Larry Williams Market Secrets (Part 2): Automating a Market Structure Trading System

Learn how to automate Larry Williams market structure concepts in MQL5 by building a complete Expert Advisor that reads swing points, generates trade signals, manages risk, and applies a dynamic trailing stop strategy.

Practical application of neural networks in trading (Part 2). Computer vision

The use of computer vision allows training neural networks on the visual representation of the price chart and indicators. This method enables wider operations with the whole complex of technical indicators, since there is no need to feed them digitally into the neural network.

Larry Williams Market Secrets (Part 2): Automating a Market Structure Trading System

Learn how to automate Larry Williams market structure concepts in MQL5 by building a complete Expert Advisor that reads swing points, generates trade signals, manages risk, and applies a dynamic trailing stop strategy.

Trading Strategy Based on Pivot Points Analysis

Pivot Points (PP) analysis is one of the simplest and most effective strategies for high intraday volatility markets. It was used as early as in the precomputer times, when traders working at stocks could not use any ADP equipment, except for counting frames and arithmometers.

Modeling time series using custom symbols according to specified distribution laws

The article provides an overview of the terminal's capabilities for creating and working with custom symbols, offers options for simulating a trading history using custom symbols, trend and various chart patterns.

Deep Learning Forecast and ordering with Python and MetaTrader5 python package and ONNX model file

The project involves using Python for deep learning-based forecasting in financial markets. We will explore the intricacies of testing the model's performance using key metrics such as Mean Absolute Error (MAE), Mean Squared Error (MSE), and R-squared (R2) and we will learn how to wrap everything into an executable. We will also make a ONNX model file with its EA.

Money management in trading

We will look at several new ways of building money management systems and define their main features. Today, there are quite a few money management strategies to fit every taste. We will try to consider several ways to manage money based on different mathematical growth models.

Learn how to deal with date and time in MQL5

A new article about a new important topic which is dealing with date and time. As traders or programmers of trading tools, it is very crucial to understand how to deal with these two aspects date and time very well and effectively. So, I will share some important information about how we can deal with date and time to create effective trading tools smoothly and simply without any complicity as much as I can.

Learn how to design a trading system by Alligator

In this article, we'll complete our series about how to design a trading system based on the most popular technical indicator. We'll learn how to create a trading system based on the Alligator indicator.

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

In this article, we will develop a grider EA for trading in a trend direction within a range. Thus, the EA is to be suited mostly for Forex and commodity markets. According to the tests, our grider showed profit since 2018. Unfortunately, this is not true for the period of 2014-2018.

A Few Tips for First-Time Customers

A proverbial wisdom often attributed to various famous people says: "He who makes no mistakes never makes anything." Unless you consider idleness itself a mistake, this statement is hard to argue with. But you can always analyze the past mistakes (your own and of others) to minimize the number of your future mistakes. We are going to attempt to review possible situations arising when executing jobs in the same-name service.

Exploring options for creating multicolored candlesticks

In this article I will address the possibilities of creating customized indicators with candlesticks, pointing out their advantages and disadvantages.

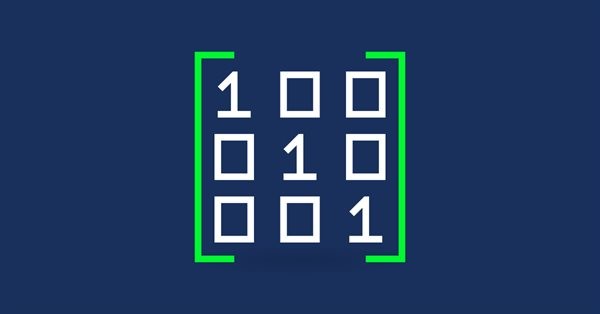

Matrices and vectors in MQL5

By using special data types 'matrix' and 'vector', it is possible to create code which is very close to mathematical notation. With these methods, you can avoid the need to create nested loops or to mind correct indexing of arrays in calculations. Therefore, the use of matrix and vector methods increases the reliability and speed in developing complex programs.

Graphical Interfaces V: The Combobox Control (Chapter 3)

In the first two chapters of the fifth part of the series, we developed classes for creating a scrollbar and a view list. In this chapter, we will speak about creating a class for the combobox control. This is also a compound control containing, among others, elements considered in the previous chapters of the fifth part.

Tips for Selecting a Trading Signal to Subscribe. Step-By-Step Guide

This step-by-step guide is dedicated to the Signals service, examination of trading signals, a system approach to the search of a required signal which would satisfy criteria of profitability, risk, trading ambitions, working on various types of accounts and financial instruments.

Easy Stock Market Trading with MetaTrader

This article raises the issues of automated trading on the stock market. Examples of MetaTrader 4 and QUIK integration are provided for your information. In addition to that, you can familiarize yourself with MetaTrader advantages aimed at solving this issue, and see how a trading robot can perform operations on MICEX.

Fundamentals of Statistics

Every trader works using certain statistical calculations, even if being a supporter of fundamental analysis. This article walks you through the fundamentals of statistics, its basic elements and shows the importance of statistics in decision making.

The RSI Deep Three Move Trading Technique

Presenting the RSI Deep Three Move Trading Technique in MetaTrader 5. This article is based on a new series of studies that showcase a few trading techniques based on the RSI, a technical analysis indicator used to measure the strength and momentum of a security, such as a stock, currency, or commodity.

Self-adapting algorithm (Part IV): Additional functionality and tests

I continue filling the algorithm with the minimum necessary functionality and testing the results. The profitability is quite low but the articles demonstrate the model of the fully automated profitable trading on completely different instruments traded on fundamentally different markets.

Graphical Interfaces VII: the Tables Controls (Chapter 1)

The seventh part of the series on MetaTrader graphical interfaces deals with three table types: text label, edit box and rendered one. Another important and frequently used controls are tabs allowing you to show/hide groups of other controls and develop space effective interfaces in your MQL applications.

Multilayer perceptron and backpropagation algorithm (Part II): Implementation in Python and integration with MQL5

There is a Python package available for developing integrations with MQL, which enables a plethora of opportunities such as data exploration, creation and use of machine learning models. The built in Python integration in MQL5 enables the creation of various solutions, from simple linear regression to deep learning models. Let's take a look at how to set up and prepare a development environment and how to use use some of the machine learning libraries.

Multicurrency monitoring of trading signals (Part 5): Composite signals

In the fifth article related to the creation of a trading signal monitor, we will consider composite signals and will implement the necessary functionality. In earlier versions, we used simple signals, such as RSI, WPR and CCI, and we also introduced the possibility to use custom indicators.

The correct way to choose an Expert Advisor from the Market

In this article, we will consider some of the essential points you should pay attention to when purchasing an Expert Advisor. We will also look for ways to increase profit, to spend money wisely, and to earn from this spending. Also, after reading the article, you will see that it is possible to earn even using simple and free products.

MQL5-RPC. Remote Procedure Calls from MQL5: Web Service Access and XML-RPC ATC Analyzer for Fun and Profit

This article describes MQL5-RPC framework that enables Remote Procedure Calls from MQL5. It starts with XML-RPC basics, MQL5 implementation and follows with two real usage examples. First example is using external web service and the second one is a client to simple XML-RPC ATC 2011 Analyzer service. If you are interested on how to implement and analyze different statistics from ATC 2011 in real time, this article is just for you.

MetaTrader 4 and MetaTrader 5 Trading Signals Widgets

Recently MetaTrader 4 and MetaTrader 5 user received an opportunity to become a Signals Provider and earn additional profit. Now, you can display your trading success on your web site, blog or social network page using the new widgets. The benefits of using widgets are obvious: they increase the Signals Providers' popularity, establish their reputation as successful traders, as well as attract new Subscribers. All traders placing widgets on other web sites can enjoy these benefits.

MQL5 Cookbook: Developing a Multi-Symbol Volatility Indicator in MQL5

In this article, we will consider the development of a multi-symbol volatility indicator. The development of multi-symbol indicators may present some difficulties for novice MQL5 developers which this article helps to clarify. The major issues arising in the course of development of a multi-symbol indicator have to do with the synchronization of other symbols' data with respect to the current symbol, the lack of some indicator data and the identification of the beginning of 'true' bars of a given time frame. All of these issues will be closely considered in the article.

Probability theory and mathematical statistics with examples (part I): Fundamentals and elementary theory

Trading is always about making decisions in the face of uncertainty. This means that the results of the decisions are not quite obvious at the time these decisions are made. This entails the importance of theoretical approaches to the construction of mathematical models allowing us to describe such cases in meaningful manner.

Interview with Dmitry Terentew (ATC 2012)

Is it really necessary to be a programmer to develop trading robots? Do we need to spend years monitoring price charts to be able to "feel" the market? All these issues have been discussed in our interview with Dmitry Terentew (SAFF), whose trading robot has been occupying the first page of the Championship from the very beginning.

Learn how to design a trading system by Bear's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator here is a new article about learning how to design a trading system by Bear's Power technical indicator.

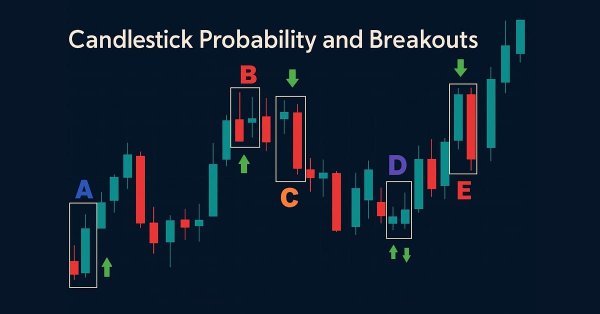

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

How Not to Fall into Optimization Traps?

The article describes the methods of how to understand the tester optimization results better. It also gives some tips that help to avoid "harmful optimization".

The Order of Object Creation and Destruction in MQL5

Every object, whether it is a custom object, a dynamic array or an array of objects, is created and deleted in MQL5-program in its particular way. Often, some objects are part of other objects, and the order of object deleting at deinitialization becomes especially important. This article provides some examples that cover the mechanisms of working with objects.

What is a trend and is the market structure based on trend or flat?

Traders often talk about trends and flats but very few of them really understand what a trend/flat really is and even fewer are able to clearly explain these concepts. Discussing these basic terms is often beset by a solid set of prejudices and misconceptions. However, if we want to make profit, we need to understand the mathematical and logical meaning of these concepts. In this article, I will take a closer look at the essence of trend and flat, as well as try to define whether the market structure is based on trend, flat or something else. I will also consider the most optimal strategies for making profit on trend and flat markets.

Modified Grid-Hedge EA in MQL5 (Part I): Making a Simple Hedge EA

We will be creating a simple hedge EA as a base for our more advanced Grid-Hedge EA, which will be a mixture of classic grid and classic hedge strategies. By the end of this article, you will know how to create a simple hedge strategy, and you will also get to know what people say about whether this strategy is truly 100% profitable.

Library for easy and quick development of MetaTrader programs (part II). Collection of historical orders and deals

In the first part, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. We created the COrder abstract object which is a base object for storing data on history orders and deals, as well as on market orders and positions. Now we will develop all the necessary objects for storing account history data in collections.

Design Patterns in software development and MQL5 (Part 4): Behavioral Patterns 2

In this article, we will complete our series about the Design Patterns topic, we mentioned that there are three types of design patterns creational, structural, and behavioral. We will complete the remaining patterns of the behavioral type which can help set the method of interaction between objects in a way that makes our code clean.

Strings: Table of ASCII Symbols and Its Use

In this article we will analyze the table of ASCII symbols and the ways it can be used. We will also deal with some new functions, the principle of operation of which is based on the peculiarities of the ASCII table, and then we will create a new library, which will include these functions. They are quite popular in other programming languages, but they are not included into the list of built-in functions. Besides, we will examine in details the basics of working with strings. So, I think you will certainly learn something new about this useful type of data.

Combination scalping: analyzing trades from the past to increase the performance of future trades

The article provides the description of the technology aimed at increasing the effectiveness of any automated trading system. It provides a brief explanation of the idea, as well as its underlying basics, possibilities and disadvantages.

MQL5 Cookbook: The History of Deals And Function Library for Getting Position Properties

It is time to briefly summarize the information provided in the previous articles on position properties. In this article, we will create a few additional functions to get the properties that can only be obtained after accessing the history of deals. We will also get familiar with data structures that will allow us to access position and symbol properties in a more convenient way.

Cross-Platform Expert Advisor: The CExpertAdvisor and CExpertAdvisors Classes

This article deals primarily with the classes CExpertAdvisor and CExpertAdvisors, which serve as the container for all the other components described in this article-series regarding cross-platform expert advisors.