Moral expectation in trading

This article is about moral expectation. We will look at several examples of its use in trading, as well as the results that can be achieved with its help.

Advanced resampling and selection of CatBoost models by brute-force method

This article describes one of the possible approaches to data transformation aimed at improving the generalizability of the model, and also discusses sampling and selection of CatBoost models.

Developing a trading Expert Advisor from scratch (Part 28): Towards the future (III)

There is still one task which our order system is not up to, but we will FINALLY figure it out. The MetaTrader 5 provides a system of tickets which allows creating and correcting order values. The idea is to have an Expert Advisor that would make the same ticket system faster and more efficient.

DoEasy. Controls (Part 3): Creating bound controls

In this article, I will create subordinate controls bound to the base element. The development will be performed using the base control functionality. In addition, I will tinker with the graphical element shadow object a bit since it still suffers from some logic errors when applied to any of the objects capable of having a shadow.

Neural networks made easy (Part 32): Distributed Q-Learning

We got acquainted with the Q-learning method in one of the earlier articles within this series. This method averages rewards for each action. Two works were presented in 2017, which show greater success when studying the reward distribution function. Let's consider the possibility of using such technology to solve our problems.

Neural networks made easy (Part 15): Data clustering using MQL5

We continue to consider the clustering method. In this article, we will create a new CKmeans class to implement one of the most common k-means clustering methods. During tests, the model managed to identify about 500 patterns.

Introduction to MQL5 (Part 14): A Beginner's Guide to Building Custom Indicators (III)

Learn to build a Harmonic Pattern indicator in MQL5 using chart objects. Discover how to detect swing points, apply Fibonacci retracements, and automate pattern recognition.

Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.

Build Self Optimizing Expert Advisors in MQL5 (Part 3): Dynamic Trend Following and Mean Reversion Strategies

Financial markets are typically classified as either in a range mode or a trending mode. This static view of the market may make it easier for us to trade in the short run. However, it is disconnected from the reality of the market. In this article, we look to better understand how exactly financial markets move between these 2 possible modes and how we can use our new understanding of market behavior to gain confidence in our algorithmic trading strategies.

Developing an Expert Advisor from scratch (Part 30): CHART TRADE as an indicator?

Today we are going to use Chart Trade again, but this time it will be an on-chart indicator which may or may not be present on the chart.

Risk Management (Part 1): Fundamentals for Building a Risk Management Class

In this article, we'll cover the basics of risk management in trading and learn how to create your first functions for calculating the appropriate lot size for a trade, as well as a stop-loss. Additionally, we will go into detail about how these features work, explaining each step. Our goal is to provide a clear understanding of how to apply these concepts in automated trading. Finally, we will put everything into practice by creating a simple script with an include file.

Understanding Programming Paradigms (Part 2): An Object-Oriented Approach to Developing a Price Action Expert Advisor

Learn about the object-oriented programming paradigm and its application in MQL5 code. This second article goes deeper into the specifics of object-oriented programming, offering hands-on experience through a practical example. You'll learn how to convert our earlier developed procedural price action expert advisor using the EMA indicator and candlestick price data to object-oriented code.

New Opportunities with MetaTrader 5

MetaTrader 4 gained its popularity with traders from all over the world, and it seemed like nothing more could be wished for. With its high processing speed, stability, wide array of possibilities for writing indicators, Expert Advisors, and informatory-trading systems, and the ability to chose from over a hundred different brokers, - the terminal greatly distinguished itself from the rest. But time doesn’t stand still, and we find ourselves facing a choice of MetaTrade 4 or MetaTrade 5. In this article, we will describe the main differences of the 5th generation terminal from our current favor.

Price Action Analysis Toolkit Development (Part 17): TrendLoom EA Tool

As a price action observer and trader, I've noticed that when a trend is confirmed by multiple timeframes, it usually continues in that direction. What may vary is how long the trend lasts, and this depends on the type of trader you are, whether you hold positions for the long term or engage in scalping. The timeframes you choose for confirmation play a crucial role. Check out this article for a quick, automated system that helps you analyze the overall trend across different timeframes with just a button click or regular updates.

Creating a ticker tape panel: Basic version

Here I will show how to create screens with price tickers which are usually used to display quotes on the exchange. I will do it by only using MQL5, without using complex external programming.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (FinCon)

We invite you to explore the FinCon framework, which is a a Large Language Model (LLM)-based multi-agent system. The framework uses conceptual verbal reinforcement to improve decision making and risk management, enabling effective performance on a variety of financial tasks.

Price Action Analysis Toolkit (Part 55): Designing a CPI Mini-Candle Overlay for Intra-bar Pressure

This article presents the design and MetaTrader 5 implementation of the Candle Pressure Index (CPI)—a CLV-based overlay that visualizes intra-Bar buying and selling pressure directly on price charts. The discussion focuses on candle structure, pressure classification, visualization mechanics, and a non-repainting, transition-based alert system designed for consistent behavior across timeframes and instruments.

Ready-made templates for including indicators to Expert Advisors (Part 2): Volume and Bill Williams indicators

In this article, we will look at standard indicators of the Volume and Bill Williams' indicators category. We will create ready-to-use templates for indicator use in EAs - declaring and setting parameters, indicator initialization and deinitialization, as well as receiving data and signals from indicator buffers in EAs.

Technical Analysis: What Do We Analyze?

This article tries to analyze several peculiarities of representation of quotes available in the MetaTrader client terminal. The article is general, it doesn't concern programming.

Population optimization algorithms: Grey Wolf Optimizer (GWO)

Let's consider one of the newest modern optimization algorithms - Grey Wolf Optimization. The original behavior on test functions makes this algorithm one of the most interesting among the ones considered earlier. This is one of the top algorithms for use in training neural networks, smooth functions with many variables.

Developing a multi-currency Expert Advisor (Part 1): Collaboration of several trading strategies

There are quite a lot of different trading strategies. So, it might be useful to apply several strategies working in parallel to diversify risks and increase the stability of trading results. But if each strategy is implemented as a separate Expert Advisor (EA), then managing their work on one trading account becomes much more difficult. To solve this problem, it would be reasonable to implement the operation of different trading strategies within a single EA.

USD and EUR index charts — example of a MetaTrader 5 service

We will consider the creation and updating of USD index (USDX) and EUR index (EURX) charts using a MetaTrader 5 service as an example. When launching the service, we will check for the presence of the required synthetic instrument, create it if necessary, and place it in the Market Watch window. The minute and tick history of the synthetic instrument is to be created afterwards followed by the chart of the created instrument.

Self Optimizing Expert Advisors in MQL5 (Part 9): Double Moving Average Crossover

This article outlines the design of a double moving average crossover strategy that uses signals from a higher timeframe (D1) to guide entries on a lower timeframe (M15), with stop-loss levels calculated from an intermediate risk timeframe (H4). It introduces system constants, custom enumerations, and logic for trend-following and mean-reverting modes, while emphasizing modularity and future optimization using a genetic algorithm. The approach allows for flexible entry and exit conditions, aiming to reduce signal lag and improve trade timing by aligning lower-timeframe entries with higher-timeframe trends.

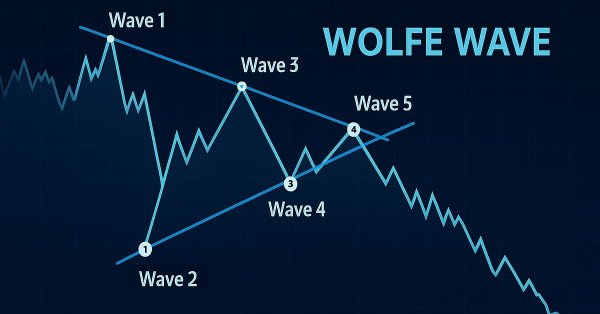

Introduction to MQL5 (Part 19): Automating Wolfe Wave Detection

This article shows how to programmatically identify bullish and bearish Wolfe Wave patterns and trade them using MQL5. We’ll explore how to identify Wolfe Wave structures programmatically and execute trades based on them using MQL5. This includes detecting key swing points, validating pattern rules, and preparing the EA to act on the signals it finds.

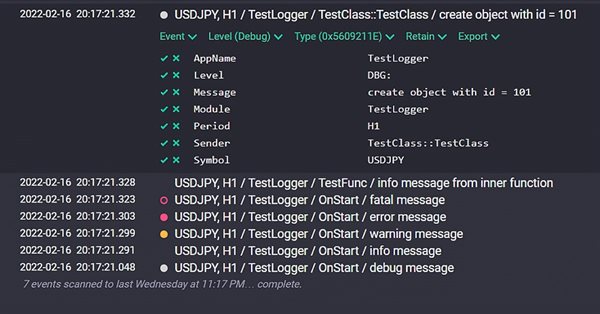

Tips from a professional programmer (Part III): Logging. Connecting to the Seq log collection and analysis system

Implementation of the Logger class for unifying and structuring messages which are printed to the Experts log. Connection to the Seq log collection and analysis system. Monitoring log messages online.

Reimagining Classic Strategies (Part 15): Daily Breakout Trading Strategy

Human traders had long participated in financial markets before the rise of computers, developing rules of thumb that guided their decisions. In this article, we revisit a well-known breakout strategy to test whether such market logic, learned through experience, can hold its own against systematic methods. Our findings show that while the original strategy produced high accuracy, it suffered from instability and poor risk control. By refining the approach, we demonstrate how discretionary insights can be adapted into more robust, algorithmic trading strategies.

Graphics in DoEasy library (Part 93): Preparing functionality for creating composite graphical objects

In this article, I will start developing the functionality for creating composite graphical objects. The library will support creating composite graphical objects allowing those objects have any hierarchy of connections. I will prepare all the necessary classes for subsequent implementation of such objects.

MetaTrader 5 Machine Learning Blueprint (Part 1): Data Leakage and Timestamp Fixes

Before we can even begin to make use of ML in our trading on MetaTrader 5, it’s crucial to address one of the most overlooked pitfalls—data leakage. This article unpacks how data leakage, particularly the MetaTrader 5 timestamp trap, can distort our model's performance and lead to unreliable trading signals. By diving into the mechanics of this issue and presenting strategies to prevent it, we pave the way for building robust machine learning models that deliver trustworthy predictions in live trading environments.

Timeseries in DoEasy library (part 54): Descendant classes of abstract base indicator

The article considers creation of classes of descendant objects of base abstract indicator. Such objects will provide access to features of creating indicator EAs, collecting and getting data value statistics of various indicators and prices. Also, create indicator object collection from which getting access to properties and data of each indicator created in the program will be possible.

How we developed the MetaTrader Signals service and Social Trading

We continue to enhance the Signals service, improve the mechanisms, add new functions and fix flaws. The MetaTrader Signals Service of 2012 and the current MetaTrader Signals Service are like two completely different services. Currently, we are implementing A Virtual Hosting Cloud service which consists of a network of servers to support specific versions of the MetaTrader client terminal.

Category Theory in MQL5 (Part 14): Functors with Linear-Orders

This article which is part of a broader series on Category Theory implementation in MQL5, delves into Functors. We examine how a Linear Order can be mapped to a set, thanks to Functors; by considering two sets of data that one would typically dismiss as having any connection.

Data Science and Machine Learning (Part 24): Forex Time series Forecasting Using Regular AI Models

In the forex markets It is very challenging to predict the future trend without having an idea of the past. Very few machine learning models are capable of making the future predictions by considering past values. In this article, we are going to discuss how we can use classical(Non-time series) Artificial Intelligence models to beat the market

Nikolay Ivanov (Techno): "What is important for programs is the accuracy of their algorithms"

A programmer from Krasnoyarsk Nikolay Ivanov (Techno) is a leader among the developers in terms of the number of completed orders - he has implemented already more than 200 applications in the Jobs service. In this interview, he is talking about the Jobs service, its specific features and challengers faced by programmers.

Population optimization algorithms: Harmony Search (HS)

In the current article, I will study and test the most powerful optimization algorithm - harmonic search (HS) inspired by the process of finding the perfect sound harmony. So what algorithm is now the leader in our rating?

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

Neural networks made easy (Part 25): Practicing Transfer Learning

In the last two articles, we developed a tool for creating and editing neural network models. Now it is time to evaluate the potential use of Transfer Learning technology using practical examples.

From Novice to Expert: Navigating Market Irregularities

Market rules are continuously evolving, and many once-reliable principles gradually lose their effectiveness. What worked in the past no longer works consistently over time. Today’s discussion focuses on probability ranges and how they can be used to navigate market irregularities. We will leverage MQL5 to develop an algorithm capable of trading effectively even in the choppiest market conditions. Join this discussion to find out more.

Formulating Dynamic Multi-Pair EA (Part 4): Volatility and Risk Adjustment

This phase fine-tunes your multi-pair EA to adapt trade size and risk in real time using volatility metrics like ATR boosting consistency, protection, and performance across diverse market conditions.

Forex arbitrage trading: A simple synthetic market maker bot to get started

Today we will take a look at my first arbitrage robot — a liquidity provider (if you can call it that) for synthetic assets. Currently, this bot is successfully operating as a module in a large machine learning system, but I pulled up an old Forex arbitrage robot from the cloud, so let's take a look at it and think about what we can do with it today.

Price Action Analysis Toolkit Development (Part 39): Automating BOS and ChoCH Detection in MQL5

This article presents Fractal Reaction System, a compact MQL5 system that converts fractal pivots into actionable market-structure signals. Using closed-bar logic to avoid repainting, the EA detects Change-of-Character (ChoCH) warnings and confirms Breaks-of-Structure (BOS), draws persistent chart objects, and logs/alerts every confirmed event (desktop, mobile and sound). Read on for the algorithm design, implementation notes, testing results and the full EA code so you can compile, test and deploy the detector yourself.