Multibot in MetaTrader: Launching multiple robots from a single chart

In this article, I will consider a simple template for creating a universal MetaTrader robot that can be used on multiple charts while being attached to only one chart, without the need to configure each instance of the robot on each individual chart.

Modeling time series using custom symbols according to specified distribution laws

The article provides an overview of the terminal's capabilities for creating and working with custom symbols, offers options for simulating a trading history using custom symbols, trend and various chart patterns.

The correct way to choose an Expert Advisor from the Market

In this article, we will consider some of the essential points you should pay attention to when purchasing an Expert Advisor. We will also look for ways to increase profit, to spend money wisely, and to earn from this spending. Also, after reading the article, you will see that it is possible to earn even using simple and free products.

How Not to Fall into Optimization Traps?

The article describes the methods of how to understand the tester optimization results better. It also gives some tips that help to avoid "harmful optimization".

MQL5 Cookbook: The History of Deals And Function Library for Getting Position Properties

It is time to briefly summarize the information provided in the previous articles on position properties. In this article, we will create a few additional functions to get the properties that can only be obtained after accessing the history of deals. We will also get familiar with data structures that will allow us to access position and symbol properties in a more convenient way.

LifeHack for Traders: Indicators of Balance, Drawdown, Load and Ticks during Testing

How to make the testing process more visual? The answer is simple: you need to use one or more indicators in the Strategy Tester, including a tick indicator, an indicator of balance and equity, an indicator of drawdown and deposit load. This solution will help you visually track the nature of ticks, balance and equity changes, as well as drawdown and deposit load.

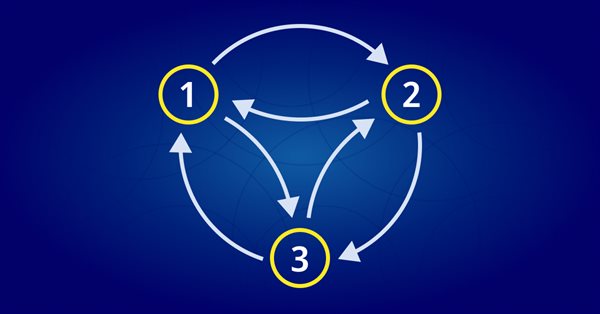

MQL5 Cookbook: Developing a Framework for a Trading System Based on the Triple Screen Strategy

In this article, we will develop a framework for a trading system based on the Triple Screen strategy in MQL5. The Expert Advisor will not be developed from scratch. Instead, we will simply modify the program from the previous article "MQL5 Cookbook: Using Indicators to Set Trading Conditions in Expert Advisors" which already substantially serves our purpose. So the article will also demonstrate how you can easily modify patterns of ready-made programs.

Testing of Expert Advisors in the MetaTrader 4 Client Terminal: An Outward Glance

What happens after you have clicked on the "Start" button? The article answers this and many other questions.

MQL5 Cookbook: Writing the History of Deals to a File and Creating Balance Charts for Each Symbol in Excel

When communicating in various forums, I often used examples of my test results displayed as screenshots of Microsoft Excel charts. I have many times been asked to explain how such charts can be created. Finally, I now have some time to explain it all in this article.

Testing Expert Advisors on Non-Standard Time Frames

It's not just simple; it's super simple. Testing Expert Advisors on non-standard time frames is possible! All we need to do is to replace standard time frame data with non-standard time frame data. Furthermore, we can even test Expert Advisors that use data from several non-standard time frames.

Using the TesterWithdrawal() Function for Modeling the Withdrawals of Profit

This article describes the usage of the TesterWithDrawal() function for estimating risks in trade systems which imply the withdrawing of a certain part of assets during their operation. In addition, it describes the effect of this function on the algorithm of calculation of the drawdown of equity in the strategy tester. This function is useful when optimizing parameter of your Expert Advisors.

LifeHack for trader: four backtests are better than one

Before the first single test, every trader faces the same question — "Which of the four modes to use?" Each of the provided modes has its advantages and features, so we will do it the easy way - run all four modes at once with a single button! The article shows how to use the Win API and a little magic to see all four testing chart at the same time.

Visualizing trading strategy optimization in MetaTrader 5

The article implements an MQL application with a graphical interface for extended visualization of the optimization process. The graphical interface applies the last version of EasyAndFast library. Many users may ask why they need graphical interfaces in MQL applications. This article demonstrates one of multiple cases where they can be useful for traders.

MQL5 Cookbook: Developing a Multi-Currency Expert Advisor with Unlimited Number of Parameters

In this article, we will create a pattern that uses a single set of parameters for optimization of a trading system, while allowing for unlimited number of parameters. The list of symbols will be created in a standard text file (*.txt). Input parameters for each symbol will also be stored in files. This way we will be able to circumvent the restriction of the terminal on the number of input parameters of an Expert Advisor.

Modified Grid-Hedge EA in MQL5 (Part II): Making a Simple Grid EA

In this article, we explored the classic grid strategy, detailing its automation using an Expert Advisor in MQL5 and analyzing initial backtest results. We highlighted the strategy's need for high holding capacity and outlined plans for optimizing key parameters like distance, takeProfit, and lot sizes in future installments. The series aims to enhance trading strategy efficiency and adaptability to different market conditions.

Introduction to MQL5 (Part 1): A Beginner's Guide into Algorithmic Trading

Dive into the fascinating realm of algorithmic trading with our beginner-friendly guide to MQL5 programming. Discover the essentials of MQL5, the language powering MetaTrader 5, as we demystify the world of automated trading. From understanding the basics to taking your first steps in coding, this article is your key to unlocking the potential of algorithmic trading even without a programming background. Join us on a journey where simplicity meets sophistication in the exciting universe of MQL5.

Gradient Boosting (CatBoost) in the development of trading systems. A naive approach

Training the CatBoost classifier in Python and exporting the model to mql5, as well as parsing the model parameters and a custom strategy tester. The Python language and the MetaTrader 5 library are used for preparing the data and for training the model.

Tester in the Terminal MetaTrader 4: It Should Be Known

The elaborate interface of the terminal MetaTrader 4 is a forefront, but beside this the terminal includes a deep-laid tester of strategies. And while the worth of MetaTrader 4 as a trading terminal is obvious, the quality of the tester's strategy testing can be assessed only in practice. This article shows the advantages and conveniences of testing in MetaTrader 4.

Continuous Walk-Forward Optimization (Part 6): Auto optimizer's logical part and structure

We have previously considered the creation of automatic walk-forward optimization. This time, we will proceed to the internal structure of the auto optimizer tool. The article will be useful for all those who wish to further work with the created project and to modify it, as well as for those who wish to understand the program logic. The current article contains UML diagrams which present the internal structure of the project and the relationships between objects. It also describes the process of optimization start, but it does not contain the description of the optimizer implementation process.

Separate optimization of a strategy on trend and flat conditions

The article considers applying the separate optimization method during various market conditions. Separate optimization means defining trading system's optimal parameters by optimizing for an uptrend and downtrend separately. To reduce the effect of false signals and improve profitability, the systems are made flexible, meaning they have some specific set of settings or input data, which is justified because the market behavior is constantly changing.

Brute force approach to pattern search (Part IV): Minimal functionality

The article presents an improved brute force version, based on the goals set in the previous article. I will try to cover this topic as broadly as possible using Expert Advisors with settings obtained using this method. A new program version is attached to this article.

Brute force approach to pattern search

In this article, we will search for market patterns, create Expert Advisors based on the identified patterns, and check how long these patterns remain valid, if they ever retain their validity.

Experiments with neural networks (Part 1): Revisiting geometry

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders.

An Example of Developing a Spread Strategy for Moscow Exchange Futures

The MetaTrader 5 platform allows developing and testing trading robots that simultaneously trade multiple financial instruments. The built-in Strategy Tester automatically downloads required tick history from the broker's server taking into account contract specifications, so the developer does not need to do anything manually. This makes it possible to easily and reliably reproduce trading environment conditions, including even millisecond intervals between the arrival of ticks on different symbols. In this article we will demonstrate the development and testing of a spread strategy on two Moscow Exchange futures.

Practical Use of Kohonen Neural Networks in Algorithmic Trading. Part II. Optimizing and forecasting

Based on universal tools designed for working with Kohonen networks, we construct the system of analyzing and selecting the optimal EA parameters and consider forecasting time series. In Part I, we corrected and improved the publicly available neural network classes, having added necessary algorithms. Now, it is time to apply them to practice.

MQL5 Cookbook: Analyzing Position Properties in the MetaTrader 5 Strategy Tester

We will present a modified version of the Expert Advisor from the previous article "MQL5 Cookbook: Position Properties on the Custom Info Panel". Some of the issues we will address include getting data from bars, checking for new bar events on the current symbol, including a trade class of the Standard Library to a file, creating a function to search for trading signals and a function for executing trading operations, as well as determining trade events in the OnTrade() function.

Brute force approach to pattern search (Part III): New horizons

This article provides a continuation to the brute force topic, and it introduces new opportunities for market analysis into the program algorithm, thereby accelerating the speed of analysis and improving the quality of results. New additions enable the highest-quality view of global patterns within this approach.

How To Implement Your Own Optimization Criteria

In this article an example of optimization by profit/drawdown criterion with results returned into a file is developed for a standard Expert Advisor - Moving Average.

A Pattern Trailing Stop and Exit the Market

Developers of order modification/closing algorithms suffer from an imperishable woe - how to compare results obtained by different methods? The mechanism of checking is well known - it is Strategy Tester. But how to make an EA to work equally for opening/closing orders? The article describes a tool that provides strong repetition of order openings that allows us to maintain a mathematically correct platform to compare the results of different algorithms for trailing stops and for exiting the market.

Testing different Moving Average types to see how insightful they are

We all know the importance of the Moving Average indicator for a lot of traders. There are other Moving average types that can be useful in trading, we will identify these types in this article and make a simple comparison between each one of them and the most popular simple Moving average type to see which one can show the best results.

Understand and Use MQL5 Strategy Tester Effectively

There is an essential need for MQL5 programmers or developers to master important and valuable tools. One of these tools is the Strategy Tester, this article is a practical guide to understanding and using the strategy tester of MQL5.

Magic of time trading intervals with Frames Analyzer tool

What is Frames Analyzer? This is a plug-in module for any Expert Advisor for analyzing optimization frames during parameter optimization in the strategy tester, as well as outside the tester, by reading an MQD file or a database that is created immediately after parameter optimization. You will be able to share these optimization results with other users who have the Frames Analyzer tool to discuss the results together.

Brute force approach to pattern search (Part II): Immersion

In this article we will continue discussing the brute force approach. I will try to provide a better explanation of the pattern using the new improved version of my application. I will also try to find the difference in stability using different time intervals and timeframes.

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.

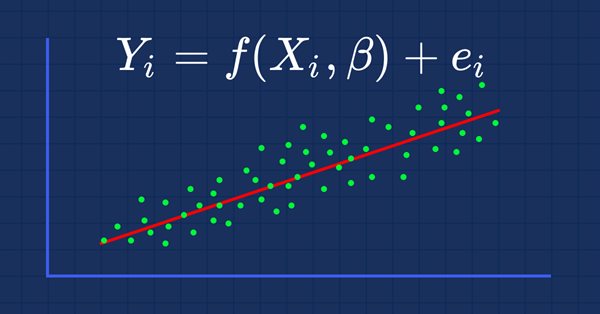

MQL5 Wizard techniques you should know (Part 01): Regression Analysis

Todays trader is a philomath who is almost always (either consciously or not...) looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. This clearly places a premium on the trader's time and the need to avoid mistakes. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders. Why? Because not only does the trader save time by assembling his new ideas with the MQL5 wizard, and greatly reduce mistakes from duplicate coding; he is ultimately set-up to channel his energy on the few critical areas of his trading philosophy.

Population optimization algorithms: Particle swarm (PSO)

In this article, I will consider the popular Particle Swarm Optimization (PSO) algorithm. Previously, we discussed such important characteristics of optimization algorithms as convergence, convergence rate, stability, scalability, as well as developed a test stand and considered the simplest RNG algorithm.

Visual evaluation of optimization results

In this article, we will consider how to build graphs of all optimization passes and to select the optimal custom criterion. We will also see how to create a desired solution with little MQL5 knowledge, using the articles published on the website and forum comments.

MQL5 Cloud Network: Are You Still Calculating?

It will soon be a year and a half since the MQL5 Cloud Network has been launched. This leading edge event ushered in a new era of algorithmic trading - now with a couple of clicks, traders can have hundreds and thousands of computing cores at their disposal for the optimization of their trading strategies.

MQL5 Wizard techniques you should know (Part 05): Markov Chains

Markov chains are a powerful mathematical tool that can be used to model and forecast time series data in various fields, including finance. In financial time series modelling and forecasting, Markov chains are often used to model the evolution of financial assets over time, such as stock prices or exchange rates. One of the main advantages of Markov chain models is their simplicity and ease of use.

MQL5 Wizard techniques you should know (Part 06): Fourier Transform

The Fourier transform introduced by Joseph Fourier is a means of deconstructing complex data wave points into simple constituent waves. This feature could be resourceful to traders and this article takes a look at that.