LibMatrix: Library of Matrix Algebra (Part One)

The author familiarizes the readers with a simple library of matrix algebra and provides descriptions and peculiarities of the main functions.

Graphics in DoEasy library (Part 94): Moving and deleting composite graphical objects

In this article, I will start the development of various composite graphical object events. We will also partially consider moving and deleting a composite graphical object. In fact, here I am going to fine-tune the things I implemented in the previous article.

Creating an EA that works automatically (Part 06): Account types (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. Our EA in its current state can work in any situation but it is not yet ready for automation. We still have to work on a few points.

Using Discriminant Analysis to Develop Trading Systems

When developing a trading system, there usually arises a problem of selecting the best combination of indicators and their signals. Discriminant analysis is one of the methods to find such combinations. The article gives an example of developing an EA for market data collection and illustrates the use of the discriminant analysis for building prognostic models for the FOREX market in Statistica software.

Algorithmic trading based on 3D reversal patterns

Discovering a new world of automated trading on 3D bars. What does a trading robot look like on multidimensional price bars? Are "yellow" clusters of 3D bars able to predict trend reversals? What does multidimensional trading look like?

Growing Neural Gas: Implementation in MQL5

The article shows an example of how to develop an MQL5-program implementing the adaptive algorithm of clustering called Growing neural gas (GNG). The article is intended for the users who have studied the language documentation and have certain programming skills and basic knowledge in the area of neuroinformatics.

Data Science and Machine Learning (Part 04): Predicting Current Stock Market Crash

In this article I am going to attempt to use our logistic model to predict the stock market crash based upon the fundamentals of the US economy, the NETFLIX and APPLE are the stocks we are going to focus on, Using the previous market crashes of 2019 and 2020 let's see how our model will perform in the current dooms and glooms.

Show Must Go On, or Once Again about ZigZag

About an obvious but still substandard method of ZigZag composition, and what it results in: the Multiframe Fractal ZigZag indicator that represents ZigZags built on three larger ons, on a single working timeframe (TF). In their turn, those larger TFs may be non-standard, too, and range from M5 to MN1.

Neural networks made easy (Part 13): Batch Normalization

In the previous article, we started considering methods aimed at improving neural network training quality. In this article, we will continue this topic and will consider another approach — batch data normalization.

Learn how to design a trading system by Force Index

Welcome to a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will learn about a new technical indicator and how to create a trading system using the Force Index indicator.

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.

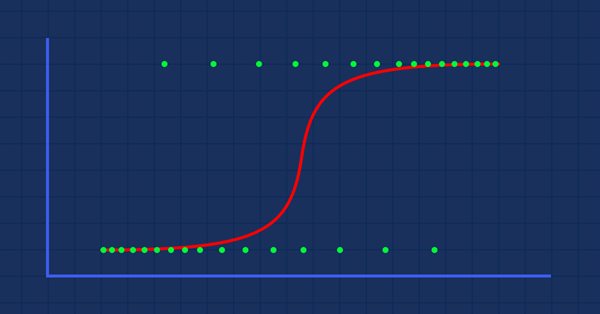

Data Science and Machine Learning (Part 02): Logistic Regression

Data Classification is a crucial thing for an algo trader and a programmer. In this article, we are going to focus on one of classification logistic algorithms that can probability help us identify the Yes's or No's, the Ups and Downs, Buys and Sells.

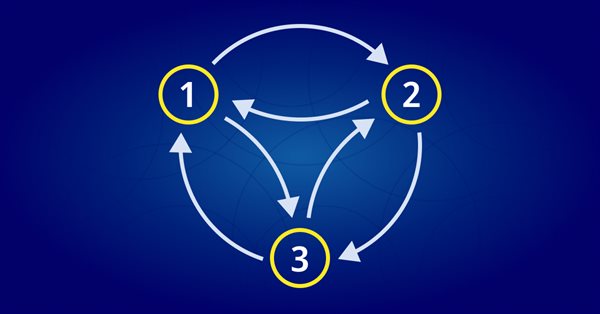

Neural networks made easy (Part 30): Genetic algorithms

Today I want to introduce you to a slightly different learning method. We can say that it is borrowed from Darwin's theory of evolution. It is probably less controllable than the previously discussed methods but it allows training non-differentiable models.

DIY technical indicator

In this article, I will consider the algorithms allowing you to create your own technical indicator. You will learn how to obtain pretty complex and interesting results with very simple initial assumptions.

Brute force approach to pattern search (Part II): Immersion

In this article we will continue discussing the brute force approach. I will try to provide a better explanation of the pattern using the new improved version of my application. I will also try to find the difference in stability using different time intervals and timeframes.

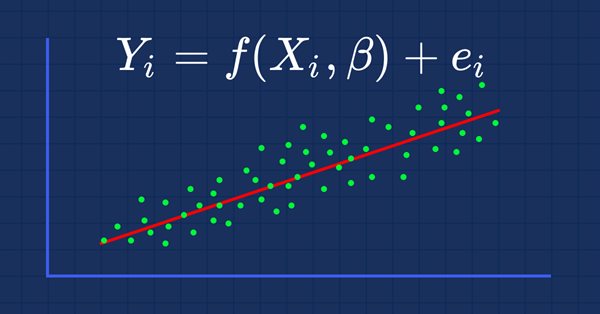

MQL5 Wizard techniques you should know (Part 01): Regression Analysis

Todays trader is a philomath who is almost always (either consciously or not...) looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. This clearly places a premium on the trader's time and the need to avoid mistakes. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders. Why? Because not only does the trader save time by assembling his new ideas with the MQL5 wizard, and greatly reduce mistakes from duplicate coding; he is ultimately set-up to channel his energy on the few critical areas of his trading philosophy.

Learn how to design a trading system by DeMarker

Here is a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will present how to create a trading system by the DeMarker indicator.

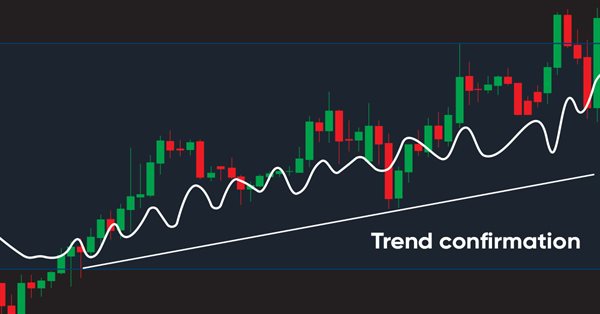

Building A Candlestick Trend Constraint Model(Part 2): Merging Native Indicators

This article focuses on taking advantage of in-built meta trader 5 indicators to screen out off-trend signals. Advancing from the previous article we will explore how to do it using MQL5 code to communicate our idea to the final program.

Implementing a Rapid-Fire Trading Strategy Algorithm with Parabolic SAR and Simple Moving Average (SMA) in MQL5

In this article, we develop a Rapid-Fire Trading Expert Advisor in MQL5, leveraging the Parabolic SAR and Simple Moving Average (SMA) indicators to create a responsive trading strategy. We detail the strategy’s implementation, including indicator usage, signal generation, and the testing and optimization process.

Price Action Analysis Toolkit Development (Part 6): Mean Reversion Signal Reaper

While some concepts may seem straightforward at first glance, bringing them to life in practice can be quite challenging. In the article below, we'll take you on a journey through our innovative approach to automating an Expert Advisor (EA) that skillfully analyzes the market using a mean reversion strategy. Join us as we unravel the intricacies of this exciting automation process.

Graphics in DoEasy library (Part 80): "Geometric animation frame" object class

In this article, I will optimize the code of classes from the previous articles and create the geometric animation frame object class allowing us to draw regular polygons with a given number of vertices.

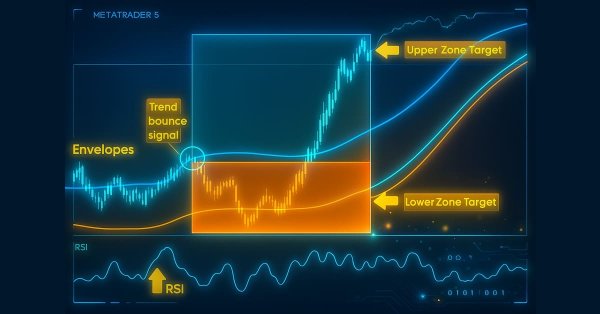

Automating Trading Strategies in MQL5 (Part 22): Creating a Zone Recovery System for Envelopes Trend Trading

In this article, we develop a Zone Recovery System integrated with an Envelopes trend-trading strategy in MQL5. We outline the architecture for using RSI and Envelopes indicators to trigger trades and manage recovery zones to mitigate losses. Through implementation and backtesting, we show how to build an effective automated trading system for dynamic markets

How to Develop a Reliable and Safe Trade Robot in MQL 4

The article deals with the most common errors that occur in developing and using of an Expert Advisor. An exemplary safe automated trading system is described, as well.

Universal regression model for market price prediction (Part 2): Natural, technological and social transient functions

This article is a logical continuation of the previous one. It highlights the facts that confirm the conclusions made in the first article. These facts were revealed within ten years after its publication. They are centered around three detected dynamic transient functions describing the patterns in market price changes.

Other classes in DoEasy library (Part 70): Expanding functionality and auto updating the chart object collection

In this article, I will expand the functionality of chart objects and arrange navigation through charts, creation of screenshots, as well as saving and applying templates to charts. Also, I will implement auto update of the collection of chart objects, their windows and indicators within them.

Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast

The article provides an example of using a perceptron as a self-sufficient price prediction tool by showcasing general concepts and the simplest ready-made Expert Advisor followed by the results of its optimization.

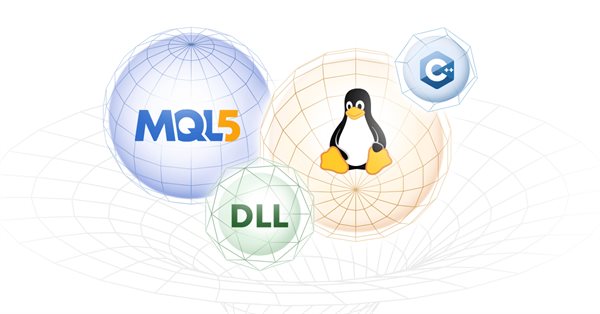

Develop a Proof-of-Concept DLL with C++ multi-threading support for MetaTrader 5 on Linux

We will begin the journey to explore the steps and workflow on how to base development for MetaTrader 5 platform solely on Linux system in which the final product works seamlessly on both Windows and Linux system. We will get to know Wine, and Mingw; both are the essential tools to make cross-platform development works. Especially Mingw for its threading implementations (POSIX, and Win32) that we need to consider in choosing which one to go with. We then build a proof-of-concept DLL and consume it in MQL5 code, finally compare the performance of both threading implementations. All for your foundation to expand further on your own. You should be comfortable building MT related tools on Linux after reading this article.

Visual evaluation of optimization results

In this article, we will consider how to build graphs of all optimization passes and to select the optimal custom criterion. We will also see how to create a desired solution with little MQL5 knowledge, using the articles published on the website and forum comments.

Learn how to design a trading system by Accumulation/Distribution (AD)

Welcome to the new article from our series about learning how to design trading systems based on the most popular technical indicators. In this article, we will learn about a new technical indicator called Accumulation/Distribution indicator and find out how to design an MQL5 trading system based on simple AD trading strategies.

Interview with Juan Pablo Alonso Escobar (ATC 2012)

"Everyone who is struggling with programming and who were not able to participate in this year's competition, know that it becomes a lot easier in time", said Juan Pablo Alonso Escobar (JPAlonso), the hero of today's interview.

Population optimization algorithms: Particle swarm (PSO)

In this article, I will consider the popular Particle Swarm Optimization (PSO) algorithm. Previously, we discussed such important characteristics of optimization algorithms as convergence, convergence rate, stability, scalability, as well as developed a test stand and considered the simplest RNG algorithm.

MQL5 Cloud Network: Are You Still Calculating?

It will soon be a year and a half since the MQL5 Cloud Network has been launched. This leading edge event ushered in a new era of algorithmic trading - now with a couple of clicks, traders can have hundreds and thousands of computing cores at their disposal for the optimization of their trading strategies.

Automating Trading Strategies in MQL5 (Part 19): Envelopes Trend Bounce Scalping — Trade Execution and Risk Management (Part II)

In this article, we implement trade execution and risk management for the Envelopes Trend Bounce Scalping Strategy in MQL5. We implement order placement and risk controls like stop-loss and position sizing. We conclude with backtesting and optimization, building on Part 18’s foundation.

Filtering Signals Based on Statistical Data of Price Correlation

Is there any correlation between the past price behavior and its future trends? Why does the price repeat today the character of its previous day movement? Can the statistics be used to forecast the price dynamics? There is an answer, and it is positive. If you have any doubt, then this article is for you. I'll tell how to create a working filter for a trading system in MQL5, revealing an interesting pattern in price changes.

MQL5 Wizard techniques you should know (Part 05): Markov Chains

Markov chains are a powerful mathematical tool that can be used to model and forecast time series data in various fields, including finance. In financial time series modelling and forecasting, Markov chains are often used to model the evolution of financial assets over time, such as stock prices or exchange rates. One of the main advantages of Markov chain models is their simplicity and ease of use.

MQL4 Language for Newbies. Difficult Questions in Simple Phrases.

This is the second article from the series "MQL4 Language for Newbies". Now we will examine more complex and advanced constructions of the language, learn new options and see, how they can be applied in everyday practice. You will get acquainted with a new cycle type 'while', new condition type 'switch', operators 'break' and 'continue'. Besides you will learn to write your own functions and work with multidimensional arrays. And for a dessert I have prepared an explanation about a preprocessor.

Introduction to Connexus (Part 1): How to Use the WebRequest Function?

This article is the beginning of a series of developments for a library called “Connexus” to facilitate HTTP requests with MQL5. The goal of this project is to provide the end user with this opportunity and show how to use this helper library. I intended to make it as simple as possible to facilitate study and to provide the possibility for future developments.

Better Programmer (Part 04): How to become a faster developer

Every developer wants to be able to write code faster, and being able to code faster and effective is not some kind of special ability that only a few people are born with. It's a skill that can be learned by every coder, regardless of years of experience on the keyboard.

Regression models of the Scikit-learn Library and their export to ONNX

In this article, we will explore the application of regression models from the Scikit-learn package, attempt to convert them into ONNX format, and use the resultant models within MQL5 programs. Additionally, we will compare the accuracy of the original models with their ONNX versions for both float and double precision. Furthermore, we will examine the ONNX representation of regression models, aiming to provide a better understanding of their internal structure and operational principles.

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part II)

In this article the author continues to analyze implementation algorithms of simplest trading systems and describes some relevant details of using optimization results. The article will be useful for beginning traders and EA writers.