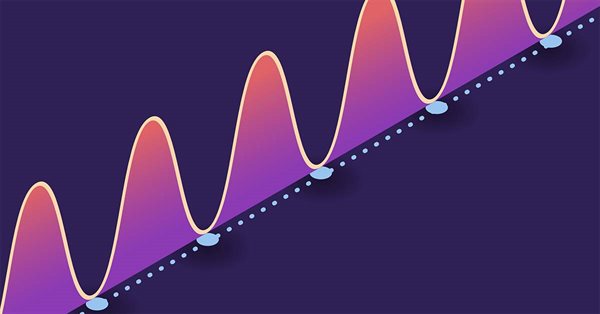

Developing a Trading Strategy: The Butterfly Oscillator Method

In this article, we demonstrated how the fascinating mathematical concept of the Butterfly Curve can be transformed into a practical trading tool. We constructed the Butterfly Oscillator and built a foundational trading strategy around it. The strategy effectively combines the oscillator's unique cyclical signals with traditional trend confirmation from moving averages, creating a systematic approach for identifying potential market entries.

Using cloud storage services for data exchange between terminals

Cloud technologies are becoming more popular. Nowadays, we can choose between paid and free storage services. Is it possible to use them in trading? This article proposes a technology for exchanging data between terminals using cloud storage services.

Continuous Walk-Forward Optimization (Part 6): Auto optimizer's logical part and structure

We have previously considered the creation of automatic walk-forward optimization. This time, we will proceed to the internal structure of the auto optimizer tool. The article will be useful for all those who wish to further work with the created project and to modify it, as well as for those who wish to understand the program logic. The current article contains UML diagrams which present the internal structure of the project and the relationships between objects. It also describes the process of optimization start, but it does not contain the description of the optimizer implementation process.

Automating Trading Strategies in MQL5 (Part 25): Trendline Trader with Least Squares Fit and Dynamic Signal Generation

In this article, we develop a trendline trader program that uses least squares fit to detect support and resistance trendlines, generating dynamic buy and sell signals based on price touches and open positions based on generated signals.

Information Storage and View

The article deals with convenient and efficient methods of information storage and viewing. Alternatives to the terminal standard log file and the Comment() function are considered here.

Multilayer perceptron and backpropagation algorithm

The popularity of these two methods grows, so a lot of libraries have been developed in Matlab, R, Python, C++ and others, which receive a training set as input and automatically create an appropriate network for the problem. Let us try to understand how the basic neural network type works (including single-neuron perceptron and multilayer perceptron). We will consider an exciting algorithm which is responsible for network training - gradient descent and backpropagation. Existing complex models are often based on such simple network models.

Graphical Interfaces IV: Informational Interface Elements (Chapter 1)

At the current stage of development, the library for creating graphical interfaces contains a form and several controls that can be attached to it. It was mentioned before that one of the future articles would be dedicated to the multi-window mode. Now, we have everything ready for that and we will deal with it in the following chapter. In this chapter, we will write classes for creating the status bar and tooltip informational interface elements.

Separate optimization of a strategy on trend and flat conditions

The article considers applying the separate optimization method during various market conditions. Separate optimization means defining trading system's optimal parameters by optimizing for an uptrend and downtrend separately. To reduce the effect of false signals and improve profitability, the systems are made flexible, meaning they have some specific set of settings or input data, which is justified because the market behavior is constantly changing.

Event handling in MQL5: Changing MA period on-the-fly

Suppose that simple MA (Moving Average) indicator with period 13 is applied to a chart. And we want to change the period to 20, but we do not want to go to indicator properties dialog box and edit the number 13 to 20: simply tired of these tedious actions with mouse and keyboard. And especially we don't want to open indicator code and modify it. We want to do all this with a single press of a button - "up arrows" next to the numeric keypad. In this article I'll describe how to do it.

DoEasy. Controls (Part 25): Tooltip WinForms object

In this article, I will start developing the Tooltip control, as well as new graphical primitives for the library. Naturally, not every element has a tooltip, but every graphical object has the ability to set it.

Library for easy and quick development of MetaTrader programs (part VIII): Order and position modification events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the seventh part, we added tracking StopLimit orders activation and prepared the functionality for tracking other events involving orders and positions. In this article, we will develop the class for tracking order and position modification events.

Neural networks made easy (Part 3): Convolutional networks

As a continuation of the neural network topic, I propose considering convolutional neural networks. This type of neural network are usually applied to analyzing visual imagery. In this article, we will consider the application of these networks in the financial markets.

Connecting NeuroSolutions Neuronets

In addition to creation of neuronets, the NeuroSolutions software suite allows exporting them as DLLs. This article describes the process of creating a neuronet, generating a DLL and connecting it to an Expert Advisor for trading in MetaTrader 5.

A system of voice notifications for trade events and signals

Nowadays, voice assistants play a prominent role in human life, as we often use navigators, voice search and translators. In this article, I will try to develop a simple and user friendly system of voice notifications for various trade events, market states or signals generated by trading signals.

Automating Trading Strategies in MQL5 (Part 43): Adaptive Linear Regression Channel Strategy

In this article, we implement an adaptive Linear Regression Channel system in MQL5 that automatically calculates the regression line and standard deviation channel over a user-defined period, only activates when the slope exceeds a minimum threshold to confirm a clear trend, and dynamically recreates or extends the channel when the price breaks out by a configurable percentage of channel width.

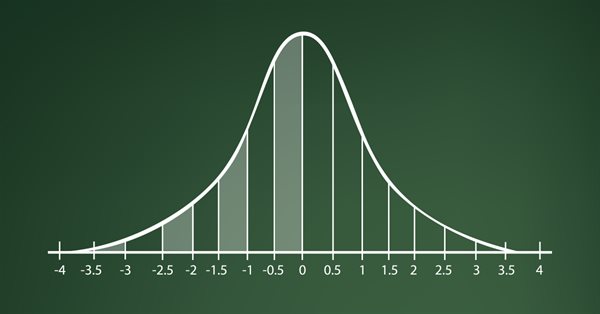

Learn how to design a trading system by Standard Deviation

Here is a new article in our series about how to design a trading system by the most popular technical indicators in MetaTrader 5 trading platform. In this new article, we will learn how to design a trading system by Standard Deviation indicator.

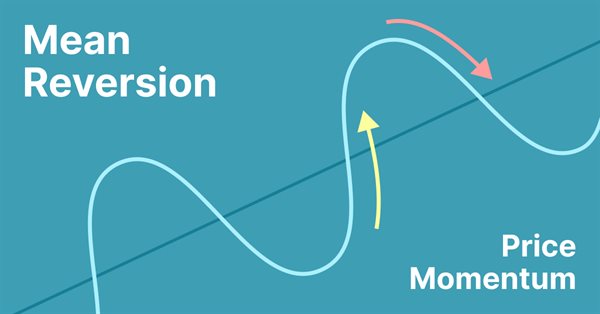

Simple Mean Reversion Trading Strategy

Mean reversion is a type of contrarian trading where the trader expects the price to return to some form of equilibrium which is generally measured by a mean or another central tendency statistic.

MQL5 Wizard: How to Create a Module of Trailing of Open Positions

The generator of trade strategies MQL5 Wizard greatly simplifies the testing of trading ideas. The article discusses how to write and connect to the generator of trade strategies MQL5 Wizard your own class of managing open positions by moving the Stop Loss level to a lossless zone when the price goes in the position direction, allowing to protect your profit decrease drawdowns when trading. It also tells about the structure and format of the description of the created class for the MQL5 Wizard.

Here Comes the New MetaTrader 5 and MQL5

This is just a brief review of MetaTrader 5. I can't describe all the system's new features for such a short time period - the testing started on 2009.09.09. This is a symbolical date, and I am sure it will be a lucky number. A few days have passed since I got the beta version of the MetaTrader 5 terminal and MQL5. I haven't managed to try all its features, but I am already impressed.

Price Action Analysis Toolkit Development (Part 53): Pattern Density Heatmap for Support and Resistance Zone Discovery

This article introduces the Pattern Density Heatmap, a price‑action mapping tool that transforms repeated candlestick pattern detections into statistically significant support and resistance zones. Rather than treating each signal in isolation, the EA aggregates detections into fixed price bins, scores their density with optional recency weighting, and confirms levels against higher‑timeframe data. The resulting heatmap reveals where the market has historically reacted—levels that can be used proactively for trade timing, risk management, and strategy confidence across any trading style.

Automating Trading Strategies in MQL5 (Part 24): London Session Breakout System with Risk Management and Trailing Stops

In this article, we develop a London Session Breakout System that identifies pre-London range breakouts and places pending orders with customizable trade types and risk settings. We incorporate features like trailing stops, risk-to-reward ratios, maximum drawdown limits, and a control panel for real-time monitoring and management.

Brute force approach to pattern search (Part IV): Minimal functionality

The article presents an improved brute force version, based on the goals set in the previous article. I will try to cover this topic as broadly as possible using Expert Advisors with settings obtained using this method. A new program version is attached to this article.

The Inverse Fair Value Gap Trading Strategy

An inverse fair value gap(IFVG) occurs when price returns to a previously identified fair value gap and, instead of showing the expected supportive or resistive reaction, fails to respect it. This failure can signal a potential shift in market direction and offer a contrarian trading edge. In this article, I'm going to introduce my self-developed approach to quantifying and utilizing inverse fair value gap as a strategy for MetaTrader 5 expert advisors.

Reading RSS News Feeds by Means of MQL4

This article deals with an example of reading RSS markup by means of MQL4 using the functions for HTML tags analysis. We will try to make a work piece which can then be turned into a news indicator or just an RSS reader on MQL4 language.

Econometric Approach to Analysis of Charts

This article describes the econometric methods of analysis, the autocorrelation analysis and the analysis of conditional variance in particular. What is the benefit of the approach described here? Use of the non-linear GARCH models allows representing the analyzed series formally from the mathematical point of view and creating a forecast for a specified number of steps.

Breakpoints in Tester: It's Possible!

The article deals with breakpoint emulation when passed through Tester, debug information being displayed.

Graphical Interfaces II: the Separation Line and Context Menu Elements (Chapter 2)

In this article we will create the separation line element. It will be possible to use it not only as an independent interface element but also as a part of many other elements. After that, we will have everything required for the development of the context menu class, which will be also considered in this article in detail. Added to that, we will introduce all necessary additions to the class, which is the base for storing pointers to all the elements of the graphical interface of the application.

Three Aspects of Manual Trading Automation. Part 1: Trading

This article is the first in a series of articles on manual trading automation in the МetaТrader 4 trading platform. Each of the articles will be devoted to one of the following aspects: automation of manual trading, current state of trade display automation and automation of reports on trade results. In this article, I will present an interesting approach to creating EA's controlled manually by a trader.

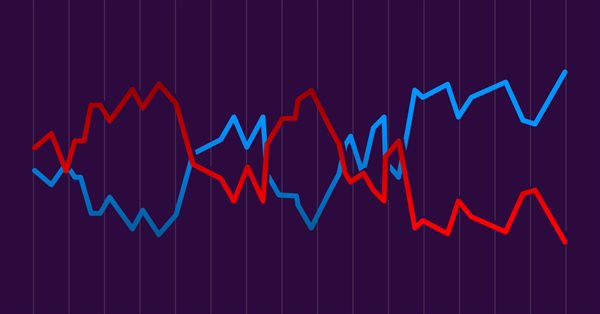

Pair trading

In this article, we will consider pair trading, namely what its principles are and if there are any prospects for its practical application. We will also try to create a pair trading strategy.

Combinatorics and probability for trading (Part IV): Bernoulli Logic

In this article, I decided to highlight the well-known Bernoulli scheme and to show how it can be used to describe trading-related data arrays. All this will then be used to create a self-adapting trading system. We will also look for a more generic algorithm, a special case of which is the Bernoulli formula, and will find an application for it.

Developing Zone Recovery Martingale strategy in MQL5

The article discusses, in a detailed perspective, the steps that need to be implemented towards the creation of an expert advisor based on the Zone Recovery trading algorithm. This helps aotomate the system saving time for algotraders.

Building a Professional Trading System with Heikin Ashi (Part 1): Developing a custom indicator

This article is the first installment in a two-part series designed to impart practical skills and best practices for writing custom indicators in MQL5. Using Heikin Ashi as a working example, the article explores the theory behind Heikin Ashi charts, explains how Heikin Ashi candlesticks are calculated, and demonstrates their application in technical analysis. The centerpiece is a step-by-step guide to developing a fully functional Heikin Ashi indicator from scratch, with clear explanations to help readers understand what to code and why. This foundational knowledge sets the stage for Part Two, where we will build an expert advisor that trades based on Heikin Ashi logic.

Graphical Interfaces VIII: The Calendar Control (Chapter 1)

In the part VIII of the series of articles dedicated to creating graphical interfaces in MetaTrader, we will consider complex composite controls like calendars, tree view, and file navigator. Due to the large amount of information, there are separate articles written for every subject. The first chapter of this part describes the calendar control and its expanded version — a drop down calendar.

MVC design pattern and its possible application

The article discusses a popular MVC pattern, as well as the possibilities, pros and cons of its usage in MQL programs. The idea is to split an existing code into three separate components: Model, View and Controller.

Learn how to design a trading system by Williams PR

A new article in our series about learning how to design a trading system by the most popular technical indicators by MQL5 to be used in the MetaTrader 5. In this article, we will learn how to design a trading system by the Williams' %R indicator.

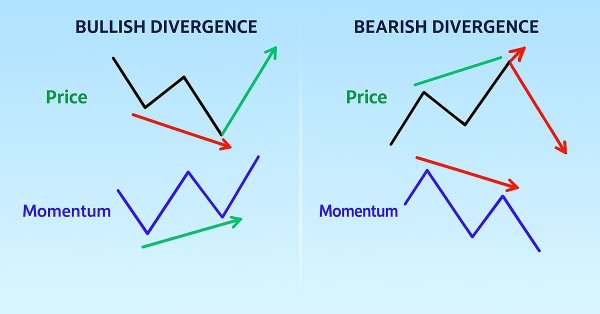

Automating Trading Strategies in MQL5 (Part 37): Regular RSI Divergence Convergence with Visual Indicators

In this article, we build an MQL5 EA that detects regular RSI divergences using swing points with strength, bar limits, and tolerance checks. It executes trades on bullish or bearish signals with fixed lots, SL/TP in pips, and optional trailing stops. Visuals include colored lines on charts and labeled swings for better strategy insights.

How to deal with lines using MQL5

In this article, you will find your way to deal with the most important lines like trendlines, support, and resistance by MQL5.

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

Building AI-Powered Trading Systems in MQL5 (Part 7): Further Modularization and Automated Trading

In this article, we enhance the AI-powered trading system's modularity by separating UI components into a dedicated include file. The system now automates trade execution based on AI-generated signals, parsing JSON responses for BUY/SELL/NONE with entry/SL/TP, visualizing patterns like engulfing or divergences on charts with arrows, lines, and labels, and optional auto-signal checks on new bars.