Yellow Brick Road

- Experts

- Michael Prescott Burney

- Version: 7.0

- Activations: 20

Overview

Yellow Brick Road for XAUUSD H1 is a purpose-built Expert Advisor that pairs a robust, discretionary-style algorithm with an embedded AI engine. It validates signals, studies trend development, and adapts parameters to your broker’s XAUUSD feed. The goal is a professional workflow that enforces discipline and repeatability—without promises or hype.

Architecture & Execution

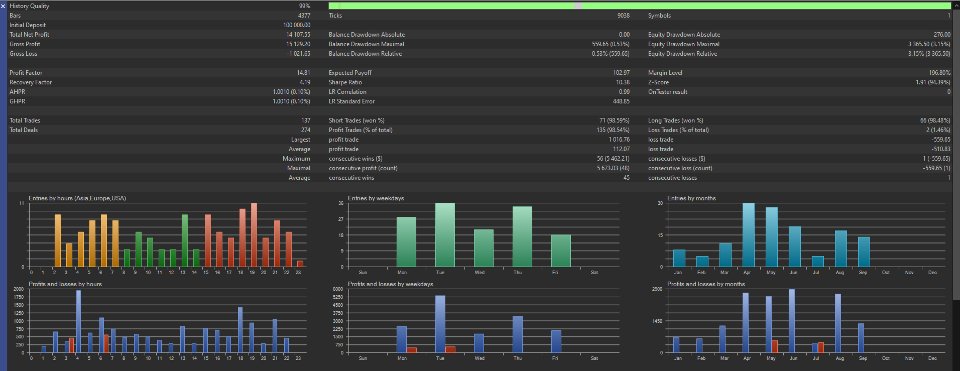

The system runs on MT5 hedging accounts with unique magic numbers per strategy, so every position is isolated and auditable. Order handling includes pre-checks and filling-mode fallbacks; spread and session rules are enforced; and execution respects your risk envelope. You may trade fixed lots, dollar-based dynamic lots, or risk-percent sizing. Value-per-pip is computed from the live symbol for broker-accurate risk math. Daily loss and drawdown guards, equity-DD limits, max spread/open-positions/open-lots, and timed session controls are integrated, with automatic suspension and reset at your chosen hour.

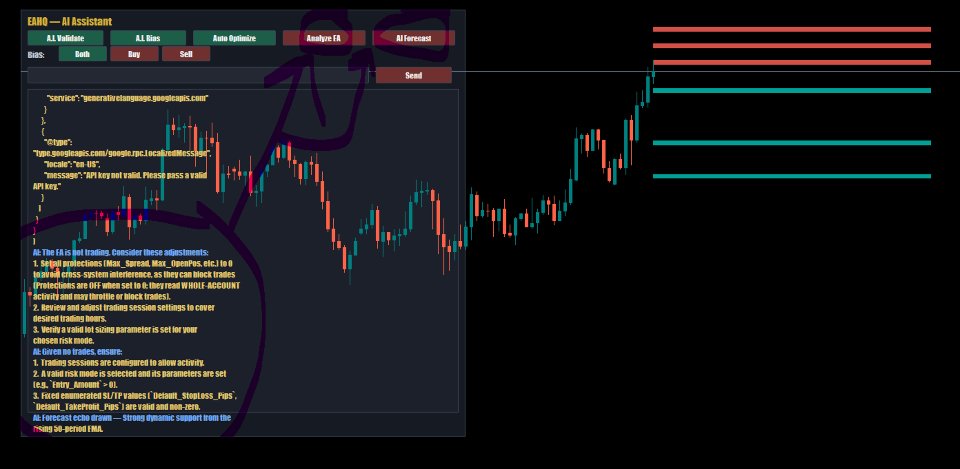

AI Engine (OpenAI & Google Gemini)

Directional Trend Bias constrains trades to BUY-only, SELL-only, or BOTH based on structure. AI Validation can be enabled to route prospective entries through a model that reads live XAUUSD H1 context—trend, volatility, momentum, and optional higher-TF alignment—and responds with a clear YES/NO and a concise reason. An optimization assistant reviews recent performance and your current settings, then suggests compact parameter refinements that better fit your broker’s flow. You remain in control; changes are never applied without your consent.

Guardian Assistant Panel

Converse with the Guardian, a guide trained on the EA’s operations. Toggle Bias, Validation, and Auto-Optimize; request audits of your setup; and capture reasoning alongside trade activity to maintain a transparent decision trail. The panel supports both fully automated operation and human-in-the-loop workflows.

Forecast Mode with On-Chart Mark-Up

With one click, the EA requests a structured outlook on the current XAUUSD H1 market. It automatically draws key support and resistance zones as rectangles and plots a price-line “echo” through predicted pivot points. The Guardian posts the rationale in the panel, so you see not only the marks but also the logic behind them. This is an analytical aid to planning likely bounces and rejections around historical and psychological levels, not a promise of future price.

Transparency

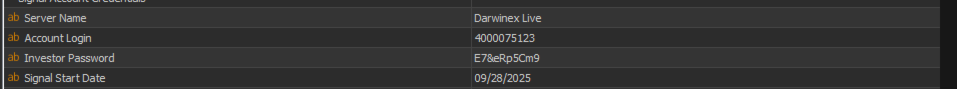

Read-only investor account access is provided so you can observe the live signal at any time via MT5 investor login. This visibility lets you compare results, study behavior around news or volatility spikes, and verify operation under real conditions. Fills and outcomes may vary by broker, feed, and account configuration.

Risk Controls & Protections

Risk is tracked continuously: open risk versus balance, daily loss and DD enforcement, equity-DD limits, spread and news buffers when enabled, and automatic entry suspension on guard triggers. Recovery is handled gracefully at the daily reset.

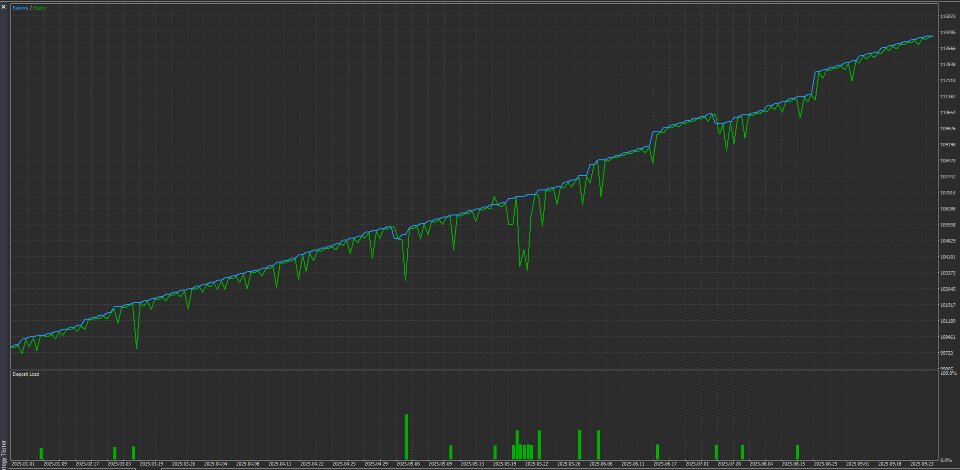

Performance Monitoring & Analytics

A live performance monitor renders recent equity progression, win/loss distribution, risk-utilization gauges, per-strategy statistics, and a strategy-similarity heatmap to surface unintended overlap. Trade logs include spread, slippage, and risk at decision to support rapid audits.

Multi-Timeframe Confluence

Optional MTF confluence lets you incorporate higher-TF context into entries. Aligning H1 trades with chosen timeframes adds an extra validation layer designed to reduce counter-trend noise while preserving responsiveness.

Setup & Requirements

Add the required Web Request URLs in MT5, paste an OpenAI or Gemini API key if using AI features, and attach the EA to XAUUSD H1. The Guardian can verify configuration, explain each protection, and assist with troubleshooting directly from the panel. The system is tuned for gold’s microstructure and assumes a modern MT5 environment with hedging support.

Roadmap & Licensing

Planned updates include AI Vision for chart-image reasoning and additional AI providers/models, with priorities shaped by community feedback. Licenses are intentionally limited to protect the strategy’s edge. The introductory launch price is 699.99 for the first week after system release; pricing may rise thereafter with demand, and total licenses are capped at 100 total copies sold to preserve exclusivity.

Responsible Use

Trading gold carries risk. Yellow Brick Road is designed to enforce process, enhance analysis, and improve decision quality; it does not guarantee outcomes. Use the built-in protections, size responsibly, and evaluate on your own broker feed before scaling.