Trend Scope pro

- Indicators

- Murtadha Majid Jeyad Al-Khuzaie

- Version: 1.2

- Activations: 5

Trend Scope Pro – Precision Linear Regression Channels for Smarter Trading

Trend Scope Pro is a powerful trading indicator built on the concept of Linear Regression Channels, designed to give traders a crystal-clear view of market trends, volatility, and potential reversal zones. This professional-grade tool brings advanced statistical analysis right onto your MetaTrader 5 charts, helping you make smarter, more confident trading decisions.

Unlike traditional moving averages or static trendlines, Trend Scope Pro dynamically calculates the regression line of price movements over a defined period and projects multiple standard deviation channels around it. These channels act as reliable boundaries, showing where the price is statistically likely to stay and where it may be overstretched, signaling trading opportunities.

How It Works

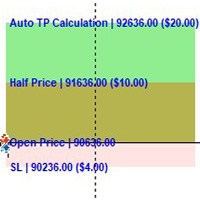

The core of Trend Scope Pro is the linear regression line (blue), which represents the “fair value” trend of the market over the selected period. Surrounding it are three sets of upper and lower channels, calculated at 1, 2, and 3 standard deviations from the regression line.

The blue line = the trend regression, showing the central tendency of price.

The orange dotted lines = 1 standard deviation zone, where price often oscillates during normal volatility.

The gray dotted lines = 2 standard deviation zone, highlighting stronger moves and possible overextensions.

The red dotted lines = 3 standard deviation extremes, signaling statistically rare price movements and potential reversal points.

When the price trades near the upper channels, it suggests overbought conditions; when it approaches the lower channels, it may indicate oversold conditions. This gives traders a clear, visual framework to spot trend continuations, pullbacks, and breakout scenarios.

How to Read the Signals

Trend Identification – The slope of the regression line tells you if the market is trending up, down, or sideways.

Volatility Measurement – Wider channels mean higher volatility, while narrower ones show consolidation.

Entry Opportunities – When price bounces from the lower bands in an uptrend, it’s often a strong buy signal; in a downtrend, rejections from the upper bands can be sell signals.

Profit Targets – Channels can serve as natural take-profit levels, as price frequently reacts near standard deviation boundaries.

Reversal Alerts – Reaching the outer red bands often signals exhaustion and possible price reversal.

Key Features of Trend Scope Pro

Advanced Regression Analysis – Accurately models market behavior using professional-grade statistics.

Dynamic Multi-Level Channels – Displays 3 customizable levels of standard deviation bands for maximum flexibility.

Clear Trend Visualization – Instantly spot bullish or bearish momentum with the regression line slope.

Works Across Markets – Suitable for Forex, indices, stocks, and commodities on any timeframe.

User-Friendly and Free – Simple, clean design optimized for both beginners and advanced traders, offered completely free of charge.

Why Choose Trend Scope Pro?

This indicator doesn’t predict the future—it equips you with the probabilities and boundaries where price is most likely to behave. Whether you’re a swing trader looking for reversals, or an intraday trader seeking breakout opportunities, Trend Scope Pro gives you the edge of statistical confidence combined with intuitive visuals.