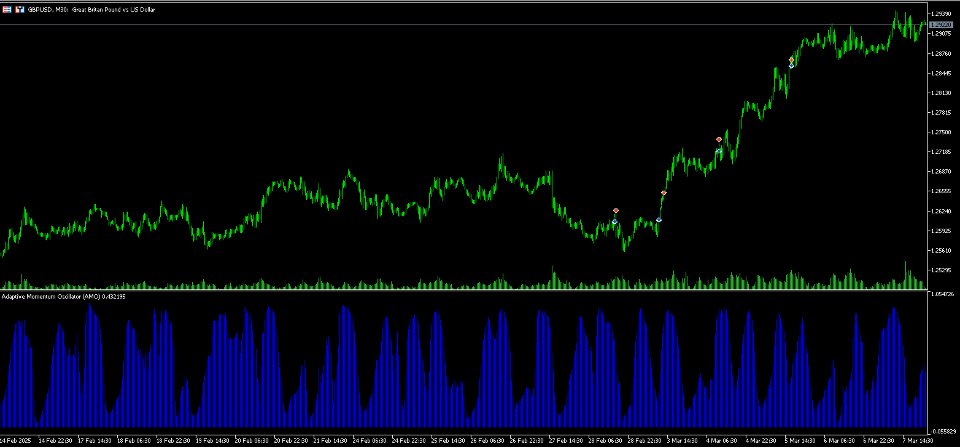

Adaptive Momentum Oscillator

- Indicators

- Michail Pavlakis

- Version: 1.0

Adaptive Momentum Oscillator (AMO) – Next-Gen Momentum Indicator

Overview

The Adaptive Momentum Oscillator (AMO) is a powerful technical analysis tool that dynamically adjusts its sensitivity to market conditions by incorporating adaptive lookback periods, noise filtering, and normalization techniques. Traditional momentum indicators use fixed lookback periods, which can lead to inefficiencies in trending and ranging markets. The AMO overcomes this limitation by adapting its calculation based on volatility, making it more responsive during strong trends and filtered during choppy market conditions.

By applying volatility scaling, exponential smoothing, and normalization, AMO offers traders an optimized view of market momentum, making it suitable for trend confirmation, divergence detection, and entry/exit timing.

Key Features

✅ Adaptive Lookback Period – Dynamically adjusts based on market volatility

✅ Noise Filtering – Exponential smoothing reduces false signals

✅ Normalization – Adjusts momentum values for consistent scaling

✅ Momentum Scaling – Uses a logistic function to bound values between 0 and 1

✅ Versatile Trading Applications – Detects divergences, trend strength, and potential reversals

Mathematical Foundation – AI-Driven Adaptability

The Adaptive Momentum Oscillator (AMO) is built upon advanced quantitative finance techniques and AI-inspired adaptability, making it a next-generation momentum indicator. Traditional indicators rely on static parameters that fail to adjust to changing market conditions. AMO, however, dynamically adapts by incorporating volatility-based adjustments, statistical normalization, and machine learning-inspired transformations, ensuring that traders receive optimized momentum signals regardless of market environment.

At its core, AMO intelligently modifies its lookback period based on real-time market fluctuations, a concept inspired by AI-driven adaptive systems. This allows it to become more reactive during strong trends while suppressing noise during consolidation phases, making it highly efficient in both trending and ranging markets. The mathematical framework behind AMO integrates techniques from statistical signal processing and econometric modeling, ensuring that it dynamically learns from market conditions rather than relying on pre-defined static settings.

To further refine its signals, AMO applies sophisticated noise-filtering mechanisms inspired by recursive filtering methods used in AI and time-series analysis. This ensures that raw momentum values are smoothed and optimized, reducing false signals while maintaining responsiveness. Unlike conventional momentum indicators, AMO does not produce erratic spikes or misleading fluctuations, making it a trustworthy tool for traders looking for consistency in their analysis.

Another key innovation in AMO is its advanced normalization process. Traditional indicators can generate values that vary drastically across different assets and timeframes, making comparison difficult. AMO overcomes this limitation by implementing a dynamic standardization method, ensuring that its output remains scaled and comparable across different market conditions. This mathematical approach allows traders to use AMO effectively on any financial instrument, from forex and stocks to commodities and indices, without the need for constant recalibration.

To make interpretation even more intuitive, AMO employs a machine learning-inspired transformation that ensures all momentum values are bounded within a controlled range. This makes it easy for traders to identify strong and weak momentum phases at a glance, without worrying about unpredictable or excessive fluctuations. The application of neural network-like transformations ensures that AMO remains both stable and responsive, providing consistent and actionable trading signals.

Why This Approach is Revolutionary?

🔹 AI-Inspired Adaptability – The indicator learns and adjusts based on real-time market conditions

🔹 Statistical Precision – Uses advanced noise-filtering and normalization techniques for superior reliability

🔹 Volatility-Based Sensitivity – Reacts dynamically to market shifts, ensuring optimal responsiveness

🔹 Cross-Market Applicability – Works seamlessly across different asset classes without requiring manual optimization

By leveraging a cutting-edge mathematical framework, AMO brings a new level of intelligence, adaptability, and accuracy to momentum trading. 🚀

How Traders Can Use AMO

1. Detecting Trend Strength & Reversals

- High values (above 0.8): Indicates strong bullish momentum

- Low values (below 0.2): Indicates strong bearish momentum

- Crossing the midline (0.5): Potential trend reversal

2. Spotting Divergences

Divergences between AMO and price action often indicate trend reversals:

- Bullish Divergence: Price makes a lower low, but AMO forms a higher low → Potential buy signal

- Bearish Divergence: Price makes a higher high, but AMO forms a lower high → Potential sell signal

3. Momentum-Based Entry & Exit Signals

- Trend Confirmation: Use AMO in conjunction with trend indicators (e.g., moving averages) to confirm the trend direction.

- Breakout Trading: High AMO readings suggest strong momentum behind a breakout.

4. Volatility-Adaptive Trading

Since AMO adapts to volatility, it helps traders avoid overtrading in low-volatility periods and capitalize on momentum surges in high-volatility markets.

Best Settings & Customization

| Parameter | Description | Recommended Values |

|---|---|---|

| BaseLookback | Initial lookback period before adaptation | 14 (default), 10-30 |

| VolScalingFactor | Controls how much lookback adapts to volatility | 0.5 (default), 0.3-1.0 |

| SmoothingAlpha | Exponential smoothing factor for noise reduction | 0.3 (default), 0.1-0.5 |

| NormWindow | Number of bars used for normalization (moving average & std dev) | 20 (default), 10-50 |

Suggested Timeframes: Works well on M5, M15, H1, and H4 for intraday and swing trading.

Suitable Markets: Forex, stocks, indices, and commodities.

Why Choose AMO?

🔹 Adaptive & Dynamic – Unlike static momentum indicators, AMO adjusts to market conditions

🔹 Reduces Noise & False Signals – Uses smoothing techniques for better clarity

🔹 Works in Trending & Ranging Markets – Adapts to volatility changes

🔹 Easy Interpretation – Bounded values (0 to 1) allow for quick decision-making

🚀 Gain an edge in momentum trading with the Adaptive Momentum Oscillator (AMO)