Volume Compair

- Indicatori

- Thiago Pereira Pinho

- Versione: 2.0

- Aggiornato: 10 agosto 2025

- Attivazioni: 20

Professional Cumulative Delta & Volume Median Indicator

Track real buying/selling pressure with this powerful volume analysis tool. The Volume Compare Indicator combines Cumulative Delta and Volume Medians to help you identify institutional activity, imbalances, and potential reversals.

Key Features:

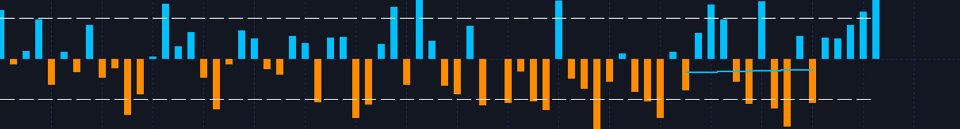

Cumulative Delta Histogram – Visualizes net buying vs. selling volume in real-time.

Buy/Sell Volume Medians – Horizontal lines showing average buy & sell volume levels.

Smart Volume Classification – Separates:

-

Strong Buying (Green) – Bullish pressure

-

Strong Selling (Red) – Bearish pressure

-

Buy Volume Median (Blue Line) – Reference for typical buy volume

-

Sell Volume Median (Orange Line) – Reference for typical sell volume

Customizable Parameters – Adjust CDIPeriod and CDIRange for sensitivity.

EMA-Smoothed Volume – Reduces noise for cleaner signals.

How It Helps Traders:

Spot Institutional Activity – Unusual volume spikes indicate big players entering.

Confirm Breakouts/Reversals – Strong delta divergence warns of fake moves.

Volume-Based Support/Resistance – Median lines act as dynamic reference levels.

Day Trading & Scalping – Gauge intraday momentum shifts.

Indicator Logic:

-

Green Bars = Net buying volume (bullish pressure).

-

Red Bars = Net selling volume (bearish pressure).

-

Blue Line = Median buy volume (typical buying strength).

-

Orange Line = Median sell volume (typical selling strength).