Improve Your Trading Charts With Interactive GUI's in MQL5 (Part II): Movable GUI (II)

Unlock the potential of dynamic data representation in your trading strategies and utilities with our in-depth guide to creating movable GUIs in MQL5. Delve into the fundamental principles of object-oriented programming and discover how to design and implement single or multiple movable GUIs on the same chart with ease and efficiency.

Developing an MQTT client for MetaTrader 5: a TDD approach

This article reports the first attempts in the development of a native MQTT client for MQL5. MQTT is a Client Server publish/subscribe messaging transport protocol. It is lightweight, open, simple, and designed to be easy to implement. These characteristics make it ideal for use in many situations.

Understanding MQL5 Object-Oriented Programming (OOP)

As developers, we need to learn how to create and develop software that can be reusable and flexible without duplicated code especially if we have different objects with different behaviors. This can be smoothly done by using object-oriented programming techniques and principles. In this article, we will present the basics of MQL5 Object-Oriented programming to understand how we can use principles and practices of this critical topic in our software.

Forecasting with ARIMA models in MQL5

In this article we continue the development of the CArima class for building ARIMA models by adding intuitive methods that enable forecasting.

Category Theory in MQL5 (Part 10): Monoid Groups

This article continues the series on category theory implementation in MQL5. Here we look at monoid-groups as a means normalising monoid sets making them more comparable across a wider span of monoid sets and data types..

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part I): Movable GUI (I)

Unleash the power of dynamic data representation in your trading strategies or utilities with our comprehensive guide on creating movable GUI in MQL5. Dive into the core concept of chart events and learn how to design and implement simple and multiple movable GUI on the same chart. This article also explores the process of adding elements to your GUI, enhancing their functionality and aesthetic appeal.

How to create a custom Donchian Channel indicator using MQL5

There are many technical tools that can be used to visualize a channel surrounding prices, One of these tools is the Donchian Channel indicator. In this article, we will learn how to create the Donchian Channel indicator and how we can trade it as a custom indicator using EA.

How to create a custom True Strength Index indicator using MQL5

Here is a new article about how to create a custom indicator. This time we will work with the True Strength Index (TSI) and will create an Expert Advisor based on it.

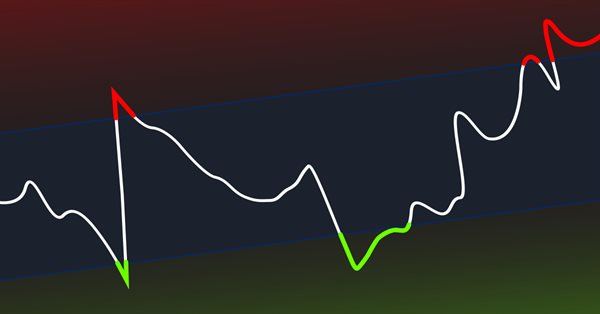

Implementing the Janus factor in MQL5

Gary Anderson developed a method of market analysis based on a theory he dubbed the Janus Factor. The theory describes a set of indicators that can be used to reveal trends and assess market risk. In this article we will implement these tools in mql5.

Canvas based indicators: Filling channels with transparency

In this article I'll introduce a method for creating custom indicators whose drawings are made using the class CCanvas from standard library and see charts properties for coordinates conversion. I'll approach specially indicators which need to fill the area between two lines using transparency.

Creating a comprehensive Owl trading strategy

My strategy is based on the classic trading fundamentals and the refinement of indicators that are widely used in all types of markets. This is a ready-made tool allowing you to follow the proposed new profitable trading strategy.

Learn how to design a trading system by Fibonacci

In this article, we will continue our series of creating a trading system based on the most popular technical indicator. Here is a new technical tool which is the Fibonacci and we will learn how to design a trading system based on this technical indicator.

Learn how to design a trading system by Bill Williams' MFI

This is a new article in the series in which we learn how to design a trading system based on popular technical indicators. This time we will cover Bill Williams' Market Facilitation Index (BW MFI).

Revisiting Murray system

Graphical price analysis systems are deservedly popular among traders. In this article, I am going to describe the complete Murray system, including its famous levels, as well as some other useful techniques for assessing the current price position and making a trading decision.

Creating a ticker tape panel: Improved version

How do you like the idea of reviving the basic version of our ticker tape panel? The first thing we will do is change the panel to be able to add an image, such as an asset logo or some other image, so that the user could quickly and easily identify the displayed symbol.

Creating a ticker tape panel: Basic version

Here I will show how to create screens with price tickers which are usually used to display quotes on the exchange. I will do it by only using MQL5, without using complex external programming.

Non-linear indicators

In this article, I will make an attempt to consider some ways of building non-linear indicators and their use in trading. There are quite a few indicators in the MetaTrader trading platform that use non-linear approaches.

Learn how to design a trading system by Gator Oscillator

A new article in our series about learning how to design a trading system based on popular technical indicators will be about the Gator Oscillator technical indicator and how to create a trading system through simple strategies.

Mountain or Iceberg charts

How do you like the idea of adding a new chart type to the MetaTrader 5 platform? Some people say it lacks a few things that other platforms offer. But the truth is, MetaTrader 5 is a very practical platform as it allows you to do things that can't be done (or at least can't be done easily) in many other platforms.

Category Theory in MQL5 (Part 1)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Developing a trading Expert Advisor from scratch (Part 31): Towards the future (IV)

We continue to remove separate parts from our EA. This is the last article within this series. And the last thing to be removed is the sound system. This can be a bit confusing if you haven't followed these article series.

Adaptive indicators

In this article, I will consider several possible approaches to creating adaptive indicators. Adaptive indicators are distinguished by the presence of feedback between the values of the input and output signals. This feedback allows the indicator to independently adjust to the optimal processing of financial time series values.

Learn how to design a trading system by Fractals

This article is a new one from our series about how to design a trading system based on the most popular technical indicators. We will learn a new indicator which Fractals indicator and we will learn how to design a trading system based on it to be executed in the MetaTrader 5 terminal.

DIY technical indicator

In this article, I will consider the algorithms allowing you to create your own technical indicator. You will learn how to obtain pretty complex and interesting results with very simple initial assumptions.

Learn how to design a trading system by Alligator

In this article, we'll complete our series about how to design a trading system based on the most popular technical indicator. We'll learn how to create a trading system based on the Alligator indicator.

CCI indicator. Three transformation steps

In this article, I will make additional changes to the CCI affecting the very logic of this indicator. Moreover, we will be able to see it in the main chart window.

Learn how to design a trading system by Accelerator Oscillator

A new article from our series about how to create simple trading systems by the most popular technical indicators. We will learn about a new one which is the Accelerator Oscillator indicator and we will learn how to design a trading system using it.

Learn how to design a trading system by Awesome Oscillator

In this new article in our series, we will learn about a new technical tool that may be useful in our trading. It is the Awesome Oscillator (AO) indicator. We will learn how to design a trading system by this indicator.

Learn how to design a trading system by Relative Vigor Index

A new article in our series about how to design a trading system by the most popular technical indicator. In this article, we will learn how to do that by the Relative Vigor Index indicator.

CCI indicator. Upgrade and new features

In this article, I will consider the possibility of upgrading the CCI indicator. Besides, I will present a modification of the indicator.

Learn how to design a trading system by DeMarker

Here is a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will present how to create a trading system by the DeMarker indicator.

Learn how to design a trading system by VIDYA

Welcome to a new article from our series about learning how to design a trading system by the most popular technical indicators, in this article we will learn about a new technical tool and learn how to design a trading system by Variable Index Dynamic Average (VIDYA).

Learn how to design a trading system by Bull's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator as we will learn in this article about a new technical indicator and how we can design a trading system by it and this indicator is the Bull's Power indicator.

Learn how to design a trading system by Bear's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator here is a new article about learning how to design a trading system by Bear's Power technical indicator.

Learn how to design a trading system by Force Index

Welcome to a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will learn about a new technical indicator and how to create a trading system using the Force Index indicator.

Complex indicators made easy using objects

This article provides a method to create complex indicators while also avoiding the problems that arise when dealing with multiple plots, buffers and/or combining data from multiple sources.

Learn how to design a trading system by Chaikin Oscillator

Welcome to our new article from our series about learning how to design a trading system by the most popular technical indicator. Through this new article, we will learn how to design a trading system by the Chaikin Oscillator indicator.

Developing a trading Expert Advisor from scratch (Part 16): Accessing data on the web (II)

Knowing how to input data from the Web into an Expert Advisor is not so obvious. It is not so easy to do without understanding all the possibilities offered by MetaTrader 5.

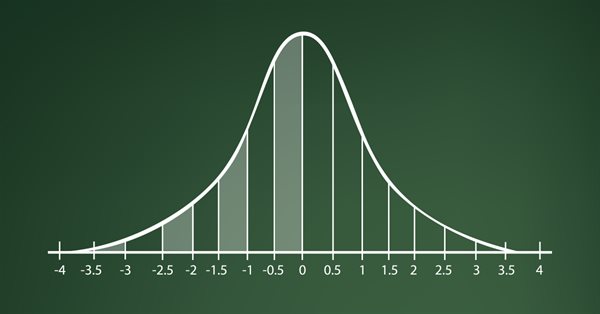

Learn how to design a trading system by Standard Deviation

Here is a new article in our series about how to design a trading system by the most popular technical indicators in MetaTrader 5 trading platform. In this new article, we will learn how to design a trading system by Standard Deviation indicator.

Developing a trading Expert Advisor from scratch (Part 15): Accessing data on the web (I)

How to access online data via MetaTrader 5? There are a lot of websites and places on the web, featuring a huge amount information. What you need to know is where to look and how best to use this information.