High frequency arbitrage trading system in Python using MetaTrader 5

In this article, we will create an arbitration system that remains legal in the eyes of brokers, creates thousands of synthetic prices on the Forex market, analyzes them, and successfully trades for profit.

Cycles and trading

This article is about using cycles in trading. We will consider building a trading strategy based on cyclical models.

Continuous walk-forward optimization (Part 8): Program improvements and fixes

The program has been modified based on comments and requests from users and readers of this article series. This article contains a new version of the auto optimizer. This version implements requested features and provides other improvements, which I found when working with the program.

Creating an EA that works automatically (Part 10): Automation (II)

Automation means nothing if you cannot control its schedule. No worker can be efficient working 24 hours a day. However, many believe that an automated system should operate 24 hours a day. But it is always good to have means to set a working time range for the EA. In this article, we will consider how to properly set such a time range.

Timeseries in DoEasy library (part 47): Multi-period multi-symbol standard indicators

In this article, I will start developing the methods of working with standard indicators, which will ultimately allow creating multi-symbol multi-period standard indicators based on library classes. Besides, I will add the "Skipped bars" event to the timeseries classes and eliminate excessive load from the main program code by moving the library preparation functions to CEngine class.

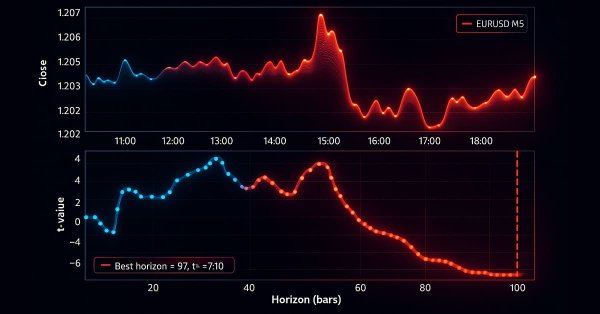

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

Sending Trade Signal Via RSS Feed

This is my idea how to send your trade signal as RSS FEEDS , a famous way to communicate with your community's members right now.

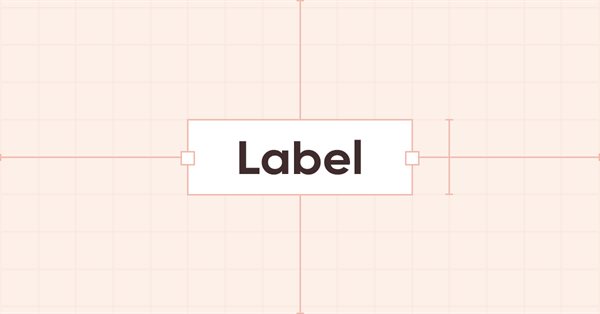

DoEasy. Controls (Part 7): Text label control

In the current article, I will create the class of the WinForms text label control object. Such an object will have the ability to position its container anywhere, while its own functionality will repeat the functionality of the MS Visual Studio text label. We will be able to set font parameters for a displayed text.

Interview with Sergey Pankratyev (ATC 2012)

The Championship is coming to an end leaving us with vivid impressions of many unusual trading strategies. However, the trading robot of Sergey Pankratyev (s75) is showing really peculiar things - it is trading all 12 currency pairs opening only long positions. It is not an error but just a response to some certain market conditions.

Data Science and Machine Learning (Part 21): Unlocking Neural Networks, Optimization algorithms demystified

Dive into the heart of neural networks as we demystify the optimization algorithms used inside the neural network. In this article, discover the key techniques that unlock the full potential of neural networks, propelling your models to new heights of accuracy and efficiency.

Population optimization algorithms: Gravitational Search Algorithm (GSA)

GSA is a population optimization algorithm inspired by inanimate nature. Thanks to Newton's law of gravity implemented in the algorithm, the high reliability of modeling the interaction of physical bodies allows us to observe the enchanting dance of planetary systems and galactic clusters. In this article, I will consider one of the most interesting and original optimization algorithms. The simulator of the space objects movement is provided as well.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

The MQL5 Standard Library Explorer (Part 1): Introduction with CTrade, CiMA, and CiATR

The MQL5 Standard Library plays a vital role in developing trading algorithms for MetaTrader 5. In this discussion series, our goal is to master its application to simplify the creation of efficient trading tools for MetaTrader 5. These tools include custom Expert Advisors, indicators, and other utilities. We begin today by developing a trend-following Expert Advisor using the CTrade, CiMA, and CiATR classes. This is an especially important topic for everyone—whether you are a beginner or an experienced developer. Join this discussion to discover more.

Neural networks made easy (Part 49): Soft Actor-Critic

We continue our discussion of reinforcement learning algorithms for solving continuous action space problems. In this article, I will present the Soft Actor-Critic (SAC) algorithm. The main advantage of SAC is the ability to find optimal policies that not only maximize the expected reward, but also have maximum entropy (diversity) of actions.

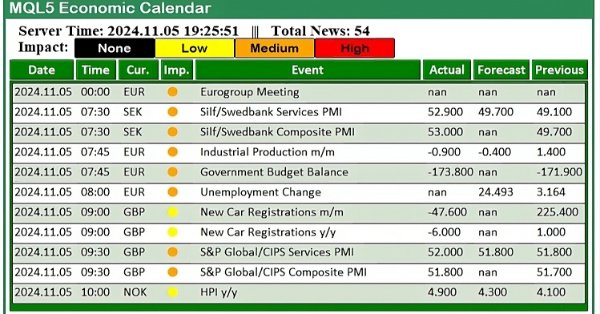

Trading with the MQL5 Economic Calendar (Part 2): Creating a News Dashboard Panel

In this article, we create a practical news dashboard panel using the MQL5 Economic Calendar to enhance our trading strategy. We begin by designing the layout, focusing on key elements like event names, importance, and timing, before moving into the setup within MQL5. Finally, we implement a filtering system to display only the most relevant news, giving traders quick access to impactful economic events.

Risk manager for algorithmic trading

The objectives of this article are to prove the necessity of using a risk manager and to implement the principles of controlled risk in algorithmic trading in a separate class, so that everyone can verify the effectiveness of the risk standardization approach in intraday trading and investing in financial markets. In this article, we will create a risk manager class for algorithmic trading. This is a logical continuation of the previous article in which we discussed the creation of a risk manager for manual trading.

MQL5 Market Results for Q2 2013

Successfully operating for 1.5 years, MQL5 Market has become the largest traders' store of trading strategies and technical indicators. It offers around 800 trading applications provided by 350 developers from around the world. Over 100.000 trading programs have already been purchased and downloaded by traders to their MetaTrader 5 terminals.

Building Your First Glass-box Model Using Python And MQL5

Machine learning models are difficult to interpret and understanding why our models deviate from our expectations is critical if we want to gain any value from using such advanced techniques. Without comprehensive insight into the inner workings of our model, we might fail to spot bugs that are corrupting our model's performance, we may waste time over engineering features that aren't predictive and in the long run we risk underutilizing the power of these models. Fortunately, there is a sophisticated and well maintained all in one solution that allows us to see exactly what our model is doing underneath the hood.

Interview with Sergey Abramov (ATC 2012)

The trading robot of Sergey Abramov (26405) is staying in TOP-10 since the second week. However, it caused much anxiety for its developer. As it turned out, the robot contains a small error in position close block. The robot has been developed almost exclusively on the basis of the past years' results.

Developing a trading Expert Advisor from scratch (Part 11): Cross order system

In this article we will create a system of cross orders. There is one type of assets that makes traders' life very difficult for traders — futures contracts. But why do they make life difficult?

MQL5 Wizard Techniques you should know (Part 09): Pairing K-Means Clustering with Fractal Waves

K-Means clustering takes the approach to grouping data points as a process that’s initially focused on the macro view of a data set that uses random generated cluster centroids before zooming in and adjusting these centroids to accurately represent the data set. We will look at this and exploit a few of its use cases.

DoEasy. Controls (Part 10): WinForms objects — Animating the interface

It is time to animate the graphical interface by implementing the functionality for object interaction with users and objects. The new functionality will also be necessary to let more complex objects work correctly.

Introduction to MQL5 (Part 25): Building an EA that Trades with Chart Objects (II)

This article explains how to build an Expert Advisor (EA) that interacts with chart objects, particularly trend lines, to identify and trade breakout and reversal opportunities. You will learn how the EA confirms valid signals, manages trade frequency, and maintains consistency with user-selected strategies.

Developing a Replay System — Market simulation (Part 21): FOREX (II)

We will continue to build a system for working in the FOREX market. In order to solve this problem, we must first declare the loading of ticks before loading the previous bars. This solves the problem, but at the same time forces the user to follow some structure in the configuration file, which, personally, does not make much sense to me. The reason is that by designing a program that is responsible for analyzing and executing what is in the configuration file, we can allow the user to declare the elements he needs in any order.

Price Action Analysis Toolkit Development (Part 41): Building a Statistical Price-Level EA in MQL5

Statistics has always been at the heart of financial analysis. By definition, statistics is the discipline that collects, analyzes, interprets, and presents data in meaningful ways. Now imagine applying that same framework to candlesticks—compressing raw price action into measurable insights. How helpful would it be to know, for a specific period of time, the central tendency, spread, and distribution of market behavior? In this article, we introduce exactly that approach, showing how statistical methods can transform candlestick data into clear, actionable signals.

Trader's Statistical Cookbook: Hypotheses

This article considers hypothesis - one of the basic ideas of mathematical statistics. Various hypotheses are examined and verified through examples using methods of mathematical statistics. The actual data is generalized using nonparametric methods. The Statistica package and the ported ALGLIB MQL5 numerical analysis library are used for processing data.

Introduction to MQL5 (Part 16): Building Expert Advisors Using Technical Chart Patterns

This article introduces beginners to building an MQL5 Expert Advisor that identifies and trades a classic technical chart pattern — the Head and Shoulders. It covers how to detect the pattern using price action, draw it on the chart, set entry, stop loss, and take profit levels, and automate trade execution based on the pattern.

Price Action Analysis Toolkit Development (Part 7): Signal Pulse EA

Unlock the potential of multi-timeframe analysis with 'Signal Pulse,' an MQL5 Expert Advisor that integrates Bollinger Bands and the Stochastic Oscillator to deliver accurate, high-probability trading signals. Discover how to implement this strategy and effectively visualize buy and sell opportunities using custom arrows. Ideal for traders seeking to enhance their judgment through automated analysis across multiple timeframes.

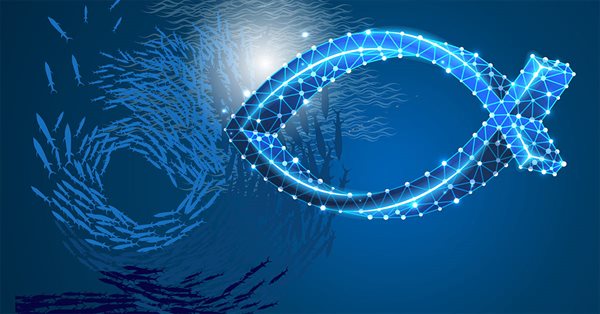

Population optimization algorithms: Fish School Search (FSS)

Fish School Search (FSS) is a new optimization algorithm inspired by the behavior of fish in a school, most of which (up to 80%) swim in an organized community of relatives. It has been proven that fish aggregations play an important role in the efficiency of foraging and protection from predators.

Implementing the Janus factor in MQL5

Gary Anderson developed a method of market analysis based on a theory he dubbed the Janus Factor. The theory describes a set of indicators that can be used to reveal trends and assess market risk. In this article we will implement these tools in mql5.

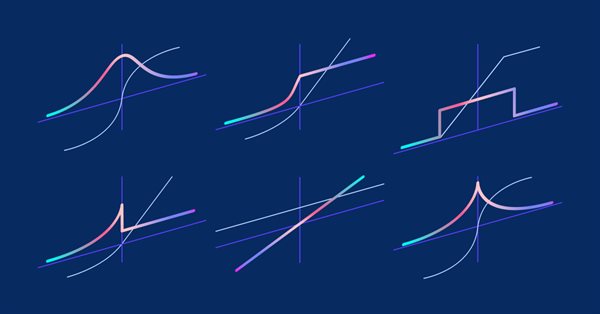

Matrices and vectors in MQL5: Activation functions

Here we will describe only one of the aspects of machine learning - activation functions. In artificial neural networks, a neuron activation function calculates an output signal value based on the values of an input signal or a set of input signals. We will delve into the inner workings of the process.

Introduction to MQL5 (Part 8): Beginner's Guide to Building Expert Advisors (II)

This article addresses common beginner questions from MQL5 forums and demonstrates practical solutions. Learn to perform essential tasks like buying and selling, obtaining candlestick prices, and managing automated trading aspects such as trade limits, trading periods, and profit/loss thresholds. Get step-by-step guidance to enhance your understanding and implementation of these concepts in MQL5.

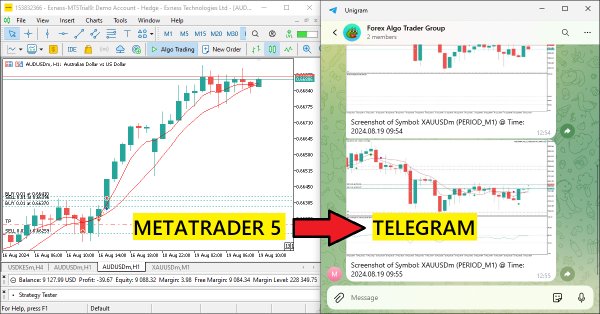

Creating an MQL5-Telegram Integrated Expert Advisor (Part 3): Sending Chart Screenshots with Captions from MQL5 to Telegram

In this article, we create an MQL5 Expert Advisor that encodes chart screenshots as image data and sends them to a Telegram chat via HTTP requests. By integrating photo encoding and transmission, we enhance the existing MQL5-Telegram system with visual trading insights directly within Telegram.

Developing a Trading Strategy: Using a Volume-Bound Approach

In the world of technical analysis, price often takes center stage. Traders meticulously map out support, resistance, and patterns, yet frequently ignore the critical force that drives these movements: volume. This article delves into a novel approach to volume analysis: the Volume Boundary indicator. This transformation, utilizing sophisticated smoothing functions like the butterfly and triple sine curves, allows for clearer interpretation and the development of systematic trading strategies.

Data Science and Machine Learning (Part 23): Why LightGBM and XGBoost outperform a lot of AI models?

These advanced gradient-boosted decision tree techniques offer superior performance and flexibility, making them ideal for financial modeling and algorithmic trading. Learn how to leverage these tools to optimize your trading strategies, improve predictive accuracy, and gain a competitive edge in the financial markets.

Sentiment Analysis and Deep Learning for Trading with EA and Backtesting with Python

In this article, we will introduce Sentiment Analysis and ONNX Models with Python to be used in an EA. One script runs a trained ONNX model from TensorFlow for deep learning predictions, while another fetches news headlines and quantifies sentiment using AI.

Developing a trading Expert Advisor from scratch (Part 14): Adding Volume At Price (II)

Today we will add some more resources to our EA. This interesting article can provide some new ideas and methods of presenting information. At the same time, it can assist in fixing minor flaws in your projects.

Developing a Replay System — Market simulation (Part 06): First improvements (I)

In this article, we will begin to stabilize the entire system, without which we might not be able to proceed to the next steps.

Python, ONNX and MetaTrader 5: Creating a RandomForest model with RobustScaler and PolynomialFeatures data preprocessing

In this article, we will create a random forest model in Python, train the model, and save it as an ONNX pipeline with data preprocessing. After that we will use the model in the MetaTrader 5 terminal.

How to build and optimize a volume-based trading system (Chaikin Money Flow - CMF)

In this article, we will provide a volume-based indicator, Chaikin Money Flow (CMF) after identifying how it can be constructed, calculated, and used. We will understand how to build a custom indicator. We will share some simple strategies that can be used and then test them to understand which one is better.