MT4TerminalSync - System for the Synchronization of MetaTrader 4 Terminals

This article is devoted to the topic "Widening possibilities of MQL4 programs by using functions of operating systems and other means of program development". The article describes an example of a program system that implements the task of the synchronization of several terminal copies based on a single source template.

William Gann methods (Part II): Creating Gann Square indicator

We will create an indicator based on the Gann's Square of 9, built by squaring time and price. We will prepare the code and test the indicator in the platform on different time intervals.

Developing a trading Expert Advisor from scratch (Part 9): A conceptual leap (II)

In this article, we will place Chart Trade in a floating window. In the previous part, we created a basic system which enables the use of templates within a floating window.

Neural networks made easy (Part 76): Exploring diverse interaction patterns with Multi-future Transformer

This article continues the topic of predicting the upcoming price movement. I invite you to get acquainted with the Multi-future Transformer architecture. Its main idea is to decompose the multimodal distribution of the future into several unimodal distributions, which allows you to effectively simulate various models of interaction between agents on the scene.

Master MQL5 from Beginner to Pro (Part VI): Basics of Developing Expert Advisors

This article continues the series for beginners. Here we will discuss the basic principles of developing Expert Advisors (EAs). We will create two EAs: the first one will trade without indicators, using pending orders, and the second one will be based on the standard MA indicator, opening deals at the current price. Here I assume that you are no longer a complete beginner and have a relatively good command of the material from the previous articles.

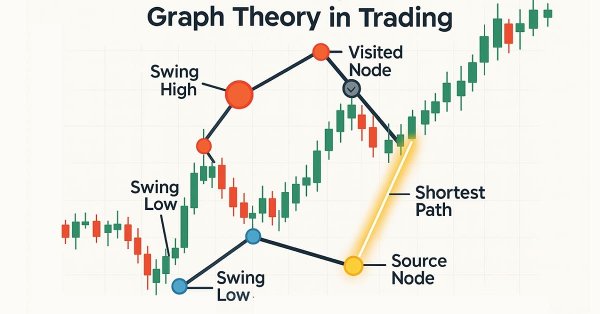

Graph Theory: Dijkstra's Algorithm Applied in Trading

Dijkstra's algorithm, a classic shortest-path solution in graph theory, can optimize trading strategies by modeling market networks. Traders can use it to find the most efficient routes in the candlestick chart data.

MQL4 as a Trader's Tool, or The Advanced Technical Analysis

Trading is, first of all, a calculus of probabilities. The proverb about idleness being an engine for progress reveals us the reason why all those indicators and trading systems have been developed. It comes that the major of newcomers in trading study "ready-made" trading theories. But, as luck would have it, there are some more undiscovered market secrets, and tools used in analyzing of price movements exist, basically, as those unrealized technical indicators or math and stat packages. Thanks awfully to Bill Williams for his contribution to the market movements theory. Though, perhaps, it's too early to rest on oars.

Beginners' Mistakes when Working with MetaTrader 4 Client Terminal

Err is human. Everybody makes mistakes: more or less frequently, through ignorance or inadvertently. You ask and we answer your questions about: terminal time, test results, Print in journal, symbols, history for Tester, history import, leverage, traffic, hints, scaling, wrong calculations, Invalid account, Empty News, Price changed, Not Enough Money, Market Is Closed.

MQL5 Cookbook — Macroeconomic events database

The article discusses the possibilities of handling databases based on the SQLite engine. The CDatabase class has been formed for convenience and efficient use of OOP principles. It is subsequently involved in the creation and management of the database of macroeconomic events. The article provides the examples of using multiple methods of the CDatabase class.

Neural Networks in Trading: Parameter-Efficient Transformer with Segmented Attention (Final Part)

In the previous work, we discussed the theoretical aspects of the PSformer framework, which includes two major innovations in the classical Transformer architecture: the Parameter Shared (PS) mechanism and attention to spatio-temporal segments (SegAtt). In this article, we continue the work we started on implementing the proposed approaches using MQL5.

From Novice to Expert: Programming Candlesticks

In this article, we take the first step in MQL5 programming, even for complete beginners. We'll show you how to transform familiar candlestick patterns into a fully functional custom indicator. Candlestick patterns are valuable as they reflect real price action and signal market shifts. Instead of manually scanning charts—an approach prone to errors and inefficiencies—we'll discuss how to automate the process with an indicator that identifies and labels patterns for you. Along the way, we’ll explore key concepts like indexing, time series, Average True Range (for accuracy in varying market volatility), and the development of a custom reusable Candlestick Pattern library for use in future projects.

Developing a trading Expert Advisor from scratch (Part 13): Time and Trade (II)

Today we will construct the second part of the Times & Trade system for market analysis. In the previous article "Times & Trade (I)" we discussed an alternative chart organization system, which would allow having an indicator for the quickest possible interpretation of deals executed in the market.

News Trading Made Easy (Part 1): Creating a Database

News trading can be complicated and overwhelming, in this article we will go through steps to obtain news data. Additionally we will learn about the MQL5 Economic Calendar and what it has to offer.

DoEasy. Controls (Part 6): Panel control, auto resizing the container to fit inner content

In the article, I will continue my work on the Panel WinForms object and implement its auto resizing to fit the general size of Dock objects located inside the panel. Besides, I will add the new properties to the Symbol library object.

How to build and optimize a volatility-based trading system (Chaikin Volatility - CHV)

In this article, we will provide another volatility-based indicator named Chaikin Volatility. We will understand how to build a custom indicator after identifying how it can be used and constructed. We will share some simple strategies that can be used and then test them to understand which one can be better.

Creating Time Series Predictions using LSTM Neural Networks: Normalizing Price and Tokenizing Time

This article outlines a simple strategy for normalizing the market data using the daily range and training a neural network to enhance market predictions. The developed models may be used in conjunction with an existing technical analysis frameworks or on a standalone basis to assist in predicting the overall market direction. The framework outlined in this article may be further refined by any technical analyst to develop models suitable for both manual and automated trading strategies.

The Random Sandbox

The article includes an interactive "sandbox" as an Excel file which simulates randomized Expert Advisor backtest data. Readers can use this to help explore and more deeply understand the EA performance metrics offered by default with MetaTrader. The text of the article is designed to guide the user through this experience.

Timeseries in DoEasy library (part 48): Multi-period multi-symbol indicators on one buffer in a subwindow

The article considers an example of creating multi-symbol multi-period standard indicators using a single indicator buffer for construction and working in the indicator subwindow. I am going to prepare the library classes for working with standard indicators working in the program main window and having more than one buffer for displaying their data.

Econometric tools for forecasting volatility: GARCH model

The article describes the properties of the non-linear model of conditional heteroscedasticity (GARCH). The iGARCH indicator has been built on its basis for predicting volatility one step ahead. The ALGLIB numerical analysis library is used to estimate the model parameters.

Population optimization algorithms

This is an introductory article on optimization algorithm (OA) classification. The article attempts to create a test stand (a set of functions), which is to be used for comparing OAs and, perhaps, identifying the most universal algorithm out of all widely known ones.

Category Theory (Part 9): Monoid-Actions

This article continues the series on category theory implementation in MQL5. Here we continue monoid-actions as a means of transforming monoids, covered in the previous article, leading to increased applications.

Price Action Analysis Toolkit Development (Part 46): Designing an Interactive Fibonacci Retracement EA with Smart Visualization in MQL5

Fibonacci tools are among the most popular instruments used by technical analysts. In this article, we’ll build an Interactive Fibonacci EA that draws retracement and extension levels that react dynamically to price movement, delivering real‑time alerts, stylish lines, and a scrolling news‑style headline. Another key advantage of this EA is flexibility; you can manually type the high (A) and low (B) swing values directly on the chart, giving you exact control over the market range you want to analyze.

DRAKON visual programming language — communication tool for MQL developers and customers

DRAKON is a visual programming language designed to simplify interaction between specialists from different fields (biologists, physicists, engineers...) with programmers in Russian space projects (for example, in the Buran reusable spacecraft project). In this article, I will talk about how DRAKON makes the creation of algorithms accessible and intuitive, even if you have never encountered code, and also how it is easier for customers to explain their thoughts when ordering trading robots, and for programmers to make fewer mistakes in complex functions.

Formulating Dynamic Multi-Pair EA (Part 3): Mean Reversion and Momentum Strategies

In this article, we will explore the third part of our journey in formulating a Dynamic Multi-Pair Expert Advisor (EA), focusing specifically on integrating Mean Reversion and Momentum trading strategies. We will break down how to detect and act on price deviations from the mean (Z-score), and how to measure momentum across multiple forex pairs to determine trade direction.

Graphics in DoEasy library (Part 85): Graphical object collection - adding newly created objects

In this article, I will complete the development of the descendant classes of the abstract graphical object class and start implementing the ability to store these objects in the collection class. In particular, I will create the functionality for adding newly created standard graphical objects to the collection class.

Neural Networks in Trading: An Agent with Layered Memory

Layered memory approaches that mimic human cognitive processes enable the processing of complex financial data and adaptation to new signals, thereby improving the effectiveness of investment decisions in dynamic markets.

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Stop Out Prevention

Join us in our discussion today as we look for an algorithmic procedure to minimize the total number of times we get stopped out of winning trades. The problem we faced is significantly challenging, and most solutions given in community discussions lack set and fixed rules. Our algorithmic approach to solving the problem increased the profitability of our trades and reduced our average loss per trade. However, there are further advancements to be made to completely filter out all trades that will be stopped out, our solution is a good first step for anyone to try.

Neural networks made easy (Part 31): Evolutionary algorithms

In the previous article, we started exploring non-gradient optimization methods. We got acquainted with the genetic algorithm. Today, we will continue this topic and will consider another class of evolutionary algorithms.

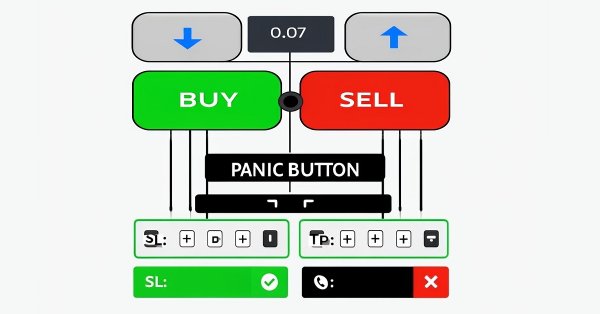

Manual Backtesting Made Easy: Building a Custom Toolkit for Strategy Tester in MQL5

In this article, we design a custom MQL5 toolkit for easy manual backtesting in the Strategy Tester. We explain its design and implementation, focusing on interactive trade controls. We then show how to use it to test strategies effectively

Cycles and Forex

Cycles are of great importance in our lives. Day and night, seasons, days of the week and many other cycles of different nature are present in the life of any person. In this article, we will consider cycles in financial markets.

Revisiting Murray system

Graphical price analysis systems are deservedly popular among traders. In this article, I am going to describe the complete Murray system, including its famous levels, as well as some other useful techniques for assessing the current price position and making a trading decision.

Interview with Enbo Lu (ATC 2012)

"Be sure to participate in the Automated Trading Championships, where you can get a truly invaluable experience!" - this is the motto of contestant Enbo Lu (luenbo) from China. He appeared in the TOP-10 of Automated Trading Championship 2012 last week and is now consistently trying to reach the podium.

High frequency arbitrage trading system in Python using MetaTrader 5

In this article, we will create an arbitration system that remains legal in the eyes of brokers, creates thousands of synthetic prices on the Forex market, analyzes them, and successfully trades for profit.

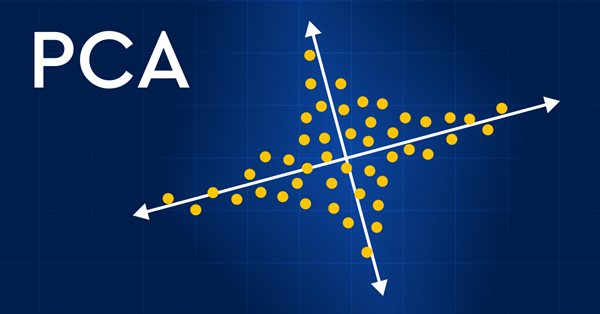

Data Science and Machine Learning (Part 13): Improve your financial market analysis with Principal Component Analysis (PCA)

Revolutionize your financial market analysis with Principal Component Analysis (PCA)! Discover how this powerful technique can unlock hidden patterns in your data, uncover latent market trends, and optimize your investment strategies. In this article, we explore how PCA can provide a new lens for analyzing complex financial data, revealing insights that would be missed by traditional approaches. Find out how applying PCA to financial market data can give you a competitive edge and help you stay ahead of the curve

Building AI-Powered Trading Systems in MQL5 (Part 1): Implementing JSON Handling for AI APIs

In this article, we develop a JSON parsing framework in MQL5 to handle data exchange for AI API integration, focusing on a JSON class for processing JSON structures. We implement methods to serialize and deserialize JSON data, supporting various data types like strings, numbers, and objects, essential for communicating with AI services like ChatGPT, enabling future AI-driven trading systems by ensuring accurate data handling and manipulation.

Graphics in DoEasy library (Part 100): Making improvements in handling extended standard graphical objects

In the current article, I will eliminate obvious flaws in simultaneous handling of extended (and standard) graphical objects and form objects on canvas, as well as fix errors detected during the test performed in the previous article. The article concludes this section of the library description.

Creating a Dynamic Multi-Symbol, Multi-Period Relative Strength Indicator (RSI) Indicator Dashboard in MQL5

In this article, we develop a dynamic multi-symbol, multi-period RSI indicator dashboard in MQL5, providing traders real-time RSI values across various symbols and timeframes. The dashboard features interactive buttons, real-time updates, and color-coded indicators to help traders make informed decisions.

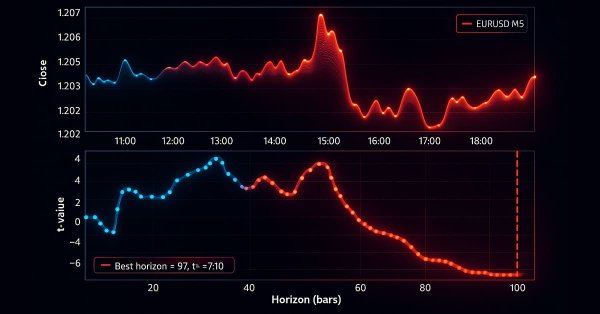

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

Implementing the Generalized Hurst Exponent and the Variance Ratio test in MQL5

In this article, we investigate how the Generalized Hurst Exponent and the Variance Ratio test can be utilized to analyze the behaviour of price series in MQL5.

Introduction to MQL5 (Part 6): A Beginner's Guide to Array Functions in MQL5 (II)

Embark on the next phase of our MQL5 journey. In this insightful and beginner-friendly article, we'll look into the remaining array functions, demystifying complex concepts to empower you to craft efficient trading strategies. We’ll be discussing ArrayPrint, ArrayInsert, ArraySize, ArrayRange, ArrarRemove, ArraySwap, ArrayReverse, and ArraySort. Elevate your algorithmic trading expertise with these essential array functions. Join us on the path to MQL5 mastery!