Sniper Entry Prop EA

- Experts

- John Muguimi Njue

- Versione: 1.51

- Aggiornato: 16 ottobre 2025

- Attivazioni: 7

- SNIPER ENTRY PROP EA

Professional Grade Market Execution System

Advanced Trading Automation Built for Precision & Institutional Discipline

System Overview

SNIPER ENTRY PROP is a sophisticated Expert Advisor engineered for traders who demand institutional-level market analysis combined with military-grade risk management. Designed for Forex pairs, metals, and high-liquidity instruments, this system transforms complex technical patterns into automated trading signals while maintaining uncompromising execution standards.

Built specifically for prop firm environments, funded accounts, and disciplined retail traders, SNIPER ENTRY PROP delivers a comprehensive framework that identifies high-probability setups through multi-layered pattern recognition, dynamic trend analysis, and adaptive trade management—all while enforcing strict broker compliance protocols.

SET FILE: MQL5 CHAT LINK

| ON SALE: $1977.00 ONLY - VALID FOR NEXT 10 SALES NEXT PRICE $9977.00 HURRY |

Operational Architecture

1. Multi-Dimensional Market Analysis

Higher Timeframe Context (H1/H4/D1):

- Establishes primary market structure and directional bias

- Identifies institutional-grade support/resistance zones

- Maps key liquidity accumulation areas

- Tracks long-term trend momentum shifts

Lower Timeframe Precision (M15/M5):

- Pinpoints optimal entry timing using pivot analysis

- Detects micro-structure breakouts and retests

- Validates price action confirmation signals

- Executes with surgical entry precision

Volatility Intelligence:

- Has Option -ATR-based dynamic stop placement (20-period calculation)

- Real-time spread monitoring and execution filtering

- Adaptive position sizing based on market conditions

- Volatility-adjusted trailing stop mechanisms

2. Advanced Pattern Recognition Engine

The EA deploys a sophisticated pattern detection system analyzing:

Reversal Structures:

- Double Top/Bottom formations with volume confirmation

- Head & Shoulders patterns (standard and inverse)

- Failed breakout traps (Turtle Soup methodology)

- Key level rejection signals

Continuation Patterns:

- Breakout + retest confirmations

- Trend channel bounces

- Consolidation range exits

- Momentum-based structure breaks

Support/Resistance Framework:

- Dynamic pivot point calculations (up to 7 simultaneous levels)

- Historical price clustering analysis (1000-bar lookback)

- Volume-weighted key level identification

- Touch-point strength validation (minimum 3 confirmations)

3. Intelligent Trade Execution System

Entry Precision:

- Minimum 40-pip breakout threshold filters noise

- 150-pip minimum distance between concurrent positions

- Cooldown mechanisms prevent signal clustering (300-second intervals)

- Session-based trade limits (2 per session, 5 daily maximum)

Position Sizing Intelligence:

- Risk-based lot calculation (0.01%-5% configurable range)

- Account equity percentage allocation

- Automatic margin requirement validation

- Volume step compliance with broker specifications

- Maximum position limits (configurable cap)

Order Management:

- Market execution with 10-point slippage tolerance

- FOK (Fill-Or-Kill) order type for instant fills

- Stop level and freeze level pre-validation

- Quote history verification (minimum 100 bars required)

4. Dynamic Risk Management Framework

Triple Take-Profit System:

- TP1 (1.0% of SL distance): First profit target for quick wins

- TP2 (2.5% of SL distance): Intermediate profit capture

- TP3 (4.0% of SL distance): Maximum profit extension

Partial Position Closing:

- TP1 Hit: Close 33% of position (or percentage-based)

- TP2 Hit: Close additional 50% of remaining

- TP3: Full position exit at maximum target

Breakeven Protection:

- Automatic trigger at 0.5% profit milestone

- Stop loss moves to entry +2 pips

- Protects capital after 15-pip favorable movement

- Locks in minimum gains while preserving upside

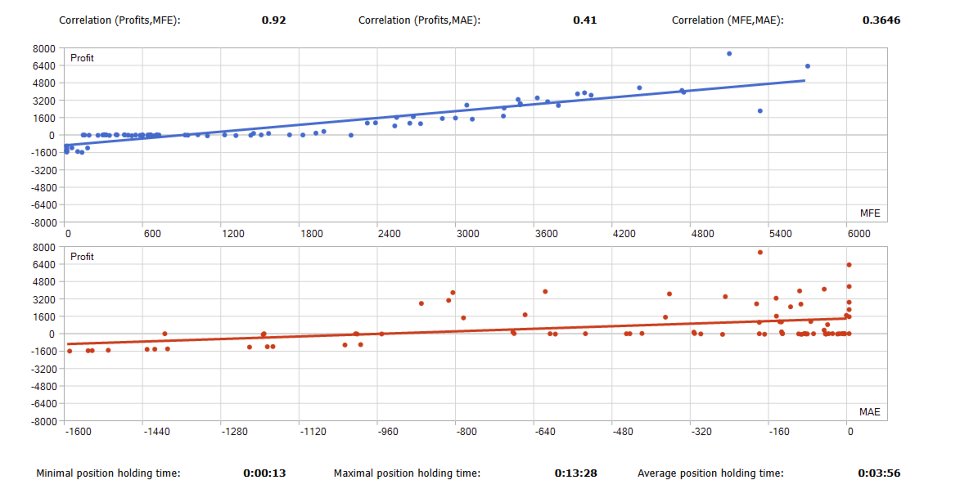

Adaptive Trailing Stop:

- ATR-based trailing mechanism (1.2x multiplier)

- Activates after 10-pip favorable movement

- Minimum 10-pip trailing increments

- Preserves profits during extended moves

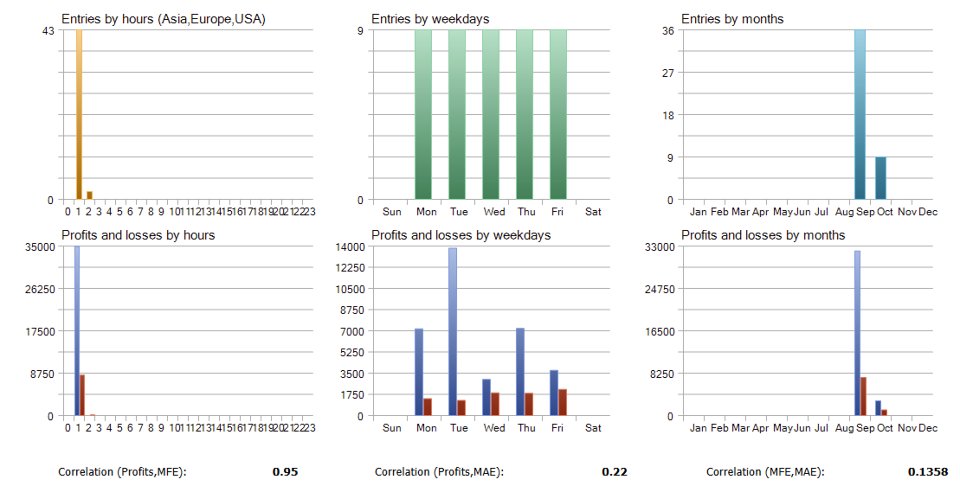

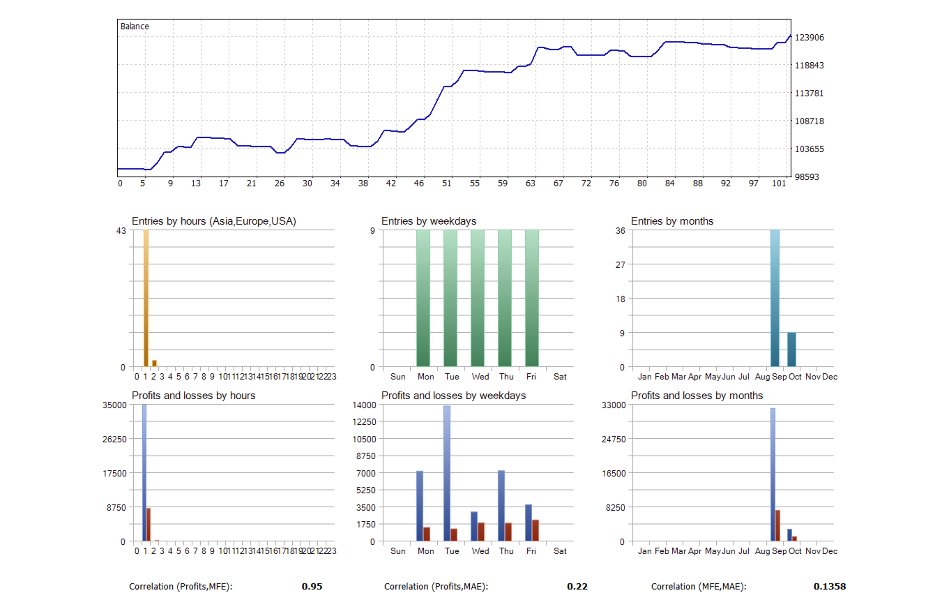

5. Kill Zone Time Optimization

Precision trading windows aligned with institutional activity:

London Session (07:00-10:00 GMT):

- European market open volatility

- High liquidity concentration

- Institutional order flow initiation

New York Open (13:00-15:00 GMT):

- US market maker activity

- Cross-continental volume surge

- Major news release window

New York Close (20:00-22:00 GMT):

- Algorithmic rebalancing period

- End-of-day position adjustments

- Reduced spread environment

Weekday Filtering:

- Full Monday-Friday operation

- Weekend trading disabled (configurable)

- Day-specific toggle controls (individual weekday activation)

6. News Event Protection System

Automated News Filter:

- Pre-news trading suspension (30 minutes before)

- Post-news trading suspension (30 minutes after)

- Three-tier impact classification:

- Low Impact: Configurable avoidance

- Medium Impact: Default avoidance enabled

- High Impact: Mandatory avoidance

- Real-time countdown to next major event

- Currency-specific news tracking

Core System Differentiators

1. Institutional-Grade Validation Pipeline

- Every trade passes through 13-layer compliance validation:

2. Adaptive Data Intelligence

Historical Data Scaling:

- Automatic lookback period adjustment (500-1000 bars)

- Limited data mode for new deployments

- Graceful degradation when history sparse

- Real-time bar availability monitoring

Broker Compatibility Engine:

- Automatic stop level detection and compliance

- Freeze level respect during modifications

- Spread-adjusted stop placement (5x spread buffer)

- Symbol-specific specification extraction

3. Military-Grade Risk Controls

Position Limits:

- Maximum 3 concurrent positions (prevents overexposure)

- Session-based caps (2 trades per kill zone)

- Daily trade limits (5 maximum)

- Minimum trade spacing (150 pips default)

Modification Safeguards:

- 10-second cooldown between position adjustments

- Price safety validation before SL/TP changes

- Market distance verification

- Trailing stop memory leak prevention (10-entry buffer)

Emergency Protocols:

- Automatic position closure on critical errors

- Margin level monitoring

- Error tracking and rate limiting (50 logs/minute max)

- Periodic error summary reports (4-hour intervals)

4. Professional Debugging System

Granular Logging Controls:

- Master debug toggle (EnableDebug)

- Detailed operation logs (EnableDetailedLogs)

- Success operation filtering (LogSuccessfulOps)

- Validation step visibility (LogValidationSteps)

- Trade operation tracking (LogTradeOperations)

- Modification logging (LogModifications)

- Pattern analysis monitoring (LogPatternAnalysis)

Error Classification:

- Requote tracking and counting

- Invalid stops diagnosis with context

- Insufficient funds alerts with margin details

- Invalid price detection

- Market closed notifications

- Trade rejection analysis

- AutoTrade status verification

Memory Protection:

- Log rate limiting (configurable entries/minute)

- Automatic counter resets

- Array overflow prevention

- Periodic error summary generation

Real-Time Intelligence Dashboard

4K-Ready Interactive Panel:

EA Health Monitoring:

- Current operational status (ACTIVE/NEWS BLOCK/SESSION OFF)

- Memory usage tracking (MB precision)

- Refresh rate display (millisecond accuracy)

- Quote history confirmation

News Filter Status:

- Current news impact level (LOW/MEDIUM/HIGH)

- Next scheduled news event countdown

- Trading block active indicator

- News avoidance configuration display

Pattern Detection Matrix:

- Active trend line count

- Double pattern formations detected

- Head & Shoulders occurrences

- Supply/demand zone identifications

- Order block detections

Performance Metrics:

- Daily profit/loss tracking

- Session trade counter (current/maximum)

- Account balance snapshot

- Daily trade limit status

Manual Override Controls:

- One-click BUY/SELL execution

- CLOSE ALL positions button

- BREAKEVEN activation for all trades

- PARTIAL profit-taking trigger

Configuration Panel:

- Live risk percentage adjustment

- ATR multiplier modification

- Stop loss pip editing

- Take profit level tuning (TP1/TP2/TP3)

- Partial profit percentage controls

System Architecture Flow

1. Market Data Acquisition ↓ 2. Quote History Validation (100+ bars) ↓ 3. Multi-Timeframe Analysis (HTF structure + LTF precision) ↓ 4. Pattern Detection Engine (7 pivot analysis + trend lines) ↓ 5. Kill Zone & Session Filter Check ↓ 6. News Event Screening ↓ 7. 13-Layer Trade Validation Pipeline ↓ 8. Risk Calculation (ATR-based SL + lot sizing) ↓ 9. Broker Compliance Pre-Check ↓ 10. Order Execution (FOK market orders) ↓ 11. Dynamic Position Management - Breakeven activation (0.5% profit) - Partial closures (TP1: 33%, TP2: 50%) - ATR trailing stop engagement - Full position exit at TP3

Example Trade Execution Workflow

Scenario: EURUSD Bullish Setup

-

HTF Analysis (H1):

- Identifies upward market structure

- Confirms bullish momentum (20-period MA alignment)

- Validates support zone at 1.0850

-

LTF Signal (M15):

- Detects double bottom pattern formation

- Price breaks above recent resistance

- Volume confirmation on breakout candle

-

Validation Pipeline:

- Pattern confirmed: Double Bottom ✓

- Kill zone active: London Open (08:45 GMT) ✓

- News filter: Clear (no events 30min window) ✓

- Session limit: 0/2 trades used ✓

- Daily limit: 2/5 trades used ✓

- Minimum distance: No positions within 150 pips ✓

-

Risk Calculation:

- Account: $10,000 | Risk: 0.1% = $10

- ATR(20): 0.0015 (15 pips)

- Stop Loss: 1.2 × ATR = 18 pips = $10 risk = 0.05 lots

- Entry: 1.0875 (market execution)

- SL: 1.0857 (-18 pips)

- TP1: 1.0893 (+18 pips, 1.0R)

- TP2: 1.0920 (+45 pips, 2.5R)

- TP3: 1.0947 (+72 pips, 4.0R)

-

Trade Management:

- At +9 pips: Breakeven triggered → SL moves to 1.0880 (+5 pips)

- At +18 pips (TP1): 33% closed (0.0165 lots) | Remaining: 0.0335 lots

- At +45 pips (TP2): 50% of remaining closed (0.0168 lots) | Remaining: 0.0167 lots

- At +60 pips: Trailing stop engaged (ATR-based)

- At +72 pips (TP3): Final 0.0167 lots closed

-

Result Documentation:

- Total profit: (+18 × 0.33) + (+45 × 0.50) + (+72 × 0.17) = 40 pip average

- Position held: 4 hours 15 minutes

- Drawdown: 0 pips (breakeven protection activated)

- Logged as: "Double Bottom - London Killzone"

Target Deployment Environments

Ideal For:

✓ Prop Firm Traders:

- Strict risk controls (0.1%-0.5% default)

- Daily trade limits prevent rule violations

- Audit-ready trade logging

- Drawdown protection mechanisms

✓ Funded Account Managers:

- Scales from $5,000 to $200,000+ identically

- Consistent risk-per-trade methodology

- Position sizing adapts to account growth

- Compliance-first architecture

✓ Swing/Position Traders:

- Multi-day holding capability

- HTF structure alignment

- Session-based entry optimization

- Trailing stop profit protection

✓ Algorithmic Portfolio Builders:

- Clean codebase for modification

- Modular strategy architecture

- Comprehensive logging for analysis

- Backtestable on Strategy Tester

✓ Risk-Conscious Retail Traders:

- Conservative default settings

- Multiple safety layers

- Transparent dashboard monitoring

- Full manual override capability

Technical Specifications

Broker Requirements:

Execution Type: ECN/STP/Market Execution Minimum Stop Level: <20 pips (10 pips optimal) Freeze Level: <10 pips Spread: <3 pips EURUSD average Slippage Tolerance: 10 points maximum Order Filling: FOK (Fill-Or-Kill) or IOC (Immediate-Or-Cancel) Account Mode: Netting or Hedging compatible

Capital Specifications:

Minimum Deposit: $500 (0.01 lot minimum) Recommended Start: $1,000+ (0.1% risk comfort) Optimal Range: $5,000-$50,000 (standard prop firm sizes) Maximum Tested: $200,000+ (institutional scale)

Symbol Compatibility:

Primary Pairs:

- EURUSD (default optimization)

- GBPUSD (high liquidity)

- XAUUSD (metals/gold)

Compatible Instruments:

- Major Forex pairs (USDJPY, AUDUSD, USDCAD)

- Precious metals (XAGUSD/silver)

- Indices (US30, NAS100, SPX500 - requires parameter adjustment)

Timeframe Flexibility:

- HTF Analysis: H1 (default), H4, D1

- LTF Execution: M15 (default), M5 (scalping), H1 (swing)

Infrastructure Requirements:

VPS Specifications:

- Uptime: 99.9% minimum (24/5 coverage)

- Latency: <50ms to broker server

- RAM: 2GB minimum, 4GB recommended

- OS: Windows Server 2016+, or Linux with Wine compatibility

- Storage: 10GB free space for log files

Network Requirements:

- Stable internet (5 Mbps minimum)

- Redundant connection recommended

- Low-latency routing to broker datacenter

Pre-Deployment Protocol

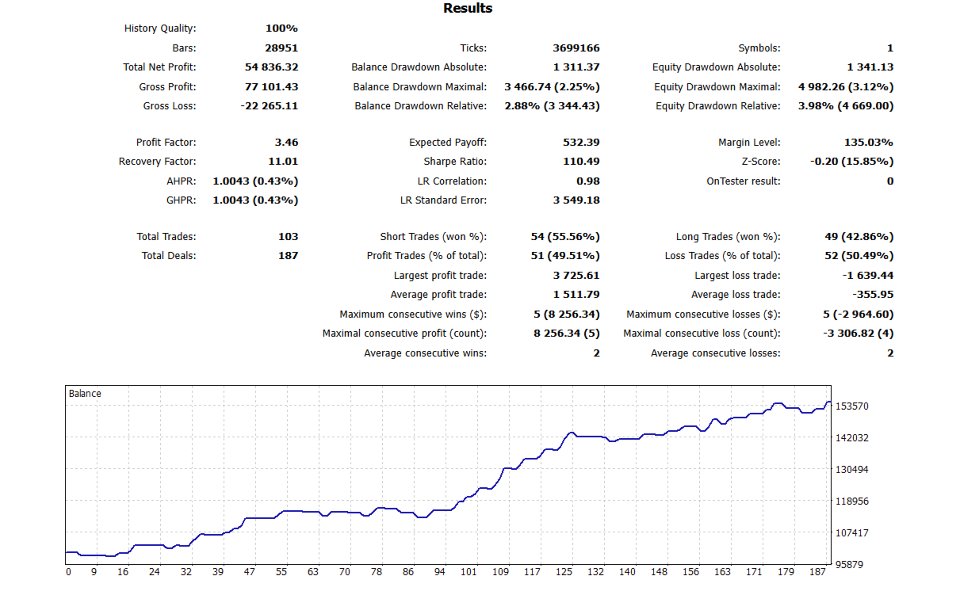

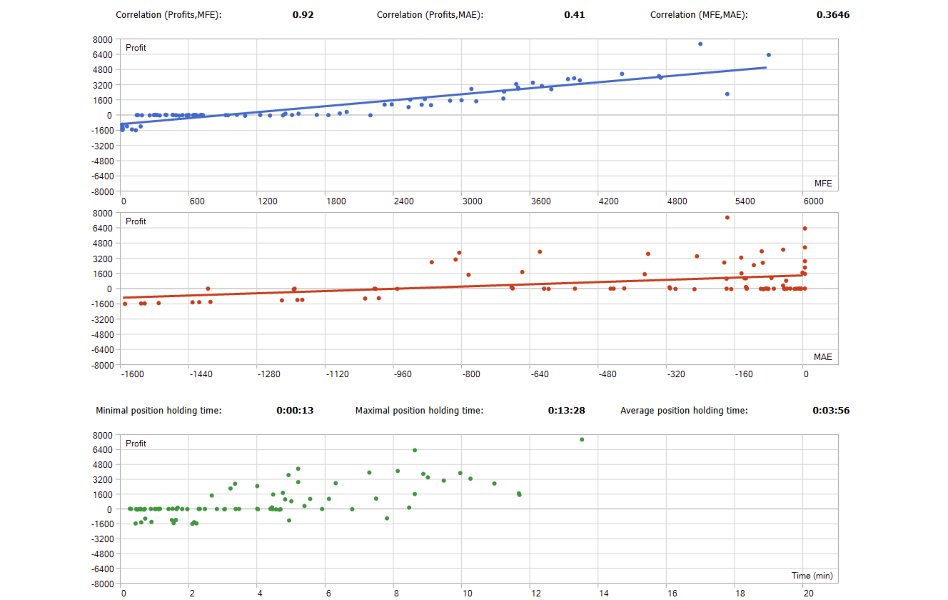

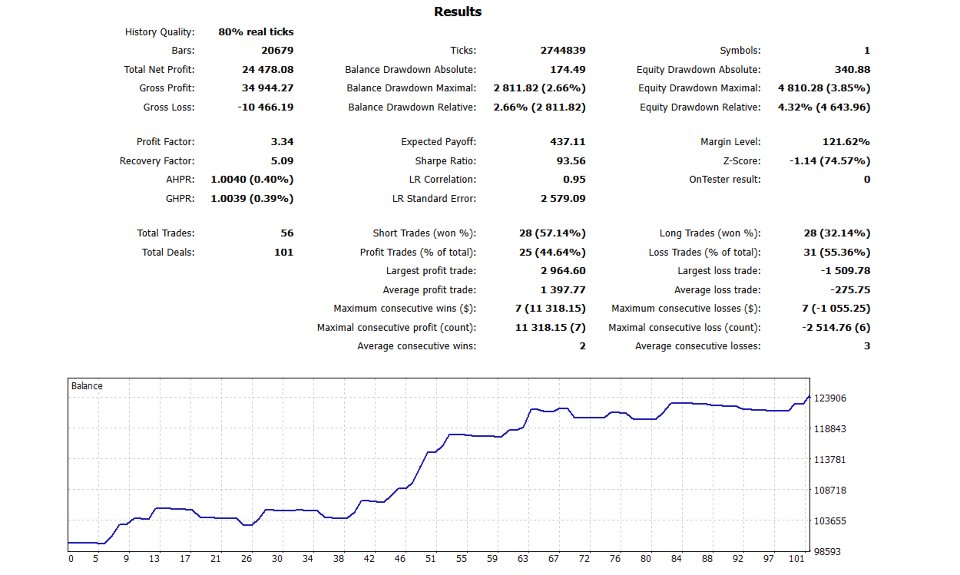

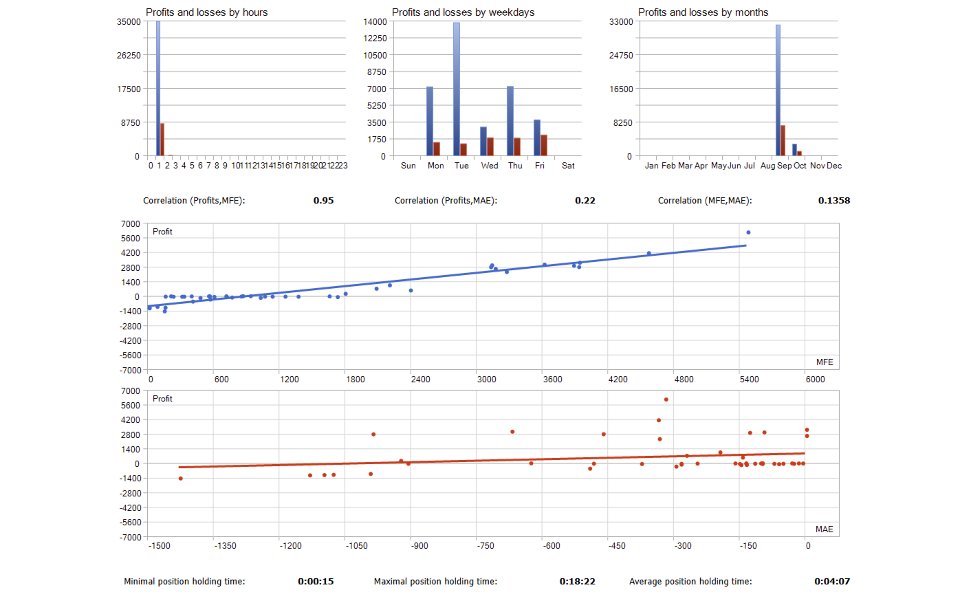

Phase 1: Strategy Tester Validation (2 weeks)

- [ ] Run M15 EURUSD backtest (2022-2024 data)

- [ ] Verify tick data quality (99.9% minimum)

- [ ] Analyze drawdown patterns

- [ ] Confirm profit factor >1.2

- [ ] Review trade distribution across kill zones

- [ ] Check error log for compliance issues

Phase 2: Demo Account Testing (3 weeks minimum)

- [ ] Deploy on live demo feed

- [ ] Monitor real-time execution quality

- [ ] Verify news filter functionality

- [ ] Test manual override controls

- [ ] Validate panel display accuracy

- [ ] Observe kill zone adherence

- [ ] Document slippage and spread behavior

Phase 3: Micro Live Testing (1-2 weeks)

- [ ] Start with minimum risk (0.01%-0.05%)

- [ ] Use minimum lot size (0.01)

- [ ] Monitor first 20 trades closely

- [ ] Verify broker compatibility

- [ ] Test VPS stability

- [ ] Confirm logging functionality

Phase 4: Full Deployment

- [ ] Gradually increase risk to target (0.1%-0.5%)

- [ ] Enable all kill zones

- [ ] Activate full news filter

- [ ] Set daily/session limits

- [ ] Configure dashboard alerts

- [ ] Establish monitoring routine

Configuration Optimization Guide

Conservative Profile (Prop Firm / New Traders):

LotSizePercent = 0.01 (0.1% risk) MaxTradesPerDay = 3 MaxTradesPerSession = 1 FixedStopLoss = 250 pips ATR_Multiplier = 1.5 TakeProfit1_Pct = 1.0 TakeProfit2_Pct = 2.0 TakeProfit3_Pct = 3.0 EnableNewsFilter = true AvoidHighImpactNews = true

Moderate Profile (Experienced Retail):

LotSizePercent = 0.05 (0.5% risk) MaxTradesPerDay = 5 MaxTradesPerSession = 2 FixedStopLoss = 200 pips ATR_Multiplier = 1.2 TakeProfit1_Pct = 1.0 TakeProfit2_Pct = 2.5 TakeProfit3_Pct = 4.0 EnableNewsFilter = true AvoidMediumImpactNews = true

Aggressive Profile (High Risk Tolerance):

LotSizePercent = 0.1 (1% risk) MaxTradesPerDay = 7 MaxTradesPerSession = 3 FixedStopLoss = 150 pips ATR_Multiplier = 1.0 TakeProfit1_Pct = 1.5 TakeProfit2_Pct = 3.0 TakeProfit3_Pct = 5.0 EnableNewsFilter = false TradeNYClose = true

Advanced Features

Trend Line Intelligence:

- Automatic uptrend/downtrend detection

- Linear regression-based slope calculation

- Multi-point touch validation (3-7 pivots)

- Breakout confirmation signals

- Visual trend line rendering (optional)

Key Level Analysis:

- 1000-bar historical price clustering

- Volume-weighted level strength scoring

- Touch frequency validation

- Dynamic horizontal line plotting

- Breakout/retest signal generation

Pattern Confluence System:

- Simultaneous multi-pattern scanning

- Reinforcement scoring (multiple patterns = higher confidence)

- Cooldown mechanisms prevent duplicate signals

- Unique arrow markers on chart for visual confirmation

Adaptive Stop Loss Modes:

- Fixed Pips: Static pip-based stops (200 default)

- ATR Dynamic: Volatility-adjusted stops (20-period ATR × 1.2)

- Swing Based: Structure-based stops (local pivot points)

- ATR + Swing Hybrid: Combined approach for optimal balance

Risk Disclosure & Best Practices

Important Considerations:

Market Risk: All trading involves potential for loss. No system guarantees profits.

Slippage Risk: Fast markets may cause execution price variation from displayed price.

Broker Dependency: Performance varies by broker execution quality and server stability.

Configuration Risk: Improper settings amplify losses. Always test thoroughly before live deployment.

VPS Reliability: System requires stable connectivity. Server downtime affects performance.

Mandatory Best Practices:

✓ Never skip demo testing (minimum 3 weeks) ✓ Start with minimum risk (0.01%-0.1% maximum initially) ✓ Use VPS for 24/5 uptime (not home computer) ✓ Monitor daily for first 2 weeks (ensure proper operation) ✓ Understand every parameter before changing defaults ✓ Keep emergency stop loss always active ✓ Review trade logs weekly for pattern recognition ✓ Never risk more than you can afford to lose

System Advantages Summary

Technical Excellence:

✓ 13-layer compliance validation pipeline ✓ Broker-agnostic parameter adaptation ✓ Memory leak prevention mechanisms ✓ Real-time error tracking and recovery ✓ MQL5 Market standard 100% compliance

Risk Management Superiority:

✓ Triple take-profit system with partial closures ✓ ATR-based dynamic trailing stops ✓ Automatic breakeven protection ✓ Session and daily trade limits ✓ Minimum position spacing enforcement ✓ News event avoidance system

Operational Intelligence:

✓ Multi-timeframe structure analysis ✓ 7-pivot pattern recognition ✓ Trend line automation with regression ✓ Key level clustering analysis ✓ Kill zone precision timing ✓ Adaptive data scaling

User Experience:

✓ Real-time 4K dashboard ✓ One-click manual overrides ✓ Comprehensive debug logging ✓ Visual pattern markers ✓ Live performance metrics ✓ Interactive configuration panel

Professional Features:

✓ Prop firm optimized defaults ✓ Audit-ready trade logging ✓ Scalable from $500 to $200K+ ✓ VPS-ready architecture ✓ Broker compatibility engine ✓ Emergency shutdown protocols

Why SNIPER ENTRY PROP?

Precision: Every trade passes 13 validation checkpoints before execution.

Discipline: Automated session limits and cooldowns eliminate emotional trading.

Transparency: Full visibility into every decision through comprehensive logging.

Adaptability: Works across account sizes, brokers, and market conditions.

Compliance: Built to MQL5 Market standards with institutional-grade validation.

Control: Manual override capability maintains trader authority over system.

Final Technical Notes

System Philosophy: SNIPER ENTRY PROP embodies surgical precision over shotgun approaches. By combining multi-layered pattern recognition with institutional risk controls, the system focuses on high-probability setups during optimal market windows rather than high-frequency trading.

Development Standards:

- professional logging only

- Modular codebase architecture

- Comprehensive error handling

- Memory-efficient operations

- Broker compatibility prioritization

Continuous Improvement: The system's adaptive intelligence allows it to function in data-limited environments while scaling capabilities as historical data accumulates. This ensures consistent operation from day-one deployment through years of trading.

SNIPER ENTRY PROP - Where Technical Analysis Meets Institutional Execution Standards

Professional trading automation built for traders who demand precision, discipline, and transparency in their algorithmic systems.

Disclaimer: This Expert Advisor is a trading tool, not financial advice. All trading involves risk. Past performance does not indicate future results. Users are responsible for their trading decisions and outcomes. Always conduct thorough testing before live deployment. Consult with financial professionals regarding your specific situation.