QuantBot Studio

- Experts

- Sahib Ul Ahsan

- Versione: 1.2

- Aggiornato: 27 gennaio 2026

- Attivazioni: 5

Quant_Bot Studio – Professional Expert Advisor for MetaTrader 5

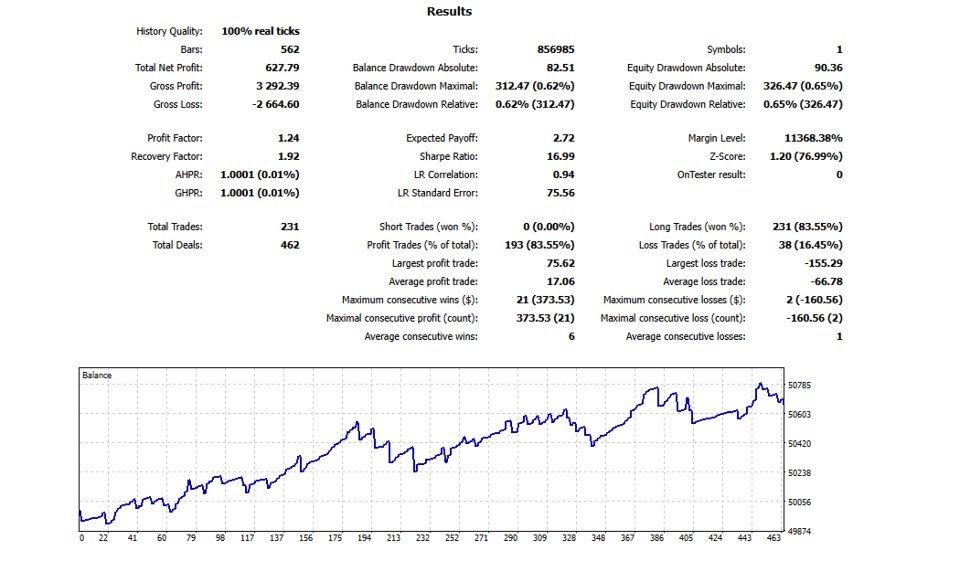

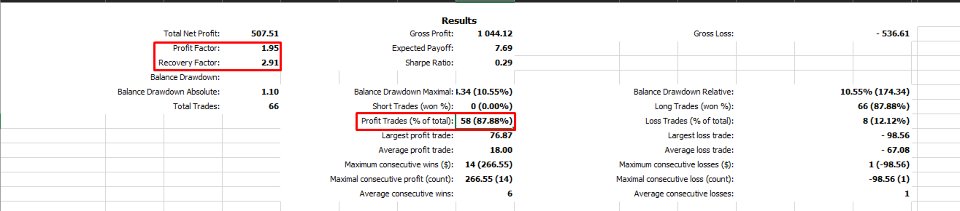

Quant_Bot Studio is a professional-grade Expert Advisor designed for traders who demand consistency, discipline, and scalability. Built on institutional Smart Money Concepts, it automates high-probability trade execution across forex, commodities, and indices while enforcing strict risk control at every stage. This system removes emotional decision-making and operational limitations, allowing traders to execute structured strategies continuously—regardless of time zone, workload, or market hours.

Whether you are an active trader seeking uninterrupted market participation or a fund manager looking to automate and scale a proven methodology, Quant_Bot Studio delivers the infrastructure required for systematic, repeatable performance without manual intervention.

Institutional Methodology, Algorithmic Precision

Quant_Bot Studio is not a generic indicator-based system. It is a purpose-built MetaTrader 5 Expert Advisor that integrates institutional Smart Money Concepts used by professional trading desks to track order flow, liquidity behavior, and market structure shifts. The system is engineered to identify where large participants accumulate and distribute positions, enabling trades to align with institutional intent rather than retail noise.

Most retail systems rely on lagging indicators that fail during volatility spikes or market manipulation phases. Quant_Bot Studio addresses this limitation by focusing on price behavior, liquidity dynamics, and structural confirmation—resulting in fewer false signals and more controlled drawdowns.

Solving the Core Problems Traders Face

Retail traders typically struggle with emotional exits, missed opportunities during off-hours, and the inability to scale strategies across instruments and timeframes. Fund managers face additional challenges in monitoring multiple accounts, maintaining execution discipline, and ensuring consistent risk exposure.

Quant_Bot Studio removes these constraints entirely by automating decision-making, enforcing predefined risk parameters, and executing trades only when institutional-grade confluence is present. The result is a streamlined, scalable trading operation capable of running continuously without performance degradation.

Advanced Smart Money & Momentum Trading Engine

-

Institutional Smart Money Concepts (SMC) framework

-

Order Block detection for institutional accumulation and distribution zones

-

Dynamic Supply & Demand zones that adapt to live market conditions

-

Break of Structure (BOS) and Change of Character (CHOCH) for precise trend validation

-

Fair Value Gap (FVG) identification for high-probability, low-risk entries

-

Higher-timeframe trend alignment to avoid counter-trend trades

-

RSI filter to confirm momentum strength and avoid exhausted price moves

-

MACD filter to validate trend direction and momentum continuation

-

Multi-layer confirmation system to significantly reduce false signals

-

Designed for forex, commodities (Gold), and indices

Professional Position Sizing and Risk Control

Quant_Bot Studio offers flexible, professional-grade position sizing to suit different trading objectives:

-

Fixed lot sizing for consistent, predictable exposure

-

ATR-based sizing that adjusts to market volatility

-

Equity-based sizing that scales positions as account equity grows, maintaining proportional risk

Each trade is governed by strict margin checks and equity protection logic, ensuring capital preservation under all market conditions.

Controlled Multi-Trade and Martingale Logic

The system includes an advanced multi-trade execution framework designed to capitalize on strong directional moves without excessive risk. Unlike traditional Martingale systems, Quant_Bot Studio enforces directional limits, margin validation, and exposure caps to prevent uncontrolled averaging in trending markets.

Profit-based entry gating ensures that new trades are opened only when the account is operating within predefined performance conditions. Equity-based stop-loss controls impose hard drawdown limits, safeguarding capital during unexpected market events.

Institutional-Grade Risk Management Features

-

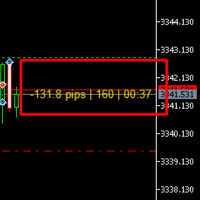

Basket Trailing Stop secures profits across multiple positions by managing cumulative exposure rather than individual trades.

-

Session Filters restrict trading to high-liquidity periods such as the London and New York sessions, avoiding low-quality market conditions.

-

Spread and Execution Control prevents entries during unfavorable spread environments, reducing slippage and execution costs.

-

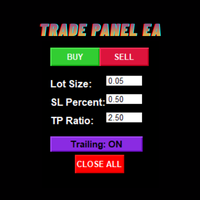

Real-Time Dashboard provides full visibility into equity, floating P/L, drawdown, active trades, and trailing stop status.

-

Debug and Analysis Mode offers transparency into every trade decision, enabling performance review and strategy refinement.

Market Coverage and Scalability

Quant_Bot Studio can trade multiple instruments simultaneously, including currency pairs, commodities, and indices, using the same institutional logic. Multi-timeframe confirmation adapts signal quality to both low-volatility consolidations and high-momentum breakout conditions.

This makes the system suitable for single-account traders and multi-account portfolio managers alike, significantly reducing operational complexity while maintaining execution discipline.

Ideal For

-

Professional traders seeking fully automated, emotion-free execution

-

Fund managers and signal providers managing multiple accounts

-

Serious retail traders with limited screen time

-

Traders transitioning from discretionary to systematic trading

-

Developers and strategy designers seeking a robust automation framework

Built for Serious Trading Operations

Quant_Bot Studio is engineered for traders who value structure, discipline, and long-term consistency over short-term hype. It combines institutional price-action intelligence with strict risk governance, offering a reliable foundation for professional trading automation.

This is not a retail toy system. It is a trading infrastructure designed to perform under real market conditions while protecting capital and enabling sustainable growth.