Advanced Variables and Data Types in MQL5

Variables and data types are very important topics not only in MQL5 programming but also in any programming language. MQL5 variables and data types can be categorized as simple and advanced ones. In this article, we will identify and learn about advanced ones because we already mentioned simple ones in a previous article.

Introduction to MQL5 (Part 5): A Beginner's Guide to Array Functions in MQL5

Explore the world of MQL5 arrays in Part 5, designed for absolute beginners. Simplifying complex coding concepts, this article focuses on clarity and inclusivity. Join our community of learners, where questions are embraced, and knowledge is shared!

Developing a Replay System (Part 31): Expert Advisor project — C_Mouse class (V)

We need a timer that can show how much time is left till the end of the replay/simulation run. This may seem at first glance to be a simple and quick solution. Many simply try to adapt and use the same system that the trading server uses. But there's one thing that many people don't consider when thinking about this solution: with replay, and even m ore with simulation, the clock works differently. All this complicates the creation of such a system.

Deep Learning GRU model with Python to ONNX with EA, and GRU vs LSTM models

We will guide you through the entire process of DL with python to make a GRU ONNX model, culminating in the creation of an Expert Advisor (EA) designed for trading, and subsequently comparing GRU model with LSTM model.

Developing a Replay System (Part 28): Expert Advisor project — C_Mouse class (II)

When people started creating the first systems capable of computing, everything required the participation of engineers, who had to know the project very well. We are talking about the dawn of computer technology, a time when there were not even terminals for programming. As it developed and more people got interested in being able to create something, new ideas and ways of programming emerged which replaced the previous-style changing of connector positions. This is when the first terminals appeared.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Data Science and Machine Learning (Part 20): Algorithmic Trading Insights, A Faceoff Between LDA and PCA in MQL5

Uncover the secrets behind these powerful dimensionality reduction techniques as we dissect their applications within the MQL5 trading environment. Delve into the nuances of Linear Discriminant Analysis (LDA) and Principal Component Analysis (PCA), gaining a profound understanding of their impact on strategy development and market analysis.

Developing a Replay System — Market simulation (Part 25): Preparing for the next phase

In this article, we complete the first phase of developing our replay and simulation system. Dear reader, with this achievement I confirm that the system has reached an advanced level, paving the way for the introduction of new functionality. The goal is to enrich the system even further, turning it into a powerful tool for research and development of market analysis.

Developing a Replay System — Market simulation (Part 24): FOREX (V)

Today we will remove a limitation that has been preventing simulations based on the Last price and will introduce a new entry point specifically for this type of simulation. The entire operating mechanism will be based on the principles of the forex market. The main difference in this procedure is the separation of Bid and Last simulations. However, it is important to note that the methodology used to randomize the time and adjust it to be compatible with the C_Replay class remains identical in both simulations. This is good because changes in one mode lead to automatic improvements in the other, especially when it comes to handling time between ticks.

Benefiting from Forex market seasonality

We are all familiar with the concept of seasonality, for example, we are all accustomed to rising prices for fresh vegetables in winter or rising fuel prices during severe frosts, but few people know that similar patterns exist in the Forex market.

Developing a Replay System — Market simulation (Part 23): FOREX (IV)

Now the creation occurs at the same point where we converted ticks into bars. This way, if something goes wrong during the conversion process, we will immediately notice the error. This is because the same code that places 1-minute bars on the chart during fast forwarding is also used for the positioning system to place bars during normal performance. In other words, the code that is responsible for this task is not duplicated anywhere else. This way we get a much better system for both maintenance and improvement.

Developing a Replay System — Market simulation (Part 22): FOREX (III)

Although this is the third article on this topic, I must explain for those who have not yet understood the difference between the stock market and the foreign exchange market: the big difference is that in the Forex there is no, or rather, we are not given information about some points that actually occurred during the course of trading.

Developing a Replay System — Market simulation (Part 21): FOREX (II)

We will continue to build a system for working in the FOREX market. In order to solve this problem, we must first declare the loading of ticks before loading the previous bars. This solves the problem, but at the same time forces the user to follow some structure in the configuration file, which, personally, does not make much sense to me. The reason is that by designing a program that is responsible for analyzing and executing what is in the configuration file, we can allow the user to declare the elements he needs in any order.

Building and testing Keltner Channel trading systems

In this article, we will try to provide trading systems using a very important concept in the financial market which is volatility. We will provide a trading system based on the Keltner Channel indicator after understanding it and how we can code it and how we can create a trading system based on a simple trading strategy and then test it on different assets.

Pair trading

In this article, we will consider pair trading, namely what its principles are and if there are any prospects for its practical application. We will also try to create a pair trading strategy.

Data Science and Machine Learning (Part 19): Supercharge Your AI models with AdaBoost

AdaBoost, a powerful boosting algorithm designed to elevate the performance of your AI models. AdaBoost, short for Adaptive Boosting, is a sophisticated ensemble learning technique that seamlessly integrates weak learners, enhancing their collective predictive strength.

ALGLIB numerical analysis library in MQL5

The article takes a quick look at the ALGLIB 3.19 numerical analysis library, its applications and new algorithms that can improve the efficiency of financial data analysis.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 6): Two RSI indicators cross each other's lines

The multi-currency expert advisor in this article is an expert advisor or trading robot that uses two RSI indicators with crossing lines, the Fast RSI which crosses with the Slow RSI.

Building and testing Aroon Trading Systems

In this article, we will learn how we can build an Aroon trading system after learning the basics of the indicators and the needed steps to build a trading system based on the Aroon indicator. After building this trading system, we will test it to see if it can be profitable or needs more optimization.

Algorithmic Trading With MetaTrader 5 And R For Beginners

Embark on a compelling exploration where financial analysis meets algorithmic trading as we unravel the art of seamlessly uniting R and MetaTrader 5. This article is your guide to bridging the realms of analytical finesse in R with the formidable trading capabilities of MetaTrader 5.

Data Science and Machine Learning (Part 18): The battle of Mastering Market Complexity, Truncated SVD Versus NMF

Truncated Singular Value Decomposition (SVD) and Non-Negative Matrix Factorization (NMF) are dimensionality reduction techniques. They both play significant roles in shaping data-driven trading strategies. Discover the art of dimensionality reduction, unraveling insights, and optimizing quantitative analyses for an informed approach to navigating the intricacies of financial markets.

Introduction to MQL5 (Part 2): Navigating Predefined Variables, Common Functions, and Control Flow Statements

Embark on an illuminating journey with Part Two of our MQL5 series. These articles are not just tutorials, they're doorways to an enchanted realm where programming novices and wizards alike unite. What makes this journey truly magical? Part Two of our MQL5 series stands out with its refreshing simplicity, making complex concepts accessible to all. Engage with us interactively as we answer your questions, ensuring an enriching and personalized learning experience. Let's build a community where understanding MQL5 is an adventure for everyone. Welcome to the enchantment!

Design Patterns in software development and MQL5 (Part 4): Behavioral Patterns 2

In this article, we will complete our series about the Design Patterns topic, we mentioned that there are three types of design patterns creational, structural, and behavioral. We will complete the remaining patterns of the behavioral type which can help set the method of interaction between objects in a way that makes our code clean.

Data Science and Machine Learning (Part 17): Money in the Trees? The Art and Science of Random Forests in Forex Trading

Discover the secrets of algorithmic alchemy as we guide you through the blend of artistry and precision in decoding financial landscapes. Unearth how Random Forests transform data into predictive prowess, offering a unique perspective on navigating the complex terrain of stock markets. Join us on this journey into the heart of financial wizardry, where we demystify the role of Random Forests in shaping market destiny and unlocking the doors to lucrative opportunities

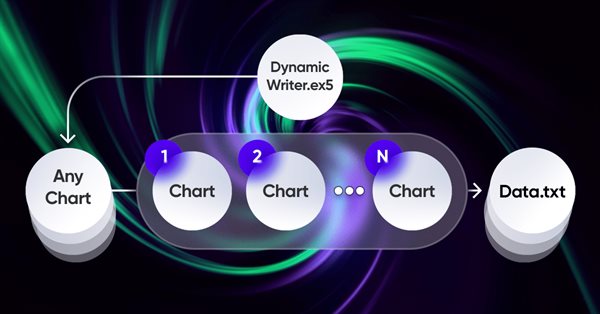

Brute force approach to patterns search (Part VI): Cyclic optimization

In this article I will show the first part of the improvements that allowed me not only to close the entire automation chain for MetaTrader 4 and 5 trading, but also to do something much more interesting. From now on, this solution allows me to fully automate both creating EAs and optimization, as well as to minimize labor costs for finding effective trading configurations.

Developing a Replay System — Market simulation (Part 20): FOREX (I)

The initial goal of this article is not to cover all the possibilities of Forex trading, but rather to adapt the system so that you can perform at least one market replay. We'll leave simulation for another moment. However, if we don't have ticks and only bars, with a little effort we can simulate possible trades that could happen in the Forex market. This will be the case until we look at how to adapt the simulator. An attempt to work with Forex data inside the system without modifying it leads to a range of errors.

Data Science and Machine Learning (Part 16): A Refreshing Look at Decision Trees

Dive into the intricate world of decision trees in the latest installment of our Data Science and Machine Learning series. Tailored for traders seeking strategic insights, this article serves as a comprehensive recap, shedding light on the powerful role decision trees play in the analysis of market trends. Explore the roots and branches of these algorithmic trees, unlocking their potential to enhance your trading decisions. Join us for a refreshing perspective on decision trees and discover how they can be your allies in navigating the complexities of financial markets.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 5): Bollinger Bands On Keltner Channel — Indicators Signal

The Multi-Currency Expert Advisor in this article is an Expert Advisor or Trading Robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair from only one symbol chart. In this article we will use signals from two indicators, in this case Bollinger Bands® on Keltner Channel.

Developing a Replay System — Market simulation (Part 19): Necessary adjustments

Here we will prepare the ground so that if we need to add new functions to the code, this will happen smoothly and easily. The current code cannot yet cover or handle some of the things that will be necessary to make meaningful progress. We need everything to be structured in order to enable the implementation of certain things with the minimal effort. If we do everything correctly, we can get a truly universal system that can very easily adapt to any situation that needs to be handled.

Design Patterns in software development and MQL5 (Part 3): Behavioral Patterns 1

A new article from Design Patterns articles and we will take a look at one of its types which is behavioral patterns to understand how we can build communication methods between created objects effectively. By completing these Behavior patterns we will be able to understand how we can create and build a reusable, extendable, tested software.

Data label for time series mining (Part 4):Interpretability Decomposition Using Label Data

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Market Reactions and Trading Strategies in Response to Dividend Announcements: Evaluating the Efficient Market Hypothesis in Stock Trading

In this article, we will analyse the impact of dividend announcements on stock market returns and see how investors can earn more returns than those offered by the market when they expect a company to announce dividends. In doing so, we will also check the validity of the Efficient Market Hypothesis in the context of the Indian Stock Market.

Developing a Replay System — Market simulation (Part 16): New class system

We need to organize our work better. The code is growing, and if this is not done now, then it will become impossible. Let's divide and conquer. MQL5 allows the use of classes which will assist in implementing this task, but for this we need to have some knowledge about classes. Probably the thing that confuses beginners the most is inheritance. In this article, we will look at how to use these mechanisms in a practical and simple way.

Developing a Replay System — Market simulation (Part 15): Birth of the SIMULATOR (V) - RANDOM WALK

In this article we will complete the development of a simulator for our system. The main goal here will be to configure the algorithm discussed in the previous article. This algorithm aims to create a RANDOM WALK movement. Therefore, to understand today's material, it is necessary to understand the content of previous articles. If you have not followed the development of the simulator, I advise you to read this sequence from the very beginning. Otherwise, you may get confused about what will be explained here.

Developing a Replay System — Market simulation (Part 14): Birth of the SIMULATOR (IV)

In this article we will continue the simulator development stage. this time we will see how to effectively create a RANDOM WALK type movement. This type of movement is very intriguing because it forms the basis of everything that happens in the capital market. In addition, we will begin to understand some concepts that are fundamental to those conducting market analysis.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 4): Triangular moving average — Indicator Signals

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Triangular moving average in multi-timeframes or single timeframe.

Design Patterns in software development and MQL5 (Part 2): Structural Patterns

In this article, we will continue our articles about Design Patterns after learning how much this topic is more important for us as developers to develop extendable, reliable applications not only by the MQL5 programming language but others as well. We will learn about another type of Design Patterns which is the structural one to learn how to design systems by using what we have as classes to form larger structures.

Developing a Replay System — Market simulation (Part 13): Birth of the SIMULATOR (III)

Here we will simplify a few elements related to the work in the next article. I'll also explain how you can visualize what the simulator generates in terms of randomness.

Brute force approach to patterns search (Part V): Fresh angle

In this article, I will show a completely different approach to algorithmic trading I ended up with after quite a long time. Of course, all this has to do with my brute force program, which has undergone a number of changes that allow it to solve several problems simultaneously. Nevertheless, the article has turned out to be more general and as simple as possible, which is why it is also suitable for those who know nothing about brute force.

The price movement model and its main provisions. (Part 3): Calculating optimal parameters of stock exchange speculations

Within the framework of the engineering approach developed by the author based on the probability theory, the conditions for opening a profitable position are found and the optimal (profit-maximizing) take profit and stop loss values are calculated.