Creating Custom Criteria of Optimization of Expert Advisors

The MetaTrader 5 Client Terminal offers a wide range of opportunities for optimization of Expert Advisor parameters. In addition to the optimization criteria included in the strategy tester, developers are given the opportunity of creating their own criteria. This leads to an almost limitless number of possibilities of testing and optimizing of Expert Advisors. The article describes practical ways of creating such criteria - both complex and simple ones.

Functions for Money Management in an Expert Advisor

The development of trading strategies primarily focuses on searching for patterns for entering and exiting the market, as well as maintaining positions. If we are able to formalize some patterns into rules for automated trading, then the trader faces the question of calculating the volume of positions, the size of the margins, as well as maintaining a safe level of mortgage funds for assuring open positions in an automated mode. In this article we will use the MQL5 language to construct simple examples of conducting these calculations.

Learn Why and How to Design Your Algorithmic Trading System

This article shows the basics of MQL for beginners to design their Algorithmic trading system (Expert Advisor) through designing a simple algorithmic trading system after mentioning some basics of MQL5

How to Copy Trading from MetaTrader 5 to MetaTrader 4

Is it possible to trade on a real MetaTrader 5 account today? How to organize such trading? The article contains the theory of these questions and the working codes used for copying trades from the MetaTrader 5 terminal to MetaTrader 4. The article will be useful both for the developers of Expert Advisors and for practicing traders.

Calculating the Hurst exponent

The article thoroughly explains the idea behind the Hurst exponent, as well as the meaning of its values and the calculation algorithm. A number of financial market segments are analyzed and the method of working with MetaTrader 5 products implementing the fractal analysis is described.

Learn how to design a trading system by MACD

In this article, we will learn a new tool from our series: we will learn how to design a trading system based on one of the most popular technical indicators Moving Average Convergence Divergence (MACD).

Basic math behind Forex trading

The article aims to describe the main features of Forex trading as simply and quickly as possible, as well as share some basic ideas with beginners. It also attempts to answer the most tantalizing questions in the trading community along with showcasing the development of a simple indicator.

MQL5 Wizard for Dummies

In early 2011 we released the first version of the MQL5 Wizard. This new application provides a simple and convenient tool to automatically generate trading robots. Any MetaTrader 5 user can create a custom Expert Advisor without even knowing how to program in MQL5.

DiNapoli trading system

The article describes the Fibo levels-based trading system developed by Joe DiNapoli. The idea behind the system and the main concepts are explained, as well as a simple indicator is provided as an example for more clarity.

A Step-by-Step Guide on Trading the Break of Structure (BoS) Strategy

A comprehensive guide to developing an automated trading algorithm based on the Break of Structure (BoS) strategy. Detailed information on all aspects of creating an advisor in MQL5 and testing it in MetaTrader 5 — from analyzing price support and resistance to risk management

Creating an assistant in manual trading

The number of trading robots used on the currency markets has significantly increased recently. They employ various concepts and strategies, however, none of them has yet succeeded to create a win-win sample of artificial intelligence. Therefore, many traders remain committed to manual trading. But even for such specialists, robotic assistants or, so called, trading panels, are created. This article is yet another example of creating a trading panel from scratch.

Evaluation of Trade Systems - the Effectiveness of Entering, Exiting and Trades in General

There are a lot of measures that allow determining the effectiveness and profitability of a trade system. However, traders are always ready to put any system to a new crash test. The article tells how the statistics based on measures of effectiveness can be used for the MetaTrader 5 platform. It includes the class for transformation of the interpretation of statistics by deals to the one that doesn't contradict the description given in the "Statistika dlya traderov" ("Statistics for Traders") book by S.V. Bulashev. It also includes an example of custom function for optimization.

MQL5 Cookbook: Implementing Your Own Depth of Market

This article demonstrates how to utilize Depth of Market (DOM) programmatically and describes the operation principle of CMarketBook class, that can expand the Standard Library of MQL5 classes and offer convenient methods of using DOM.

Learn how to design different Moving Average systems

There are many strategies that can be used to filter generated signals based on any strategy, even by using the moving average itself which is the subject of this article. So, the objective of this article is to share with you some of Moving Average Strategies and how to design an algorithmic trading system.

Learn how to design a trading system by Fibonacci

In this article, we will continue our series of creating a trading system based on the most popular technical indicator. Here is a new technical tool which is the Fibonacci and we will learn how to design a trading system based on this technical indicator.

Auto detection of extreme points based on a specified price variation

Automation of trading strategies involving graphical patterns requires the ability to search for extreme points on the charts for further processing and interpretation. Existing tools do not always provide such an ability. The algorithms described in the article allow finding all extreme points on charts. The tools discussed here are equally efficient both during trends and flat movements. The obtained results are not strongly affected by a selected timeframe and are only defined by a specified scale.

Developing a self-adapting algorithm (Part II): Improving efficiency

In this article, I will continue the development of the topic by improving the flexibility of the previously created algorithm. The algorithm became more stable with an increase in the number of candles in the analysis window or with an increase in the threshold percentage of the overweight of falling or growing candles. I had to make a compromise and set a larger sample size for analysis or a larger percentage of the prevailing candle excess.

Indicator for Constructing a Three Line Break Chart

This article is dedicated to the Three Line Break chart, suggested by Steve Nison in his book "Beyond Candlesticks". The greatest advantage of this chart is that it allows filtering minor fluctuations of a price in relation to the previous movement. We are going to discuss the principle of the chart construction, the code of the indicator and some examples of trading strategies based on it.

Exploring Seasonal Patterns of Financial Time Series with Boxplot

In this article we will view seasonal characteristics of financial time series using Boxplot diagrams. Each separate boxplot (or box-and-whiskey diagram) provides a good visualization of how values are distributed along the dataset. Boxplots should not be confused with the candlestick charts, although they can be visually similar.

Machine Learning: How Support Vector Machines can be used in Trading

Support Vector Machines have long been used in fields such as bioinformatics and applied mathematics to assess complex data sets and extract useful patterns that can be used to classify data. This article looks at what a support vector machine is, how they work and why they can be so useful in extracting complex patterns. We then investigate how they can be applied to the market and potentially used to advise on trades. Using the Support Vector Machine Learning Tool, the article provides worked examples that allow readers to experiment with their own trading.

Plotting trend lines based on fractals using MQL4 and MQL5

The article describes the automation of trend lines plotting based on the Fractals indicator using MQL4 and MQL5. The article structure provides a comparative view of the solution for two languages. Trend lines are plotted using two last known fractals.

Using limit orders instead of Take Profit without changing the EA's original code

Using limit orders instead of conventional take profits has long been a topic of discussions on the forum. What is the advantage of this approach and how can it be implemented in your trading? In this article, I want to offer you my vision of this topic.

Automating Trading Strategies in MQL5 (Part 41): Candle Range Theory (CRT) – Accumulation, Manipulation, Distribution (AMD)

In this article, we develop a Candle Range Theory (CRT) trading system in MQL5 that identifies accumulation ranges on a specified timeframe, detects breaches with manipulation depth filtering, and confirms reversals for entry trades in the distribution phase. The system supports dynamic or static stop-loss and take-profit calculations based on risk-reward ratios, optional trailing stops, and limits on positions per direction for controlled risk management.

Create Your Own Expert Advisor in MQL5 Wizard

The knowledge of programming languages is no longer a prerequisite for creating trading robots. Earlier lack of programming skills was an impassable obstacle to the implementation of one's own trading strategies, but with the emergence of the MQL5 Wizard, the situation radically changed. Novice traders can stop worrying because of the lack of programming experience - with the new Wizard, which allows you to generate Expert Advisor code, it is not necessary.

How to use MQL5 to detect candlesticks patterns

A new article to learn how to detect candlesticks patterns on prices automatically by MQL5.

Expert Advisor featuring GUI: Adding functionality (part II)

This is the second part of the article showing the development of a multi-symbol signal Expert Advisor for manual trading. We have already created the graphical interface. It is now time to connect it with the program's functionality.

Testing patterns that arise when trading currency pair baskets. Part III

In this article, we finish testing the patterns that can be detected when trading currency pair baskets. Here we present the results of testing the patterns tracking the movement of pair's currencies relative to each other.

Automating Trading Strategies in MQL5 (Part 42): Session-Based Opening Range Breakout (ORB) System

In this article, we create a fully customizable session-based Opening Range Breakout (ORB) system in MQL5 that lets us set any desired session start time and range duration, automatically calculates the high and low of that opening period, and trades only confirmed breakouts in the direction of the move.

MQL5 Wizard: New Version

The article contains descriptions of the new features available in the updated MQL5 Wizard. The modified architecture of signals allow creating trading robots based on the combination of various market patterns. The example contained in the article explains the procedure of interactive creation of an Expert Advisor.

Strategy builder based on Merrill patterns

In the previous article, we considered application of Merrill patterns to various data, such as to a price value on a currency symbol chart and values of standard MetaTrader 5 indicators: ATR, WPR, CCI, RSI, among others. Now, let us try to create a strategy construction set based on Merrill patterns.

Martingale as the basis for a long-term trading strategy

In this article we will consider in detail the martingale system. We will review whether this system can be applied in trading and how to use it in order to minimize risks. The main disadvantage of this simple system is the probability of losing the entire deposit. This fact must be taken into account, if you decide to trade using the martingale technique.

How to Become a Successful Signal Provider on MQL5.com

My main goal in this article is to provide you with a simple and accurate account of the steps that will help you become a top signal provider on MQL5.com. Drawing upon my knowledge and experience, I will explain what it takes to become a successful signal provider, including how to find, test, and optimize a good strategy. Additionally, I will provide tips on publishing your signal, writing a compelling description and effectively promoting and managing it.

Bid/Ask spread analysis in MetaTrader 5

An indicator to report your brokers Bid/Ask spread levels. Now we can use MT5s tick data to analyze what the historic true average Bid/Ask spread actually have recently been. You shouldn't need to look at the current spread because that is available if you show both bid and ask price lines.

The Indicators of the Micro, Middle and Main Trends

The aim of this article is to investigate the possibilities of trade automation and the analysis, on the basis of some ideas from a book by James Hyerczyk "Pattern, Price & Time: Using Gann Theory in Trading Systems" in the form of indicators and Expert Advisor. Without claiming to be exhaustive, here we investigate only the Model - the first part of the Gann theory.

Better Programmer (Part 07): Notes on becoming a successful freelance developer

Do you wish to become a successful Freelance developer on MQL5? If the answer is yes, this article is right for you.

Deep Neural Networks (Part VIII). Increasing the classification quality of bagging ensembles

The article considers three methods which can be used to increase the classification quality of bagging ensembles, and their efficiency is estimated. The effects of optimization of the ELM neural network hyperparameters and postprocessing parameters are evaluated.

Indicator for Point and Figure Charting

There are lots of chart types that provide information on the current market situation. Many of them, such as Point and Figure chart, are the legacy of the remote past. The article describes an example of Point and Figure charting using a real time indicator.

Building an Automatic News Trader

This is the continuation of Another MQL5 OOP class article which showed you how to build a simple OO EA from scratch and gave you some tips on object-oriented programming. Today I am showing you the technical basics needed to develop an EA able to trade the news. My goal is to keep on giving you ideas about OOP and also cover a new topic in this series of articles, working with the file system.

Applying OLAP in trading (part 4): Quantitative and visual analysis of tester reports

The article offers basic tools for the OLAP analysis of tester reports relating to single passes and optimization results. The tool can work with standard format files (tst and opt), and it also provides a graphical interface. MQL source codes are attached below.

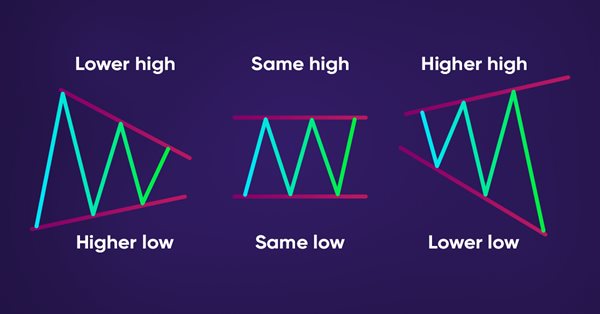

How to detect trends and chart patterns using MQL5

In this article, we will provide a method to detect price actions patterns automatically by MQL5, like trends (Uptrend, Downtrend, Sideways), Chart patterns (Double Tops, Double Bottoms).