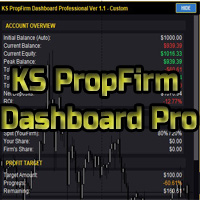

KS Price Action Trendline Fibonacci Auto Expert

- Experts

- Kulvinder Singh

- Versione: 4.28

- Aggiornato: 20 gennaio 2026

- Attivazioni: 7

When you install first Select Trendline Breakout Strategy for Fibonacci Trades

This Expert Advisor (EA) is a sophisticated automated trading system built for MetaTrader 5 (MT5). It focuses on price action trading using trendlines, Fibonacci retracements, and various filters for risk management and trade optimization. Below is a comprehensive list of its key features, derived from the code and input parameters. The EA emphasizes breakout trading with pullback entries, incorporating advanced notifications, a news filter, and a live dashboard.

Core Trading Strategy- Automatically detects swing highs and lows on a configurable timeframe using a specified number of bars and minimum point threshold to identify potential trendline points.

- Draws and monitors upper (resistance) and lower (support) trendlines on the chart. Supports up to 10 trendlines per type, with customizable colors, width, style, and extension. Hides parallel lines or those broken by price (with a 20-point threshold).

- Monitors for breaks using close price or wicks, with a configurable point move threshold to trigger.

- Requires a minimum pullback (default: 200 points) after a break to create a Fibonacci setup.

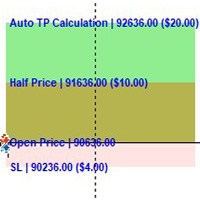

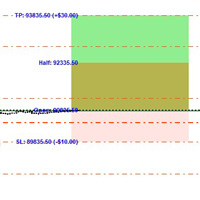

- Draws Fibonacci retracement zones (0%, 23.6%, 38.2%, 50%, 61.8%, 78.6%, 100%) with visual boxes on the chart (customizable colors and transparency).

- Supports multiple zones: 23.6%, 38.2%, 50%, 61.8%, 78.6%, or Golden Zone (38.2%-61.8%).

- Tolerance for zone triggers (default: 50 points).

- Enables trades on price touching a trendline and reversing (with touch distance threshold, default: 100 points)

- candle confirmation on a specified timeframe (default: H4). Can wait for candle close or allow zone re-entries:

- Buys on upward trendline breaks with pullback to Fib zone.

- Sells on downward trendline breaks with pullback to Fib zone.

- Draws entry arrows on the chart (customizable colors).

- Supports one trade at a time, max trades per day (default: 5), and minimum seconds between trades (default: 60) to prevent rapid reversals.

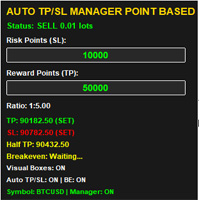

- Lot Sizing: Fixed lots (default: 0.1) or auto-lot based on risk percent (default: 1%) per trade.

- Stop Loss (SL): Configurable in points (default: 500) or based on swing low/high.

- Take Profit (TP): Configurable in points (default: 1000) or via Risk:Reward ratio (e.g., 1:2).

- Trailing Stop: Activates after profit threshold (default: 500 points), with step intervals (default: 500 points), max steps (optional), and breakeven move (default: enabled).

- Partial Profit Booking: Closes a percentage of the position (default: 50%) after profit points (default: 1000), with option to continue trailing.

- Fib setups invalidate if price moves beyond 0% by points (default: 100) or expires after hours (default: 48).

- News Filter :

- Avoids trading during high/medium/low impact news for specified currencies (e.g., USD, EUR).

- Configurable minutes before/after news (e.g., 60 minutes).

- Auto-closes positions on news and sends notifications.

- Updates from MQL5 calendar every 5 minutes.

- Session Filter: Not explicitly detailed in code, but implied in dashboard (blocks trading during certain sessions).

- Performance Optimization: Updates logic every N seconds , processes only new bars, limits bar checks, and cleans up executed setups.

- Push Notifications: For trendline breaks, retracements, Fib triggers, and trades (configurable).

- Advanced Notification System (KS Notification System v1.00):

- Sends formatted messages with emojis, details, and context (account, balance, symbol, time).

- Rate-limited (max 10 per minute) to avoid spam.

- Types: Info, Success, Warning, Error, Trade Open/Close, Alert, Breakout.

- Telegram Integration: Sends screenshots on trade open/close with captions (bot token, chat ID required). Supports personal chats, groups/channels.

- Discord Webhook: Sends screenshots to Discord channels.

- Screenshots: Captures chart (1920x1080) on key events, with sequencing delays to prevent MT5 hangs.

Add for screenshot proper you Details of Bot System and webhook and enable MT5 Allow WebRequest URL

https://api.telegram.org

https://nfs.faireconomy.media

https://discordapp.com

https://discord.com

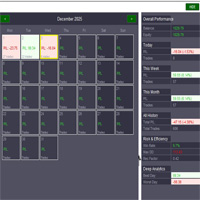

- Live Dashboard (KS Dashboard System v1.00):

- Displays on-chart with customizable position, size, colors, font.

- Shows: Candle countdown, daily/weekly profits and win rates, live position status, EA status, IST time, broker time, GMT offset, balance/equity, spread.

- Solid background option; auto-GMT detection; weekly reset on Mondays.

- Visual Elements: Trendlines, Fibonacci boxes/labels, entry arrows. Option to keep Fib visible after trades.

- Cleanup: Automatically deletes objects for executed trades (unless disabled).

- Magic Number and Comment: For identifying EA trades.

- Initialization and Deinit: Initializes dashboard, cleans up objects on removal.

- Error Handling: Logs detailed errors for orders, WebRequests (e.g., Telegram/Discord), and news updates.

- Dependencies: Uses MQL5 Trade library; no external installs needed.

- Compatibility: Strict mode; MT5-specific etc.).

This EA is designed for professional use, with a focus on robustness (e.g., handling invalid requests, filling modes) and user customization. It avoids high-risk activities like martingale or grid trading, emphasizing quality setups. For best results, backtest on historical data and configure inputs carefully (e.g., news filter during volatile periods). If you need help with specific settings or modifications, let me know!

Please read these warnings carefully. This EA is a powerful tool, but trading involves significant risks. No EA guarantees profits.

Warning : -High Risk of Loss Forex/CFD trading carries a high risk of losing money rapidly due to leverage. This EA uses stop losses and trailing stops, but slippage, spreads, broker execution delays, or extreme market moves can cause losses larger than expected.

You Must Test It Yourself Thoroughly- After buy never use immediately on a live/real money account.

- Always start with a demo account for at least 1–2weeks.

- Perform your own forward testing and backtesting on multiple symbols, timeframes, and market conditions (trending, ranging, high volatility, news events).

- Verify that the strategy matches your trading style and risk tolerance.