Trading with the MQL5 Economic Calendar (Part 8): Optimizing News-Driven Backtesting with Smart Event Filtering and Targeted Logs

In this article, we optimize our economic calendar with smart event filtering and targeted logging for faster, clearer backtesting in live and offline modes. We streamline event processing and focus logs on critical trade and dashboard events, enhancing strategy visualization. These improvements enable seamless testing and refinement of news-driven trading strategies.

Neural networks made easy (Part 72): Trajectory prediction in noisy environments

The quality of future state predictions plays an important role in the Goal-Conditioned Predictive Coding method, which we discussed in the previous article. In this article I want to introduce you to an algorithm that can significantly improve the prediction quality in stochastic environments, such as financial markets.

From Novice to Expert: Animated News Headline Using MQL5 (VIII) — Quick Trade Buttons for News Trading

While algorithmic trading systems manage automated operations, many news traders and scalpers prefer active control during high-impact news events and fast-paced market conditions, requiring rapid order execution and management. This underscores the need for intuitive front-end tools that integrate real-time news feeds, economic calendar data, indicator insights, AI-driven analytics, and responsive trading controls.

Developing A Swing Entries Monitoring (EA)

As the year approaches its end, long-term traders often reflect on market history to analyze its behavior and trends, aiming to project potential future movements. In this article, we will explore the development of a long-term entry monitoring Expert Advisor (EA) using MQL5. The objective is to address the challenge of missed long-term trading opportunities caused by manual trading and the absence of automated monitoring systems. We'll use one of the most prominently traded pairs as an example to strategize and develop our solution effectively.

Neural networks made easy (Part 62): Using Decision Transformer in hierarchical models

In recent articles, we have seen several options for using the Decision Transformer method. The method allows analyzing not only the current state, but also the trajectory of previous states and actions performed in them. In this article, we will focus on using this method in hierarchical models.

Neural Networks in Trading: Spatio-Temporal Neural Network (STNN)

In this article we will talk about using space-time transformations to effectively predict upcoming price movement. To improve the numerical prediction accuracy in STNN, a continuous attention mechanism is proposed that allows the model to better consider important aspects of the data.

Neural networks made easy (Part 64): ConserWeightive Behavioral Cloning (CWBC) method

As a result of tests performed in previous articles, we came to the conclusion that the optimality of the trained strategy largely depends on the training set used. In this article, we will get acquainted with a fairly simple yet effective method for selecting trajectories to train models.

Neural networks made easy (Part 65): Distance Weighted Supervised Learning (DWSL)

In this article, we will get acquainted with an interesting algorithm that is built at the intersection of supervised and reinforcement learning methods.

From Novice to Expert: Animated News Headline Using MQL5 (IV) — Locally hosted AI model market insights

In today's discussion, we explore how to self-host open-source AI models and use them to generate market insights. This forms part of our ongoing effort to expand the News Headline EA, introducing an AI Insights Lane that transforms it into a multi-integration assistive tool. The upgraded EA aims to keep traders informed through calendar events, financial breaking news, technical indicators, and now AI-generated market perspectives—offering timely, diverse, and intelligent support to trading decisions. Join the conversation as we explore practical integration strategies and how MQL5 can collaborate with external resources to build a powerful and intelligent trading work terminal.

Neural Networks in Trading: Hybrid Graph Sequence Models (Final Part)

We continue exploring hybrid graph sequence models (GSM++), which integrate the advantages of different architectures, providing high analysis accuracy and efficient distribution of computing resources. These models effectively identify hidden patterns, reducing the impact of market noise and improving forecasting quality.

Neural Networks Made Easy (Part 97): Training Models With MSFformer

When exploring various model architecture designs, we often devote insufficient attention to the process of model training. In this article, I aim to address this gap.

Neural networks made easy (Part 52): Research with optimism and distribution correction

As the model is trained based on the experience reproduction buffer, the current Actor policy moves further and further away from the stored examples, which reduces the efficiency of training the model as a whole. In this article, we will look at the algorithm of improving the efficiency of using samples in reinforcement learning algorithms.

Neural networks made easy (Part 41): Hierarchical models

The article describes hierarchical training models that offer an effective approach to solving complex machine learning problems. Hierarchical models consist of several levels, each of which is responsible for different aspects of the task.

Neural Networks in Trading: Superpoint Transformer (SPFormer)

In this article, we introduce a method for segmenting 3D objects based on Superpoint Transformer (SPFormer), which eliminates the need for intermediate data aggregation. This speeds up the segmentation process and improves the performance of the model.

Risk-Based Trade Placement EA with On-Chart UI (Part 1): Designing the User Interface

Learn how to build a clean and professional on-chart control panel in MQL5 for a Risk-Based Trade Placement Expert Advisor. This step-by-step guide explains how to design a functional GUI that allows traders to input trade parameters, calculate lot size, and prepare for automated order placement.

ARIMA Forecasting Indicator in MQL5

In this article we are implementing ARIMA forecasting indicator in MQL5. It examines how the ARIMA model generates forecasts, its applicability to the Forex market and the stock market in general. It also explains what AR autoregression is, how autoregressive models are used for forecasting, and how the autoregression mechanism works.

Developing a quality factor for Expert Advisors

In this article, we will see how to develop a quality score that your Expert Advisor can display in the strategy tester. We will look at two well-known calculation methods – Van Tharp and Sunny Harris.

Neural Networks in Trading: Market Analysis Using a Pattern Transformer

When we use models to analyze the market situation, we mainly focus on the candlestick. However, it has long been known that candlestick patterns can help in predicting future price movements. In this article, we will get acquainted with a method that allows us to integrate both of these approaches.

Trading with the MQL5 Economic Calendar (Part 3): Adding Currency, Importance, and Time Filters

In this article, we implement filters in the MQL5 Economic Calendar dashboard to refine news event displays by currency, importance, and time. We first establish filter criteria for each category and then integrate these into the dashboard to display only relevant events. Finally, we ensure each filter dynamically updates to provide traders with focused, real-time economic insights.

MQL5 Trading Tools (Part 9): Developing a First Run User Setup Wizard for Expert Advisors with Scrollable Guide

In this article, we develop an MQL5 First Run User Setup Wizard for Expert Advisors, featuring a scrollable guide with an interactive dashboard, dynamic text formatting, and visual controls like buttons and a checkbox allowing users to navigate instructions and configure trading parameters efficiently. Users of the program get to have insight of what the program is all about and what to do on the first run, more like an orientation model.

From Novice to Expert: Animated News Headline Using MQL5 (I)

News accessibility is a critical factor when trading on the MetaTrader 5 terminal. While numerous news APIs are available, many traders face challenges in accessing and integrating them effectively into their trading environment. In this discussion, we aim to develop a streamlined solution that brings news directly onto the chart—where it’s most needed. We'll accomplish this by building a News Headline Expert Advisor that monitors and displays real-time news updates from API sources.

Neural Networks in Trading: Hierarchical Feature Learning for Point Clouds

We continue to study algorithms for extracting features from a point cloud. In this article, we will get acquainted with the mechanisms for increasing the efficiency of the PointNet method.

Neural networks made easy (Part 89): Frequency Enhanced Decomposition Transformer (FEDformer)

All the models we have considered so far analyze the state of the environment as a time sequence. However, the time series can also be represented in the form of frequency features. In this article, I introduce you to an algorithm that uses frequency components of a time sequence to predict future states.

Trading with the MQL5 Economic Calendar (Part 7): Preparing for Strategy Testing with Resource-Based News Event Analysis

In this article, we prepare our MQL5 trading system for strategy testing by embedding economic calendar data as a resource for non-live analysis. We implement event loading and filtering for time, currency, and impact, then validate it in the Strategy Tester. This enables effective backtesting of news-driven strategies.

Creating a Trading Administrator Panel in MQL5 (Part VI): Multiple Functions Interface (I)

The Trading Administrator's role goes beyond just Telegram communications; they can also engage in various control activities, including order management, position tracking, and interface customization. In this article, we’ll share practical insights on expanding our program to support multiple functionalities in MQL5. This update aims to overcome the current Admin Panel's limitation of focusing primarily on communication, enabling it to handle a broader range of tasks.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (II): Modularization

In this discussion, we take a step further in breaking down our MQL5 program into smaller, more manageable modules. These modular components will then be integrated into the main program, enhancing its organization and maintainability. This approach simplifies the structure of our main program and makes the individual components reusable in other Expert Advisors (EAs) and indicator developments. By adopting this modular design, we create a solid foundation for future enhancements, benefiting both our project and the broader developer community.

Neural Networks in Trading: Hierarchical Vector Transformer (Final Part)

We continue studying the Hierarchical Vector Transformer method. In this article, we will complete the construction of the model. We will also train and test it on real historical data.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (V): AnalyticsPanel Class

In this discussion, we explore how to retrieve real-time market data and trading account information, perform various calculations, and display the results on a custom panel. To achieve this, we will dive deeper into developing an AnalyticsPanel class that encapsulates all these features, including panel creation. This effort is part of our ongoing expansion of the New Admin Panel EA, introducing advanced functionalities using modular design principles and best practices for code organization.

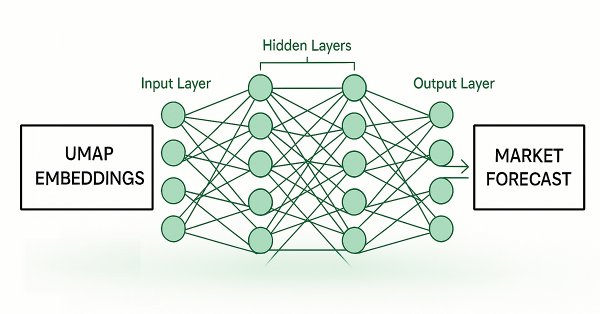

Feature Engineering With Python And MQL5 (Part IV): Candlestick Pattern Recognition With UMAP Regression

Dimension reduction techniques are widely used to improve the performance of machine learning models. Let us discuss a relatively new technique known as Uniform Manifold Approximation and Projection (UMAP). This new technique has been developed to explicitly overcome the limitations of legacy methods that create artifacts and distortions in the data. UMAP is a powerful dimension reduction technique, and it helps us group similar candle sticks in a novel and effective way that reduces our error rates on out of sample data and improves our trading performance.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (I)

This discussion delves into the challenges encountered when working with large codebases. We will explore the best practices for code organization in MQL5 and implement a practical approach to enhance the readability and scalability of our Trading Administrator Panel source code. Additionally, we aim to develop reusable code components that can potentially benefit other developers in their algorithm development. Read on and join the conversation.

Triangular and Sawtooth Waves: Analytical Tools for Traders

Wave analysis is one of the methods used in technical analysis. This article focuses on two less conventional wave patterns: triangular and sawtooth waves. These formations underpin a number of technical indicators designed for market price analysis.

Neural Networks in Trading: Contrastive Pattern Transformer (Final Part)

In the previous last article within this series, we looked at the Atom-Motif Contrastive Transformer (AMCT) framework, which uses contrastive learning to discover key patterns at all levels, from basic elements to complex structures. In this article, we continue implementing AMCT approaches using MQL5.

Price Action Analysis Toolkit Development (Part 9): External Flow

This article explores a new dimension of analysis using external libraries specifically designed for advanced analytics. These libraries, like pandas, provide powerful tools for processing and interpreting complex data, enabling traders to gain more profound insights into market dynamics. By integrating such technologies, we can bridge the gap between raw data and actionable strategies. Join us as we lay the foundation for this innovative approach and unlock the potential of combining technology with trading expertise.

Neural networks made easy (Part 79): Feature Aggregated Queries (FAQ) in the context of state

In the previous article, we got acquainted with one of the methods for detecting objects in an image. However, processing a static image is somewhat different from working with dynamic time series, such as the dynamics of the prices we analyze. In this article, we will consider the method of detecting objects in video, which is somewhat closer to the problem we are solving.

The MQL5 Standard Library Explorer (Part 7): Interactive Position Labeling with CCanvas

In this article, we explore how to build a position information visualization tool using the MQL5 Standard Library’s CCanvas. This project strengthens your skills in working with library modules while providing traders with a practical tool to visualize and interact with open positions directly on a live chart. Join the discussion to learn more.

Neural Networks Made Easy (Part 81): Context-Guided Motion Analysis (CCMR)

In previous works, we always assessed the current state of the environment. At the same time, the dynamics of changes in indicators always remained "behind the scenes". In this article I want to introduce you to an algorithm that allows you to evaluate the direct change in data between 2 successive environmental states.

Twitter Sentiment Analysis with Sockets

This innovative trading bot integrates MetaTrader 5 with Python to leverage real-time social media sentiment analysis for automated trading decisions. By analyzing Twitter sentiment related to specific financial instruments, the bot translates social media trends into actionable trading signals. It utilizes a client-server architecture with socket communication, enabling seamless interaction between MT5's trading capabilities and Python's data processing power. The system demonstrates the potential of combining quantitative finance with natural language processing, offering a cutting-edge approach to algorithmic trading that capitalizes on alternative data sources.

Risk Management (Part 5): Integrating the Risk Management System into an Expert Advisor

In this article, we will implement the risk management system developed in previous publications and add the Order Blocks indicator described in other articles. In addition, we will run a backtest so we can compare results with the risk management system enabled and evaluate the impact of dynamic risk.

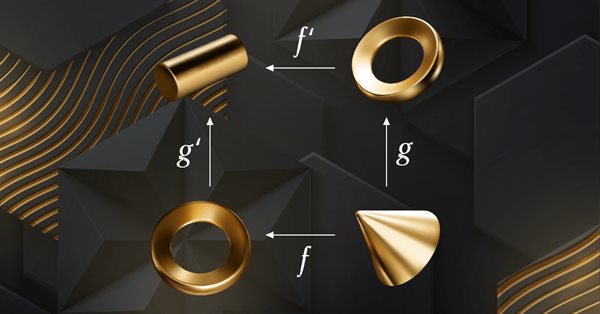

Category Theory in MQL5 (Part 6): Monomorphic Pull-Backs and Epimorphic Push-Outs

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (III): Communication Module

Join us for an in-depth discussion on the latest advancements in MQL5 interface design as we unveil the redesigned Communications Panel and continue our series on building the New Admin Panel using modularization principles. We'll develop the CommunicationsDialog class step by step, thoroughly explaining how to inherit it from the Dialog class. Additionally, we'll leverage arrays and ListView class in our development. Gain actionable insights to elevate your MQL5 development skills—read through the article and join the discussion in the comments section!