RSI NextGen

- Indicators

- Murtadha Majid Jeyad Al-Khuzaie

- Version: 1.35

- Activations: 5

RSI NextGen Advanced RSI Indicator

The RSI NextGen is an advanced and modernized version of the classic Relative Strength Index (RSI). It comes with enhanced features that deliver far more accurate and reliable signals across different market conditions. This indicator has been designed to provide traders with a dynamic and adaptive view of overbought and oversold zones, instead of relying on the static and rigid settings of the traditional RSI.

Unlike the standard RSI, which is calculated using a fixed period, the RSI NextGen automatically adjusts its calculation period in real-time, based on market volatility, trading volume, and price speed. This ensures that you get a more realistic reading of market momentum, helping you separate genuine reversals from false signals.

How to Read the Indicator

The indicator appears in a separate window below the main chart, as a single blue line ranging between 0 and 100.

Horizontal levels (25 – 50 – 75) act as reference points to evaluate momentum.

When the line rises above 70–75, the market is considered overbought, indicating a potential pullback or bearish correction.

When the line drops below 30–25, the market is considered oversold, signaling a possible bullish rebound.

The mid-level 50 serves as a balance point:

Above 50 → buyers dominate momentum.

Below 50 → sellers dominate momentum.

What makes RSI NextGen special is that these readings are not static. They adapt automatically according to ATR-based volatility, moving average of volume, and price acceleration, making overbought/oversold signals much more precise.

How It Works Technically

RSI NextGen combines multiple advanced techniques into one seamless calculation:

Adaptive Periods – dynamically shifts the RSI calculation period between 7 and 28 depending on volatility.

Weighted Calculation – gives higher importance to price movements backed by high volume or sharp speed.

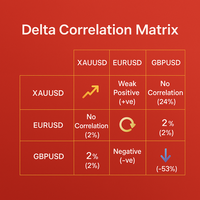

Delta Filtering – measures the difference between raw RSI and smoothed RSI to filter out noise.

Dynamic Bands – adds adaptive upper and lower bands (similar to Bollinger Bands) for accurate overbought/oversold detection.

The result is a smarter RSI that captures price explosions and strong breakouts before they fully unfold.

Key Features

Dynamic market adaptation – no need to manually change settings; adjusts itself automatically.

Sharper, more accurate signals than the standard RSI.

Combines volatility and volume for stronger momentum detection.

Clean and simple interface with a single easy-to-read line.

Identifies breakout momentum and explosive market moves early.

Works across all timeframes – from scalping to swing trading.

Final Thoughts

The RSI NextGen is not just a simple upgrade of the RSI. It is a next-generation momentum tool that adapts to the market in real-time, providing high-quality trading signals. By integrating volatility, volume, and speed, it empowers traders to make more confident entry and exit decisions.