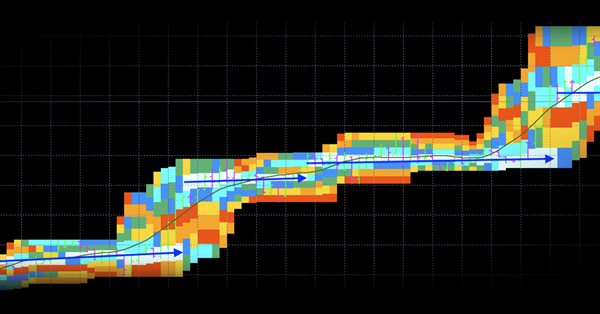

Forecasting Time Series (Part 1): Empirical Mode Decomposition (EMD) Method

This article deals with the theory and practical use of the algorithm for forecasting time series, based on the empirical decomposition mode. It proposes the MQL implementation of this method and presents test indicators and Expert Advisors.

Library for easy and quick development of MetaTrader programs (part XXXIV): Pending trading requests - removing and modifying orders and positions under certain conditions

In this article, we will complete the description of the pending request trading concept and create the functionality for removing pending orders, as well as modifying orders and positions under certain conditions. Thus, we are going to have the entire functionality enabling us to develop simple custom strategies, or rather EA behavior logic activated upon user-defined conditions.

Developing a self-adapting algorithm (Part II): Improving efficiency

In this article, I will continue the development of the topic by improving the flexibility of the previously created algorithm. The algorithm became more stable with an increase in the number of candles in the analysis window or with an increase in the threshold percentage of the overweight of falling or growing candles. I had to make a compromise and set a larger sample size for analysis or a larger percentage of the prevailing candle excess.

Exploring Seasonal Patterns of Financial Time Series with Boxplot

In this article we will view seasonal characteristics of financial time series using Boxplot diagrams. Each separate boxplot (or box-and-whiskey diagram) provides a good visualization of how values are distributed along the dataset. Boxplots should not be confused with the candlestick charts, although they can be visually similar.

Evaluation and selection of variables for machine learning models

This article focuses on specifics of choice, preconditioning and evaluation of the input variables (predictors) for use in machine learning models. New approaches and opportunities of deep predictor analysis and their influence on possible overfitting of models will be considered. The overall result of using models largely depends on the result of this stage. We will analyze two packages offering new and original approaches to the selection of predictors.

Applying the Monte Carlo method for optimizing trading strategies

Before launching a robot on a trading account, we usually test and optimize it on quotes history. However, a reasonable question arises: how can past results help us in the future? The article describes applying the Monte Carlo method to construct custom criteria for trading strategy optimization. In addition, the EA stability criteria are considered.

Library for easy and quick development of MetaTrader programs (part I). Concept, data management and first results

While analyzing a huge number of trading strategies, orders for development of applications for MetaTrader 5 and MetaTrader 4 terminals and various MetaTrader websites, I came to the conclusion that all this diversity is based mostly on the same elementary functions, actions and values appearing regularly in different programs. This resulted in DoEasy cross-platform library for easy and quick development of МetaТrader 5 and МetaТrader 4 applications.

Library for easy and quick development of MetaTrader programs (part XV): Collection of symbol objects

In this article, we will consider creation of a symbol collection based on the abstract symbol object developed in the previous article. The abstract symbol descendants are to clarify a symbol data and define the availability of the basic symbol object properties in a program. Such symbol objects are to be distinguished by their affiliation with groups.

Timeseries in DoEasy library (part 42): Abstract indicator buffer object class

In this article, we start the development of the indicator buffer classes for the DoEasy library. We will create the base class of the abstract buffer which is to be used as a foundation for the development of different class types of indicator buffers.

Application of the Eigen-Coordinates Method to Structural Analysis of Nonextensive Statistical Distributions

The major problem of applied statistics is the problem of accepting statistical hypotheses. It was long considered impossible to be solved. The situation has changed with the emergence of the eigen-coordinates method. It is a fine and powerful tool for a structural study of a signal allowing to see more than what is possible using methods of modern applied statistics. The article focuses on practical use of this method and sets forth programs in MQL5. It also deals with the problem of function identification using as an example the distribution introduced by Hilhorst and Schehr.

Library for easy and quick development of MetaTrader programs (part XX): Creating and storing program resources

The article deals with storing data in the program's source code and creating audio and graphical files out of them. When developing an application, we often need audio and images. The MQL language features several methods of using such data.

Deep Neural Networks (Part I). Preparing Data

This series of articles continues exploring deep neural networks (DNN), which are used in many application areas including trading. Here new dimensions of this theme will be explored along with testing of new methods and ideas using practical experiments. The first article of the series is dedicated to preparing data for DNN.

Library for easy and quick development of MetaTrader programs (part XXXII): Pending trading requests - placing orders under certain conditions

We continue the development of the functionality allowing users to trade using pending requests. In this article, we are going to implement the ability to place pending orders under certain conditions.

Continuous Walk-Forward Optimization (Part 1): Working with Optimization Reports

The first article is devoted to the creation of a toolkit for working with optimization reports, for importing them from the terminal, as well as for filtering and sorting the obtained data. MetaTrader 5 allows downloading optimization results, however our purpose is to add our own data to the optimization report.

Library for easy and quick development of MetaTrader programs (part XXIX): Pending trading requests - request object classes

In the previous articles, we checked the concept of pending trading requests. A pending request is, in fact, a common trading order executed by a certain condition. In this article, we are going to create full-fledged classes of pending request objects — a base request object and its descendants.

Analyzing Balance/Equity graphs by symbols and EAs' ORDER_MAGIC

With the introduction of hedging, MetaTrader 5 provides an excellent opportunity to trade several Expert Advisors on a single trading account simultaneously. When one strategy is profitable, while the second one is loss-making, the profit graph may hang around zero. In this case, it is useful to build the Balance and Equity graphs for each trading strategy separately.

Bid/Ask spread analysis in MetaTrader 5

An indicator to report your brokers Bid/Ask spread levels. Now we can use MT5s tick data to analyze what the historic true average Bid/Ask spread actually have recently been. You shouldn't need to look at the current spread because that is available if you show both bid and ask price lines.

Applying OLAP in trading (part 4): Quantitative and visual analysis of tester reports

The article offers basic tools for the OLAP analysis of tester reports relating to single passes and optimization results. The tool can work with standard format files (tst and opt), and it also provides a graphical interface. MQL source codes are attached below.

Moving Mini-Max: a New Indicator for Technical Analysis and Its Implementation in MQL5

In the following article I am describing a process of implementing Moving Mini-Max indicator based on a paper by Z.G.Silagadze 'Moving Mini-max: a new indicator for technical analysis'. The idea of the indicator is based on simulation of quantum tunneling phenomena, proposed by G. Gamov in the theory of alpha decay.

On Methods to Detect Overbought/Oversold Zones. Part I

Overbought/oversold zones characterize a certain state of the market, differentiating through weaker changes in the prices of securities. This adverse change in the synamics is pronounced most at the final stage in the development of trends of any scales. Since the profit value in trading depends directly on the capability of covering as large trend amplitude as possible, the accuracy of detecting such zones is a key task in trading with any securities whatsoever.

Library for easy and quick development of MetaTrader programs (part V): Classes and collection of trading events, sending events to the program

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the fourth part, we tested tracking trading events on the account. In this article, we will develop trading event classes and place them to the event collections. From there, they will be sent to the base object of the Engine library and the control program chart.

Library for easy and quick development of MetaTrader programs (part XXVI): Working with pending trading requests - first implementation (opening positions)

In this article, we are going to store some data in the value of the orders and positions magic number and start the implementation of pending requests. To check the concept, let's create the first test pending request for opening market positions when receiving a server error requiring waiting and sending a repeated request.

950 websites broadcast the Economic Calendar from MetaQuotes

The widget provides websites with a detailed release schedule of 500 indicators and indices, of the world's largest economies. Thus, traders quickly receive up-to-date information on all important events with explanations and graphs in addition to the main website content.

Optimizing a strategy using balance graph and comparing results with "Balance + max Sharpe Ratio" criterion

In this article, we consider yet another custom trading strategy optimization criterion based on the balance graph analysis. The linear regression is calculated using the function from the ALGLIB library.

Developing a self-adapting algorithm (Part I): Finding a basic pattern

In the upcoming series of articles, I will demonstrate the development of self-adapting algorithms considering most market factors, as well as show how to systematize these situations, describe them in logic and take them into account in your trading activity. I will start with a very simple algorithm that will gradually acquire theory and evolve into a very complex project.

MQL5 Programming Basics: Lists

The new version of the programming language for trading strategy development, MQL [MQL5], provides more powerful and effective features as compared with the previous version [MQL4]. The advantage essentially lies in the object-oriented programming features. This article looks into the possibility of using complex custom data types, such as nodes and lists. It also provides an example of using lists in practical programming in MQL5.

Practical application of correlations in trading

In this article, we will analyze the concept of correlation between variables, as well as methods for the calculation of correlation coefficients and their practical use in trading. Correlation is a statistical relationship between two or more random variables (or quantities which can be considered random with some acceptable degree of accuracy). Changes in one ore more variables lead to systematic changes of other related variables.

Optimization management (Part II): Creating key objects and add-on logic

This article is a continuation of the previous publication related to the creation of a graphical interface for optimization management. The article considers the logic of the add-on. A wrapper for the MetaTrader 5 terminal will be created: it will enable the running of the add-on as a managed process via C#. In addition, operation with configuration files and setup files is considered in this article. The application logic is divided into two parts: the first one describes the methods called after pressing a particular key, while the second part covers optimization launch and management.

Using spreadsheets to build trading strategies

The article describes the basic principles and methods that allow you to analyze any strategy using spreadsheets (Excel, Calc, Google). The obtained results are compared with MetaTrader 5 tester.

Visualize this! MQL5 graphics library similar to 'plot' of R language

When studying trading logic, visual representation in the form of graphs is of great importance. A number of programming languages popular among the scientific community (such as R and Python) feature the special 'plot' function used for visualization. It allows drawing lines, point distributions and histograms to visualize patterns. In MQL5, you can do the same using the CGraphics class.

Mathematics in trading: Sharpe and Sortino ratios

Return on investments is the most obvious indicator which investors and novice traders use for the analysis of trading efficiency. Professional traders use more reliable tools to analyze strategies, such as Sharpe and Sortino ratios, among others.

Library for easy and quick development of MetaTrader programs (part XXI): Trading classes - Base cross-platform trading object

In this article, we will start the development of the new library section - trading classes. Besides, we will consider the development of a unified base trading object for MetaTrader 5 and MetaTrader 4 platforms. When sending a request to the server, such a trading object implies that verified and correct trading request parameters are passed to it.

Library for easy and quick development of MetaTrader programs (part XXXI): Pending trading requests - opening positions under certain conditions

Starting with this article, we are going to develop a functionality allowing users to trade using pending requests under certain conditions, for example, when reaching a certain time limit, exceeding a specified profit or closing a position by stop loss.

Extract profit down to the last pip

The article describes an attempt to combine theory with practice in the algorithmic trading field. Most of discussions concerning the creation of Trading Systems is connected with the use of historic bars and various indicators applied thereon. This is the most well covered field and thus we will not consider it. Bars represent a very artificial entity; therefore we will work with something closer to proto-data, namely the price ticks.

Library for easy and quick development of MetaTrader programs (part XIII): Account object events

The article considers working with account events for tracking important changes in account properties affecting the automated trading. We have already implemented some functionality for tracking account events in the previous article when developing the account object collection.

Forecasting Time Series (Part 2): Least-Square Support-Vector Machine (LS-SVM)

This article deals with the theory and practical application of the algorithm for forecasting time series, based on support-vector method. It also proposes its implementation in MQL and provides test indicators and Expert Advisors. This technology has not been implemented in MQL yet. But first, we have to get to know math for it.

Combinatorics and probability theory for trading (Part I): The basics

In this series of article, we will try to find a practical application of probability theory to describe trading and pricing processes. In the first article, we will look into the basics of combinatorics and probability, and will analyze the first example of how to apply fractals in the framework of the probability theory.

Statistical distributions in the form of histograms without indicator buffers and arrays

The article discusses the possibility of plotting statistical distribution histograms of market conditions with the help of the graphical memory meaning no indicator buffers and arrays are applied. Sample histograms are described in details and the "hidden" functionality of MQL5 graphical objects is shown.

Developing Pivot Mean Oscillator: a novel Indicator for the Cumulative Moving Average

This article presents Pivot Mean Oscillator (PMO), an implementation of the cumulative moving average (CMA) as a trading indicator for the MetaTrader platforms. In particular, we first introduce Pivot Mean (PM) as a normalization index for timeseries that computes the fraction between any data point and the CMA. We then build PMO as the difference between the moving averages applied to two PM signals. Some preliminary experiments carried out on the EURUSD symbol to test the efficacy of the proposed indicator are also reported, leaving ample space for further considerations and improvements.

The price movement model and its main provisions (Part 1): The simplest model version and its applications

The article provides the foundations of a mathematically rigorous price movement and market functioning theory. Up to the present, we have not had any mathematically rigorous price movement theory. Instead, we have had to deal with experience-based assumptions stating that the price moves in a certain way after a certain pattern. Of course, these assumptions have been supported neither by statistics, nor by theory.