Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal API, Part 2

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. It is a continuation of the first part: "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". In the second part, we discuss integration of custom Expert Advisors with HedgeTerminalAPI, which is a special visualization library designed for bi-directional trading in a comfortable software environment providing tools for convenient position management.

Graphics in DoEasy library (Part 74): Basic graphical element powered by the CCanvas class

In this article, I will rework the concept of building graphical objects from the previous article and prepare the base class of all graphical objects of the library powered by the Standard Library CCanvas class.

The RSI Deep Three Move Trading Technique

Presenting the RSI Deep Three Move Trading Technique in MetaTrader 5. This article is based on a new series of studies that showcase a few trading techniques based on the RSI, a technical analysis indicator used to measure the strength and momentum of a security, such as a stock, currency, or commodity.

Using MetaTrader 5 as a Signal Provider for MetaTrader 4

Analyse and examples of techniques how trading analysis can be performed on MetaTrader 5 platform, but executed by MetaTrader 4. Article will show you how to create simple signal provider in your MetaTrader 5, and connect to it with multiple clients, even running MetaTrader 4. Also you will find out how you can follow participants of Automated Trading Championship in your real MetaTrader 4 account.

Automating Trading Strategies in MQL5 (Part 12): Implementing the Mitigation Order Blocks (MOB) Strategy

In this article, we build an MQL5 trading system that automates order block detection for Smart Money trading. We outline the strategy’s rules, implement the logic in MQL5, and integrate risk management for effective trade execution. Finally, we backtest the system to assess its performance and refine it for optimal results.

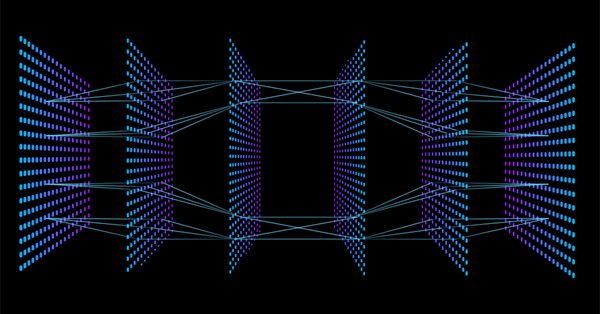

Neural networks made easy (Part 10): Multi-Head Attention

We have previously considered the mechanism of self-attention in neural networks. In practice, modern neural network architectures use several parallel self-attention threads to find various dependencies between the elements of a sequence. Let us consider the implementation of such an approach and evaluate its impact on the overall network performance.

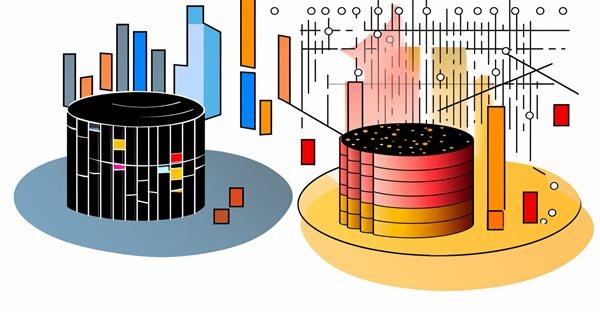

Deep Neural Networks (Part II). Working out and selecting predictors

The second article of the series about deep neural networks will consider the transformation and choice of predictors during the process of preparing data for training a model.

Can Heiken-Ashi Combined With Moving Averages Provide Good Signals Together?

Combinations of strategies may offer better opportunities. We can combine indicators or patterns together, or even better, indicators with patterns, so that we get an extra confirmation factor. Moving averages help us confirm and ride the trend. They are the most known technical indicators and this is because of their simplicity and their proven track record of adding value to analyses.

Learn how to design a trading system by MFI

The new article from our series about designing a trading system based on the most popular technical indicators considers a new technical indicator - the Money Flow Index (MFI). We will learn it in detail and develop a simple trading system by means of MQL5 to execute it in MetaTrader 5.

Creating an EA that works automatically (Part 02): Getting started with the code

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we discussed the first steps that anyone needs to understand before proceeding to creating an Expert Advisor that trades automatically. We considered the concepts and the structure.

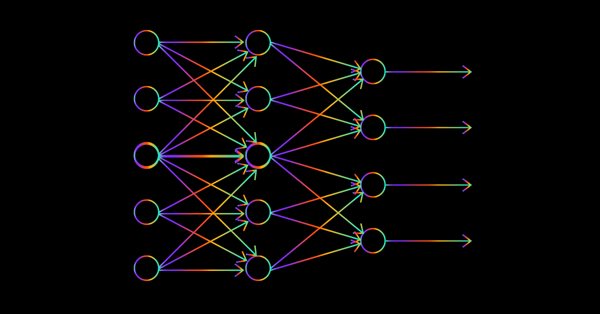

Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified

Many people love them but a few understand the whole operations behind Neural Networks. In this article I will try to explain everything that goes behind closed doors of a feed-forward multi-layer perception in plain English.

CatBoost machine learning algorithm from Yandex with no Python or R knowledge required

The article provides the code and the description of the main stages of the machine learning process using a specific example. To obtain the model, you do not need Python or R knowledge. Furthermore, basic MQL5 knowledge is enough — this is exactly my level. Therefore, I hope that the article will serve as a good tutorial for a broad audience, assisting those interested in evaluating machine learning capabilities and in implementing them in their programs.

Cross-Platform Expert Advisor: Reuse of Components from the MQL5 Standard Library

There exists some components in the MQL5 Standard Library that may prove to be useful in the MQL4 version of cross-platform expert advisors. This article deals with a method of making certain components of the MQL5 Standard Library compatible with the MQL4 compiler.

Risk and capital management using Expert Advisors

This article is about what you can not see in a backtest report, what you should expect using automated trading software, how to manage your money if you are using expert advisors, and how to cover a significant loss to remain in the trading activity when you are using automated procedures.

Data Science and Machine Learning — Neural Network (Part 02): Feed forward NN Architectures Design

There are minor things to cover on the feed-forward neural network before we are through, the design being one of them. Let's see how we can build and design a flexible neural network to our inputs, the number of hidden layers, and the nodes for each of the network.

Naive Bayes classifier for signals of a set of indicators

The article analyzes the application of the Bayes' formula for increasing the reliability of trading systems by means of using signals from multiple independent indicators. Theoretical calculations are verified with a simple universal EA, configured to work with arbitrary indicators.

Neural networks made easy (Part 11): A take on GPT

Perhaps one of the most advanced models among currently existing language neural networks is GPT-3, the maximal variant of which contains 175 billion parameters. Of course, we are not going to create such a monster on our home PCs. However, we can view which architectural solutions can be used in our work and how we can benefit from them.

Learn how to deal with date and time in MQL5

A new article about a new important topic which is dealing with date and time. As traders or programmers of trading tools, it is very crucial to understand how to deal with these two aspects date and time very well and effectively. So, I will share some important information about how we can deal with date and time to create effective trading tools smoothly and simply without any complicity as much as I can.

The Player of Trading Based on Deal History

The player of trading. Only four words, no explanation is needed. Thoughts about a small box with buttons come to your mind. Press one button - it plays, move the lever - the playback speed changes. In reality, it is pretty similar. In this article, I want to show my development that plays trade history almost like it is in real time. The article covers some nuances of OOP, working with indicators and managing charts.

Deep Learning Forecast and ordering with Python and MetaTrader5 python package and ONNX model file

The project involves using Python for deep learning-based forecasting in financial markets. We will explore the intricacies of testing the model's performance using key metrics such as Mean Absolute Error (MAE), Mean Squared Error (MSE), and R-squared (R2) and we will learn how to wrap everything into an executable. We will also make a ONNX model file with its EA.

Developing a trading Expert Advisor from scratch (Part 7): Adding Volume at Price (I)

This is one of the most powerful indicators currently existing. Anyone who trades trying to have a certain degree of confidence must have this indicator on their chart. Most often the indicator is used by those who prefer “tape reading” while trading. Also, this indicator can be utilized by those who use only Price Action while trading.

Learn how to design a trading system by Awesome Oscillator

In this new article in our series, we will learn about a new technical tool that may be useful in our trading. It is the Awesome Oscillator (AO) indicator. We will learn how to design a trading system by this indicator.

Using the TesterWithdrawal() Function for Modeling the Withdrawals of Profit

This article describes the usage of the TesterWithDrawal() function for estimating risks in trade systems which imply the withdrawing of a certain part of assets during their operation. In addition, it describes the effect of this function on the algorithm of calculation of the drawdown of equity in the strategy tester. This function is useful when optimizing parameter of your Expert Advisors.

Statistical Carry Trade Strategy

An algorithm of statistical protection of open positive swap positions from unwanted price movements. This article features a variant of the carry trade protection strategy that allows to compensate for potential risk of the price movement in the direction opposite to that of the open position.

An Analysis of Why Expert Advisors Fail

This article presents an analysis of currency data to better understand why expert advisors can have good performance in some regions of time and poor performance in other regions of time.

Applying OLAP in trading (part 2): Visualizing the interactive multidimensional data analysis results

In this article, we consider the creation of an interactive graphical interface for an MQL program, which is designed for the processing of account history and trading reports using OLAP techniques. To obtain a visual result, we will use maximizable and scalable windows, an adaptive layout of rubber controls and a new control for displaying diagrams. To provide the visualization functionality, we will implement a GUI with the selection of variables along coordinate axes, as well as with the selection of aggregate functions, diagram types and sorting options.

Graphics in DoEasy library (Part 76): Form object and predefined color themes

In this article, I will describe the concept of building various library GUI design themes, create the Form object, which is a descendant of the graphical element class object, and prepare data for creating shadows of the library graphical objects, as well as for further development of the functionality.

Neural networks made easy (Part 12): Dropout

As the next step in studying neural networks, I suggest considering the methods of increasing convergence during neural network training. There are several such methods. In this article we will consider one of them entitled Dropout.

Visualizing trading strategy optimization in MetaTrader 5

The article implements an MQL application with a graphical interface for extended visualization of the optimization process. The graphical interface applies the last version of EasyAndFast library. Many users may ask why they need graphical interfaces in MQL applications. This article demonstrates one of multiple cases where they can be useful for traders.

Cross-Platform Expert Advisor: Stops

This article discusses an implementation of stop levels in an expert advisor in order to make it compatible with the two platforms MetaTrader 4 and MetaTrader 5.

Implementation of Indicators as Classes by Examples of Zigzag and ATR

Debate about an optimal way of calculating indicators is endless. Where should we calculate the indicator values - in the indicator itself or embed the entire logic in a Expert Advisor that uses it? The article describes one of the variants of moving the source code of a custom indicator iCustom right in the code of an Expert Advisor or script with optimization of calculations and modeling the prev_calculated value.

Neural networks made easy (Part 8): Attention mechanisms

In previous articles, we have already tested various options for organizing neural networks. We also considered convolutional networks borrowed from image processing algorithms. In this article, I suggest considering Attention Mechanisms, the appearance of which gave impetus to the development of language models.

Video: Simple automated trading – How to create a simple Expert Advisor with MQL5

The majority of students in my courses felt that MQL5 was really difficult to understand. In addition to this, they were searching for a straightforward method to automate a few processes. Find out how to begin working with MQL5 right now by reading the information contained in this article. Even if you have never done any form of programming before. And even in the event that you are unable to comprehend the previous illustrations that you have observed.

Automating Trading Strategies in MQL5 (Part 9): Building an Expert Advisor for the Asian Breakout Strategy

In this article, we build an Expert Advisor in MQL5 for the Asian Breakout Strategy by calculating the session's high and low and applying trend filtering with a moving average. We implement dynamic object styling, user-defined time inputs, and robust risk management. Finally, we demonstrate backtesting and optimization techniques to refine the program.

Introduction to MQL5 (Part 7): Beginner's Guide to Building Expert Advisors and Utilizing AI-Generated Code in MQL5

Discover the ultimate beginner's guide to building Expert Advisors (EAs) with MQL5 in our comprehensive article. Learn step-by-step how to construct EAs using pseudocode and harness the power of AI-generated code. Whether you're new to algorithmic trading or seeking to enhance your skills, this guide provides a clear path to creating effective EAs.

Developing a cross-platform grider EA (part III): Correction-based grid with martingale

In this article, we will make an attempt to develop the best possible grid-based EA. As usual, this will be a cross-platform EA capable of working both with MetaTrader 4 and MetaTrader 5. The first EA was good enough, except that it could not make a profit over a long period of time. The second EA could work at intervals of more than several years. Unfortunately, it was unable to yield more than 50% of profit per year with a maximum drawdown of less than 50%.

Learn how to design a trading system by Relative Vigor Index

A new article in our series about how to design a trading system by the most popular technical indicator. In this article, we will learn how to do that by the Relative Vigor Index indicator.

Automating Trading Strategies in MQL5 (Part 11): Developing a Multi-Level Grid Trading System

In this article, we develop a multi-level grid trading system EA using MQL5, focusing on the architecture and algorithm design behind grid trading strategies. We explore the implementation of multi-layered grid logic and risk management techniques to handle varying market conditions. Finally, we provide detailed explanations and practical tips to guide you through building, testing, and refining the automated trading system.

Building a Social Technology Startup, Part II: Programming an MQL5 REST Client

Let's now shape the PHP-based Twitter idea which was introduced in the first part of this article. We are assembling the different parts of the SDSS. Regarding the client side of the system architecture, we are relying on the new MQL5 WebRequest() function for sending trading signals via HTTP.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part III): Simple Movable Trading GUI

Join us in Part III of the "Improve Your Trading Charts With Interactive GUIs in MQL5" series as we explore the integration of interactive GUIs into movable trading dashboards in MQL5. This article builds on the foundations set in Parts I and II, guiding readers to transform static trading dashboards into dynamic, movable ones.