Self Optimizing Expert Advisors in MQL5 (Part 17): Ensemble Intelligence

All algorithmic trading strategies are difficult to set up and maintain, regardless of complexity—a challenge shared by beginners and experts alike. This article introduces an ensemble framework where supervised models and human intuition work together to overcome their shared limitations. By aligning a moving average channel strategy with a Ridge Regression model on the same indicators, we achieve centralized control, faster self-correction, and profitability from otherwise unprofitable systems.

Multiple Symbol Analysis With Python And MQL5 (Part 3): Triangular Exchange Rates

Traders often face drawdowns from false signals, while waiting for confirmation can lead to missed opportunities. This article introduces a triangular trading strategy using Silver’s pricing in Dollars (XAGUSD) and Euros (XAGEUR), along with the EURUSD exchange rate, to filter out noise. By leveraging cross-market relationships, traders can uncover hidden sentiment and refine their entries in real time.

Reimagining Classic Strategies (Part II): Bollinger Bands Breakouts

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

MQL5 Trading Toolkit (Part 1): Developing A Positions Management EX5 Library

Learn how to create a developer's toolkit for managing various position operations with MQL5. In this article, I will demonstrate how to create a library of functions (ex5) that will perform simple to advanced position management operations, including automatic handling and reporting of the different errors that arise when dealing with position management tasks with MQL5.

Neural Networks in Trading: Enhancing Transformer Efficiency by Reducing Sharpness (Final Part)

SAMformer offers a solution to the key drawbacks of Transformer models in long-term time series forecasting, such as training complexity and poor generalization on small datasets. Its shallow architecture and sharpness-aware optimization help avoid suboptimal local minima. In this article, we will continue to implement approaches using MQL5 and evaluate their practical value.

GIT: What is it?

In this article, I will introduce a very important tool for developers. If you are not familiar with GIT, read this article to get an idea of what it is and how to use it with MQL5.

From Novice to Expert: Collaborative Debugging in MQL5

Problem-solving can establish a concise routine for mastering complex skills, such as programming in MQL5. This approach allows you to concentrate on solving problems while simultaneously developing your skills. The more problems you tackle, the more advanced expertise is transferred to your brain. Personally, I believe that debugging is the most effective way to master programming. Today, we will walk through the code-cleaning process and discuss the best techniques for transforming a messy program into a clean, functional one. Read through this article and uncover valuable insights.

MQL5 Wizard Techniques you should know (Part 17): Multicurrency Trading

Trading across multiple currencies is not available by default when an expert advisor is assembled via the wizard. We examine 2 possible hacks traders can make when looking to test their ideas off more than one symbol at a time.

From Novice to Expert: Reporting EA — Setting up the work flow

Brokerages often provide trading account reports at regular intervals, based on a predefined schedule. These firms, through their API technologies, have access to your account activity and trading history, allowing them to generate performance reports on your behalf. Similarly, the MetaTrader 5 terminal stores detailed records of your trading activity, which can be leveraged using MQL5 to create fully customized reports and define personalized delivery methods.

Automating Black-Scholes Greeks: Advanced Scalping and Microstructure Trading

Gamma and Delta were originally developed as risk-management tools for hedging options exposure, but over time they evolved into powerful instruments for advanced scalping, order-flow modeling, and microstructure trading. Today, they serve as real-time indicators of price sensitivity and liquidity behavior, enabling traders to anticipate short-term volatility with remarkable precision.

Feature Engineering With Python And MQL5 (Part I): Forecasting Moving Averages For Long-Range AI Models

The moving averages are by far the best indicators for our AI models to predict. However, we can improve our accuracy even further by carefully transforming our data. This article will demonstrate, how you can build AI Models capable of forecasting further into the future than you may currently be practicing without significant drops to your accuracy levels. It is truly remarkable, how useful the moving averages are.

Developing a trading Expert Advisor from scratch (Part 26): Towards the future (I)

Today we will take our order system to the next level. But before that, we need to solve a few problems. Now we have some questions that are related to how we want to work and what things we do during the trading day.

DoEasy. Controls (Part 24): Hint auxiliary WinForms object

In this article, I will revise the logic of specifying the base and main objects for all WinForms library objects, develop a new Hint base object and several of its derived classes to indicate the possible direction of moving the separator.

Population optimization algorithms: Saplings Sowing and Growing up (SSG)

Saplings Sowing and Growing up (SSG) algorithm is inspired by one of the most resilient organisms on the planet demonstrating outstanding capability for survival in a wide variety of conditions.

Gain An Edge Over Any Market (Part II): Forecasting Technical Indicators

Did you know that we can gain more accuracy forecasting certain technical indicators than predicting the underlying price of a traded symbol? Join us to explore how to leverage this insight for better trading strategies.

From Novice to Expert: Automating Trade Discipline with an MQL5 Risk Enforcement EA

For many traders, the gap between knowing a risk rule and following it consistently is where accounts go to die. Emotional overrides, revenge trading, and simple oversight can dismantle even the best strategy. Today, we will transform the MetaTrader 5 platform into an unwavering enforcer of your trading rules by developing a Risk Enforcement Expert Advisor. Join this discussion to find out more.

Reimagining Classic Strategies (Part 21): Bollinger Bands And RSI Ensemble Strategy Discovery

This article explores the development of an ensemble algorithmic trading strategy for the EURUSD market that combines the Bollinger Bands and the Relative Strength Indicator (RSI). Initial rule-based strategies produced high-quality signals but suffered from low trade frequency and limited profitability. Multiple iterations of the strategy were evaluated, revealing flaws in our understanding of the market, increased noise, and degraded performance. By appropriately employing statistical learning algorithms, shifting the modeling target to technical indicators, applying proper scaling, and combining machine learning forecasts with classical trading rules, the final strategy achieved significantly improved profitability and trade frequency while maintaining acceptable signal quality.

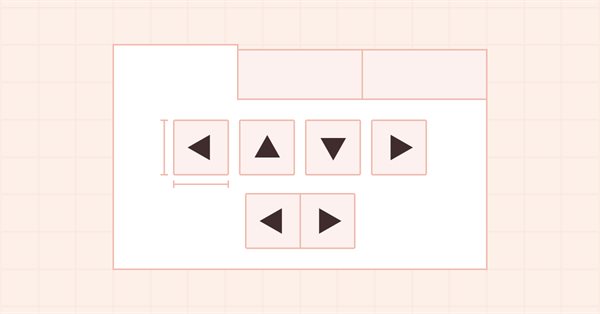

DoEasy. Controls (Part 17): Cropping invisible object parts, auxiliary arrow buttons WinForms objects

In this article, I will create the functionality for hiding object sections located beyond their containers. Besides, I will create auxiliary arrow button objects to be used as part of other WinForms objects.

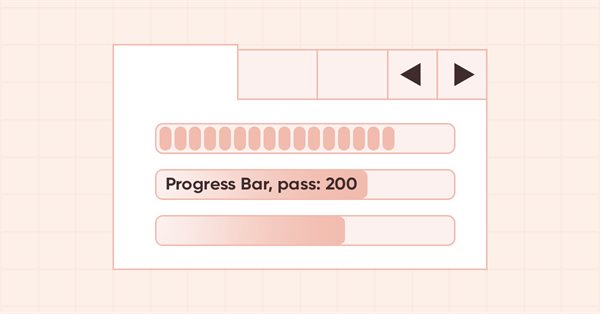

DoEasy. Controls (Part 28): Bar styles in the ProgressBar control

In this article, I will develop display styles and description text for the progress bar of the ProgressBar control.

Population optimization algorithms: Nelder–Mead, or simplex search (NM) method

The article presents a complete exploration of the Nelder-Mead method, explaining how the simplex (function parameter space) is modified and rearranged at each iteration to achieve an optimal solution, and describes how the method can be improved.

Reimagining Classic Strategies (Part III): Forecasting Higher Highs And Lower Lows

In this series article, we will empirically analyze classic trading strategies to see if we can improve them using AI. In today's discussion, we tried to predict higher highs and lower lows using the Linear Discriminant Analysis model.

Trading Insights Through Volume: Moving Beyond OHLC Charts

Algorithmic trading system that combines volume analysis with machine learning techniques, specifically LSTM neural networks. Unlike traditional trading approaches that primarily focus on price movements, this system emphasizes volume patterns and their derivatives to predict market movements. The methodology incorporates three main components: volume derivatives analysis (first and second derivatives), LSTM predictions for volume patterns, and traditional technical indicators.

Creating a Trading Administrator Panel in MQL5 (Part VIII): Analytics Panel

Today, we delve into incorporating useful trading metrics within a specialized window integrated into the Admin Panel EA. This discussion focuses on the implementation of MQL5 to develop an Analytics Panel and highlights the value of the data it provides to trading administrators. The impact is largely educational, as valuable lessons are drawn from the development process, benefiting both upcoming and experienced developers. This feature demonstrates the limitless opportunities this development series offers in equipping trade managers with advanced software tools. Additionally, we'll explore the implementation of the PieChart and ChartCanvas classes as part of the continued expansion of the Trading Administrator panel’s capabilities.

Brain Storm Optimization algorithm (Part II): Multimodality

In the second part of the article, we will move on to the practical implementation of the BSO algorithm, conduct tests on test functions and compare the efficiency of BSO with other optimization methods.

Population optimization algorithms: Bat algorithm (BA)

In this article, I will consider the Bat Algorithm (BA), which shows good convergence on smooth functions.

Developing a Replay System (Part 59): A New Future

Having a proper understanding of different ideas allows us to do more with less effort. In this article, we'll look at why it's necessary to configure a template before the service can interact with the chart. Also, what if we improve the mouse pointer so we can do more things with it?

DoEasy. Controls (Part 27): Working on ProgressBar WinForms object

In this article, I will continue the development of the ProgressBar control. In particular, I will create the functionality for managing the progress bar and visual effects.

From Basic to Intermediate: Array (I)

This article is a transition between what has been discussed so far and a new stage of research. To understand this article, you need to read the previous ones. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

SQLite capabilities in MQL5: Example of a dashboard with trading statistics by symbols and magic numbers

In this article, we will consider creating an indicator that displays trading statistics on a dashboard by account and by symbols and trading strategies. We will implement the code based on examples from the Documentation and the article on working with databases.

Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

Developing Market Memory Zones Indicator: Where Price Is Likely To Return

In this discussion, we will develop an indicator to identify price zones created by strong market activity, such as impulsive moves, structure shifts, and liquidity events. These zones represent areas where the market has left “memory” due to unfilled orders or rapid price displacement. By marking these regions on the chart, the indicator highlights where price is statistically more likely to revisit and react in the future.

Simple solutions for handling indicators conveniently

In this article, I will describe how to make a simple panel to change the indicator settings directly from the chart, and what changes need to be made to the indicator to connect the panel. This article is intended for novice MQL5 users.

Developing a Replay System — Market simulation (Part 17): Ticks and more ticks (I)

Here we will see how to implement something really interesting, but at the same time very difficult due to certain points that can be very confusing. The worst thing that can happen is that some traders who consider themselves professionals do not know anything about the importance of these concepts in the capital market. Well, although we focus here on programming, understanding some of the issues involved in market trading is paramount to what we are going to implement.

Developing a Replay System (Part 32): Order System (I)

Of all the things that we have developed so far, this system, as you will probably notice and eventually agree, is the most complex. Now we need to do something very simple: make our system simulate the operation of a trading server. This need to accurately implement the way the trading server operates seems like a no-brainer. At least in words. But we need to do this so that the everything is seamless and transparent for the user of the replay/simulation system.

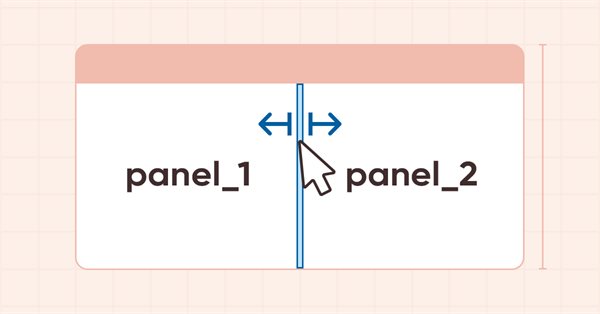

DoEasy. Controls (Part 22): SplitContainer. Changing the properties of the created object

In the current article, I will implement the ability to change the properties and appearance of the newly created SplitContainer control.

Master MQL5 from Beginner to Pro (Part III): Complex Data Types and Include Files

This is the third article in a series describing the main aspects of MQL5 programming. This article covers complex data types that were not discussed in the previous article. These include structures, unions, classes, and the 'function' data type. It also explains how to add modularity to your program using the #include preprocessor directive.

Pattern Recognition Using Dynamic Time Warping in MQL5

In this article, we discuss the concept of dynamic time warping as a means of identifying predictive patterns in financial time series. We will look into how it works as well as present its implementation in pure MQL5.

Angle-based operations for traders

This article will cover angle-based operations. We will look at methods for constructing angles and using them in trading.

Building a Candlestick Trend Constraint Model (Part 10): Strategic Golden and Death Cross (EA)

Did you know that the Golden Cross and Death Cross strategies, based on moving average crossovers, are some of the most reliable indicators for identifying long-term market trends? A Golden Cross signals a bullish trend when a shorter moving average crosses above a longer one, while a Death Cross indicates a bearish trend when the shorter average moves below. Despite their simplicity and effectiveness, manually applying these strategies often leads to missed opportunities or delayed trades.

Creating a Trading Administrator Panel in MQL5 (Part V): Two-Factor Authentication (2FA)

Today, we will discuss enhancing security for the Trading Administrator Panel currently under development. We will explore how to implement MQL5 in a new security strategy, integrating the Telegram API for two-factor authentication (2FA). This discussion will provide valuable insights into the application of MQL5 in reinforcing security measures. Additionally, we will examine the MathRand function, focusing on its functionality and how it can be effectively utilized within our security framework. Continue reading to discover more!