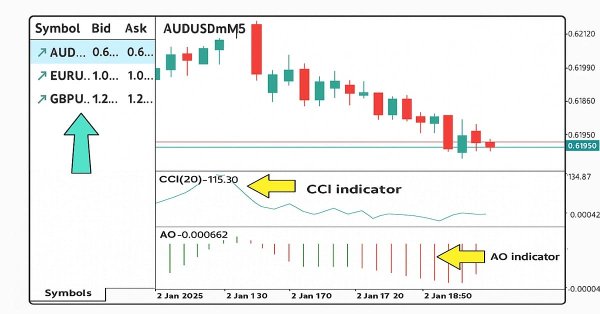

Automating Trading Strategies in MQL5 (Part 20): Multi-Symbol Strategy Using CCI and AO

In this article, we create a multi-symbol trading strategy using CCI and AO indicators to detect trend reversals. We cover its design, MQL5 implementation, and backtesting process. The article concludes with tips for performance improvement.

Fast trading strategy tester in Python using Numba

The article implements a fast strategy tester for machine learning models using Numba. It is 50 times faster than the pure Python strategy tester. The author recommends using this library to speed up mathematical calculations, especially the ones involving loops.

Developing Advanced ICT Trading Systems: Implementing Order Blocks in an Indicator

In this article, we will learn how to create an indicator that detects, draws, and alerts on the mitigation of order blocks. We will also take a detailed look at how to identify these blocks on the chart, set accurate alerts, and visualize their position using rectangles to better understand the price action. This indicator will serve as a key tool for traders who follow the Smart Money Concepts and the Inner Circle Trader methodology.

Installing MetaTrader 5 and Other MetaQuotes Apps on HarmonyOS NEXT

Easily install MetaTrader 5 and other MetaQuotes apps on HarmonyOS NEXT devices using DroiTong. A detailed step-by-step guide for your phone or laptop.

From Novice to Expert: Animated News Headline Using MQL5 (II)

Today, we take another step forward by integrating an external news API as the source of headlines for our News Headline EA. In this phase, we’ll explore various news sources—both established and emerging—and learn how to access their APIs effectively. We'll also cover methods for parsing the retrieved data into a format optimized for display within our Expert Advisor. Join the discussion as we explore the benefits of accessing news headlines and the economic calendar directly on the chart, all within a compact, non-intrusive interface.

Training a multilayer perceptron using the Levenberg-Marquardt algorithm

The article presents an implementation of the Levenberg-Marquardt algorithm for training feedforward neural networks. A comparative analysis of performance with algorithms from the scikit-learn Python library has been conducted. Simpler learning methods, such as gradient descent, gradient descent with momentum, and stochastic gradient descent are preliminarily discussed.

Creating a Trading Administrator Panel in MQL5 (Part XII): Integration of a Forex Values Calculator

Accurate calculation of key trading values is an indispensable part of every trader’s workflow. In this article, we will discuss, the integration of a powerful utility—the Forex Calculator—into the Trade Management Panel, further extending the functionality of our multi-panel Trading Administrator system. Efficiently determining risk, position size, and potential profit is essential when placing trades, and this new feature is designed to make that process faster and more intuitive within the panel. Join us as we explore the practical application of MQL5 in building advanced, trading panels.

MQL5 Wizard Techniques you should know (Part 69): Using Patterns of SAR and the RVI

The Parabolic-SAR (SAR) and the Relative Vigour Index (RVI) are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered in the past, is also complementary since SAR defines the trend while RVI checks momentum. As usual, we use the MQL5 wizard to build and test any potential this indicator pairing may have.

Automating Trading Strategies in MQL5 (Part 19): Envelopes Trend Bounce Scalping — Trade Execution and Risk Management (Part II)

In this article, we implement trade execution and risk management for the Envelopes Trend Bounce Scalping Strategy in MQL5. We implement order placement and risk controls like stop-loss and position sizing. We conclude with backtesting and optimization, building on Part 18’s foundation.

Introduction to MQL5 (Part 17): Building Expert Advisors for Trend Reversals

This article teaches beginners how to build an Expert Advisor (EA) in MQL5 that trades based on chart pattern recognition using trend line breakouts and reversals. By learning how to retrieve trend line values dynamically and compare them with price action, readers will be able to develop EAs capable of identifying and trading chart patterns such as ascending and descending trend lines, channels, wedges, triangles, and more.

MQL5 Trading Tools (Part 3): Building a Multi-Timeframe Scanner Dashboard for Strategic Trading

In this article, we build a multi-timeframe scanner dashboard in MQL5 to display real-time trading signals. We plan an interactive grid interface, implement signal calculations with multiple indicators, and add a close button. The article concludes with backtesting and strategic trading benefits

ALGLIB library optimization methods (Part I)

In this article, we will get acquainted with the ALGLIB library optimization methods for MQL5. The article includes simple and clear examples of using ALGLIB to solve optimization problems, which will make mastering the methods as accessible as possible. We will take a detailed look at the connection of such algorithms as BLEIC, L-BFGS and NS, and use them to solve a simple test problem.

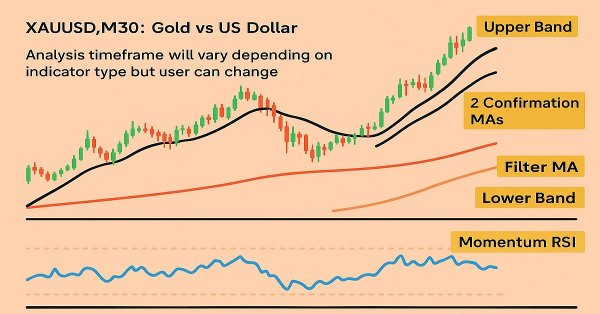

Automating Trading Strategies in MQL5 (Part 18): Envelopes Trend Bounce Scalping - Core Infrastructure and Signal Generation (Part I)

In this article, we build the core infrastructure for the Envelopes Trend Bounce Scalping Expert Advisor in MQL5. We initialize envelopes and other indicators for signal generation. We set up backtesting to prepare for trade execution in the next part.

MQL5 Wizard Techniques you should know (Part 67): Using Patterns of TRIX and the Williams Percent Range

The Triple Exponential Moving Average Oscillator (TRIX) and the Williams Percentage Range Oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered recently, is also complementary given that TRIX defines the trend while Williams Percent Range affirms support and Resistance levels. As always, we use the MQL5 wizard to prototype any potential these two may have.

Trading with the MQL5 Economic Calendar (Part 10): Draggable Dashboard and Interactive Hover Effects for Seamless News Navigation

In this article, we enhance the MQL5 Economic Calendar by introducing a draggable dashboard that allows us to reposition the interface for better chart visibility. We implement hover effects for buttons to improve interactivity and ensure seamless navigation with a dynamically positioned scrollbar.

Introduction to MQL5 (Part 16): Building Expert Advisors Using Technical Chart Patterns

This article introduces beginners to building an MQL5 Expert Advisor that identifies and trades a classic technical chart pattern — the Head and Shoulders. It covers how to detect the pattern using price action, draw it on the chart, set entry, stop loss, and take profit levels, and automate trade execution based on the pattern.

Trading with the MQL5 Economic Calendar (Part 9): Elevating News Interaction with a Dynamic Scrollbar and Polished Display

In this article, we enhance the MQL5 Economic Calendar with a dynamic scrollbar for intuitive news navigation. We ensure seamless event display and efficient updates. We validate the responsive scrollbar and polished dashboard through testing.

Trading with the MQL5 Economic Calendar (Part 8): Optimizing News-Driven Backtesting with Smart Event Filtering and Targeted Logs

In this article, we optimize our economic calendar with smart event filtering and targeted logging for faster, clearer backtesting in live and offline modes. We streamline event processing and focus logs on critical trade and dashboard events, enhancing strategy visualization. These improvements enable seamless testing and refinement of news-driven trading strategies.

Automating Trading Strategies in MQL5 (Part 17): Mastering the Grid-Mart Scalping Strategy with a Dynamic Dashboard

In this article, we explore the Grid-Mart Scalping Strategy, automating it in MQL5 with a dynamic dashboard for real-time trading insights. We detail its grid-based Martingale logic and risk management features. We also guide backtesting and deployment for robust performance.

African Buffalo Optimization (ABO)

The article presents the African Buffalo Optimization (ABO) algorithm, a metaheuristic approach developed in 2015 based on the unique behavior of these animals. The article describes in detail the stages of the algorithm implementation and its efficiency in finding solutions to complex problems, which makes it a valuable tool in the field of optimization.

MQL5 Trading Tools (Part 2): Enhancing the Interactive Trade Assistant with Dynamic Visual Feedback

In this article, we upgrade our Trade Assistant Tool by adding drag-and-drop panel functionality and hover effects to make the interface more intuitive and responsive. We refine the tool to validate real-time order setups, ensuring accurate trade configurations relative to market prices. We also backtest these enhancements to confirm their reliability.

Finding custom currency pair patterns in Python using MetaTrader 5

Are there any repeating patterns and regularities in the Forex market? I decided to create my own pattern analysis system using Python and MetaTrader 5. A kind of symbiosis of math and programming for conquering Forex.

High frequency arbitrage trading system in Python using MetaTrader 5

In this article, we will create an arbitration system that remains legal in the eyes of brokers, creates thousands of synthetic prices on the Forex market, analyzes them, and successfully trades for profit.

MQL5 Trading Tools (Part 1): Building an Interactive Visual Pending Orders Trade Assistant Tool

In this article, we introduce the development of an interactive Trade Assistant Tool in MQL5, designed to simplify placing pending orders in Forex trading. We outline the conceptual design, focusing on a user-friendly GUI for setting entry, stop-loss, and take-profit levels visually on the chart. Additionally, we detail the MQL5 implementation and backtesting process to ensure the tool’s reliability, setting the stage for advanced features in the preceding parts.

Artificial Showering Algorithm (ASHA)

The article presents the Artificial Showering Algorithm (ASHA), a new metaheuristic method developed for solving general optimization problems. Based on simulation of water flow and accumulation processes, this algorithm constructs the concept of an ideal field, in which each unit of resource (water) is called upon to find an optimal solution. We will find out how ASHA adapts flow and accumulation principles to efficiently allocate resources in a search space, and see its implementation and test results.

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

Creating Dynamic MQL5 Graphical Interfaces through Resource-Driven Image Scaling with Bicubic Interpolation on Trading Charts

In this article, we explore dynamic MQL5 graphical interfaces, using bicubic interpolation for high-quality image scaling on trading charts. We detail flexible positioning options, enabling dynamic centering or corner anchoring with custom offsets.

Building a Custom Market Regime Detection System in MQL5 (Part 2): Expert Advisor

This article details building an adaptive Expert Advisor (MarketRegimeEA) using the regime detector from Part 1. It automatically switches trading strategies and risk parameters for trending, ranging, or volatile markets. Practical optimization, transition handling, and a multi-timeframe indicator are included.

Automating Trading Strategies in MQL5 (Part 15): Price Action Harmonic Cypher Pattern with Visualization

In this article, we explore the automation of the Cypher harmonic pattern in MQL5, detailing its detection and visualization on MetaTrader 5 charts. We implement an Expert Advisor that identifies swing points, validates Fibonacci-based patterns, and executes trades with clear graphical annotations. The article concludes with guidance on backtesting and optimizing the program for effective trading.

Atmosphere Clouds Model Optimization (ACMO): Practice

In this article, we will continue diving into the implementation of the ACMO (Atmospheric Cloud Model Optimization) algorithm. In particular, we will discuss two key aspects: the movement of clouds into low-pressure regions and the rain simulation, including the initialization of droplets and their distribution among clouds. We will also look at other methods that play an important role in managing the state of clouds and ensuring their interaction with the environment.

Building a Custom Market Regime Detection System in MQL5 (Part 1): Indicator

This article details creating an MQL5 Market Regime Detection System using statistical methods like autocorrelation and volatility. It provides code for classes to classify trending, ranging, and volatile conditions and a custom indicator.

Trading with the MQL5 Economic Calendar (Part 7): Preparing for Strategy Testing with Resource-Based News Event Analysis

In this article, we prepare our MQL5 trading system for strategy testing by embedding economic calendar data as a resource for non-live analysis. We implement event loading and filtering for time, currency, and impact, then validate it in the Strategy Tester. This enables effective backtesting of news-driven strategies.

From Novice to Expert: Programming Candlesticks

In this article, we take the first step in MQL5 programming, even for complete beginners. We'll show you how to transform familiar candlestick patterns into a fully functional custom indicator. Candlestick patterns are valuable as they reflect real price action and signal market shifts. Instead of manually scanning charts—an approach prone to errors and inefficiencies—we'll discuss how to automate the process with an indicator that identifies and labels patterns for you. Along the way, we’ll explore key concepts like indexing, time series, Average True Range (for accuracy in varying market volatility), and the development of a custom reusable Candlestick Pattern library for use in future projects.

Integrating AI model into already existing MQL5 trading strategy

This topic focuses on incorporating a trained AI model (such as a reinforcement learning model like LSTM or a machine learning-based predictive model) into an existing MQL5 trading strategy.

Decoding Opening Range Breakout Intraday Trading Strategies

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Developing a multi-currency Expert Advisor (Part 18): Automating group selection considering forward period

Let's continue to automate the steps we previously performed manually. This time we will return to the automation of the second stage, that is, the selection of the optimal group of single instances of trading strategies, supplementing it with the ability to take into account the results of instances in the forward period.

Automating Trading Strategies in MQL5 (Part 14): Trade Layering Strategy with MACD-RSI Statistical Methods

In this article, we introduce a trade layering strategy that combines MACD and RSI indicators with statistical methods to automate dynamic trading in MQL5. We explore the architecture of this cascading approach, detail its implementation through key code segments, and guide readers on backtesting to optimize performance. Finally, we conclude by highlighting the strategy’s potential and setting the stage for further enhancements in automated trading.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (V): AnalyticsPanel Class

In this discussion, we explore how to retrieve real-time market data and trading account information, perform various calculations, and display the results on a custom panel. To achieve this, we will dive deeper into developing an AnalyticsPanel class that encapsulates all these features, including panel creation. This effort is part of our ongoing expansion of the New Admin Panel EA, introducing advanced functionalities using modular design principles and best practices for code organization.

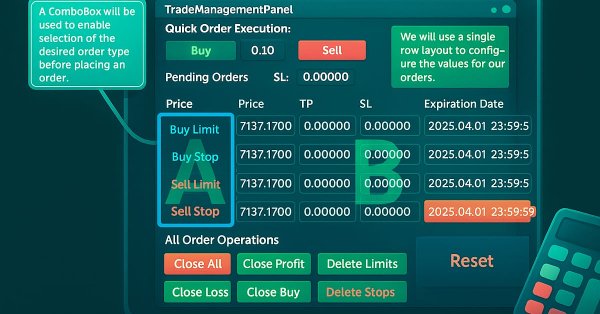

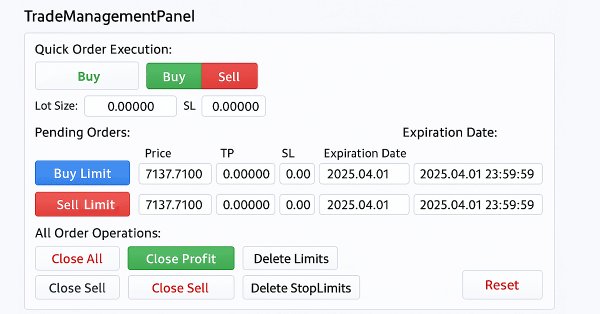

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (IV): Trade Management Panel class

This discussion covers the updated TradeManagementPanel in our New_Admin_Panel EA. The update enhances the panel by using built-in classes to offer a user-friendly trade management interface. It includes trading buttons for opening positions and controls for managing existing trades and pending orders. A key feature is the integrated risk management that allows setting stop loss and take profit values directly in the interface. This update improves code organization for large programs and simplifies access to order management tools, which are often complex in the terminal.

Advanced Memory Management and Optimization Techniques in MQL5

Discover practical techniques to optimize memory usage in MQL5 trading systems. Learn to build efficient, stable, and fast-performing Expert Advisors and indicators. We’ll explore how memory really works in MQL5, the common traps that slow your systems down or cause them to fail, and — most importantly — how to fix them.