Graphical Interfaces VI: the Checkbox Control, the Edit Control and their Mixed Types (Chapter 1)

This article is the beginning of the sixth part of the series dedicated to the development of the library for creating graphical interfaces in the MetaTrader terminals. In the first chapter, we are going to discuss the checkbox control, the edit control and their mixed types.

Universal Expert Advisor: CUnIndicator and Use of Pending Orders (Part 9)

The article describes the work with indicators through the universal CUnIndicator class. In addition, new methods of working with pending orders are considered. Please note: from this point on, the structure of the CStrategy project has undergone substantial changes. Now all its files are located in a single directory for the convenience of users.

Creating an EA that works automatically (Part 02): Getting started with the code

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we discussed the first steps that anyone needs to understand before proceeding to creating an Expert Advisor that trades automatically. We considered the concepts and the structure.

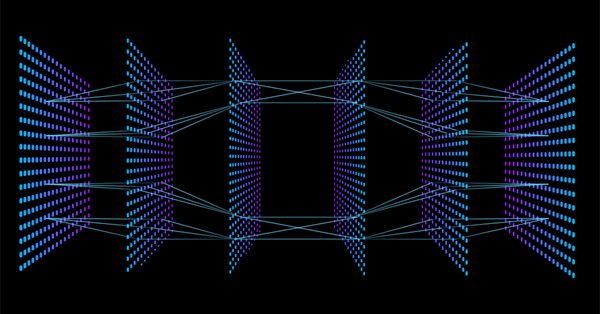

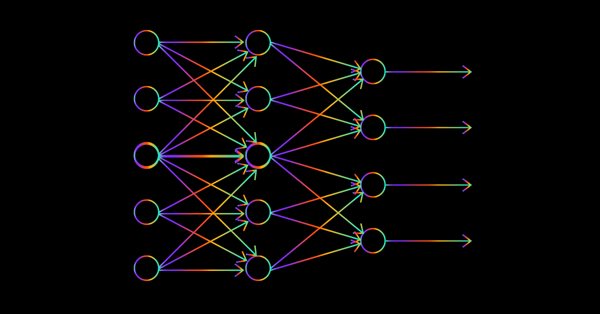

Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified

Many people love them but a few understand the whole operations behind Neural Networks. In this article I will try to explain everything that goes behind closed doors of a feed-forward multi-layer perception in plain English.

Deep Neural Networks (Part II). Working out and selecting predictors

The second article of the series about deep neural networks will consider the transformation and choice of predictors during the process of preparing data for training a model.

Forex Trading ABC

Working on financial markets represents, first of all, trade operations. We all, starting from the very childhood, have an intuitive idea of what is to buy and to sell. But Forex trading is still something special. This article deals with the ideas necessary to explain some terms. We will also consider the MQL 4 functions that correspond with those terms.

Testing of Expert Advisors in the MetaTrader 4 Client Terminal: An Outward Glance

What happens after you have clicked on the "Start" button? The article answers this and many other questions.

Testing patterns that arise when trading currency pair baskets. Part I

We begin testing the patterns and trying the methods described in the articles about trading currency pair baskets. Let's see how oversold/overbought level breakthrough patterns are applied in practice.

MQL as a Markup Tool for the Graphical Interface of MQL Programs. Part 2

This paper continues checking the new conception to describe the window interface of MQL programs, using the structures of MQL. Automatically creating GUI based on the MQL markup provides additional functionality for caching and dynamically generating the elements and controlling the styles and new schemes for processing the events. Attached is an enhanced version of the standard library of controls.

Analysis of the Main Characteristics of Time Series

This article introduces a class designed to give a quick preliminary estimate of characteristics of various time series. As this takes place, statistical parameters and autocorrelation function are estimated, a spectral estimation of time series is carried out and a histogram is built.

Creating a comprehensive Owl trading strategy

My strategy is based on the classic trading fundamentals and the refinement of indicators that are widely used in all types of markets. This is a ready-made tool allowing you to follow the proposed new profitable trading strategy.

MQL5 Cookbook: Processing of the TradeTransaction Event

This article considers capabilities of the MQL5 language from the point of view of the event-driven programming. The greatest advantage of this approach is that the program can receive information about phased implementation of a trade operation. The article also contains an example of receiving and processing information about ongoing trade operation using the TradeTransaction event handler. In my opinion, such an approach can be used for copying deals from one terminal to another.

Build Self Optmising Expert Advisors in MQL5

Build expert advisors that look forward and adjust themselves to any market.

Scalping Orderflow for MQL5

This MetaTrader 5 Expert Advisor implements a Scalping OrderFlow strategy with advanced risk management. It uses multiple technical indicators to identify trading opportunities based on order flow imbalances. Backtesting shows potential profitability but highlights the need for further optimization, especially in risk management and trade outcome ratios. Suitable for experienced traders, it requires thorough testing and understanding before live deployment.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 1): Sending Messages from MQL5 to Telegram

In this article, we create an Expert Advisor (EA) in MQL5 to send messages to Telegram using a bot. We set up the necessary parameters, including the bot's API token and chat ID, and then perform an HTTP POST request to deliver the messages. Later, we handle the response to ensure successful delivery and troubleshoot any issues that arise in case of failure. This ensures we send messages from MQL5 to Telegram via the created bot.

MQL5 Cookbook: Writing the History of Deals to a File and Creating Balance Charts for Each Symbol in Excel

When communicating in various forums, I often used examples of my test results displayed as screenshots of Microsoft Excel charts. I have many times been asked to explain how such charts can be created. Finally, I now have some time to explain it all in this article.

Principles of Exchange Pricing through the Example of Moscow Exchange's Derivatives Market

This article describes the theory of exchange pricing and clearing specifics of Moscow Exchange's Derivatives Market. This is a comprehensive article for beginners who want to get their first exchange experience on derivatives trading, as well as for experienced forex traders who are considering trading on a centralized exchange platform.

Money Management Revisited

The article deals with some issues arising when traders apply various money management systems to Forex trading. Experimental data obtained from performing trading deals using different money management (MM) methods is also described.

Universal Expert Advisor: Trading in a Group and Managing a Portfolio of Strategies (Part 4)

In the last part of the series of articles about the CStrategy trading engine, we will consider simultaneous operation of multiple trading algorithms, will learn to load strategies from XML files, and will present a simple panel for selecting Expert Advisors from a single executable module, and managing their trading modes.

Selection and navigation utility in MQL5 and MQL4: Adding auto search for patterns and displaying detected symbols

In this article, we continue expanding the features of the utility for collecting and navigating through symbols. This time, we will create new tabs displaying only the symbols that satisfy some of the necessary parameters and find out how to easily add custom tabs with the necessary sorting rules.

Implementation of Indicators as Classes by Examples of Zigzag and ATR

Debate about an optimal way of calculating indicators is endless. Where should we calculate the indicator values - in the indicator itself or embed the entire logic in a Expert Advisor that uses it? The article describes one of the variants of moving the source code of a custom indicator iCustom right in the code of an Expert Advisor or script with optimization of calculations and modeling the prev_calculated value.

CatBoost machine learning algorithm from Yandex with no Python or R knowledge required

The article provides the code and the description of the main stages of the machine learning process using a specific example. To obtain the model, you do not need Python or R knowledge. Furthermore, basic MQL5 knowledge is enough — this is exactly my level. Therefore, I hope that the article will serve as a good tutorial for a broad audience, assisting those interested in evaluating machine learning capabilities and in implementing them in their programs.

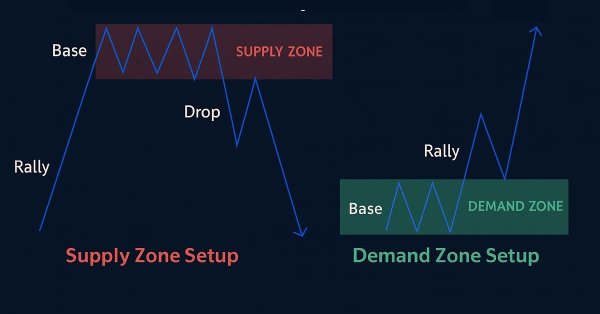

Automating Trading Strategies in MQL5 (Part 36): Supply and Demand Trading with Retest and Impulse Model

In this article, we create a supply and demand trading system in MQL5 that identifies supply and demand zones through consolidation ranges, validates them with impulsive moves, and trades retests with trend confirmation and customizable risk parameters. The system visualizes zones with dynamic labels and colors, supporting trailing stops for risk management.

Creating an MQL5 Expert Advisor Based on the Daily Range Breakout Strategy

In this article, we create an MQL5 Expert Advisor based on the Daily Range Breakout strategy. We cover the strategy’s key concepts, design the EA blueprint, and implement the breakout logic in MQL5. In the end, we explore techniques for backtesting and optimizing the EA to maximize its effectiveness.

Testing Expert Advisors on Non-Standard Time Frames

It's not just simple; it's super simple. Testing Expert Advisors on non-standard time frames is possible! All we need to do is to replace standard time frame data with non-standard time frame data. Furthermore, we can even test Expert Advisors that use data from several non-standard time frames.

An Analysis of Why Expert Advisors Fail

This article presents an analysis of currency data to better understand why expert advisors can have good performance in some regions of time and poor performance in other regions of time.

How to create a custom indicator (Heiken Ashi) using MQL5

In this article, we will learn how to create a custom indicator using MQL5 based on our preferences, to be used in MetaTrader 5 to help us read charts or to be used in automated Expert Advisors.

Graphical interfaces X: Advanced management of lists and tables. Code optimization (build 7)

The library code needs to be optimized: it should be more regularized, which is — more readable and comprehensible for studying. In addition, we will continue to develop the controls created previously: lists, tables and scrollbars.

Naive Bayes classifier for signals of a set of indicators

The article analyzes the application of the Bayes' formula for increasing the reliability of trading systems by means of using signals from multiple independent indicators. Theoretical calculations are verified with a simple universal EA, configured to work with arbitrary indicators.

Social Trading. Can a profitable signal be made even better?

Most subscribers choose a trade signal by the beauty of the balance curve and by the number of subscribers. This is why many today's providers care of beautiful statistics rather than of real signal quality, often playing with lot sizes and artificially reducing the balance curve to an ideal appearance. This paper deals with the reliability criteria and the methods a provider may use to enhance its signal quality. An exemplary analysis of a specific signal history is presented, as well as methods that would help a provider to make it more profitable and less risky.

Data Science and Machine Learning — Neural Network (Part 02): Feed forward NN Architectures Design

There are minor things to cover on the feed-forward neural network before we are through, the design being one of them. Let's see how we can build and design a flexible neural network to our inputs, the number of hidden layers, and the nodes for each of the network.

MQL5 Cookbook: Handling Typical Chart Events

This article considers typical chart events and includes examples of their processing. We will focus on mouse events, keystrokes, creation/modification/removal of a graphical object, mouse click on a chart and on a graphical object, moving a graphical object with a mouse, finish editing of text in a text field, as well as on chart modification events. A sample of an MQL5 program is provided for each type of event considered.

Neural networks made easy (Part 11): A take on GPT

Perhaps one of the most advanced models among currently existing language neural networks is GPT-3, the maximal variant of which contains 175 billion parameters. Of course, we are not going to create such a monster on our home PCs. However, we can view which architectural solutions can be used in our work and how we can benefit from them.

Learn how to design a trading system by Awesome Oscillator

In this new article in our series, we will learn about a new technical tool that may be useful in our trading. It is the Awesome Oscillator (AO) indicator. We will learn how to design a trading system by this indicator.

MQL Parsing by Means of MQL

The article describes a preprocessor, a scanner, and a parser to be used in parsing the MQL-based source codes. MQL implementation is attached.

Using the TesterWithdrawal() Function for Modeling the Withdrawals of Profit

This article describes the usage of the TesterWithDrawal() function for estimating risks in trade systems which imply the withdrawing of a certain part of assets during their operation. In addition, it describes the effect of this function on the algorithm of calculation of the drawdown of equity in the strategy tester. This function is useful when optimizing parameter of your Expert Advisors.

The Player of Trading Based on Deal History

The player of trading. Only four words, no explanation is needed. Thoughts about a small box with buttons come to your mind. Press one button - it plays, move the lever - the playback speed changes. In reality, it is pretty similar. In this article, I want to show my development that plays trade history almost like it is in real time. The article covers some nuances of OOP, working with indicators and managing charts.

Drawing Channels - Inside and Outside View

I guess it won't be an exaggeration, if I say the channels are the most popular tool for the analysis of market and making trade decisions after the moving averages. Without diving deeply into the mass of trade strategies that use channels and their components, we are going to discuss the mathematical basis and the practical implementation of an indicator, which draws a channel determined by three extremums on the screen of the client terminal.

Universal Regression Model for Market Price Prediction

The market price is formed out of a stable balance between demand and supply which, in turn, depend on a variety of economic, political and psychological factors. Differences in nature as well as causes of influence of these factors make it difficult to directly consider all the components. This article sets forth an attempt to predict the market price on the basis of an elaborated regression model.

Take a few lessons from Prop Firms (Part 1) — An introduction

In this introductory article, I address a few of the lessons one can take from the challenge rules that proprietary trading firms implement. This is especially relevant for beginners and those who struggle to find their footing in this world of trading. The subsequent article will address the code implementation.