Heiken Ashi Smoothed Indicator

- Indicators

- Leonardo Daniel Isaia

- Version: 1.5

Heiken Ashi Smoothed Indicator for MT5

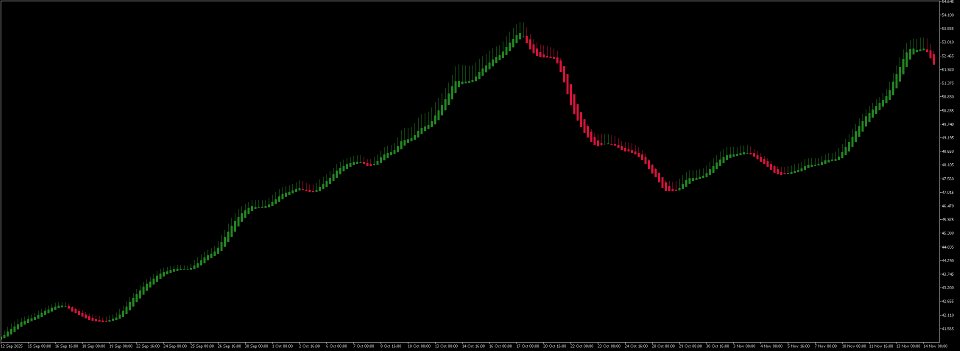

Advanced Heiken Ashi with smoothing filter. Reduces noise, eliminates false signals, and identifies trends early. Ideal for Forex, indices, stocks, and crypto on H1-D1.

How It Works and How It Is Smoothed

The traditional Heiken Ashi calculates candles by averaging open, close, high, and low values from previous periods, which already reduces the impact of minor fluctuations. However, the Heiken Ashi Smoothed takes this approach further by applying an additional smoothing filter to the "raw" prices. Instead of using direct prices, the indicator employs moving averages (such as EMA or SMA, configurable) to process the input data, generating candles that represent more stable and fluid trends.

This smoothing process is carried out in two stages:

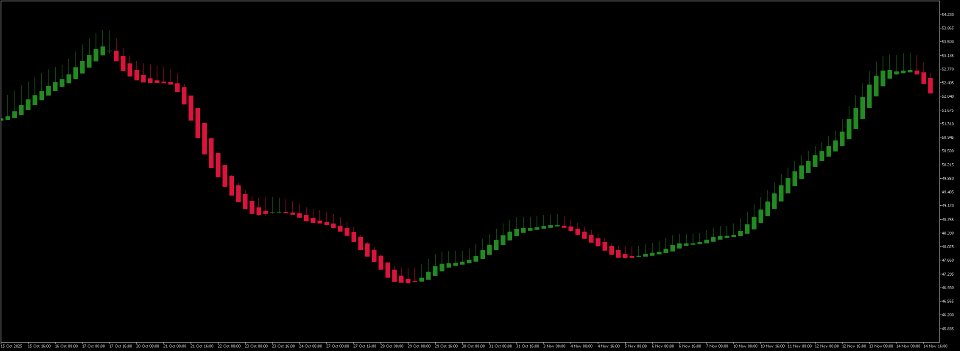

- Base Heiken Ashi Calculation: Prices are averaged to form initial candles, where bullish candles (generally green or white) indicate uptrends and bearish ones (red or black) indicate downtrends.

- Recursive Smoothing: A moving average is applied to the result, eliminating erratic peaks and creating a more linear representation of price movement. This minimizes the "noise" caused by temporary volatility, without introducing excessive lag, making it ideal for real-time analysis.

As a result, the smoothed candles behave similarly to a dynamic moving average: price above the candle indicates bullish strength, and below it, bearish. Crossovers with price generate clear entry or exit signals.

Key Advantages

This indicator stands out for its ability to improve trading accuracy, offering concrete benefits:

- Reduction of False Signals: By filtering market noise, it drastically reduces whipsaws (false movements), allowing a more disciplined focus on real trends.

- Early Trend Identification: Colored candles with reduced shadows highlight direction changes earlier than standard candles, facilitating trend-following strategies.

- Ease of Use: Visually intuitive, with customization options such as smoothing period, media type (EMA/SMA), and alerts for color changes or crosses.

- EA Compatibility: Accessible via iCustom for integration into trading robots, expanding its utility in automated systems.

- Less Emotional Stress: By smoothing volatility, it helps maintain calm in choppy markets, improving operational consistency.

Compared to the standard Heiken Ashi, the smoothed version offers controlled lag that balances sensitivity and reliability, ideal for intermediate and advanced traders.

What Types of Assets and Timeframes Is It Recommended For?

The Heiken Ashi Smoothed Indicator excels in assets with defined trends and moderate volatility, where smoothing maximizes its effectiveness:

- Forex: Perfect for major pairs like EUR/USD or GBP/USD, where intraday trends are common.

- Indices and Stocks: Useful in markets like the S&P 500 or high-liquidity stocks, to capture sustained rallies or declines.

- Commodities: Recommended for gold (XAU/USD) or oil, which exhibit strong directional movements but with occasional noise.

- Cryptocurrencies: Helps filter extreme volatility in BTC/USD or ETH/USD, focusing on macro trends.

It adapts best to medium and high timeframes, such as H1, H4, or D1, to avoid excess noise in low timeframes (M1-M15). For scalping, combine it with additional confirmations like RSI or ATR for greater precision.

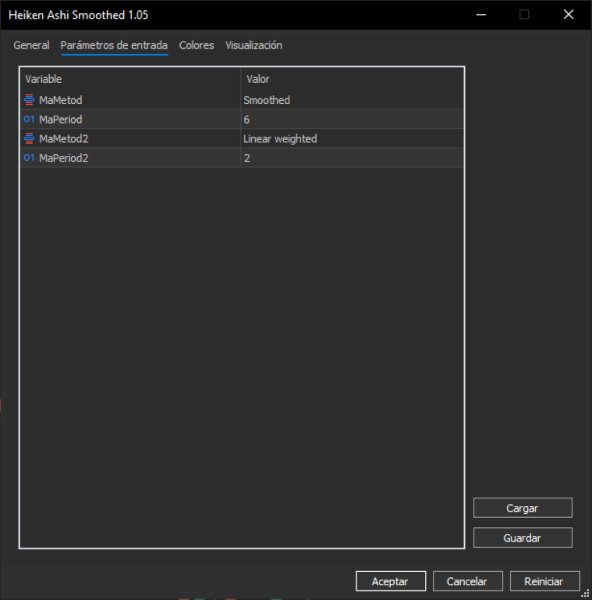

Installation and Configuration

- Download and install the indicator in MT5 from the MQL5 Market.

- Drag it to the desired chart.

- Adjust key parameters: Smoothing period (recommended 8-14 for balance), media type, and candle colors.