Deep Neural Networks (Part IV). Creating, training and testing a model of neural network

This article considers new capabilities of the darch package (v.0.12.0). It contains a description of training of a deep neural networks with different data types, different structure and training sequence. Training results are included.

Developing a trading Expert Advisor from scratch

In this article, we will discuss how to develop a trading robot with minimum programming. Of course, MetaTrader 5 provides a high level of control over trading positions. However, using only the manual ability to place orders can be quite difficult and risky for less experienced users.

Deep Neural Networks (Part VII). Ensemble of neural networks: stacking

We continue to build ensembles. This time, the bagging ensemble created earlier will be supplemented with a trainable combiner — a deep neural network. One neural network combines the 7 best ensemble outputs after pruning. The second one takes all 500 outputs of the ensemble as input, prunes and combines them. The neural networks will be built using the keras/TensorFlow package for Python. The features of the package will be briefly considered. Testing will be performed and the classification quality of bagging and stacking ensembles will be compared.

950 websites broadcast the Economic Calendar from MetaQuotes

The widget provides websites with a detailed release schedule of 500 indicators and indices, of the world's largest economies. Thus, traders quickly receive up-to-date information on all important events with explanations and graphs in addition to the main website content.

Order Strategies. Multi-Purpose Expert Advisor

This article centers around strategies that actively use pending orders, a metalanguage that can be created to formally describe such strategies and the use of a multi-purpose Expert Advisor whose operation is based on those descriptions

Understanding order placement in MQL5

When creating any trading system, there is a task we need to deal with effectively. This task is order placement or to let the created trading system deal with orders automatically because it is crucial in any trading system. So, you will find in this article most of the topics that you need to understand about this task to create your trading system in terms of order placement effectively.

Developing a self-adapting algorithm (Part I): Finding a basic pattern

In the upcoming series of articles, I will demonstrate the development of self-adapting algorithms considering most market factors, as well as show how to systematize these situations, describe them in logic and take them into account in your trading activity. I will start with a very simple algorithm that will gradually acquire theory and evolve into a very complex project.

Testing currency pair patterns: Practical application and real trading perspectives. Part IV

This article concludes the series devoted to trading currency pair baskets. Here we test the remaining pattern and discuss applying the entire method in real trading. Market entries and exits, searching for patterns and analyzing them, complex use of combined indicators are considered.

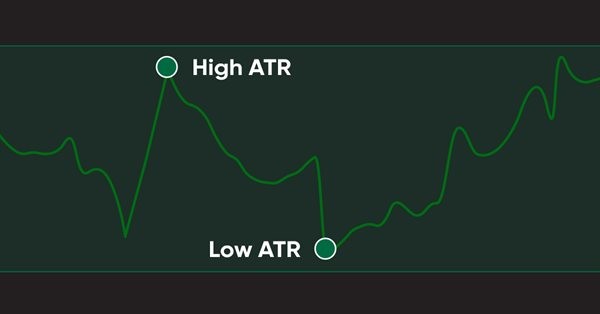

Learn how to design a trading system by ATR

In this article, we will learn a new technical tool that can be used in trading, as a continuation within the series in which we learn how to design simple trading systems. This time we will work with another popular technical indicator: Average True Range (ATR).

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

Using spreadsheets to build trading strategies

The article describes the basic principles and methods that allow you to analyze any strategy using spreadsheets (Excel, Calc, Google). The obtained results are compared with MetaTrader 5 tester.

Mathematics in trading: Sharpe and Sortino ratios

Return on investments is the most obvious indicator which investors and novice traders use for the analysis of trading efficiency. Professional traders use more reliable tools to analyze strategies, such as Sharpe and Sortino ratios, among others.

Dealing with Time (Part 1): The Basics

Functions and code snippets that simplify and clarify the handling of time, broker offset, and the changes to summer or winter time. Accurate timing may be a crucial element in trading. At the current hour, is the stock exchange in London or New York already open or not yet open, when does the trading time for Forex trading start and end? For a trader who trades manually and live, this is not a big problem.

A Virtual Order Manager to track orders within the position-centric MetaTrader 5 environment

This class library can be added to an MetaTrader 5 Expert Advisor to enable it to be written with an order-centric approach broadly similar to MetaTrader 4, in comparison to the position-based approach of MetaTrader 5. It does this by keeping track of virtual orders at the MetaTrader 5 client terminal, while maintaining a protective broker stop for each position for disaster protection.

Combinatorics and probability theory for trading (Part I): The basics

In this series of article, we will try to find a practical application of probability theory to describe trading and pricing processes. In the first article, we will look into the basics of combinatorics and probability, and will analyze the first example of how to apply fractals in the framework of the probability theory.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Automating Trading Strategies in MQL5 (Part 47): Nick Rypock Trailing Reverse (NRTR) with Hedging Features

In this article, we develop a Nick Rypock Trailing Reverse (NRTR) trading system in MQL5 that uses channel indicators for reversal signals, enabling trend-following entries with hedging support for buys and sells. We incorporate risk management features like auto lot sizing based on equity or balance, fixed or dynamic stop-loss and take-profit levels using ATR multipliers, and position limits.

Practical application of neural networks in trading. Python (Part I)

In this article, we will analyze the step-by-step implementation of a trading system based on the programming of deep neural networks in Python. This will be performed using the TensorFlow machine learning library developed by Google. We will also use the Keras library for describing neural networks.

Patterns available when trading currency baskets

Following up our previous article on the currency baskets trading principles, here we are going to analyze the patterns traders can detect. We will also consider the advantages and the drawbacks of each pattern and provide some recommendations on their use. The indicators based on Williams' oscillator will be used as analysis tools.

Developing a cross-platform Expert Advisor to set StopLoss and TakeProfit based on risk settings

In this article, we will create an Expert Advisor for automated entry lot calculation based on risk values. Also the Expert Advisor will be able to automatically place Take Profit with the select ratio to Stop Loss. That is, it can calculate Take Profit based on any selected ratio, such as 3 to 1, 4 to 1 or any other selected value.

Advanced EA constructor for MetaTrader - botbrains.app

In this article, we demonstrate features of botbrains.app - a no-code platform for trading robots development. To create a trading robot you don't need to write any code - just drag and drop the necessary blocks onto the scheme, set their parameters, and establish connections between them.

Learn how to design a trading system by ADX

In this article, we will continue our series about designing a trading system using the most popular indicators and we will talk about the average directional index (ADX) indicator. We will learn this indicator in detail to understand it well and we will learn how we to use it through a simple strategy. By learning something deeply we can get more insights and we can use it better.

Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average

This article presents Pivot Mean Oscillator (PMO), an implementation of the cumulative moving average (CMA) as a trading indicator for the MetaTrader platforms. In particular, we first introduce Pivot Mean (PM) as a normalization index for timeseries that computes the fraction between any data point and the CMA. We then build PMO as the difference between the moving averages applied to two PM signals. Some preliminary experiments carried out on the EURUSD symbol to test the efficacy of the proposed indicator are also reported, leaving ample space for further considerations and improvements.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. The algorithms making such hedging reliable are described in layman's terms and illustrated with simple charts and diagrams. This article is dedicated to the new panel HedgeTerminal, which is essentially a fully featured trading terminal within MetaTrader 5. Using HedgeTerminal and the virtualization of the trade it offers, positions can be managed in the way similar to MetaTrader 4.

Machine learning in Grid and Martingale trading systems. Would you bet on it?

This article describes the machine learning technique applied to grid and martingale trading. Surprisingly, this approach has little to no coverage in the global network. After reading the article, you will be able to create your own trading bots.

Custom symbols: Practical basics

The article is devoted to the programmatic generation of custom symbols which are used to demonstrate some popular methods for displaying quotes. It describes a suggested variant of minimally invasive adaptation of Expert Advisors for trading a real symbol from a derived custom symbol chart. MQL source codes are attached to this article.

Mini Market Emulator or Manual Strategy Tester

Mini Market Emulator is an indicator designed for partial emulation of work in the terminal. Presumably, it can be used to test "manual" strategies of market analysis and trading.

Gap - a profitable strategy or 50/50?

The article dwells on gaps — significant differences between a close price of a previous timeframe and an open price of the next one, as well as on forecasting a daily bar direction. Applying the GetOpenFileName function by the system DLL is considered as well.

Manual charting and trading toolkit (Part I). Preparation: structure description and helper class

This is the first article in a series, in which I am going to describe a toolkit which enables manual application of chart graphics by utilizing keyboard shortcuts. It is very convenient: you press one key and a trendline appears, you press another key — this will create a Fibonacci fan with the necessary parameters. It will also be possible to switch timeframes, to rearrange layers or to delete all objects from the chart.

The power of ZigZag (part I). Developing the base class of the indicator

Many researchers do not pay enough attention to determining the price behavior. At the same time, complex methods are used, which very often are simply “black boxes”, such as machine learning or neural networks. The most important question arising in that case is what data to submit for training a particular model.

Multicurrency monitoring of trading signals (Part 2): Implementation of the visual part of the application

In the previous article, we created the application framework, which we will use as the basis for all further work. In this part, we will proceed with the development: we will create the visual part of the application and will configure basic interaction of interface elements.

How to Make Money from MetaTrader AppStore and Trading Signals Services If You Are Not a Seller or a Provider

It is possible to start making money on MQL5.com right now without having to be a seller of Market applications or a profitable signals provider. Select the products you like and post links to them on various web resources. Attract potential customers and the profit is yours!

Learn how to design a trading system by Ichimoku

Here is a new article in our series about how to design a trading system b the most popular indicators, we will talk about the Ichimoku indicator in detail and how to design a trading system by this indicator.

Trading DiNapoli levels

The article considers one of the variants for Expert Advisor practical realization to trade DiNapoli levels using MQL5 standard tools. Its performance is tested and conclusions are made.

Limitations and Verifications in Expert Advisors

Is it allowed to trade this symbol on Monday? Is there enough money to open position? How big is the loss if Stop Loss triggers? How to limit the number of pending orders? Was the trade operation executed at the current bar or at the previous one? If a trade robot cannot perform this kind of verifications, then any trade strategy can turn into a losing one. This article shows the examples of verifications that are useful in any Expert Advisor.

R-squared as an estimation of quality of the strategy balance curve

This article describes the construction of the custom optimization criterion R-squared. This criterion can be used to estimate the quality of a strategy's balance curve and to select the most smoothly growing and stable strategies. The work discusses the principles of its construction and statistical methods used in estimation of properties and quality of this metric.

Patterns available when trading currency baskets. Part II

We continue our discussion of the patterns traders can come across while trading currency baskets. In this part, we will consider the patterns formed when using combined trend indicators. Indicators based on a currency index are to be used as the analytical tool.

Learn how to design a trading system by Envelopes

In this article, I will share with you one of the methods of how to trade bands. This time we will consider Envelopes and will see how easy it is to create some strategies based on the Envelopes.

The power of ZigZag (part II). Examples of receiving, processing and displaying data

In the first part of the article, I have described a modified ZigZag indicator and a class for receiving data of that type of indicators. Here, I will show how to develop indicators based on these tools and write an EA for tests that features making deals according to signals formed by ZigZag indicator. As an addition, the article will introduce a new version of the EasyAndFast library for developing graphical user interfaces.

Random Walk and the Trend Indicator

Random Walk looks very similar to the real market data, but it has some significant features. In this article we will consider the properties of Random Walk, simulated using the coin-tossing game. To study the properties of the data, the trendiness indicator is developed.