MQL5 Cookbook: Developing a Framework for a Trading System Based on the Triple Screen Strategy

Introduction

When searching for or developing trading systems, many traders must have heard about the Triple Screen strategy introduced by Dr. Alexander Elder. There are lots of people in the Internet whose judgment on that strategy is negative. However, many people believe that it can help one to profit. You do not have to trust either of the two opinions. Everything should always be checked first-hand. If you study programming, it's all in your hands as you can check the trading strategy performance using back-testing.

In this article, we will develop a framework for a trading system based on the Triple Screen strategy in MQL5. The Expert Advisor will not be developed from scratch. Instead, we will simply modify the program from the previous article "MQL5 Cookbook: Using Indicators to Set Trading Conditions in Expert Advisors". So the article will also demonstrate how you can easily modify patterns of ready-made programs.

The Expert Advisor from the previous article already features the possibility to enable/disable the Stop Loss/Take Profit and Trailing Stop levels, position volume increase and position reversal on the opposite signal. All the necessary functions have been set in place. So our task is centered around changing the list of external parameters by adding additional options and modifying some existing functions.

For illustrative purposes, we will arrange for signals on three time frames to be generated using the Moving Average indicator. Later on, in continuing to experiment on the developed framework, you will be able to employ any other indicator by slightly modifying the code. We will also implement the opportunity to set time frames for each screen. If the parameter responsible for the indicator period has zero value, this will denote that the corresponding screen is not used. In other words, the system can be set up to have one or two time frames.

Before you start, make a copy of the folder with the files of the Expert Advisor from the previous article and rename it.

Expert Advisor Development

Let's start with the external parameters. Below is the code of the updated list. New lines are singled out. Time frames are declared with the ENUM_TIMEFRAMES enumeration type. You will be able to select any time frame from the drop-down list.

//--- External parameters of the Expert Advisor sinput long MagicNumber=777; // Magic number sinput int Deviation=10; // Slippage //--- input ENUM_TIMEFRAMES Screen01TimeFrame=PERIOD_W1; // Time frame of the first screen input int Screen01IndicatorPeriod=14; // Indicator period of the first screen //--- input ENUM_TIMEFRAMES Screen02TimeFrame=PERIOD_D1; // Time frame of the second screen input int Screen02IndicatorPeriod=24; // Indicator period of the second screen //--- input ENUM_TIMEFRAMES Screen03TimeFrame=PERIOD_H4; // Time frame of the third screen input int Screen03IndicatorPeriod=44; // Indicator period of the third screen //--- input double Lot=0.1; // Lot input double VolumeIncrease=0.1; // Position volume increase input double VolumeIncreaseStep=10; // Step for position volume increase input double StopLoss=50; // Stop Loss input double TakeProfit=100; // Take Profit input double TrailingStop=10; // Trailing Stop input bool Reverse=true; // Position reversal sinput bool ShowInfoPanel=true; // Display of the info panel

The IndicatorSegments parameter, as well as the AllowedNumberOfSegments variable and the CorrectInputParameters() function have been removed to simplify the example. Those of you who are interested in this condition can try to implement it on your own. You should also remove the enumeration of indicators in the Enums.mqh file as this Expert Advisor will only employ one indicator.

Since there will be a separate indicator on each time frame, we will need a separate variable to get a handle of each of the indicators:

//--- Indicator handles int Screen01IndicatorHandle=INVALID_HANDLE; // Indicator handle on the first screen int Screen02IndicatorHandle=INVALID_HANDLE; // Indicator handle on the second screen int Screen03IndicatorHandle=INVALID_HANDLE; // Indicator handle on the third screen

The new bar will be checked using the minimum time frame. When setting the minimum time frame in the external parameters, we do not have to follow a specific order, i.e. maximum, intermediate, minimum. The reverse order and basically any order would do. So we need a function that will identify the minimum time frame out of all time frames specified.

Since the Expert Advisor can be set to operate on three time frames, as well as on one or two, all options need to be considered when determining the minimum time frame. Below if the code of the GetMinimumTimeframe() function:

//+------------------------------------------------------------------+ //| Determining the minimum time frame for the new bar check | //+------------------------------------------------------------------+ ENUM_TIMEFRAMES GetMinimumTimeframe(ENUM_TIMEFRAMES timeframe1,int period1, ENUM_TIMEFRAMES timeframe2,int period2, ENUM_TIMEFRAMES timeframe3,int period3) { //--- Default minimum time frame value ENUM_TIMEFRAMES timeframe_min=PERIOD_CURRENT; //--- Convert time frame values to seconds for calculations int t1= PeriodSeconds(timeframe1); int t2= PeriodSeconds(timeframe2); int t3= PeriodSeconds(timeframe3); //--- Check for incorrect period values if(period1<=0 && period2<=0 && period3<=0) return(timeframe_min); //--- Conditions for a single time frame if(period1>0 && period2<=0 && period3<=0) return(timeframe1); if(period2>0 && period1<=0 && period3<=0) return(timeframe2); if(period3>0 && period1<=0 && period2<=0) return(timeframe3); //--- Conditions for two time frames if(period1>0 && period2>0 && period3<=0) { timeframe_min=(MathMin(t1,t2)==t1) ? timeframe1 : timeframe2; return(timeframe_min); } if(period1>0 && period3>0 && period2<=0) { timeframe_min=(MathMin(t1,t3)==t1) ? timeframe1 : timeframe3; return(timeframe_min); } if(period2>0 && period3>0 && period1<=0) { timeframe_min=(MathMin(t2,t3)==t2) ? timeframe2 : timeframe3; return(timeframe_min); } //--- Conditions for three time frames if(period1>0 && period2>0 && period3>0) { timeframe_min=(int)MathMin(t1,t2)==t1 ? timeframe1 : timeframe2; int t_min=PeriodSeconds(timeframe_min); timeframe_min=(int)MathMin(t_min,t3)==t_min ? timeframe_min : timeframe3; return(timeframe_min); } return(WRONG_VALUE); }

To save the minimum time frame value, we will create another global scope variable:

//--- Variable for determining the minimum time frame ENUM_TIMEFRAMES MinimumTimeframe=WRONG_VALUE;

The GetMinimumTimeframe() function will need to be called when initializing the Expert Advisor in the OnInit() function.

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- Determine the minimum time frame for the new bar check MinimumTimeframe=GetMinimumTimeframe(Screen01TimeFrame,Screen01IndicatorPeriod, Screen02TimeFrame,Screen02IndicatorPeriod, Screen03TimeFrame,Screen03IndicatorPeriod); //--- Get indicator handles GetIndicatorHandles(); //--- Initialize the new bar CheckNewBar(); //--- Get the properties GetPositionProperties(P_ALL); //--- Set the info panel SetInfoPanel(); //--- return(0); }

The MinimumTimeframe variable value is then used in the CheckNewBar() and GetBarsData() functions.

The GetIndicatorHandle() function now looks as shown below. The period and time frame is specified for each indicator.

//+------------------------------------------------------------------+ //| Getting indicator handles | //+------------------------------------------------------------------+ void GetIndicatorHandles() { //--- Get handles of the indicators specified in the parameters if(Screen01IndicatorPeriod>0) Screen01IndicatorHandle=iMA(_Symbol,Screen01TimeFrame,Screen01IndicatorPeriod,0,MODE_SMA,PRICE_CLOSE); if(Screen02IndicatorPeriod>0) Screen02IndicatorHandle=iMA(_Symbol,Screen02TimeFrame,Screen02IndicatorPeriod,0,MODE_SMA,PRICE_CLOSE); if(Screen03IndicatorPeriod>0) Screen03IndicatorHandle=iMA(_Symbol,Screen03TimeFrame,Screen03IndicatorPeriod,0,MODE_SMA,PRICE_CLOSE); //--- If the indicator handle for the first time frame could not be obtained if(Screen01IndicatorHandle==INVALID_HANDLE) Print("Failed to get the indicator handle for Screen 1!"); //--- If the indicator handle for the second time frame could not be obtained if(Screen01IndicatorHandle==INVALID_HANDLE) Print("Failed to get the indicator handle for Screen 2!"); //--- If the indicator handle for the third time frame could not be obtained if(Screen01IndicatorHandle==INVALID_HANDLE) Print("Failed to get the indicator handle for Screen 3!"); }

Further, we need to add arrays for getting indicator values (separately for each time frame):

//--- Arrays for values of the indicators double indicator_buffer1[]; double indicator_buffer2[]; double indicator_buffer3[];

The GetIndicatorsData() function for getting indicator values now looks as shown below. The obtained handles are checked for accuracy and if everything is fine, the arrays are filled with indicator values.

//+------------------------------------------------------------------+ //| Getting indicator values | //+------------------------------------------------------------------+ bool GetIndicatorsData() { //--- Number of indicator buffer values for determining the trading signal int NumberOfValues=3; //--- If indicator handles have not been obtained if((Screen01IndicatorPeriod>0 && Screen01IndicatorHandle==INVALID_HANDLE) || (Screen02IndicatorPeriod>0 && Screen02IndicatorHandle==INVALID_HANDLE) || (Screen03IndicatorPeriod>0 && Screen03IndicatorHandle==INVALID_HANDLE)) //--- try to get them again GetIndicatorHandles(); //--- If the time frame of the first screen is used and the indicator handle has been obtained if(Screen01TimeFrame>0 && Screen01IndicatorHandle!=INVALID_HANDLE) { //--- Reverse the indexing order (... 3 2 1 0) ArraySetAsSeries(indicator_buffer1,true); //--- Get indicator values if(CopyBuffer(Screen01IndicatorHandle,0,0,NumberOfValues,indicator_buffer1)<NumberOfValues) { Print("Failed to copy the values ("+ _Symbol+"; "+TimeframeToString(Period())+") to the indicator_buffer1 array! Error ("+ IntegerToString(GetLastError())+"): "+ErrorDescription(GetLastError())); //--- return(false); } } //--- If the time frame of the second screen is used and the indicator handle has been obtained if(Screen02TimeFrame>0 && Screen02IndicatorHandle!=INVALID_HANDLE) { //--- Reverse the indexing order (... 3 2 1 0) ArraySetAsSeries(indicator_buffer2,true); //--- Get indicator values if(CopyBuffer(Screen02IndicatorHandle,0,0,NumberOfValues,indicator_buffer2)<NumberOfValues) { Print("Failed to copy the values ("+ _Symbol+"; "+TimeframeToString(Period())+") to the indicator_buffer2 array! Error ("+ IntegerToString(GetLastError())+"): "+ErrorDescription(GetLastError())); //--- return(false); } } //--- If the time frame of the third screen is used and the indicator handle has been obtained if(Screen03TimeFrame>0 && Screen03IndicatorHandle!=INVALID_HANDLE) { //--- Reverse the indexing order (... 3 2 1 0) ArraySetAsSeries(indicator_buffer3,true); //--- Get indicator values if(CopyBuffer(Screen03IndicatorHandle,0,0,NumberOfValues,indicator_buffer3)<NumberOfValues) { Print("Failed to copy the values ("+ _Symbol+"; "+TimeframeToString(Period())+") to the indicator_buffer3 array! Error ("+ IntegerToString(GetLastError())+"): "+ErrorDescription(GetLastError())); //--- return(false); } } //--- return(true); }

The GetTradingSignal() and GetSignal() functions should be modified according to the task at hand. Below is the code of these functions for your consideration.

//+------------------------------------------------------------------+ //| Determining trading signals | //+------------------------------------------------------------------+ ENUM_ORDER_TYPE GetTradingSignal() { //--- If there is no position if(!pos.exists) { //--- A Sell signal if(GetSignal()==ORDER_TYPE_SELL) return(ORDER_TYPE_SELL); //--- A Buy signal if(GetSignal()==ORDER_TYPE_BUY) return(ORDER_TYPE_BUY); } //--- If the position exists if(pos.exists) { //--- Get the position type GetPositionProperties(P_TYPE); //--- Get the last deal price GetPositionProperties(P_PRICE_LAST_DEAL); //--- A Sell signal if(pos.type==POSITION_TYPE_BUY && GetSignal()==ORDER_TYPE_SELL) return(ORDER_TYPE_SELL); if(pos.type==POSITION_TYPE_SELL && GetSignal()==ORDER_TYPE_SELL && close_price[1]<pos.last_deal_price-CorrectValueBySymbolDigits(VolumeIncreaseStep*_Point)) return(ORDER_TYPE_SELL); //--- A Buy signal if(pos.type==POSITION_TYPE_SELL && GetSignal()==ORDER_TYPE_BUY) return(ORDER_TYPE_BUY); if(pos.type==POSITION_TYPE_BUY && GetSignal()==ORDER_TYPE_BUY && close_price[1]>pos.last_deal_price+CorrectValueBySymbolDigits(VolumeIncreaseStep*_Point)) return(ORDER_TYPE_BUY); } //--- No signal return(WRONG_VALUE); }

The GetSignal() function, just like in determining the minimum time frame, takes into account all possible variants of external parameter states relating to position opening conditions. The code of the function is provided below:

//+------------------------------------------------------------------+ //| Checking the condition and returning a signal | //+------------------------------------------------------------------+ ENUM_ORDER_TYPE GetSignal() { //--- A SELL SIGNAL: the current value of the indicators on completed bars is lower than on the previous bars //--- Conditions for a single time frame if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod<=0 && Screen03IndicatorPeriod<=0) { if(indicator_buffer1[1]<indicator_buffer1[2]) return(ORDER_TYPE_SELL); } if(Screen01IndicatorPeriod<=0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod<=0) { if(indicator_buffer2[1]<indicator_buffer2[2]) return(ORDER_TYPE_SELL); } //--- if(Screen01IndicatorPeriod<=0 && Screen02IndicatorPeriod<=0 && Screen03IndicatorPeriod>0) { if(indicator_buffer3[1]<indicator_buffer3[2]) return(ORDER_TYPE_SELL); } //--- Conditions for two time frames if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod<=0) { if(indicator_buffer1[1]<indicator_buffer1[2] && indicator_buffer2[1]<indicator_buffer2[2]) return(ORDER_TYPE_SELL); } if(Screen01IndicatorPeriod<=0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod>0) { if(indicator_buffer2[1]<indicator_buffer2[2] && indicator_buffer3[1]<indicator_buffer3[2]) return(ORDER_TYPE_SELL); } if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod<=0 && Screen03IndicatorPeriod>0) { if(indicator_buffer1[1]<indicator_buffer1[2] && indicator_buffer3[1]<indicator_buffer3[2]) return(ORDER_TYPE_SELL); } //--- Conditions for three time frames if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod>0) { if(indicator_buffer1[1]<indicator_buffer1[2] && indicator_buffer2[1]<indicator_buffer2[2] && indicator_buffer3[1]<indicator_buffer3[2] ) return(ORDER_TYPE_SELL); } //--- A BUY SIGNAL: the current value of the indicators on completed bars is higher than on the previous bars //--- Conditions for a single time frame if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod<=0 && Screen03IndicatorPeriod<=0) { if(indicator_buffer1[1]>indicator_buffer1[2]) return(ORDER_TYPE_BUY); } if(Screen01IndicatorPeriod<=0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod<=0) { if(indicator_buffer2[1]>indicator_buffer2[2]) return(ORDER_TYPE_BUY); } if(Screen01IndicatorPeriod<=0 && Screen02IndicatorPeriod<=0 && Screen03IndicatorPeriod>0) { if(indicator_buffer3[1]>indicator_buffer3[2]) return(ORDER_TYPE_BUY); } //--- Conditions for two time frames if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod<=0) { if(indicator_buffer1[1]>indicator_buffer1[2] && indicator_buffer2[1]>indicator_buffer2[2]) return(ORDER_TYPE_BUY); } if(Screen01IndicatorPeriod<=0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod>0) { if(indicator_buffer2[1]>indicator_buffer2[2] && indicator_buffer3[1]>indicator_buffer3[2]) return(ORDER_TYPE_BUY); } if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod<=0 && Screen03IndicatorPeriod>0) { if(indicator_buffer1[1]>indicator_buffer1[2] && indicator_buffer3[1]>indicator_buffer3[2]) return(ORDER_TYPE_BUY); } //--- Conditions for three time frames if(Screen01IndicatorPeriod>0 && Screen02IndicatorPeriod>0 && Screen03IndicatorPeriod>0) { if(indicator_buffer1[1]>indicator_buffer1[2] && indicator_buffer2[1]>indicator_buffer2[2] && indicator_buffer3[1]>indicator_buffer3[2] ) return(ORDER_TYPE_BUY); } //--- No signal return(WRONG_VALUE); }

Now, we only need to make small changes to the OnInit() and OnDeinit() functions. You can see the changes highlighted in the below code:

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- Determine the minimum time frame for the new bar check MinimumTimeframe=GetMinimumTimeframe(Screen01TimeFrame,Screen01IndicatorPeriod, Screen02TimeFrame,Screen02IndicatorPeriod, Screen03TimeFrame,Screen03IndicatorPeriod); //--- Get indicator handles GetIndicatorHandles(); //--- Initialize the new bar CheckNewBar(); //--- Get the properties GetPositionProperties(P_ALL); //--- Set the info panel SetInfoPanel(); //--- return(0); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- Print the deinitialization reason to the journal Print(GetDeinitReasonText(reason)); //--- When deleting from the chart if(reason==REASON_REMOVE) { //--- Delete all objects relating to the info panel from the chart DeleteInfoPanel(); //--- Delete the indicator handles IndicatorRelease(Screen01IndicatorHandle); IndicatorRelease(Screen02IndicatorHandle); IndicatorRelease(Screen03IndicatorHandle); } }

The framework for trading systems based on the Triple Screen strategy is ready. It can be modified at any time, by changing the indicators or adding some additional conditions, if necessary.

Optimizing Parameters and Testing Expert Advisor

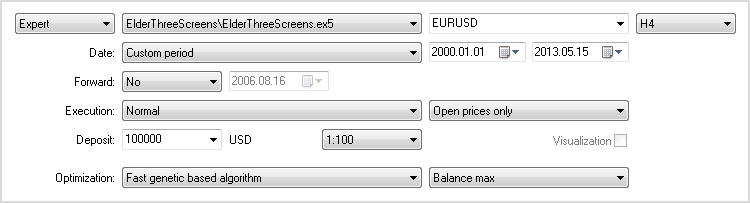

Let's proceed to parameter optimization and check the results. The Strategy Tester is set as shown below (be sure to specify the lowest of the three time frames):

Fig. 1. Strategy Tester settings.

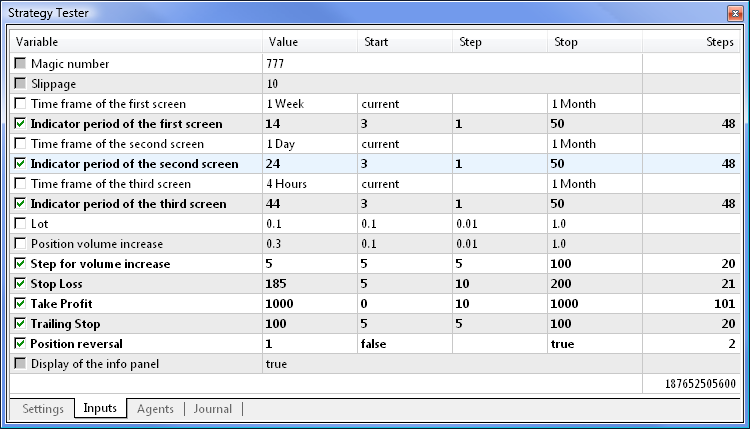

The Expert Advisor parameters for optimization have been set as shown below. Time frames can be set for optimization but I prefer to set them manually.

Fig. 2. Settings of the Expert Advisor.

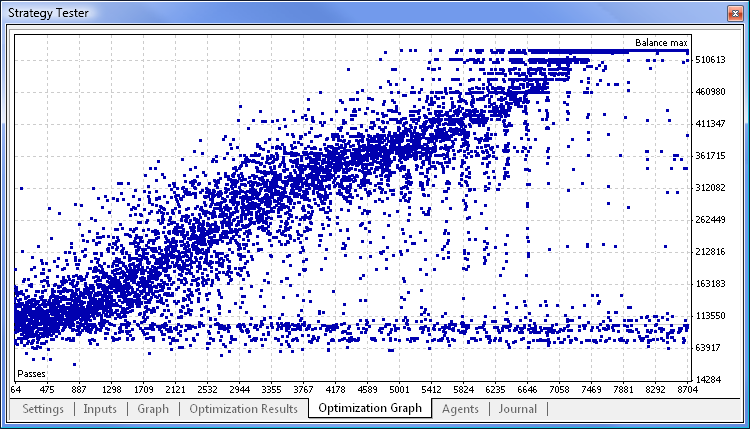

The optimization has been completed in about 30 minutes on a dual-core processor. The Optimization Graph is provided below:

Fig. 3. Optimization Graph.

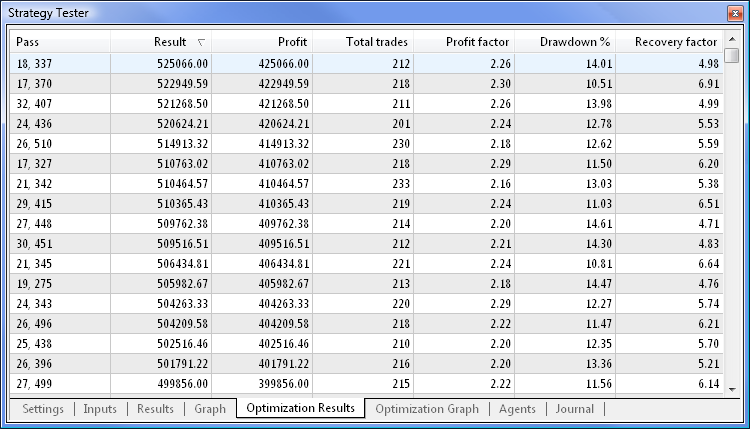

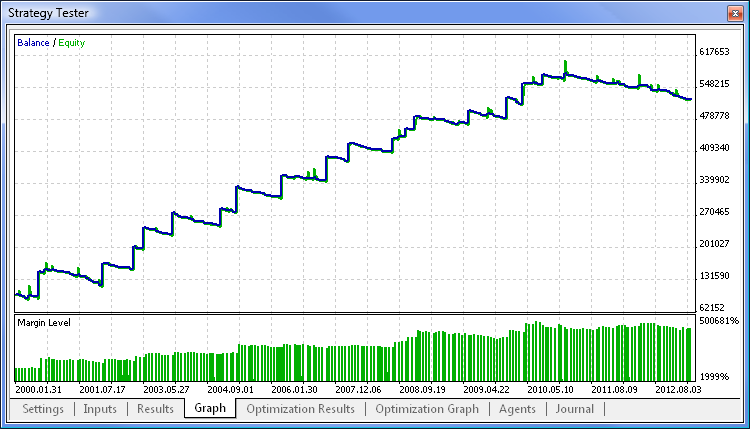

Maximum balance test results show less drawdown than the maximum recovery factor test results, which is why the maximum balance test results are used for demonstration purposes:

Fig. 4. Maximum balance test results.

Fig. 5. Maximum balance test graph.

Conclusion

The article has demonstrated that the Expert Advisor can be fairly quickly modified, if the main functions are available. You can get a new trading system by only changing the signal block and indicators. Attached to the article is a downloadable archive containing the source codes of the Expert Advisor described herein above for your further self-study, as well as a set-file with the input parameter settings.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/647

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

The Random Sandbox

The Random Sandbox

Three Aspects of Manual Trading Automation. Part 1: Trading

Three Aspects of Manual Trading Automation. Part 1: Trading

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Thanks for article!

Is it possible to use this expert on account with 0.1 lot limitation? Not ECN account. I tryed on ECN -- at least testing looks just fine, as in the article.I understand, this was published long time ago, but amazingly, no discussion on the forum whatsoever!

Testing works perfect on ECN account!Published article MQL5 Recipes - Developing a scheme for a trading system of "Elder's Three Screens" type:

Author: Anatoli Kazharski

The article is interesting... but:

i) the strategy implemented isn't the Elder's Triple Screen. Elder proposal was based on the old Tide, Wave and Ripples principle: Find a tide, wait for a Wave and go with the Ripples. It isn't what you have implemented.

ii) it uses 3 simple MA as each timeframe indicator and only compares value to value, which is unrealistic.