within reach for most potential subscribers. A lower price tends to make a signal more attractive, while an excessively high price can deter subscribers.

An aspect I haven't addressed yet in this guide is slippage, which is one of the crucial factors that can make signal copying challenging or even impossible at times. When planning to publish a signal on MQL5.com, it is essential to consider that slippage (the price difference between brokers) can significantly influence its success or failure. Therefore, it is crucial to use a well-known and reputable broker that facilitates easier copying for potential subscribers. Before opening a trading account (if the intention is to publish it as a signal later), one should check the slippage tab of other signals using the same broker and ensure compatibility with other brokers/servers.

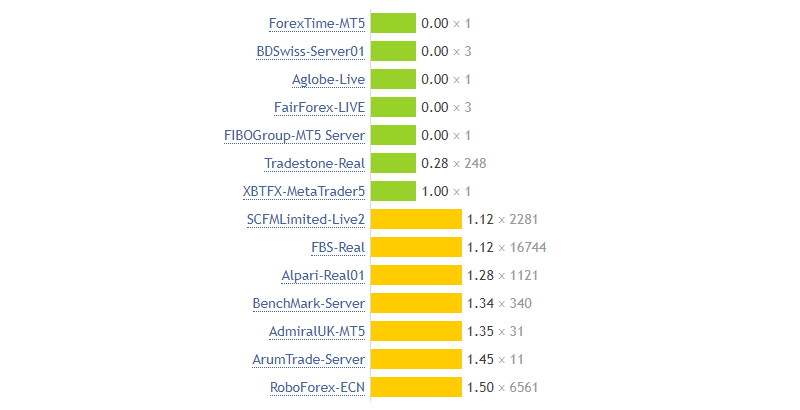

In the example below, you can observe various brokers/servers that were used to copy a signal and their corresponding slippage data on the right side. The first number represents the average slippage per trade in points, and the second number indicates the number of executed trades used to calculate the average slippage. While these numbers are approximate and not always reliable, they provide a good indication of what to expect. As a signal provider, it is advisable to seek brokers with multiple available broker/server setups, displaying relatively low slippage values (preferably within the green and yellow range) and a significant number of executed trades, as shown in the photo below. The examples of 1.12 points slippage over 16,744 trades and 1.50 points slippage over 6,561 trades are indicative of attractive copying.

7. Writing a Good Signal Description

Another important factor that undoubtedly contributes to the success and attraction of a profitable signal is an informative and well-written signal description. Many signal providers with a commendable trading record lack the ability or willingness to craft an engaging description for their signal, which leads to skepticism among potential subscribers regarding their strategy. Prospective signal subscribers appreciate detailed insights into your trading history, risk and money management plans, as well as your approach to unexpected situations. A well-written description not only helps them understand your plan but also reduces the number of private messages seeking clarification about your signal.

A well-structured signal description should include the following components:

- Introduction: Share a few words about your trading background and provide a brief overview of your strategy.

- Strategy Details: Offer additional information about your trading strategy, including the tools or expert advisors (EAs) you employ, as well as your risk and money management plans.

- Signal Advantages: Highlight the strengths of your signal, such as your consistent use of stop-loss in your trades, the fixed risk percentage per trade (if applicable), expected maximum drawdown, and the absence of risky techniques like martingale or grid (if not utilized). Include any other positive aspects you believe are noteworthy for your signal.

- Subscriber Recommendations: Provide advice to potential subscribers regarding the recommended broker/server setup, account type, leverage, and other relevant details. Discuss potential slippage issues they may encounter and offer useful tips to facilitate smooth signal copying.

By adhering to these guidelines and ensuring a well-structured and informative signal description, you can enhance your signal's appeal and increase its chances of attracting subscribers.

8. Publishing your Signal

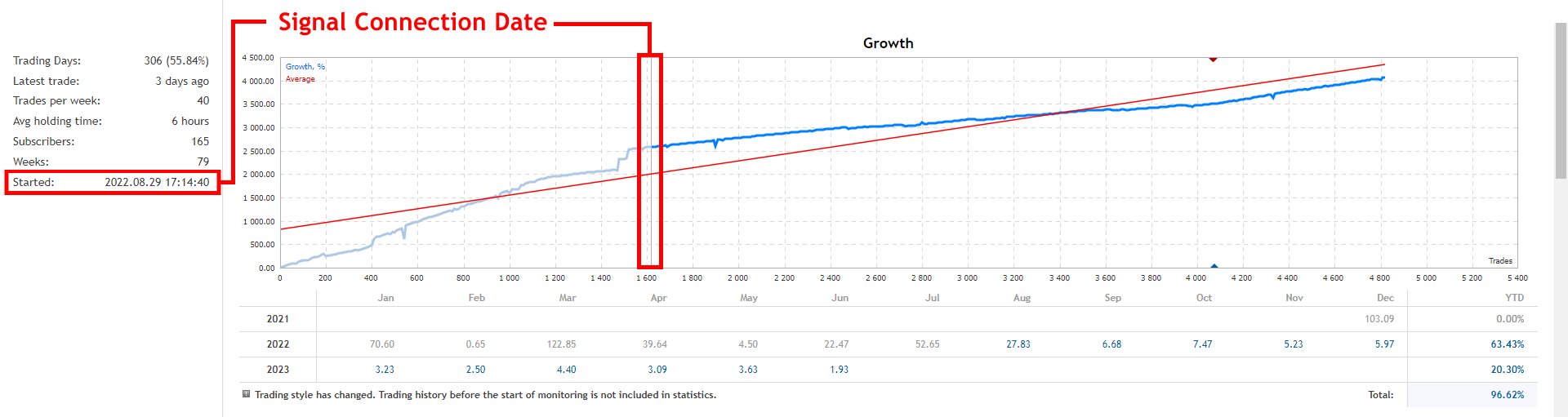

After you have developed your trading strategy, you may consider putting it to the test by publishing your trading account as a signal. It is advisable to trade for at least a couple of months without publishing your signal, ensuring that you are on the right track. In my experience, it is beneficial to connect your signal to the MQL5.com signal database from its inception as a private signal. This allows for monitoring purposes and avoids the appearance of a light blue vertical line in the growth chart, which indicates that your signal was not connected to MQL5.com from the very beginning.

Once a solid trading history is established, you can edit your signal and change its visibility from private to public. Some signal providers intentionally delay connecting their signals to hide their actual (and often high) maximum drawdown. This is because platforms cannot detect the open/live drawdown of past trades unless they have been monitoring your trading account since the beginning. While this strategy may help attract more subscribers in the short term, the truth inevitably emerges, leading to the erosion of their credibility.

9. Promoting your Signal

After you have published your signal, it is essential to consider how you will promote it to attract potential subscribers. On the MQL5.com website, there are limited options for promotion, such as advertising and posting on your profile page. Your 'friends' on the platform will be able to see your posts, and if they find something appealing, they may become interested in your signal. Therefore, it is crucial to highlight the positive aspects of your signal, emphasizing any special advantages that set it apart from the competition. You can discuss your trading strategy, the tools you utilize, and the safety measures implemented in your trading.

Graphics play a significant role in promoting your signal. Eye-catching banners or visually appealing images can captivate attention and bring your signal to life. Sharing your growth charts, particularly if they demonstrate outstanding performance, can be highly beneficial. If you are not proficient in photo editing or using graphic illustration applications, consider seeking assistance from a friend or hiring a professional. The effort and expense will be worthwhile.

Some signal providers also utilize social media platforms to promote their signals. They create profiles, groups, or teams and add numerous members who receive regular updates, news, and engaging information about their trading ventures. Social media platforms offer modern marketing opportunities and appeal to a growing number of followers every day.

Ideally, signal providers should employ all available means to promote and advertise their signals, reaching larger audiences and potentially acquiring more subscribers.

10. Staying Informed

Another crucial aspect for the longevity of a successful signal is the provider's ability to stay informed and keep track of all the important economic and political news and events taking place worldwide. Forex lies at the heart of everything significant happening around the planet, and even the smallest news or sudden announcement can significantly impact major and minor currencies, stock market indexes, or commodities. An accident or an earthquake, for instance, can cause financial turmoil and instantaneously affect your trading strategy. Therefore, it is vital for a well-informed signal provider to stay on top of all these developments.

The websites I rely on for real-time news coverage include:

- https://www.forexlive.com/ (for real-time forex news)

- https://www.fxstreet.com/ (primarily for analysis articles)

- https://www.investing.com/ (especially their Economic Calendar)

- https://www.efxdata.com/ (for institutional insights)

- https://www.marketwatch.com/ (for stocks & indexes)

- https://www.bloomberg.com/ (for political and financial news)

- https://www.reuters.com/ (for real-time news updates)

Some of the most crucial news and events that a well-informed signal provider should closely monitor are:

- Central banks' meetings and interest rate announcements.

- Elections and other major political events.

- Central bankers' speeches and press conferences.

- U.S. Nonfarm payrolls (NFP) data announcements (first Friday of every month).

- Unemployment rate announcements.

- Gross domestic product (GDP) growth rate announcements.

- Consumer price index (CPI) announcements.

- Retail sales data announcements.

- Purchasing managers' index (PMI) announcements.

All of the above economic data announcements typically affect currency pairs that involve the country releasing them. However, they often have an impact on other currencies as well, especially when their economies are affected by such events.

11. Posting News Updates

Signal subscribers expect communication from the signal provider, which includes frequent updates through the 'What's new' section of the signal. Providing a weekly report that highlights the signal's developments, performance analysis, and achievements can be ideal for maintaining good relations with your followers. When there is no communication with your subscribers, leaving them in the dark about your trading decisions or any unfortunate losses, it only increases their anxiety and nervousness, ultimately impacting your subscriber base.

12. Answering Private Messages from Subscribers

Communicating with your subscribers through the 'What's new' section of your signal can reassure most of them during times of anxiety and awkward results. However, some followers may prefer to contact you in a more personal manner by sending a private message through the MQL5.com platform. It is highly advisable to respond to these messages with a calm and respectful attitude if you want to maintain a good relationship with your members. Take the time to explain the situation regarding your signal or any other aspect that requires further analysis.

In my experience, there have been interesting signals in the past that employed well-structured and effective strategies. However, their providers lacked the skills or willingness to stay in touch with their subscribers, resulting in a significant impact on their subscriber base. On the other hand, I have seen mediocre signals thrive due to their providers' excellent marketing tools and consistent communication. Therefore, it is extremely important to stay connected with your followers and always respond to their private messages to the best of your ability. Overcoming language barriers or improving social skills may present challenges, but with effort, these barriers can be overcome.

13. The First Signs that Something is Going Wrong

Apart from the failure of your trading strategy, there are several other ways to understand that something is not going well with your signal. Firstly, you will notice or be contacted by subscribers regarding copying issues, which are usually caused by slippage or the growing number of subscribers and the impact of their large volume of copied trades during thin market conditions or sensitive hours of the trading day/night. I have personally witnessed this situation when everything was going well, and all subscribers were smoothly copying trades as long as their number was in the hundreds. However, the situation significantly worsened when the number exceeded a thousand or reached even higher figures. While some may find it absurd to believe that a few subscribers can affect the global market, trust me, when thousands of subscribers collectively buy or sell large volumes in a thin night market with limited liquidity, it significantly impacts signal copying.

Another factor that can affect the signal's performance is the pressure that subscribers can exert on the signal provider, and this is no joke. Many successful and popular signals fail when the provider's luck runs out or when their trading strategy wasn't well-planned and relied too heavily on ideal market conditions. Additionally, if the provider cannot handle excessive criticism or suggestions from subscribers, the psychological pressure can influence trading decisions and the ability to cope with market abnormalities. The result is reflected in the signal's performance, marking the beginning of its decline.

In other words, there are specific reasons why no top signal has ever remained above the thousand subscriber level for more than a few months, as explained above. It would be interesting to see in the future if anyone succeeds in staying on top for more than a few months or even over a year. However, based on my personal experience, that hasn't been observed thus far.

14. And Now What?

When your signal completes its course, there is no need to think that this is the end of your journey as a signal provider. I have seen many providers who have managed to come back, often with more energy and better strategies, gaining more subscribers and recognition than before. So, it is healthy to accept this, move on, and set new targets for the future. After the dust settles, it is a great time for self-criticism, evaluating your actions, and assessing the advantages and disadvantages of your signal in order to improve your skills for any new signal you publish.

The end of your first journey in the signals world could only be the first step toward your next accomplishment, and this applies to everything in your life. Ambition is the path to success, as long as it is controlled, and you pursue it with patience, persistence and discipline.

PS. The information and advice presented in this article are a direct result of the valuable insights I have acquired through personal experiences, encompassing my own mistakes.

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Multilayer perceptron and backpropagation algorithm (Part 3): Integration with the Strategy Tester - Overview (I).

Multilayer perceptron and backpropagation algorithm (Part 3): Integration with the Strategy Tester - Overview (I).

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I have a good signal, six months running at plus, no subscribers, that's sad.

Yes, it's sad that there are no subscribers. Maybe because the signal has been "sitting" in drawdown for a month ? ;)

Regards, Vladimir.

No offence, but you are far from the author of the article.

And what is it to be offended? I am not familiar with it at all.... What do I care who is far away or close to the author of the article.

You can't! The full history is taken into account.

If you want to start fresh, then obtain a new account from your broker, transfer funds to it, and then provide that account as a signal.

You will then need to trade for a while on the new account until it is considered acceptable for subscriptions to be enabled.

This post was originally written in English. The system has auto-translated it for the other languages.

Articles

How to correctly present a product for sale on the market?

MetaQuotes, 2014.08.11 14:25

To sell your software to traders, it is not enough to simply create a convenient and useful program and publish it on the Marketplace, it is essential to provide your Product with a great description and good illustrations. A quality logo and well-made screenshots are no less important than "true coding". Remember: no downloads == no sales.Articles

200 usd for your algorithmic trading article!

MetaQuotes, 2014.02.19 11:20

Write an article and contribute to the development of algorithmic trading. Share your trading and programming experience and we will pay you $200. Moreover, the publication on the popular website MQL5.com will be a great opportunity for your personal promotion in the professional environment. You will be read by thousands of traders. You will be able to discuss your ideas with like-minded people, gain new experience and make your knowledge profitable.