Creating a Trading Administrator Panel in MQL5 (Part VI):Trade Management Panel (II)

In this article, we enhance the Trade Management Panel of our multi-functional Admin Panel. We introduce a powerful helper function that simplifies the code, improving readability, maintainability, and efficiency. We will also demonstrate how to seamlessly integrate additional buttons and enhance the interface to handle a wider range of trading tasks. Whether managing positions, adjusting orders, or simplifying user interactions, this guide will help you develop a robust, user-friendly Trade Management Panel.

The MQL5 Standard Library Explorer (Part 5): Multiple Signal Expert

In this session, we will build a sophisticated, multi-signal Expert Advisor using the MQL5 Standard Library. This approach allows us to seamlessly blend built-in signals with our own custom logic, demonstrating how to construct a powerful and flexible trading algorithm. For more, click to read further.

From Novice to Expert: Animated News Headline Using MQL5 (III) — Indicator Insights

In this article, we’ll advance the News Headline EA by introducing a dedicated indicator insights lane—a compact, on-chart display of key technical signals generated from popular indicators such as RSI, MACD, Stochastic, and CCI. This approach eliminates the need for multiple indicator subwindows on the MetaTrader 5 terminal, keeping your workspace clean and efficient. By leveraging the MQL5 API to access indicator data in the background, we can process and visualize market insights in real-time using custom logic. Join us as we explore how to manipulate indicator data in MQL5 to create an intelligent and space-saving scrolling insights system, all within a single horizontal lane on your trading chart.

Fortified Profit Architecture: Multi-Layered Account Protection

In this discussion, we introduce a structured, multi-layered defense system designed to pursue aggressive profit targets while minimizing exposure to catastrophic loss. The focus is on blending offensive trading logic with protective safeguards at every level of the trading pipeline. The idea is to engineer an EA that behaves like a “risk-aware predator”—capable of capturing high-value opportunities, but always with layers of insulation that prevent blindness to sudden market stress.

Atomic Orbital Search (AOS) algorithm

The article considers the Atomic Orbital Search (AOS) algorithm, which uses the concepts of the atomic orbital model to simulate the search for solutions. The algorithm is based on probability distributions and the dynamics of interactions in the atom. The article discusses in detail the mathematical aspects of AOS, including updating the positions of candidate solutions and the mechanisms of energy absorption and release. AOS opens new horizons for applying quantum principles to computing problems by offering an innovative approach to optimization.

Self Optimizing Expert Advisors in MQL5 (Part 13): A Gentle Introduction To Control Theory Using Matrix Factorization

Financial markets are unpredictable, and trading strategies that look profitable in the past often collapse in real market conditions. This happens because most strategies are fixed once deployed and cannot adapt or learn from their mistakes. By borrowing ideas from control theory, we can use feedback controllers to observe how our strategies interact with markets and adjust their behavior toward profitability. Our results show that adding a feedback controller to a simple moving average strategy improved profits, reduced risk, and increased efficiency, proving that this approach has strong potential for trading applications.

DoEasy. Service functions (Part 3): Outside Bar pattern

In this article, we will develop the Outside Bar Price Action pattern in the DoEasy library and optimize the methods of access to price pattern management. In addition, we will fix errors and shortcomings identified during library tests.

Developing a Replay System (Part 42): Chart Trade Project (I)

Let's create something more interesting. I don't want to spoil the surprise, so follow the article for a better understanding. From the very beginning of this series on developing the replay/simulator system, I was saying that the idea is to use the MetaTrader 5 platform in the same way both in the system we are developing and in the real market. It is important that this is done properly. No one wants to train and learn to fight using one tool while having to use another one during the fight.

Time Evolution Travel Algorithm (TETA)

This is my own algorithm. The article presents the Time Evolution Travel Algorithm (TETA) inspired by the concept of parallel universes and time streams. The basic idea of the algorithm is that, although time travel in the conventional sense is impossible, we can choose a sequence of events that lead to different realities.

Alternative risk return metrics in MQL5

In this article we present the implementation of several risk return metrics billed as alternatives to the Sharpe ratio and examine hypothetical equity curves to analyze their characteristics.

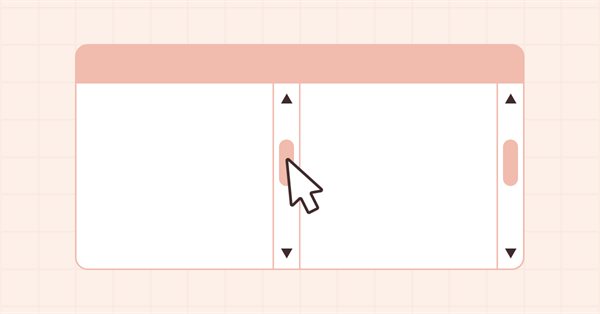

DoEasy. Controls (Part 31): Scrolling the contents of the ScrollBar control

In this article, I will implement the functionality of scrolling the contents of the container using the buttons of the horizontal scrollbar.

Self Optimizing Expert Advisors in MQL5 (Part 16): Supervised Linear System Identification

Linear system identifcation may be coupled to learn to correct the error in a supervised learning algorithm. This allows us to build applications that depend on statistical modelling techniques without necessarily inheriting the fragility of the model's restrictive assumptions. Classical supervised learning algorithms have many needs that may be supplemented by pairing these models with a feedback controller that can correct the model to keep up with current market conditions.

Price Action Analysis Toolkit Development (Part 37): Sentiment Tilt Meter

Market sentiment is one of the most overlooked yet powerful forces influencing price movement. While most traders rely on lagging indicators or guesswork, the Sentiment Tilt Meter (STM) EA transforms raw market data into clear, visual guidance, showing whether the market is leaning bullish, bearish, or staying neutral in real-time. This makes it easier to confirm trades, avoid false entries, and time market participation more effectively.

Price Action Analysis Toolkit Development (Part 34): Turning Raw Market Data into Predictive Models Using an Advanced Ingestion Pipeline

Have you ever missed a sudden market spike or been caught off‑guard when one occurred? The best way to anticipate live events is to learn from historical patterns. Intending to train an ML model, this article begins by showing you how to create a script in MetaTrader 5 that ingests historical data and sends it to Python for storage—laying the foundation for your spike‑detection system. Read on to see each step in action.

GUI: Tips and Tricks for creating your own Graphic Library in MQL

We'll go through the basics of GUI libraries so that you can understand how they work or even start making your own.

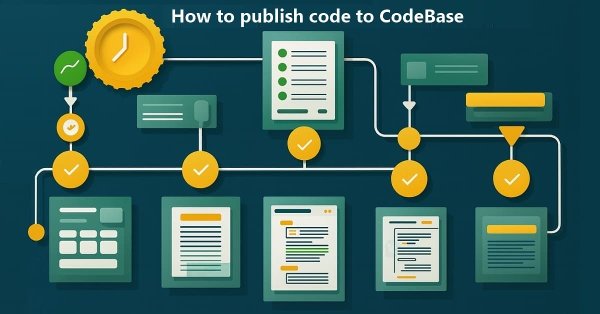

How to publish code to CodeBase: A practical guide

In this article, we will use real-life examples to illustrate posting various types of terminal programs in the MQL5 source code base.

From Basic to Intermediate: Operators

In this article we will look at the main operators. Although the topic is simple to understand, there are certain points that are of great importance when it comes to including mathematical expressions in the code format. Without an adequate understanding of these details, programmers with little or no experience eventually give up trying to create their own solutions.

Websockets for MetaTrader 5: Asynchronous client connections with the Windows API

This article details the development of a custom dynamically linked library designed to facilitate asynchronous websocket client connections for MetaTrader programs.

Population optimization algorithms: Differential Evolution (DE)

In this article, we will consider the algorithm that demonstrates the most controversial results of all those discussed previously - the differential evolution (DE) algorithm.

From Basic to Intermediate: Template and Typename (V)

In this article, we'll explore one last simple use case for templates, and discuss the benefits and necessity of using typename in your code. Although this article may seem a bit complicated at first, it is important to understand it properly in order to use templates and typename later.

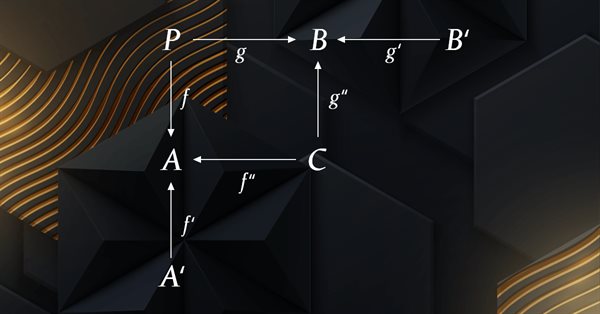

Category Theory in MQL5 (Part 4): Spans, Experiments, and Compositions

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that provides insight while hopefully furthering the use of this remarkable field in Traders' strategy development.

Population optimization algorithms: Mind Evolutionary Computation (MEC) algorithm

The article considers the algorithm of the MEC family called the simple mind evolutionary computation algorithm (Simple MEC, SMEC). The algorithm is distinguished by the beauty of its idea and ease of implementation.

Data label for time series mining (Part 4):Interpretability Decomposition Using Label Data

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

A Generic Optimization Formulation (GOF) to Implement Custom Max with Constraints

In this article we will present a way to implement optimization problems with multiple objectives and constraints when selecting "Custom Max" in the Setting tab of the MetaTrader 5 terminal. As an example, the optimization problem could be: Maximize Profit Factor, Net Profit, and Recovery Factor, such that the Draw Down is less than 10%, the number of consecutive losses is less than 5, and the number of trades per week is more than 5.

Build Self Optimizing Expert Advisors in MQL5 (Part 7): Trading With Multiple Periods At Once

In this series of articles, we have considered multiple different ways of identifying the best period to use our technical indicators with. Today, we shall demonstrate to the reader how they can instead perform the opposite logic, that is to say, instead of picking the single best period to use, we will demonstrate to the reader how to employ all available periods effectively. This approach reduces the amount of data discarded, and offers alternative use cases for machine learning algorithms beyond ordinary price prediction.

Mastering Log Records (Part 1): Fundamental Concepts and First Steps in MQL5

Welcome to the beginning of another journey! This article opens a special series where we will create, step by step, a library for log manipulation, tailored for those who develop in the MQL5 language.

Data label for time series mining (Part 6):Apply and Test in EA Using ONNX

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Multiple Symbol Analysis With Python And MQL5 (Part I): NASDAQ Integrated Circuit Makers

Join us as we discuss how you can use AI to optimize your position sizing and order quantities to maximize the returns of your portfolio. We will showcase how to algorithmically identify an optimal portfolio and tailor your portfolio to your returns expectations or risk tolerance levels. In this discussion, we will use the SciPy library and the MQL5 language to create an optimal and diversified portfolio using all the data we have.

Developing a Replay System (Part 70): Getting the Time Right (III)

In this article, we will look at how to use the CustomBookAdd function correctly and effectively. Despite its apparent simplicity, it has many nuances. For example, it allows you to tell the mouse indicator whether a custom symbol is on auction, being traded, or the market is closed. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Novice to Expert: Revealing the Candlestick Shadows (Wicks)

In this discussion, we take a step forward to uncover the underlying price action hidden within candlestick wicks. By integrating a wick visualization feature into the Market Periods Synchronizer, we enhance the tool with greater analytical depth and interactivity. This upgraded system allows traders to visualize higher-timeframe price rejections directly on lower-timeframe charts, revealing detailed structures that were once concealed within the shadows.

From Basic to Intermediate: Variables (III)

Today we will look at how to use predefined MQL5 language variables and constants. In addition, we will analyze another special type of variables: functions. Knowing how to properly work with these variables can mean the difference between an application that works and one that doesn't. In order to understand what is presented here, it is necessary to understand the material that was discussed in previous articles.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

Developing a Replay System (Part 73): An Unusual Communication (II)

In this article, we will look at how to transmit information in real time between the indicator and the service, and also understand why problems may arise when changing the timeframe and how to solve them. As a bonus, you will get access to the latest version of the replay /simulation app.

Developing a Replay System (Part 51): Things Get Complicated (III)

In this article, we will look into one of the most difficult issues in the field of MQL5 programming: how to correctly obtain a chart ID, and why objects are sometimes not plotted on the chart. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Gain An Edge Over Any Market (Part IV): CBOE Euro And Gold Volatility Indexes

We will analyze alternative data curated by the Chicago Board Of Options Exchange (CBOE) to improve the accuracy of our deep neural networks when forecasting the XAUEUR symbol.

Example of CNA (Causality Network Analysis), SMOC (Stochastic Model Optimal Control) and Nash Game Theory with Deep Learning

We will add Deep Learning to those three examples that were published in previous articles and compare results with previous. The aim is to learn how to add DL to other EA.

DoEasy. Controls (Part 11): WinForms objects — groups, CheckedListBox WinForms object

The article considers grouping WinForms objects and creation of the CheckBox objects list object.

From Basic to Intermediate: Variables (I)

Many beginning programmers have a hard time understanding why their code doesn't work as they expect. There are many things that make code truly functional. It's not just a bunch of different functions and operations that make the code work. Today I invite you to learn how to properly create real code, rather than copy and paste fragments of it. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Category Theory in MQL5 (Part 10): Monoid Groups

This article continues the series on category theory implementation in MQL5. Here we look at monoid-groups as a means normalising monoid sets making them more comparable across a wider span of monoid sets and data types..

Developing a Replay System (Part 54): The Birth of the First Module

In this article, we will look at how to put together the first of a number of truly functional modules for use in the replay/simulator system that will also be of general purpose to serve other purposes. We are talking about the mouse module.