CandleForce Pro

- Indicators

- Saqr Mohammad Yousef Almasarweh

- Version: 1.0

- Activations: 5

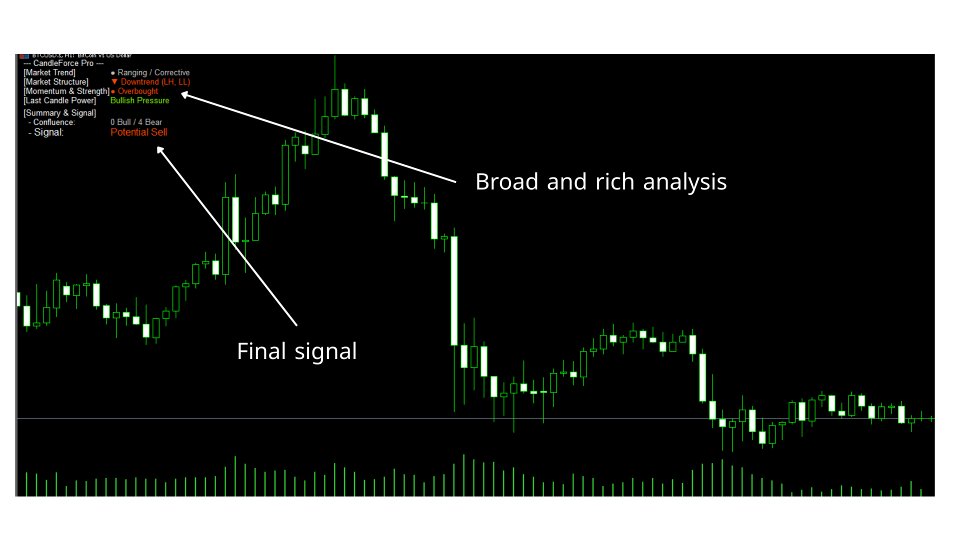

CandleForce Pro: The Ultimate Decision-Support Dashboard for Modern Traders

Introduction: Overcoming the Chaos of Modern Markets

In today's hyper-connected financial markets, the modern trader faces a paradox of choice. We are inundated with an endless stream of data, indicators, news, and strategies, all promising to unlock the secrets of profitable trading. This constant influx often leads to "analysis paralysis"—a state of cognitive overload where conflicting signals create confusion, hesitation, and ultimately, missed opportunities or poor decisions. Chart screens become cluttered with lagging indicators, oscillators flash contradictory signals, and the true underlying sentiment of the market becomes lost in the noise.

What if you could cut through that noise? What if you could have a single, intuitive system that acts as your co-pilot, constantly scanning the market, processing its core dynamics, and presenting a clear, objective, and actionable summary?

This is the very problem that CandleForce Pro was engineered to solve. It is not merely another indicator to add to the clutter; it is a sophisticated, integrated dashboard designed to replace it. CandleForce Pro serves as your central command center, a decision-support system that synthesizes the four most critical pillars of technical analysis into one unified, at-a-glance interface. It is designed to bring clarity, confidence, and discipline to your trading by answering the most important question on every tick: "Who is in control of the market right now?"

The CandleForce Pro Philosophy: The Unshakeable Power of Confluence

The foundational principle behind CandleForce Pro is Confluence. Seasoned traders understand that the most reliable, high-probability trading signals are not generated by a single tool but emerge from the alignment of multiple, non-correlated analytical factors. When the trend, market structure, momentum, and immediate price action all point in the same direction, the probability of a successful outcome increases exponentially.

CandleForce Pro automates this process of seeking confluence. It meticulously examines the market through four distinct analytical lenses, each representing a fundamental force of price movement. By assigning a quantifiable score to each force and then aggregating them, the indicator delivers a holistic and multi-dimensional view of the market that is impossible to achieve with standard, one-dimensional tools. This methodical approach transforms subjective chart reading into an objective, data-driven process, empowering you to trade with conviction rather than guesswork.

A Deep Dive: Deconstructing the Four Pillars of Analysis

At the heart of CandleForce Pro is its powerful analytical engine, which continuously evaluates the market across four pillars.

Pillar 1: The Overall Trend – Navigating "The River"

The trend is the single most powerful force in the market. As the old adage goes, "the trend is your friend." This pillar is designed to objectively identify the direction and health of the dominant market current.

Tools Used: A dual Exponential Moving Average (EMA) system, specifically the EMA 34 and EMA 50, which together form "The River." This combination is renowned for its ability to act as a dynamic zone of support and resistance.

Methodology: The logic is multifaceted. A Strong Uptrend (+1) is confirmed only when two conditions are met: the price is trading decisively above The River, and the faster EMA (34) is positioned above the slower EMA (50). This confirms both short-term strength and long-term bullish alignment. Conversely, a Strong Downtrend (-1) requires the price to be below The River with the fast EMA below the slow one. Any other condition—such as price trading within The River or the EMAs being crossed—is correctly identified as a Neutral (0), corrective, or ranging phase, protecting the trader from entering during periods of low conviction.

Pillar 2: Market Structure – The Architectural Blueprint of Price

While moving averages are excellent for gauging trend smoothness, the true definition of a trend lies in its structure. This pillar analyzes the market's "bones" according to the foundational principles of Dow Theory.

Tool Used: A proprietary algorithm that intelligently identifies the most recent significant swing highs and swing lows without the lag associated with indicators like ZigZag.

Methodology: The indicator scans recent price action to determine its architectural pattern. A Bullish Structure (+1) is registered when the market is clearly forging a pattern of Higher Highs (HH) and Higher Lows (HL), the indisputable signature of an uptrend. A Bearish Structure (-1) is identified when the pattern consists of Lower Highs (LH) and Lower Lows (LL). If this clear progressive pattern is broken or absent, the structure is deemed Ranging (0), signaling a period of consolidation or indecision. This analysis provides a pure, unfiltered view of trend integrity.

Pillar 3: Momentum and Exhaustion – The Engine of the Market

A trend without momentum is like a car without fuel—it won't go far. This pillar measures the force and sustainability behind price movements, and critically, it warns of potential exhaustion points.

Tools Used: A synergistic combination of the Relative Strength Index (RSI) and the Stochastic Oscillator.

Methodology: CandleForce Pro uses these two oscillators in a complementary fashion. The RSI (set to a period of 14) is used to gauge the underlying strength; readings above 55 suggest Bullish Momentum (+1), while readings below 45 suggest Bearish Momentum (-1). However, to avoid entering at points of exhaustion, the Stochastic Oscillator is used as a filter. A bullish RSI signal is validated only if the Stochastic is not in the overbought zone (above 80). Furthermore, the indicator astutely interprets an oversold Stochastic reading as a potential launching point for a new bullish move, and an overbought reading as a potential bearish reversal zone, adding a layer of predictive insight to the momentum analysis.

Pillar 4: Candlestick Force – The Footprint of Conviction

This is perhaps the most unique and immediate pillar of the CandleForce Pro system. While the other pillars analyze the broader context, this one zooms in on the most recent, completed candle to measure the real-time conviction of buyers and sellers.

Tool Used: A mathematical analysis of the last candle's anatomy (its body-to-range ratio).

Methodology: The indicator measures the "power" of the last candle. A candle with a large body and small wicks signifies a decisive victory for one side. A Strong Bullish Control (+1) score is awarded if the candle is bullish and its body constitutes more than 60% of its total range (from high to low). This represents a high-conviction, Marubozu-like candle. The opposite is true for a Strong Bearish Control (-1) score. If the candle has a small body and long wicks (like a Doji or a Spinning Top), it represents indecision and pressure, not control, and is scored as Neutral (0). This final check ensures you are entering the market at a moment of confirmed strength, not hesitation.

The Synthesis: From Raw Data to Actionable Intelligence

CandleForce Pro’s true genius lies in how it synthesizes these four distinct analyses into a simple, actionable output.

The Total Score: The individual scores (+1, -1, 0) are summed to produce a final, aggregate Total Score ranging from -4 (Perfect Bearish Confluence) to +4 (Perfect Bullish Confluence). This single number provides an immediate, quantitative measure of market conviction.

The Confluence Readout: To add context, the dashboard displays the breakdown of forces (e.g., "3 Bull / 1 Bear"), allowing you to see which factors are aligned and which are not.

The Textual Signal: The numerical score is translated into an intuitive, human-readable signal like "Very Strong Buy," "Potential Sell," or "Wait / Neutral," removing all ambiguity from the interpretation.

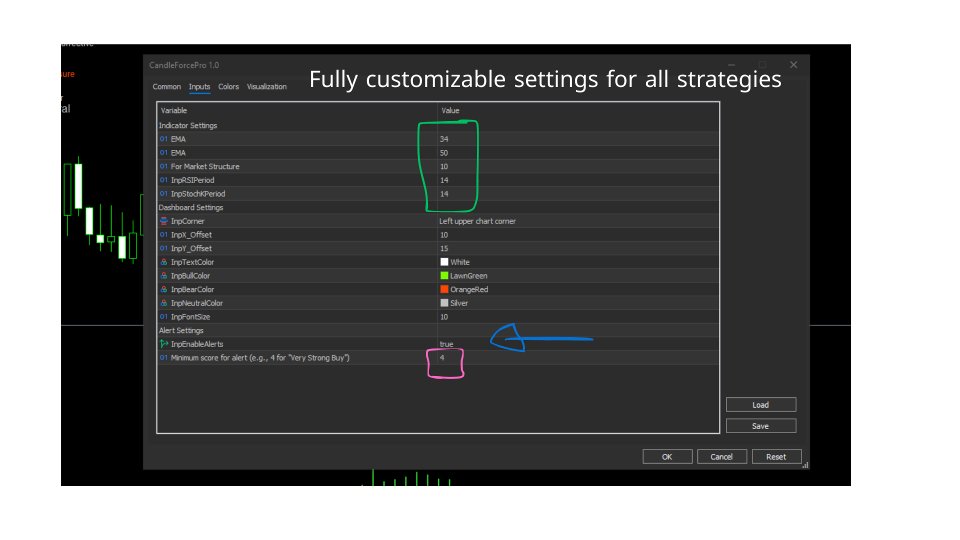

The Game-Changer: The Intelligent Real-Time Alert System

A powerful analysis tool is only useful if you are there to see its signals. CandleForce Pro transforms from a passive dashboard into an active trading assistant with its fully integrated alert system. You can define a minimum score threshold for alerts (e.g., 4). When the market conditions align and the Total Score meets your criteria, the indicator instantly notifies you via:

An on-screen pop-up alert.

An audible sound notification.

A push notification sent directly to your MetaTrader 5 mobile app.

This feature frees you from having to be glued to your screen, allowing you to go about your day with the confidence that you will be alerted the moment a high-probability opportunity, as defined by your own rules, materializes.

Strategic Application: Integrating CandleForce Pro into Your Trading

CandleForce Pro is a versatile tool designed to enhance, not replace, a trader’s strategy. Here’s how to integrate it effectively:

As a High-Powered Confirmation Tool: Use the dashboard to validate entries signaled by your existing strategy. A high score (+3 or +4) provides a powerful green light, increasing your confidence in the trade.

As a Primary Market Filter: Before you even begin your analysis, a glance at the CandleForce Pro score tells you if the market is worth trading. A neutral score (-1 to +1) instantly signals a choppy, low-probability environment, saving you time and capital.

For Precision Entry Timing: Wait for a "perfect score" of +4 or -4 to enter the market. This ensures you are trading only when all major market forces are perfectly aligned in your favor.

For Proactive Trade Management: Monitor the score while you are in a trade. If you are in a long position and the score degrades from +4 to +1, it could be an early warning sign that momentum is waning, prompting you to tighten your stop-loss or take partial profits.

Conclusion: Trade with Unprecedented Clarity and Confidence

CandleForce Pro is more than an indicator—it is a complete framework for understanding and navigating the market. It systematically filters out noise, quantifies the forces of trend, structure, and momentum, and confirms them with real-time candle analysis. By providing a clear, objective, and actionable signal, it helps eliminate indecision, fosters discipline, and empowers you to trade with the clarity and confidence that only comes from knowing the full story of the market. Step up your trading and let CandleForce Pro be your guide to a more objective and successful trading journey.