Mastering Log Records (Part 7): How to Show Logs on Chart

Learn how to display logs directly on the MetaTrader chart in an organized way, with frames, titles and automatic scrolling. In this article, we show you how to create a visual log system using MQL5, ideal for monitoring what your robot is doing in real time.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (I)

This discussion delves into the challenges encountered when working with large codebases. We will explore the best practices for code organization in MQL5 and implement a practical approach to enhance the readability and scalability of our Trading Administrator Panel source code. Additionally, we aim to develop reusable code components that can potentially benefit other developers in their algorithm development. Read on and join the conversation.

Developing a Replay System (Part 44): Chart Trade Project (III)

In the previous article I explained how you can manipulate template data for use in OBJ_CHART. In that article, I only outlined the topic without going into details, since in that version the work was done in a very simplified way. This was done to make it easier to explain the content, because despite the apparent simplicity of many things, some of them were not so obvious, and without understanding the simplest and most basic part, you would not be able to truly understand the entire picture.

Reimagining Classic Strategies (Part 17): Modelling Technical Indicators

In this discussion, we focus on how we can break the glass ceiling imposed by classical machine learning techniques in finance. It appears that the greatest limitation to the value we can extract from statistical models does not lie in the models themselves — neither in the data nor in the complexity of the algorithms — but rather in the methodology we use to apply them. In other words, the true bottleneck may be how we employ the model, not the model’s intrinsic capability.

Chemical reaction optimization (CRO) algorithm (Part II): Assembling and results

In the second part, we will collect chemical operators into a single algorithm and present a detailed analysis of its results. Let's find out how the Chemical reaction optimization (CRO) method copes with solving complex problems on test functions.

Balancing risk when trading multiple instruments simultaneously

This article will allow a beginner to write an implementation of a script from scratch for balancing risks when trading multiple instruments simultaneously. Besides, it may give experienced users new ideas for implementing their solutions in relation to the options proposed in this article.

The MQL5 Standard Library Explorer (Part 3): Expert Standard Deviation Channel

In this discussion, we will develop an Expert Advisor using the CTrade and CStdDevChannel classes, while applying several filters to enhance profitability. This stage puts our previous discussion into practical application. Additionally, I’ll introduce another simple approach to help you better understand the MQL5 Standard Library and its underlying codebase. Join the discussion to explore these concepts in action.

Developing a Replay System (Part 66): Playing the service (VII)

In this article, we will implement the first solution that will allow us to determine when a new bar may appear on the chart. This solution is applicable in a wide variety of situations. Understanding its development will help you grasp several important aspects. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 49): Things Get Complicated (I)

In this article, we'll complicate things a little. Using what was shown in the previous articles, we will start to open up the template file so that the user can use their own template. However, I will be making changes gradually, as I will also be refining the indicator to reduce the load on MetaTrader 5.

Artificial Cooperative Search (ACS) algorithm

Artificial Cooperative Search (ACS) is an innovative method using a binary matrix and multiple dynamic populations based on mutualistic relationships and cooperation to find optimal solutions quickly and accurately. ACS unique approach to predators and prey enables it to achieve excellent results in numerical optimization problems.

From Novice to Expert: Animated News Headline Using MQL5 (VII) — Post Impact Strategy for News Trading

The risk of whipsaw is extremely high during the first minute following a high-impact economic news release. In that brief window, price movements can be erratic and volatile, often triggering both sides of pending orders. Shortly after the release—typically within a minute—the market tends to stabilize, resuming or correcting the prevailing trend with more typical volatility. In this section, we’ll explore an alternative approach to news trading, aiming to assess its effectiveness as a valuable addition to a trader’s toolkit. Continue reading for more insights and details in this discussion.

From Novice to Expert: Statistical Validation of Supply and Demand Zones

Today, we uncover the often overlooked statistical foundation behind supply and demand trading strategies. By combining MQL5 with Python through a Jupyter Notebook workflow, we conduct a structured, data-driven investigation aimed at transforming visual market assumptions into measurable insights. This article covers the complete research process, including data collection, Python-based statistical analysis, algorithm design, testing, and final conclusions. To explore the methodology and findings in detail, read the full article.

Reimagining Classic Strategies: Crude Oil

In this article, we revisit a classic crude oil trading strategy with the aim of enhancing it by leveraging supervised machine learning algorithms. We will construct a least-squares model to predict future Brent crude oil prices based on the spread between Brent and WTI crude oil prices. Our goal is to identify a leading indicator of future changes in Brent prices.

Developing a Replay System — Market simulation (Part 07): First improvements (II)

In the previous article, we made some fixes and added tests to our replication system to ensure the best possible stability. We also started creating and using a configuration file for this system.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (III): Communication Module

Join us for an in-depth discussion on the latest advancements in MQL5 interface design as we unveil the redesigned Communications Panel and continue our series on building the New Admin Panel using modularization principles. We'll develop the CommunicationsDialog class step by step, thoroughly explaining how to inherit it from the Dialog class. Additionally, we'll leverage arrays and ListView class in our development. Gain actionable insights to elevate your MQL5 development skills—read through the article and join the discussion in the comments section!

Population optimization algorithms: Evolution Strategies, (μ,λ)-ES and (μ+λ)-ES

The article considers a group of optimization algorithms known as Evolution Strategies (ES). They are among the very first population algorithms to use evolutionary principles for finding optimal solutions. We will implement changes to the conventional ES variants and revise the test function and test stand methodology for the algorithms.

Population optimization algorithms: Simulated Isotropic Annealing (SIA) algorithm. Part II

The first part was devoted to the well-known and popular algorithm - simulated annealing. We have thoroughly considered its pros and cons. The second part of the article is devoted to the radical transformation of the algorithm, which turns it into a new optimization algorithm - Simulated Isotropic Annealing (SIA).

Developing a Replay System (Part 47): Chart Trade Project (VI)

Finally, our Chart Trade indicator starts interacting with the EA, allowing information to be transferred interactively. Therefore, in this article, we will improve the indicator, making it functional enough to be used together with any EA. This will allow us to access the Chart Trade indicator and work with it as if it were actually connected with an EA. But we will do it in a much more interesting way than before.

Matrix Factorization: The Basics

Since the goal here is didactic, we will proceed as simply as possible. That is, we will implement only what we need: matrix multiplication. You will see today that this is enough to simulate matrix-scalar multiplication. The most significant difficulty that many people encounter when implementing code using matrix factorization is this: unlike scalar factorization, where in almost all cases the order of the factors does not change the result, this is not the case when using matrices.

From Novice to Expert: Animated News Headline Using MQL5 (XI)—Correlation in News Trading

In this discussion, we will explore how the concept of Financial Correlation can be applied to improve decision-making efficiency when trading multiple symbols during major economic events announcement. The focus is on addressing the challenge of heightened risk exposure caused by increased volatility during news releases.

Creating a Trading Administrator Panel in MQL5 (Part III): Extending Built-in Classes for Theme Management (II)

In this discussion, we will carefully extend the existing Dialog library to incorporate theme management logic. Furthermore, we will integrate methods for theme switching into the CDialog, CEdit, and CButton classes utilized in our Admin Panel project. Continue reading for more insightful perspectives.

Population optimization algorithms: Bird Swarm Algorithm (BSA)

The article explores the bird swarm-based algorithm (BSA) inspired by the collective flocking interactions of birds in nature. The different search strategies of individuals in BSA, including switching between flight, vigilance and foraging behavior, make this algorithm multifaceted. It uses the principles of bird flocking, communication, adaptability, leading and following to efficiently find optimal solutions.

Reimagining Classic Strategies (Part 13): Taking Our Crossover Strategy to New Dimensions (Part 2)

Join us in our discussion as we look for additional improvements to make to our moving-average cross over strategy to reduce the lag in our trading strategy to more reliable levels by leveraging our skills in data science. It is a well-studied fact that projecting your data to higher dimensions can at times improve the performance of your machine learning models. We will demonstrate what this practically means for you as a trader, and illustrate how you can weaponize this powerful principle using your MetaTrader 5 Terminal.

Adaptive Social Behavior Optimization (ASBO): Schwefel, Box-Muller Method

This article provides a fascinating insight into the world of social behavior in living organisms and its influence on the creation of a new mathematical model - ASBO (Adaptive Social Behavior Optimization). We will examine how the principles of leadership, neighborhood, and cooperation observed in living societies inspire the development of innovative optimization algorithms.

Developing a Replay System (Part 72): An Unusual Communication (I)

What we create today will be difficult to understand. Therefore, in this article I will only talk about the initial stage. Please read this article carefully, it is an important prerequisite before we proceed to the next step. The purpose of this material is purely didactic as we will only study and master the presented concepts, without practical application.

From Basic to Intermediate: Recursion

In this article we will look at a very interesting and quite challenging programming concept, although it should be treated with great caution, as its misuse or misunderstanding can turn relatively simple programs into something unnecessarily complex. But when used correctly and adapted perfectly to equally suitable situations, recursion becomes an excellent ally in solving problems that would otherwise be much more laborious and time-consuming. The materials presented here are intended for educational purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 62): Playing the service (III)

In this article, we will begin to address the issue of tick excess that can impact application performance when using real data. This excess often interferes with the correct timing required to construct a one-minute bar in the appropriate window.

Price Action Analysis Toolkit Development (Part 45): Creating a Dynamic Level-Analysis Panel in MQL5

In this article, we explore a powerful MQL5 tool that let's you test any price level you desire with just one click. Simply enter your chosen level and press analyze, the EA instantly scans historical data, highlights every touch and breakout on the chart, and displays statistics in a clean, organized dashboard. You'll see exactly how often price respected or broke through your level, and whether it behaved more like support or resistance. Continue reading to explore the detailed procedure.

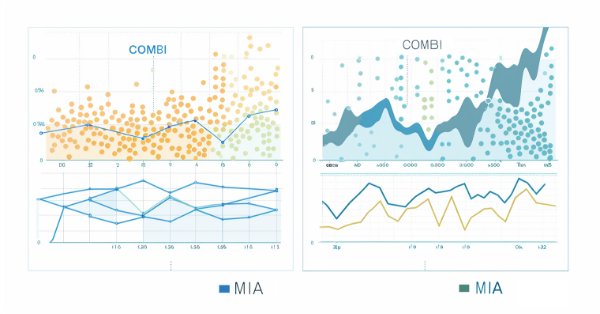

The Group Method of Data Handling: Implementing the Combinatorial Algorithm in MQL5

In this article we continue our exploration of the Group Method of Data Handling family of algorithms, with the implementation of the Combinatorial Algorithm along with its refined incarnation, the Combinatorial Selective Algorithm in MQL5.

Developing a Replay System (Part 50): Things Get Complicated (II)

We will solve the chart ID problem and at the same time we will begin to provide the user with the ability to use a personal template for the analysis and simulation of the desired asset. The materials presented here are for didactic purposes only and should in no way be considered as an application for any purpose other than studying and mastering the concepts presented.

Reimagining Classic Strategies (Part 14): Multiple Strategy Analysis

In this article, we continue our exploration of building an ensemble of trading strategies and using the MT5 genetic optimizer to tune the strategy parameters. Today, we analyzed the data in Python, showing our model could better predict which strategy would outperform, achieving higher accuracy than forecasting market returns directly. However, when we tested our application with its statistical models, our performance levels fell dismally. We subsequently discovered that the genetic optimizer unfortunately favored highly correlated strategies, prompting us to revise our method to keep vote weights fixed and focus optimization on indicator settings instead.

Permuting price bars in MQL5

In this article we present an algorithm for permuting price bars and detail how permutation tests can be used to recognize instances where strategy performance has been fabricated to deceive potential buyers of Expert Advisors.

From Basic to Intermediate: The Include Directive

In today's article, we will discuss a compilation directive that is widely used in various codes that can be found in MQL5. Although this directive will be explained rather superficially here, it is important that you begin to understand how to use it, as it will soon become indispensable as you move to higher levels of programming. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Basic to Intermediate: Structs (II)

In this article, we will try to understand why programming languages like MQL5 have structures, and why in some cases structures are the ideal way to pass values between functions and procedures, while in other cases they may not be the best way to do it.

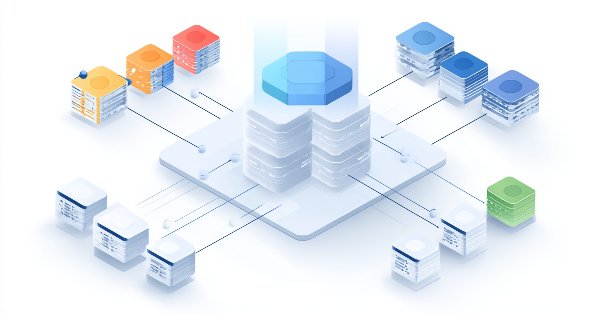

Integrating MQL5 with data processing packages (Part 4): Big Data Handling

Exploring advanced techniques to integrate MQL5 with powerful data processing tools, this part focuses on efficient handling of big data to enhance trading analysis and decision-making.

Artificial Bee Hive Algorithm (ABHA): Theory and methods

In this article, we will consider the Artificial Bee Hive Algorithm (ABHA) developed in 2009. The algorithm is aimed at solving continuous optimization problems. We will look at how ABHA draws inspiration from the behavior of a bee colony, where each bee has a unique role that helps them find resources more efficiently.

Resampling techniques for prediction and classification assessment in MQL5

In this article, we will explore and implement, methods for assessing model quality that utilize a single dataset as both training and validation sets.

Developing an MQL5 RL agent with RestAPI integration (Part 3): Creating automatic moves and test scripts in MQL5

This article discusses the implementation of automatic moves in the tic-tac-toe game in Python, integrated with MQL5 functions and unit tests. The goal is to improve the interactivity of the game and ensure the reliability of the system through testing in MQL5. The presentation covers game logic development, integration, and hands-on testing, and concludes with the creation of a dynamic game environment and a robust integrated system.

Simplifying Databases in MQL5 (Part 2): Using metaprogramming to create entities

We explored the advanced use of #define for metaprogramming in MQL5, creating entities that represent tables and column metadata (type, primary key, auto-increment, nullability, etc.). We centralized these definitions in TickORM.mqh, automating the generation of metadata classes and paving the way for efficient data manipulation by the ORM, without having to write SQL manually.

Reimagining Classic Strategies (Part IV): SP500 and US Treasury Notes

In this series of articles, we analyze classical trading strategies using modern algorithms to determine whether we can improve the strategy using AI. In today's article, we revisit a classical approach for trading the SP500 using the relationship it has with US Treasury Notes.