Video: How to setup MetaTrader 5 and MQL5 for simple automated trading

In this little video course you will learn how to download, install and setup MetaTrader 5 for Automated Trading. You will also learn how to adjust the chart settings and the options for automated trading. You will do your first backtest and by the end of this course you will know how to import an Expert Advisor that can automatically trade 24/7 while you don't have to sit in front of your screen.

Library for easy and quick development of MetaTrader programs (part XIX): Class of library messages

In this article, we will consider the class of displaying text messages. Currently, we have a sufficient number of different text messages. It is time to re-arrange the methods of their storage, display and translation of Russian or English messages to other languages. Besides, it would be good to introduce convenient ways of adding new languages to the library and quickly switching between them.

Processing optimization results using the graphical interface

This is a continuation of the idea of processing and analysis of optimization results. This time, our purpose is to select the 100 best optimization results and display them in a GUI table. The user will be able to select a row in the optimization results table and receive a multi-symbol balance and drawdown graph on separate charts.

Self-adapting algorithm (Part III): Abandoning optimization

It is impossible to get a truly stable algorithm if we use optimization based on historical data to select parameters. A stable algorithm should be aware of what parameters are needed when working on any trading instrument at any time. It should not forecast or guess, it should know for sure.

Learn how to design a trading system by Stochastic

In this article, we continue our learning series — this time we will learn how to design a trading system using one of the most popular and useful indicators, which is the Stochastic Oscillator indicator, to build a new block in our knowledge of basics.

Graphics in DoEasy library (Part 75): Methods of handling primitives and text in the basic graphical element

In this article, I will continue the development of the basic graphical element class of all library graphical objects powered by the CCanvas Standard Library class. I will create the methods for drawing graphical primitives and for displaying a text on a graphical element object.

Reversing: Reducing maximum drawdown and testing other markets

In this article, we continue to dwell on reversing techniques. We will try to reduce the maximum balance drawdown till an acceptable level for the instruments considered earlier. We will see if the measures will reduce the profit. We will also check how the reversing method performs on other markets, including stock, commodity, index, ETF and agricultural markets. Attention, the article contains a lot of images!

DIY multi-threaded asynchronous MQL5 WebRequest

The article describes the library allowing you to increase the efficiency of working with HTTP requests in MQL5. Execution of WebRequest in non-blocking mode is implemented in additional threads that use auxiliary charts and Expert Advisors, exchanging custom events and reading shared resources. The source codes are applied as well.

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

Resolving entries into indicators

Different situations happen in trader’s life. Often, the history of successful trades allows us to restore a strategy, while looking at a loss history we try to develop and improve it. In both cases, we compare trades with known indicators. This article suggests methods of batch comparison of trades with a number of indicators.

The Optimal Method for Calculation of Total Position Volume by Specified Magic Number

The problem of calculation of the total position volume of the specified symbol and magic number is considered in this article. The proposed method requests only the minimum necessary part of the history of deals, finds the closest time when the total position was equal to zero, and performs the calculations with the recent deals. Working with global variables of the client terminal is also considered.

Reversing: Formalizing the entry point and developing a manual trading algorithm

This is the last article within the series devoted to the Reversing trading strategy. Here we will try to solve the problem, which caused the testing results instability in previous articles. We will also develop and test our own algorithm for manual trading in any market using the reversing strategy.

Learn how to design a trading system by Momentum

In my previous article, I mentioned the importance of identifying the trend which is the direction of prices. In this article I will share one of the most important concepts and indicators which is the Momentum indicator. I will share how to design a trading system based on this Momentum indicator.

MQL5 Cookbook - Programming moving channels

This article presents a method of programming the equidistant channel system. Certain details of building such channels are being considered here. Channel typification is provided, and a universal type of moving channels' method is suggested. Object-oriented programming (OOP) is used for code implementation.

Creating a trading robot for Moscow Exchange. Where to start?

Many traders on Moscow Exchange would like to automate their trading algorithms, but they do not know where to start. The MQL5 language offers a huge range of trading functions, and it additionally provides ready classes that help users to make their first steps in algo trading.

Learn how to design a trading system by Volumes

Here is a new article from our series about learning how to design a trading system based on the most popular technical indicators. The current article will be devoted to the Volumes indicator. Volume as a concept is one of the very important factors in financial markets trading and we have to pay attention to it. Through this article, we will learn how to design a simple trading system by Volumes indicator.

Neural networks made easy (Part 7): Adaptive optimization methods

In previous articles, we used stochastic gradient descent to train a neural network using the same learning rate for all neurons within the network. In this article, I propose to look towards adaptive learning methods which enable changing of the learning rate for each neuron. We will also consider the pros and cons of this approach.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Learn how to design a trading system by Fractals

This article is a new one from our series about how to design a trading system based on the most popular technical indicators. We will learn a new indicator which Fractals indicator and we will learn how to design a trading system based on it to be executed in the MetaTrader 5 terminal.

Ready-made Expert Advisors from the MQL5 Wizard work in MetaTrader 4

The article offers a simple emulator of the MetaTrader 5 trading environment for MetaTrader 4. The emulator implements migration and adjustment of trade classes of the Standard Library. As a result, Expert Advisors generated in the MetaTrader 5 Wizard can be compiled and executed in MetaTrader 4 without changes.

Neural networks made easy (Part 4): Recurrent networks

We continue studying the world of neural networks. In this article, we will consider another type of neural networks, recurrent networks. This type is proposed for use with time series, which are represented in the MetaTrader 5 trading platform by price charts.

MQL5 Cookbook: Saving Optimization Results of an Expert Advisor Based on Specified Criteria

We continue the series of articles on MQL5 programming. This time we will see how to get results of each optimization pass right during the Expert Advisor parameter optimization. The implementation will be done so as to ensure that if the conditions specified in the external parameters are met, the corresponding pass values will be written to a file. In addition to test values, we will also save the parameters that brought about such results.

Multibot in MetaTrader: Launching multiple robots from a single chart

In this article, I will consider a simple template for creating a universal MetaTrader robot that can be used on multiple charts while being attached to only one chart, without the need to configure each instance of the robot on each individual chart.

Practical application of neural networks in trading (Part 2). Computer vision

The use of computer vision allows training neural networks on the visual representation of the price chart and indicators. This method enables wider operations with the whole complex of technical indicators, since there is no need to feed them digitally into the neural network.

Cross-Platform Expert Advisor: Custom Stops, Breakeven and Trailing

This article discusses how custom stop levels can be set up in a cross-platform expert advisor. It also discusses a closely-related method by which the evolution of a stop level over time can be defined.

A Few Tips for First-Time Customers

A proverbial wisdom often attributed to various famous people says: "He who makes no mistakes never makes anything." Unless you consider idleness itself a mistake, this statement is hard to argue with. But you can always analyze the past mistakes (your own and of others) to minimize the number of your future mistakes. We are going to attempt to review possible situations arising when executing jobs in the same-name service.

Modeling time series using custom symbols according to specified distribution laws

The article provides an overview of the terminal's capabilities for creating and working with custom symbols, offers options for simulating a trading history using custom symbols, trend and various chart patterns.

Self-adapting algorithm (Part IV): Additional functionality and tests

I continue filling the algorithm with the minimum necessary functionality and testing the results. The profitability is quite low but the articles demonstrate the model of the fully automated profitable trading on completely different instruments traded on fundamentally different markets.

Building interactive semi-automatic drag-and-drop Expert Advisor based on predefined risk and R/R ratio

Some traders execute all their trades automatically, and some mix automatic and manual trades based on the output of several indicators. Being a member of the latter group I needed an interactive tool to asses dynamically risk and reward price levels directly from the chart. This article will present a way to implement an interactive semi-automatic Expert Advisor with predefined equity risk and R/R ratio. The Expert Advisor risk, R/R and lot size parameters can be changed during runtime on the EA panel.

Learn how to design a trading system by Bear's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator here is a new article about learning how to design a trading system by Bear's Power technical indicator.

Learn how to design a trading system by Alligator

In this article, we'll complete our series about how to design a trading system based on the most popular technical indicator. We'll learn how to create a trading system based on the Alligator indicator.

Design Patterns in software development and MQL5 (Part 4): Behavioral Patterns 2

In this article, we will complete our series about the Design Patterns topic, we mentioned that there are three types of design patterns creational, structural, and behavioral. We will complete the remaining patterns of the behavioral type which can help set the method of interaction between objects in a way that makes our code clean.

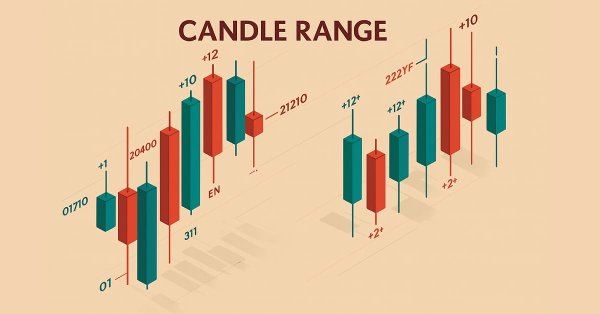

Price Action Analysis Toolkit Development (Part 33): Candle Range Theory Tool

Upgrade your market reading with the Candle-Range Theory suite for MetaTrader 5, a fully MQL5-native solution that converts raw price bars into real-time volatility intelligence. The lightweight CRangePattern library benchmarks each candle’s true range against an adaptive ATR and classifies it the instant it closes; the CRT Indicator then projects those classifications on your chart as crisp, color-coded rectangles and arrows that reveal tightening consolidations, explosive breakouts, and full-range engulfment the moment they occur.

Another MQL5 OOP Class

This article shows you how to build an Object-Oriented Expert Advisor from scratch, from conceiving a theoretical trading idea to programming a MQL5 EA that makes that idea real in the empirical world. Learning by doing is IMHO a solid approach to succeed, so I am showing a practical example in order for you to see how you can order your ideas to finally code your Forex robots. My goal is also to invite you to adhere the OO principles.

Applying OLAP in trading (part 3): Analyzing quotes for the development of trading strategies

In this article we will continue dealing with the OLAP technology applied to trading. We will expand the functionality presented in the first two articles. This time we will consider the operational analysis of quotes. We will put forward and test the hypotheses on trading strategies based on aggregated historical data. The article presents Expert Advisors for studying bar patterns and adaptive trading.

Matrices and vectors in MQL5

By using special data types 'matrix' and 'vector', it is possible to create code which is very close to mathematical notation. With these methods, you can avoid the need to create nested loops or to mind correct indexing of arrays in calculations. Therefore, the use of matrix and vector methods increases the reliability and speed in developing complex programs.

Cross-Platform Expert Advisor: Introduction

This article details a method by which cross-platform expert advisors can be developed faster and easier. The proposed method consolidates the features shared by both versions into a single class, and splits the implementation on derived classes for incompatible features.

Cross-Platform Expert Advisor: The CExpertAdvisor and CExpertAdvisors Classes

This article deals primarily with the classes CExpertAdvisor and CExpertAdvisors, which serve as the container for all the other components described in this article-series regarding cross-platform expert advisors.

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

In this article, we will develop a grider EA for trading in a trend direction within a range. Thus, the EA is to be suited mostly for Forex and commodity markets. According to the tests, our grider showed profit since 2018. Unfortunately, this is not true for the period of 2014-2018.

Neural Networks Cheap and Cheerful - Link NeuroPro with MetaTrader 5

If specific neural network programs for trading seem expensive and complex or, on the contrary, too simple, try NeuroPro. It is free and contains the optimal set of functionalities for amateurs. This article will tell you how to use it in conjunction with MetaTrader 5.