DCA Guardian

- Experts

- Yulia Azan Sabaeva

- Version: 1.0

- Activations: 6

EA 100% focused on GBPUSD on M15. DCA strategy with a basket of up to 5 orders, additions based on percentage deviation, and basket take-profit. Comes with two presets:

Funding (conservative): built to pass prop-firm challenges with low drawdown.

Turbo (aggressive): same algorithm with higher lot size and equity SL for those seeking speed while accepting higher risk.

✔️ No external indicators or news filters (pure price execution).

✔️ Equity SL as % of balance (hard risk cut).

✔️ Grid-less logic (no fixed grids on every tick; only adds when price deviates by X%).

✔️ Built exclusively for GBPUSD on M15.

What it does and how it works

Initial entry: opens a single order based on its internal price signal on GBPUSD M15.

Smart DCA: if price moves against the position, it adds up to a configurable maximum (Max. DCA orders) whenever the Price deviation (%) from the last entry is reached.

Position sizing: each new order can multiply the lot size (Lot multiplier) to speed up the basket exit.

Exit: closes the entire basket when the defined Profit target (%) for the set is hit, or triggers an equity Stop loss when the specified % of balance is reached (hard risk cut for the whole strategy).

Usage requirements: GBPUSD on M15. Not designed or supported for other symbols or timeframes.

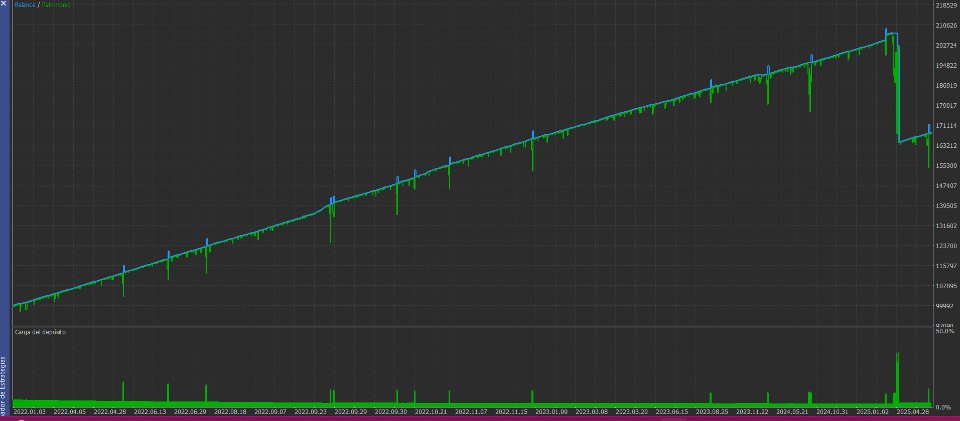

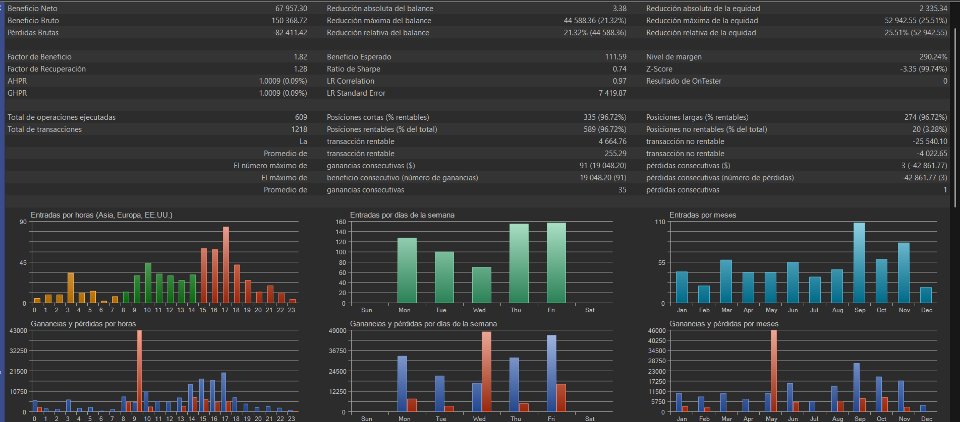

Results

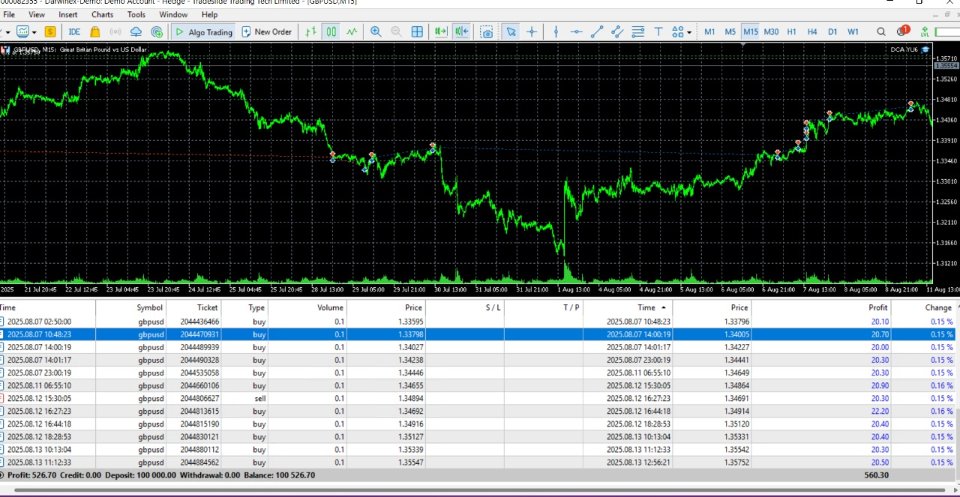

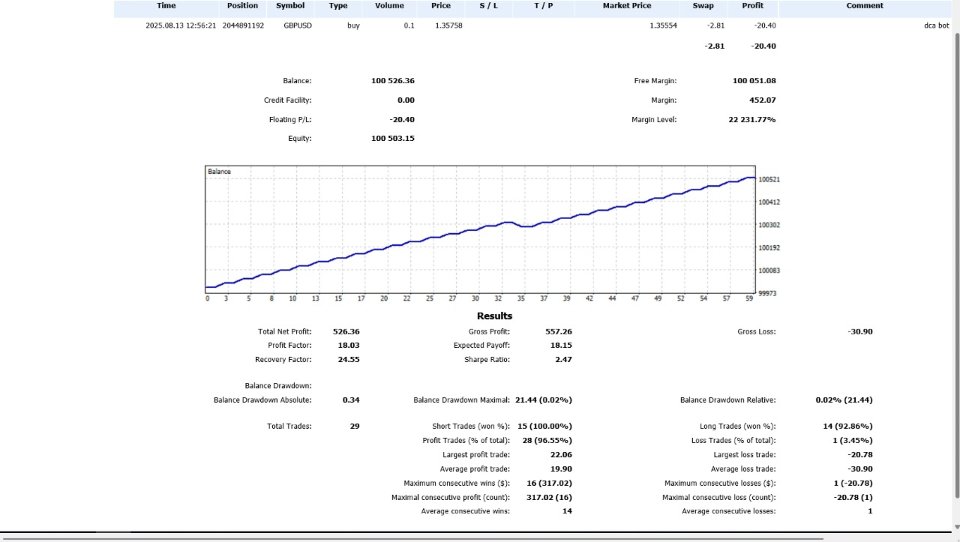

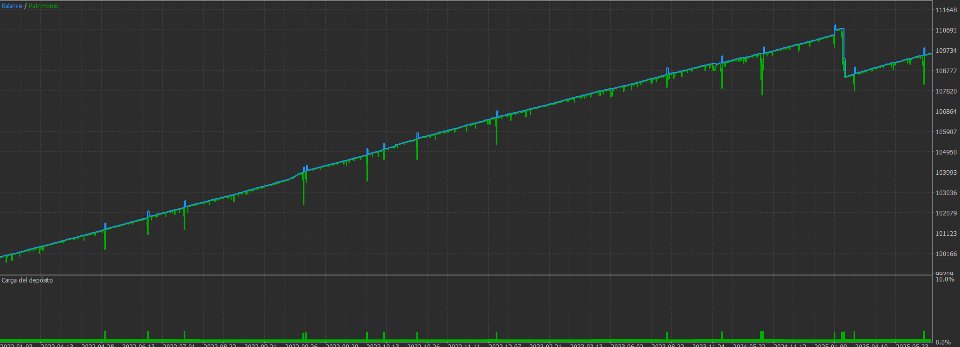

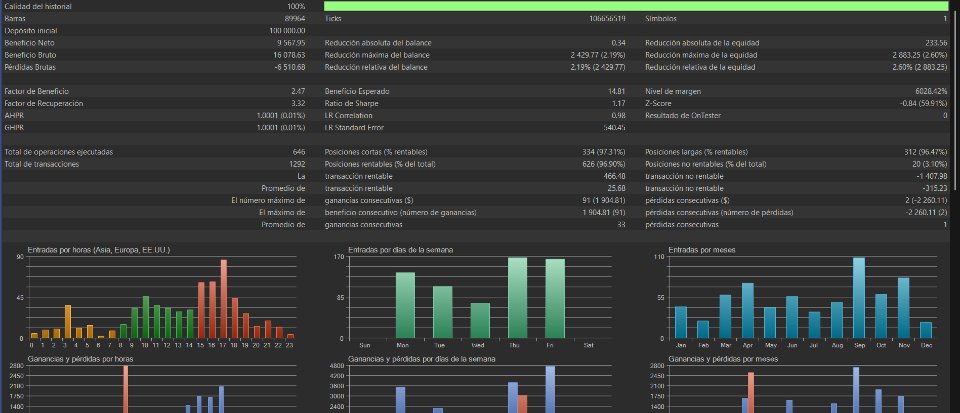

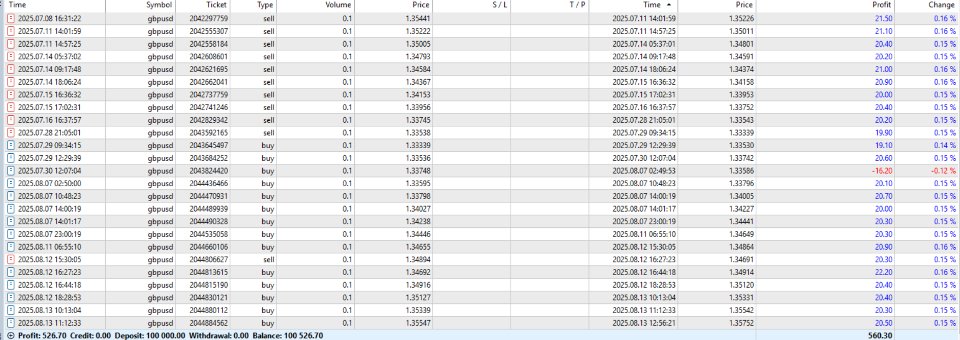

Live test (over 1 month, Darwinex Demo, GBPUSD M15):

Net profit: $526.36, Profit factor: 18.03, Expected payoff: 18.15, Sharpe: 2.47.

29 trades, 96.55% winners; largest loss per trade: −20.78; average profit per trade: 19.90.

Recommended presets

1) Funding (conservative, prop firms):

-

Symbol: GBPUSD — Timeframe: M15

-

Initial lot size: 0.10

-

Profit target (%): 4.5

-

Max. DCA orders: 5

-

Price deviation (%): 3.1

-

Stop loss (% of balance): 2

-

Lot multiplier: 3

2) Turbo (aggressive):

Same parameters except: Initial lot size = 1.0 and Stop loss (% of balance) = 20.

Both values appear in your input screenshots for both versions.

Parameters

-

Currency pair: Fixed to GBPUSD (not recommended outside this pair).

-

Timeframe in minutes: 15.

-

Initial lot size: lot size of the first order in the basket.

-

Profit target (%): basket-level take-profit.

-

Max. DCA orders: maximum counter-trend additions per basket (includes the initial order).

-

Price deviation (%): percentage move from the last entry to add a new DCA order.

-

Stop loss (% of balance): equity risk cut; once reached, positions are closed.

-

Lot multiplier: lot size multiplier for each new DCA order.

Recommendations

-

Broker/execution: ECN, low GBPUSD spread, no hedging restrictions (the account used in your tests is Hedge).

-

VPS: recommended to avoid disconnections.

-

News: since there’s no news filter, consider pausing during high-impact macro events if you want an even more conservative profile.

-

Risk: Stop loss (% of balance) is the key protection; align it with your tolerance and your prop-firm rules.

Quick setup

-

Attach the EA to GBPUSD M15.

-

Load the Funding or Turbo set (or replicate the values above).

-

Enable Algo Trading and verify the symbol and timeframe.

-

Let it run; the bot handles entries, DCA, and exits.

FAQ

Is it martingale?

It uses controlled lot multiplication (configurable) within a capped number of DCA orders and with an equity SL. It does not open infinite grids.

Does it work on other pairs or timeframes?

No. It’s designed and supported only for GBPUSD M15.

Is it suitable for prop-firm challenges?

The Funding preset is designed to reduce curve stress and help comply with typical rules. Even so, each firm has different rules—test in demo/Strategy Tester first.

Why do I sometimes see small clusters of entries?

That’s the DCA logic: when price moves away by the configured deviation %, it adds positions up to the limit and aims to close the basket at target or cut via equity SL.

Disclaimer

Past performance (backtests or demo) does not guarantee future results. This EA does not eliminate risk; use only capital you are willing to risk and parameters aligned with your profile.