Implementing a Bollinger Bands Trading Strategy with MQL5: A Step-by-Step Guide

A step-by-step guide to implementing an automated trading algorithm in MQL5 based on the Bollinger Bands trading strategy. A detailed tutorial based on creating an Expert Advisor that can be useful for traders.

Risk manager for manual trading

In this article we will discuss in detail how to write a risk manager class for manual trading from scratch. This class can also be used as a base class for inheritance by algorithmic traders who use automated programs.

Data Science and ML (Part 28): Predicting Multiple Futures for EURUSD, Using AI

It is a common practice for many Artificial Intelligence models to predict a single future value. However, in this article, we will delve into the powerful technique of using machine learning models to predict multiple future values. This approach, known as multistep forecasting, allows us to predict not only tomorrow's closing price but also the day after tomorrow's and beyond. By mastering multistep forecasting, traders and data scientists can gain deeper insights and make more informed decisions, significantly enhancing their predictive capabilities and strategic planning.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.

Building A Candlestick Trend Constraint Model (Part 7): Refining our model for EA development

In this article, we will delve into the detailed preparation of our indicator for Expert Advisor (EA) development. Our discussion will encompass further refinements to the current version of the indicator to enhance its accuracy and functionality. Additionally, we will introduce new features that mark exit points, addressing a limitation of the previous version, which only identified entry points.

Introduction to MQL5 (Part 8): Beginner's Guide to Building Expert Advisors (II)

This article addresses common beginner questions from MQL5 forums and demonstrates practical solutions. Learn to perform essential tasks like buying and selling, obtaining candlestick prices, and managing automated trading aspects such as trade limits, trading periods, and profit/loss thresholds. Get step-by-step guidance to enhance your understanding and implementation of these concepts in MQL5.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Cascade Order Trading Strategy Based on EMA Crossovers for MetaTrader 5

The article guides in demonstrating an automated algorithm based on EMA Crossovers for MetaTrader 5. Detailed information on all aspects of demonstrating an Expert Advisor in MQL5 and testing it in MetaTrader 5 - from analyzing price range behaviors to risk management.

Creating an Interactive Graphical User Interface in MQL5 (Part 2): Adding Controls and Responsiveness

Enhancing the MQL5 GUI panel with dynamic features can significantly improve the trading experience for users. By incorporating interactive elements, hover effects, and real-time data updates, the panel becomes a powerful tool for modern traders.

Using PatchTST Machine Learning Algorithm for Predicting Next 24 Hours of Price Action

In this article, we apply a relatively complex neural network algorithm released in 2023 called PatchTST for predicting the price action for the next 24 hours. We will use the official repository, make slight modifications, train a model for EURUSD, and apply it to making future predictions both in Python and MQL5.

Creating a Daily Drawdown Limiter EA in MQL5

The article discusses, from a detailed perspective, how to implement the creation of an Expert Advisor (EA) based on the trading algorithm. This helps to automate the system in the MQL5 and take control of the Daily Drawdown.

Creating an Interactive Graphical User Interface in MQL5 (Part 1): Making the Panel

This article explores the fundamental steps in crafting and implementing a Graphical User Interface (GUI) panel using MetaQuotes Language 5 (MQL5). Custom utility panels enhance user interaction in trading by simplifying common tasks and visualizing essential trading information. By creating custom panels, traders can streamline their workflow and save time during trading operations.

Developing Zone Recovery Martingale strategy in MQL5

The article discusses, in a detailed perspective, the steps that need to be implemented towards the creation of an expert advisor based on the Zone Recovery trading algorithm. This helps aotomate the system saving time for algotraders.

Mastering Market Dynamics: Creating a Support and Resistance Strategy Expert Advisor (EA)

A comprehensive guide to developing an automated trading algorithm based on the Support and Resistance strategy. Detailed information on all aspects of creating an expert advisor in MQL5 and testing it in MetaTrader 5 – from analyzing price range behaviors to risk management.

Creating Time Series Predictions using LSTM Neural Networks: Normalizing Price and Tokenizing Time

This article outlines a simple strategy for normalizing the market data using the daily range and training a neural network to enhance market predictions. The developed models may be used in conjunction with an existing technical analysis frameworks or on a standalone basis to assist in predicting the overall market direction. The framework outlined in this article may be further refined by any technical analyst to develop models suitable for both manual and automated trading strategies.

Building A Candlestick Trend Constraint Model (Part 5): Notification System (Part II)

Today, we are discussing a working Telegram integration for MetaTrader 5 Indicator notifications using the power of MQL5, in partnership with Python and the Telegram Bot API. We will explain everything in detail so that no one misses any point. By the end of this project, you will have gained valuable insights to apply in your projects.

Integrate Your Own LLM into EA (Part 4): Training Your Own LLM with GPU

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Data Science and Machine Learning (Part 24): Forex Time series Forecasting Using Regular AI Models

In the forex markets It is very challenging to predict the future trend without having an idea of the past. Very few machine learning models are capable of making the future predictions by considering past values. In this article, we are going to discuss how we can use classical(Non-time series) Artificial Intelligence models to beat the market

MQL5 Wizard Techniques you should know (Part 23): CNNs

Convolutional Neural Networks are another machine learning algorithm that tend to specialize in decomposing multi-dimensioned data sets into key constituent parts. We look at how this is typically achieved and explore a possible application for traders in another MQL5 wizard signal class.

Developing a multi-currency Expert Advisor (Part 3): Architecture revision

We have already made some progress in developing a multi-currency EA with several strategies working in parallel. Considering the accumulated experience, let's review the architecture of our solution and try to improve it before we go too far ahead.

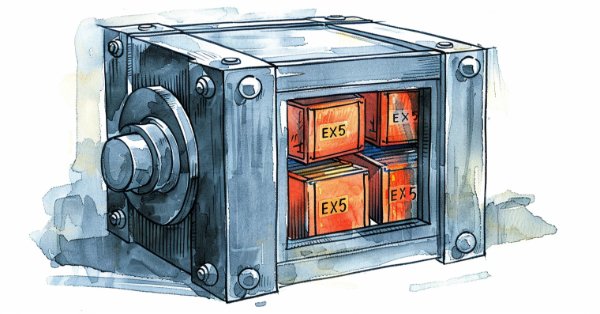

MQL5 Trading Toolkit (Part 1): Developing A Positions Management EX5 Library

Learn how to create a developer's toolkit for managing various position operations with MQL5. In this article, I will demonstrate how to create a library of functions (ex5) that will perform simple to advanced position management operations, including automatic handling and reporting of the different errors that arise when dealing with position management tasks with MQL5.

A Step-by-Step Guide on Trading the Break of Structure (BoS) Strategy

A comprehensive guide to developing an automated trading algorithm based on the Break of Structure (BoS) strategy. Detailed information on all aspects of creating an advisor in MQL5 and testing it in MetaTrader 5 — from analyzing price support and resistance to risk management

Balancing risk when trading multiple instruments simultaneously

This article will allow a beginner to write an implementation of a script from scratch for balancing risks when trading multiple instruments simultaneously. Besides, it may give experienced users new ideas for implementing their solutions in relation to the options proposed in this article.

Using optimization algorithms to configure EA parameters on the fly

The article discusses the practical aspects of using optimization algorithms to find the best EA parameters on the fly, as well as virtualization of trading operations and EA logic. The article can be used as an instruction for implementing optimization algorithms into an EA.

Developing a multi-currency Expert Advisor (Part 2): Transition to virtual positions of trading strategies

Let's continue developing a multi-currency EA with several strategies working in parallel. Let's try to move all the work associated with opening market positions from the strategy level to the level of the EA managing the strategies. The strategies themselves will trade only virtually, without opening market positions.

Trailing stop in trading

In this article, we will look at the use of a trailing stop in trading. We will assess how useful and effective it is, and how it can be used. The efficiency of a trailing stop largely depends on price volatility and the selection of the stop loss level. A variety of approaches can be used to set a stop loss.

Building A Candlestick Trend Constraint Model(Part 3): Detecting changes in trends while using this system

This article explores how economic news releases, investor behavior, and various factors can influence market trend reversals. It includes a video explanation and proceeds by incorporating MQL5 code into our program to detect trend reversals, alert us, and take appropriate actions based on market conditions. This builds upon previous articles in the series.

Developing a multi-currency Expert Advisor (Part 1): Collaboration of several trading strategies

There are quite a lot of different trading strategies. So, it might be useful to apply several strategies working in parallel to diversify risks and increase the stability of trading results. But if each strategy is implemented as a separate Expert Advisor (EA), then managing their work on one trading account becomes much more difficult. To solve this problem, it would be reasonable to implement the operation of different trading strategies within a single EA.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Triangular arbitrage with predictions

This article simplifies triangular arbitrage, showing you how to use predictions and specialized software to trade currencies smarter, even if you're new to the market. Ready to trade with expertise?

Building A Candlestick Trend Constraint Model(Part 2): Merging Native Indicators

This article focuses on taking advantage of in-built meta trader 5 indicators to screen out off-trend signals. Advancing from the previous article we will explore how to do it using MQL5 code to communicate our idea to the final program.

Introduction to MQL5 (Part 7): Beginner's Guide to Building Expert Advisors and Utilizing AI-Generated Code in MQL5

Discover the ultimate beginner's guide to building Expert Advisors (EAs) with MQL5 in our comprehensive article. Learn step-by-step how to construct EAs using pseudocode and harness the power of AI-generated code. Whether you're new to algorithmic trading or seeking to enhance your skills, this guide provides a clear path to creating effective EAs.

Custom Indicators (Part 1): A Step-by-Step Introductory Guide to Developing Simple Custom Indicators in MQL5

Learn how to create custom indicators using MQL5. This introductory article will guide you through the fundamentals of building simple custom indicators and demonstrate a hands-on approach to coding different custom indicators for any MQL5 programmer new to this interesting topic.

How to build and optimize a volatility-based trading system (Chaikin Volatility - CHV)

In this article, we will provide another volatility-based indicator named Chaikin Volatility. We will understand how to build a custom indicator after identifying how it can be used and constructed. We will share some simple strategies that can be used and then test them to understand which one can be better.

Building A Candlestick Trend Constraint Model (Part 1): For EAs And Technical Indicators

This article is aimed at beginners and pro-MQL5 developers. It provides a piece of code to define and constrain signal-generating indicators to trends in higher timeframes. In this way, traders can enhance their strategies by incorporating a broader market perspective, leading to potentially more robust and reliable trading signals.

Creating a market making algorithm in MQL5

How do market makers work? Let's consider this issue and create a primitive market-making algorithm.

Introduction to MQL5 (Part 6): A Beginner's Guide to Array Functions in MQL5 (II)

Embark on the next phase of our MQL5 journey. In this insightful and beginner-friendly article, we'll look into the remaining array functions, demystifying complex concepts to empower you to craft efficient trading strategies. We’ll be discussing ArrayPrint, ArrayInsert, ArraySize, ArrayRange, ArrarRemove, ArraySwap, ArrayReverse, and ArraySort. Elevate your algorithmic trading expertise with these essential array functions. Join us on the path to MQL5 mastery!

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 7): ZigZag with Awesome Oscillator Indicators Signal

The multi-currency expert advisor in this article is an expert advisor or automated trading that uses ZigZag indicator which are filtered with the Awesome Oscillator or filter each other's signals.