Advantages of MQL5 Signals

Trading Signals service recently introduced in MetaTrader 5 allows traders to copy trading operations of any signals provider. Users can select any signal, subscribe to it and all deals will be copied at their accounts. Signals providers can set their subscription prices and receive a fixed monthly fee from their subscribers.

How to Make the Detection and Recovery of Errors in an Expert Advisor Code Easier

In Export Advisors development, the questions of code errors detection and recovery are very important. The peculiarity is that a not detected in time error may ruin a precious idea of a trading system already on the stage of its first testings. That is why any sensible EA developer takes into account such problems from the very beginning. This article dwells on some approaches, helping in this difficult matter.

Checking the Myth: The Whole Day Trading Depends on How the Asian Session Is Traded

In this article we will check the well-known statement that "The whole day trading depends on how the Asian session is traded".

Using Layouts and Containers for GUI Controls: The CGrid Class

This article presents an alternative method of GUI creation based on layouts and containers, using one layout manager — the CGrid class. The CGrid class is an auxiliary control that acts as a container for other containers and controls using a grid layout.

Lite_EXPERT2.mqh: Expert Advisor Implementation Examples

In this article, the author continues to familiarize the readers with the Lite_EXPERT2.mqh functions using real Expert Advisor implementation examples. The article deals with the idea of using floating pending orders and pending orders that vary dynamically from deal to deal which are determined based on Average True Range (ATR) indicator values.

Neural Networks Made Easy (Part 96): Multi-Scale Feature Extraction (MSFformer)

Efficient extraction and integration of long-term dependencies and short-term features remain an important task in time series analysis. Their proper understanding and integration are necessary to create accurate and reliable predictive models.

Calculating mathematical expressions (Part 1). Recursive descent parsers

The article considers the basic principles of mathematical expression parsing and calculation. We will implement recursive descent parsers operating in the interpreter and fast calculation modes, based on a pre-built syntax tree.

Graphics in DoEasy library (Part 95): Composite graphical object controls

In this article, I will consider the toolkit for managing composite graphical objects - controls for managing an extended standard graphical object. Today, I will slightly digress from relocating a composite graphical object and implement the handler of change events on a chart featuring a composite graphical object. Besides, I will focus on the controls for managing a composite graphical object.

Multiple indicators on one chart (Part 04): Advancing to an Expert Advisor

In my previous articles, I have explained how to create an indicator with multiple subwindows, which becomes interesting when using custom indicators. This time we will see how to add multiple windows to an Expert Advisor.

Practical Application Of Databases For Markets Analysis

Working with data has become the main task for modern software - both for standalone and network applications. To solve this problem a specialized software were created. These are Database Management Systems (DBMS), that can structure, systematize and organize data for their computer storage and processing. As for trading, the most of analysts don't use databases in their work. But there are tasks, where such a solution would have to be handy. This article provides an example of indicators, that can save and load data from databases both with client-server and file-server architectures.

Raise Your Linear Trading Systems to the Power

Today's article shows intermediate MQL5 programmers how they can get more profit from their linear trading systems (Fixed Lot) by easily implementing the so-called technique of exponentiation. This is because the resulting equity curve growth is then geometric, or exponential, taking the form of a parabola. Specifically, we will implement a practical MQL5 variant of the Fixed Fractional position sizing developed by Ralph Vince.

Developing a trading Expert Advisor from scratch (Part 21): New order system (IV)

Finally, the visual system will start working, although it will not yet be completed. Here we will finish making the main changes. There will be quite a few of them, but they are all necessary. Well, the whole work will be quite interesting.

Optimization. A Few Simple Ideas

The optimization process can require significant resources of your computer or even of the MQL5 Cloud Network test agents. This article comprises some simple ideas that I use for work facilitation and improvement of the MetaTrader 5 Strategy Tester. I got these ideas from the documentation, forum and articles.

Area method

The "area method" trading system works based on unusual interpretation of the RSI oscillator readings. The indicator that visualizes the area method, and the Expert Advisor that trades using this system are detailed here. The article is also supplemented with detailed findings of testing the Expert Advisor for various symbols, time frames and values of the area.

Graphical Interfaces XI: Rendered controls (build 14.2)

In the new version of the library, all controls will be drawn on separate graphical objects of the OBJ_BITMAP_LABEL type. We will also continue to describe the optimization of code: changes in the core classes of the library will be discussed.

Optimal approach to the development and analysis of trading systems

In this article, I will show the criteria to be used when selecting a system or a signal for investing your funds, as well as describe the optimal approach to the development of trading systems and highlight the importance of this matter in Forex trading.

Building and testing Keltner Channel trading systems

In this article, we will try to provide trading systems using a very important concept in the financial market which is volatility. We will provide a trading system based on the Keltner Channel indicator after understanding it and how we can code it and how we can create a trading system based on a simple trading strategy and then test it on different assets.

Effective Averaging Algorithms with Minimal Lag: Use in Indicators

The article describes custom averaging functions of higher quality developed by the author: JJMASeries(), JurXSeries(), JLiteSeries(), ParMASeries(), LRMASeries(), T3Series(). The article also deals with application of the above functions in indicators. The author introduces a rich indicators library based on the use of these functions.

Mastering ONNX: The Game-Changer for MQL5 Traders

Dive into the world of ONNX, the powerful open-standard format for exchanging machine learning models. Discover how leveraging ONNX can revolutionize algorithmic trading in MQL5, allowing traders to seamlessly integrate cutting-edge AI models and elevate their strategies to new heights. Uncover the secrets to cross-platform compatibility and learn how to unlock the full potential of ONNX in your MQL5 trading endeavors. Elevate your trading game with this comprehensive guide to Mastering ONNX

Drawing Indicator's Emissions in MQL5

In this article, we will consider the emission of indicators - a new approach to the market research. The calculation of emission is based on the intersection of different indicators: more and more points with different colors and shapes appear after each tick. They form numerous clusters like nebulae, clouds, tracks, lines, arcs, etc. These shapes help to detect the invisible springs and forces that affect the movement of market prices.

Custom Graphical Controls. Part 2. Control Library

The second article of the "Custom Graphical Controls" series introduces a control library for handling the main problems arising in interaction between a program (Expert Advisor, script, indicator) and a user. The library contains a great number of classes (CInputBox, CSpinInputBox, CCheckBox, CRadioGroup, CVSсrollBar, CHSсrollBar, CList, CListMS, CComBox, CHMenu, CVMenu, CHProgress, CDialer, CDialerInputBox, CTable) and examples of their use.

Social Trading with the MetaTrader 4 and MetaTrader 5 Trading Platforms

What is social trading? It is a mutually beneficial cooperation of traders and investors whereby successful traders allow monitoring of their trading and potential investors take the opportunity to monitor their performance and copy trades of those who look more promising.

Learn how to design a trading system by Bull's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator as we will learn in this article about a new technical indicator and how we can design a trading system by it and this indicator is the Bull's Power indicator.

Neural networks made easy (Part 27): Deep Q-Learning (DQN)

We continue to study reinforcement learning. In this article, we will get acquainted with the Deep Q-Learning method. The use of this method has enabled the DeepMind team to create a model that can outperform a human when playing Atari computer games. I think it will be useful to evaluate the possibilities of the technology for solving trading problems.

Visual Optimization of Indicator and Signal Profitability

This article is a continuation and development of my previous article "Visual Testing of Profitability of Indicators and Alerts". Having added some interactivity to the parameter changing process and having reworked the study objectives, I have managed to get a new tool that does not only show the prospective trade results based on the signals used but also allows you to immediately get a layout of deals, balance chart and the end result of trading by moving virtual sliders that act as controls for signal parameter values in the main chart.

Econometrics EURUSD One-Step-Ahead Forecast

The article focuses on one-step-ahead forecasting for EURUSD using EViews software and a further evaluation of forecasting results using the programs in EViews. The forecast involves regression models and is evaluated by means of an Expert Advisor developed for MetaTrader 4.

Regression Analysis of the Influence of Macroeconomic Data on Currency Prices Fluctuation

This article considers the application of multiple regression analysis to macroeconomic statistics. It also gives an insight into the evaluation of the statistics impact on the currency exchange rate fluctuation based on the example of the currency pair EURUSD. Such evaluation allows automating the fundamental analysis which becomes available to even novice traders.

Introduction to MQL5 (Part 12): A Beginner's Guide to Building Custom Indicators

Learn how to build a custom indicator in MQL5. With a project-based approach. This beginner-friendly guide covers indicator buffers, properties, and trend visualization, allowing you to learn step-by-step.

Creating Information Boards Using Standard Library Classes and Google Chart API

The MQL5 programming language primarily targets the creation of automated trading systems and complex instruments of technical analyses. But aside from this, it allows us to create interesting information systems for tracking market situations, and provides a return connection with the trader. The article describes the MQL5 Standard Library components, and shows examples of their use in practice for reaching these objectives. It also demonstrates an example of using Google Chart API for the creation of charts.

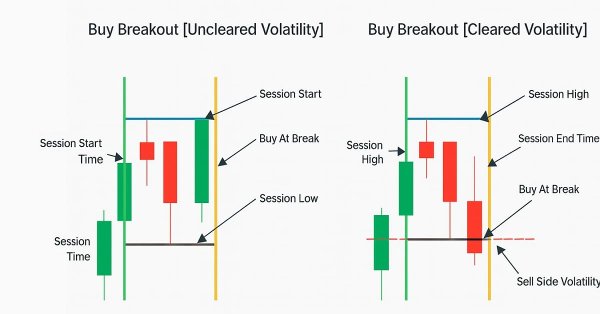

Developing a Volatility Based Breakout System

Volatility based breakout system identifies market ranges, then trades when price breaks above or below those levels, filtered by volatility measures such as ATR. This approach helps capture strong directional moves.

Cascade Order Trading Strategy Based on EMA Crossovers for MetaTrader 5

The article guides in demonstrating an automated algorithm based on EMA Crossovers for MetaTrader 5. Detailed information on all aspects of demonstrating an Expert Advisor in MQL5 and testing it in MetaTrader 5 - from analyzing price range behaviors to risk management.

Multiple Null Bar Re-Count in Some Indicators

The article is concerned with the problem of re-counting of the indicator value in the MetaTrader 4 Client Terminal when the null bar changes. It outlines general idea of how to add to the indicator code some extra program items that allow to restore program code saved before multiple re-counting.

Construction of Fractal Lines

The article describes construction of fractal lines of various types using trend lines and fractals.

Multicurrency monitoring of trading signals (Part 3): Introducing search algorithms

In the previous article, we developed the visual part of the application, as well as the basic interaction of GUI elements. This time we are going to add internal logic and the algorithm of trading signal data preparation, as well us the ability to set up signals, to search them and to visualize them in the monitor.

MQL5 Cookbook - Multi-Currency Expert Advisor and Working with Pending Orders in MQL5

This time we are going to create a multi-currency Expert Advisor with a trading algorithm based on work with the pending orders Buy Stop and Sell Stop. This article considers the following matters: trading in a specified time range, placing/modifying/deleting pending orders, checking if the last position was closed at Take Profit or Stop Loss and control of the deals history for each symbol.

Graphical Interfaces II: Setting Up the Event Handlers of the Library (Chapter 3)

The previous articles contain the implementation of the classes for creating constituent parts of the main menu. Now, it is time to take a close look at the event handlers in the principle base classes and in the classes of the created controls. We will also pay special attention to managing the state of the chart depending on the location of the mouse cursor.

Neural networks made easy (Part 6): Experimenting with the neural network learning rate

We have previously considered various types of neural networks along with their implementations. In all cases, the neural networks were trained using the gradient decent method, for which we need to choose a learning rate. In this article, I want to show the importance of a correctly selected rate and its impact on the neural network training, using examples.

Algorithmic Trading With MetaTrader 5 And R For Beginners

Embark on a compelling exploration where financial analysis meets algorithmic trading as we unravel the art of seamlessly uniting R and MetaTrader 5. This article is your guide to bridging the realms of analytical finesse in R with the formidable trading capabilities of MetaTrader 5.

Reimagining Classic Strategies (Part 20): Modern Stochastic Oscillators

This article demonstrates how the stochastic oscillator, a classical technical indicator, can be repurposed beyond its conventional use as a mean-reversion tool. By viewing the indicator through a different analytical lens, we show how familiar strategies can yield new value and support alternative trading rules, including trend-following interpretations. Ultimately, the article highlights how every technical indicator in the MetaTrader 5 terminal holds untapped potential, and how thoughtful trial and error can uncover meaningful interpretations hidden from view.