Drawing Horizontal Break-Through Levels Using Fractals

The article describes creation of an indicator that would display the support/resistance levels using up/down fractals.

What Is a Martingale?

A short description of various illusions that come up when people trade using martingale betting strategies or misuse spiking and the like approaches.

Building an Interactive Application to Display RSS Feeds in MetaTrader 5

In this article we look at the possibility of creating an application for the display of RSS feeds. The article will show how aspects of the Standard Library can be used to create interactive programs for MetaTrader 5.

Creating an EA that works automatically (Part 03): New functions

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we started to develop an order system that we will use in our automated EA. However, we have created only one of the necessary functions.

Building a Trading System (Part 2): The Science of Position Sizing

Even with a positive-expectancy system, position sizing determines whether you thrive or collapse. It’s the pivot of risk management—translating statistical edges into real-world results while safeguarding your capital.

MQL5 Wizard techniques you should know (Part 06): Fourier Transform

The Fourier transform introduced by Joseph Fourier is a means of deconstructing complex data wave points into simple constituent waves. This feature could be resourceful to traders and this article takes a look at that.

A Library for Constructing a Chart via Google Chart API

The construction of various types of diagrams is an essential part of the analyses of the market situation and the testing of a trading system. Frequently, in order to construct a nice looking diagram, it is necessary to organize the data output into a file, after which it is used in applications such as MS Excel. This is not very convenient and deprives us of the ability to dynamically update the data. Google Charts API provided the means for creating charts in online modes, by sending a special request to the server. In this article we attempt to automate the process of creating such a request and obtaining a chart from the Google server.

Creating multi-symbol, multi-period indicators

In this article, we will look at the principles of creating multi-symbol, multi-period indicators. We will also see how to access the data of such indicators from Expert Advisors and other indicators. We will consider the main features of using multi-indicators in Expert Advisors and indicators and will see how to plot them through custom indicator buffers.

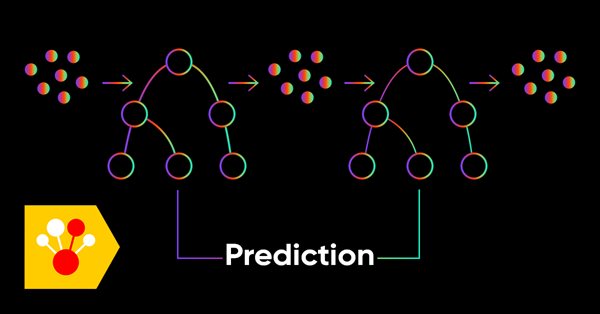

Gradient boosting in transductive and active machine learning

In this article, we will consider active machine learning methods utilizing real data, as well discuss their pros and cons. Perhaps you will find these methods useful and will include them in your arsenal of machine learning models. Transduction was introduced by Vladimir Vapnik, who is the co-inventor of the Support-Vector Machine (SVM).

Price Action Analysis Toolkit Development (Part 38): Tick Buffer VWAP and Short-Window Imbalance Engine

In Part 38, we build a production-grade MT5 monitoring panel that converts raw ticks into actionable signals. The EA buffers tick data to compute tick-level VWAP, a short-window imbalance (flow) metric, and ATR-based position sizing. It then visualizes spread, ATR, and flow with low-flicker bars. The system calculates a suggested lot size and a 1R stop, and issues configurable alerts for tight spreads, strong flow, and edge conditions. Auto-trading is intentionally disabled; the focus remains on robust signal generation and a clean user experience.

Running MetaTrader 4 Client Terminal on Linux-Desktop

Description of a step-by-step Linux-desktop setup using a non-emulator wine for running MetaTrader 4 Client Terminal on it.

Developing a trading robot in Python (Part 3): Implementing a model-based trading algorithm

We continue the series of articles on developing a trading robot in Python and MQL5. In this article, we will create a trading algorithm in Python.

Learn how to design a trading system by Chaikin Oscillator

Welcome to our new article from our series about learning how to design a trading system by the most popular technical indicator. Through this new article, we will learn how to design a trading system by the Chaikin Oscillator indicator.

MQL5 Cookbook — Services

The article describes the versatile capabilities of services — MQL5 programs that do not require binding graphs. I will also highlight the differences of services from other MQL5 programs and emphasize the nuances of the developer's work with services. As examples, the reader is offered various tasks covering a wide range of functionality that can be implemented as a service.

Neural networks made easy (Part 14): Data clustering

It has been more than a year since I published my last article. This is quite a lot time to revise ideas and to develop new approaches. In the new article, I would like to divert from the previously used supervised learning method. This time we will dip into unsupervised learning algorithms. In particular, we will consider one of the clustering algorithms—k-means.

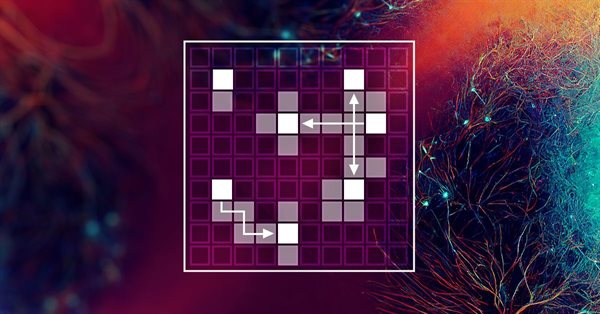

MQL5 Trading Tools (Part 3): Building a Multi-Timeframe Scanner Dashboard for Strategic Trading

In this article, we build a multi-timeframe scanner dashboard in MQL5 to display real-time trading signals. We plan an interactive grid interface, implement signal calculations with multiple indicators, and add a close button. The article concludes with backtesting and strategic trading benefits

Automated Trading Championship: The Reverse of the Medal

Automated Trading Championship based on online trading platform MetaTrader 4 is being conducted for the third time and accepted by many people as a matter-of-course yearly event being waited for with impatience. However, this competition specifies strict requirements to the Participants. This is precisely the topic we're going to discuss in this article.

Understanding functions in MQL5 with applications

Functions are critical things in any programming language, it helps developers apply the concept of (DRY) which means do not repeat yourself, and many other benefits. In this article, you will find much more information about functions and how we can create our own functions in MQL5 with simple applications that can be used or called in any system you have to enrich your trading system without complicating things.

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

Prices in DoEasy library (part 60): Series list of symbol tick data

In this article, I will create the list for storing tick data of a single symbol and check its creation and retrieval of required data in an EA. Tick data lists that are individual for each used symbol will further constitute a collection of tick data.

Graphics in DoEasy library (Part 87): Graphical object collection - managing object property modification on all open charts

In this article, I will continue my work on tracking standard graphical object events and create the functionality allowing users to control changes in the properties of graphical objects placed on any charts opened in the terminal.

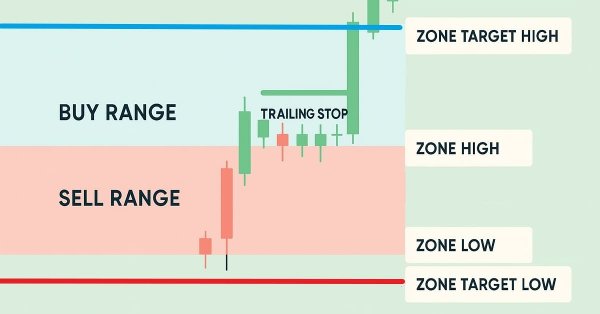

Automating Trading Strategies in MQL5 (Part 23): Zone Recovery with Trailing and Basket Logic

In this article, we enhance our Zone Recovery System by introducing trailing stops and multi-basket trading capabilities. We explore how the improved architecture uses dynamic trailing stops to lock in profits and a basket management system to handle multiple trade signals efficiently. Through implementation and backtesting, we demonstrate a more robust trading system tailored for adaptive market performance.

Tips for Purchasing a Product on the Market. Step-By-Step Guide

This step-by-step guide provides tips and tricks for better understanding and searching for a required product. The article makes an attempt to puzzle out different methods of searching for an appropriate product, sorting out unwanted products, determining product efficiency and essentiality for you.

Alan Andrews and his methods of time series analysis

Alan Andrews is one of the most famous "educators" of the modern world in the field of trading. His "pitchfork" is included in almost all modern quote analysis programs. But most traders do not use even a fraction of the opportunities that this tool provides. Besides, Andrews' original training course includes a description not only of the pitchfork (although it remains the main tool), but also of some other useful constructions. The article provides an insight into the marvelous chart analysis methods that Andrews taught in his original course. Beware, there will be a lot of images.

Calculation of Integral Characteristics of Indicator Emissions

Indicator emissions are a little-studied area of market research. Primarily, this is due to the difficulty of analysis that is caused by the processing of very large arrays of time-varying data. Existing graphical analysis is too resource intensive and has therefore triggered the development of a parsimonious algorithm that uses time series of emissions. This article demonstrates how visual (intuitive image) analysis can be replaced with the study of integral characteristics of emissions. It can be of interest to both traders and developers of automated trading systems.

Graphical interfaces X: New features for the Rendered table (build 9)

Until today, the CTable was the most advanced type of tables among all presented in the library. This table is assembled from edit boxes of the OBJ_EDIT type, and its further development becomes problematic. Therefore, in terms of maximum capabilities, it is better to develop rendered tables of the CCanvasTable type even at the current development stage of the library. Its current version is completely lifeless, but starting from this article, we will try to fix the situation.

Neural networks made easy (Part 36): Relational Reinforcement Learning

In the reinforcement learning models we discussed in previous article, we used various variants of convolutional networks that are able to identify various objects in the original data. The main advantage of convolutional networks is the ability to identify objects regardless of their location. At the same time, convolutional networks do not always perform well when there are various deformations of objects and noise. These are the issues which the relational model can solve.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

The Most Active MQL5.community Members Have Been Awarded iPhones!

After we decided to reward the most outstanding MQL5.com participants, we have selected the key criteria to determine each participant's contribution to the Community development. As a result, we have the following champions who published the greatest amount of articles on the website - investeo (11 articles) and victorg (10 articles), and who submitted their programs to Code Base – GODZILLA (340 programs), Integer (61 programs) and abolk (21 programs).

How to choose an Expert Advisor: Twenty strong criteria to reject a trading bot

This article tries to answer the question: how can we choose the right expert advisors? Which are the best for our portfolio, and how can we filter the large trading bots list available on the market? This article will present twenty clear and strong criteria to reject an expert advisor. Each criterion will be presented and well explained to help you make a more sustained decision and build a more profitable expert advisor collection for your profits.

DoEasy. Controls (Part 2): Working on the CPanel class

In the current article, I will get rid of some errors related to handling graphical elements and continue the development of the CPanel control. In particular, I will implement the methods for setting the parameters of the font used by default for all panel text objects.

Jeremy Scott - Successful MQL5 Market Seller

Jeremy Scott who is better known under Johnnypasado nickname at MQL5.community became famous offering products in our MQL5 Market service. Jeremy has already made several thousands of dollars in the Market and that is not the limit. We decided to take a closer look at the future millionaire and receive some pieces of advice for MQL5 Market sellers.

Prices in DoEasy library (part 62): Updating tick series in real time, preparation for working with Depth of Market

In this article, I will implement updating tick data in real time and prepare the symbol object class for working with Depth of Market (DOM itself is to be implemented in the next article).

Gain An Edge Over Any Market

Learn how you can get ahead of any market you wish to trade, regardless of your current level of skill.

Timeseries in DoEasy library (part 58): Timeseries of indicator buffer data

In conclusion of the topic of working with timeseries organise storage, search and sort of data stored in indicator buffers which will allow to further perform the analysis based on values of the indicators to be created on the library basis in programs. The general concept of all collection classes of the library allows to easily find necessary data in the corresponding collection. Respectively, the same will be possible in the class created today.

Creating an MQL5 Expert Advisor Based on the PIRANHA Strategy by Utilizing Bollinger Bands

In this article, we create an Expert Advisor (EA) in MQL5 based on the PIRANHA strategy, utilizing Bollinger Bands to enhance trading effectiveness. We discuss the key principles of the strategy, the coding implementation, and methods for testing and optimization. This knowledge will enable you to deploy the EA in your trading scenarios effectively

Trade transactions. Request and response structures, description and logging

The article considers handling trade request structures, namely creating a request, its preliminary verification before sending it to the server, the server's response to a trade request and the structure of trade transactions. We will create simple and convenient functions for sending trading orders to the server and, based on everything discussed, create an EA informing of trade transactions.

Principles of Time Transformation in Intraday Trading

This article contains the concept of operation time that allows to receive more even price flow. It also contains the code of the changed moving average with an allowance for this time transformation.

Graphics in DoEasy library (Part 79): "Animation frame" object class and its descendant objects

In this article, I will develop the class of a single animation frame and its descendants. The class is to allow drawing shapes while maintaining and then restoring the background under them.

Lite_EXPERT2.mqh: Functional Kit for Developers of Expert Advisors

This article continues the series of articles "Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization". It familiarizes the readers with a more universal function library of the Lite_EXPERT2.mqh file.