Developing Market Memory Zones Indicator: Where Price Is Likely To Return

In this discussion, we will develop an indicator to identify price zones created by strong market activity, such as impulsive moves, structure shifts, and liquidity events. These zones represent areas where the market has left “memory” due to unfilled orders or rapid price displacement. By marking these regions on the chart, the indicator highlights where price is statistically more likely to revisit and react in the future.

Population optimization algorithms: Nelder–Mead, or simplex search (NM) method

The article presents a complete exploration of the Nelder-Mead method, explaining how the simplex (function parameter space) is modified and rearranged at each iteration to achieve an optimal solution, and describes how the method can be improved.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Developing a Replay System (Part 59): A New Future

Having a proper understanding of different ideas allows us to do more with less effort. In this article, we'll look at why it's necessary to configure a template before the service can interact with the chart. Also, what if we improve the mouse pointer so we can do more things with it?

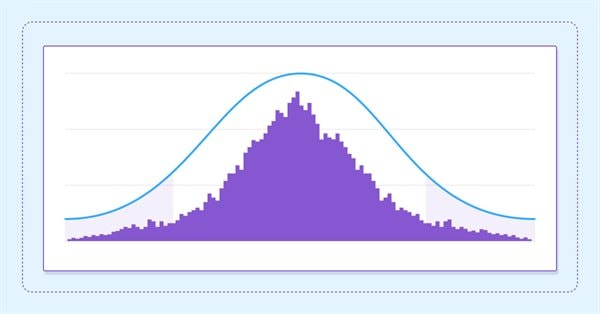

Estimate future performance with confidence intervals

In this article we delve into the application of boostrapping techniques as a means to estimate the future performance of an automated strategy.

Atomic Orbital Search (AOS) algorithm: Modification

In the second part of the article, we will continue developing a modified version of the AOS (Atomic Orbital Search) algorithm focusing on specific operators to improve its efficiency and adaptability. After analyzing the fundamentals and mechanics of the algorithm, we will discuss ideas for improving its performance and the ability to analyze complex solution spaces, proposing new approaches to extend its functionality as an optimization tool.

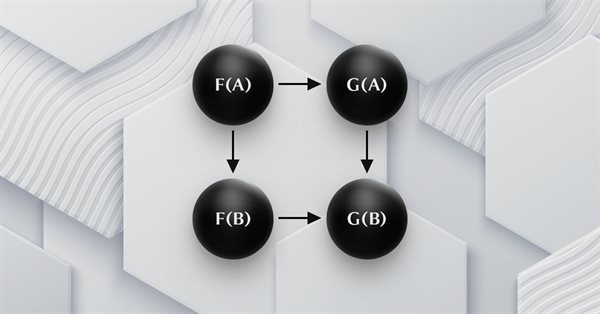

Category Theory in MQL5 (Part 18): Naturality Square

This article continues our series into category theory by introducing natural transformations, a key pillar within the subject. We look at the seemingly complex definition, then delve into examples and applications with this series’ ‘bread and butter’; volatility forecasting.

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?

Developing a Replay System — Market simulation (Part 17): Ticks and more ticks (I)

Here we will see how to implement something really interesting, but at the same time very difficult due to certain points that can be very confusing. The worst thing that can happen is that some traders who consider themselves professionals do not know anything about the importance of these concepts in the capital market. Well, although we focus here on programming, understanding some of the issues involved in market trading is paramount to what we are going to implement.

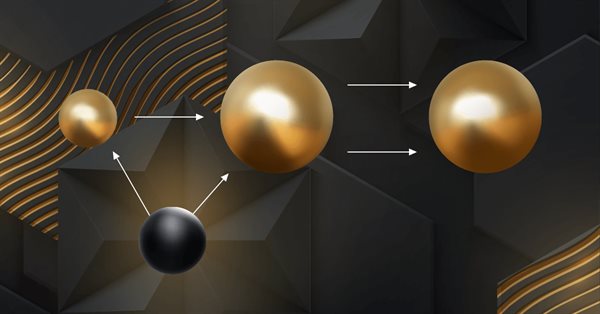

Billiards Optimization Algorithm (BOA)

The BOA method is inspired by the classic game of billiards and simulates the search for optimal solutions as a game with balls trying to fall into pockets representing the best results. In this article, we will consider the basics of BOA, its mathematical model, and its efficiency in solving various optimization problems.

Chaos theory in trading (Part 1): Introduction, application in financial markets and Lyapunov exponent

Can chaos theory be applied to financial markets? In this article, we will consider how conventional Chaos theory and chaotic systems are different from the concept proposed by Bill Williams.

Developing a Replay System (Part 32): Order System (I)

Of all the things that we have developed so far, this system, as you will probably notice and eventually agree, is the most complex. Now we need to do something very simple: make our system simulate the operation of a trading server. This need to accurately implement the way the trading server operates seems like a no-brainer. At least in words. But we need to do this so that the everything is seamless and transparent for the user of the replay/simulation system.

A New Approach to Custom Criteria in Optimizations (Part 1): Examples of Activation Functions

The first of a series of articles looking at the mathematics of Custom Criteria with a specific focus on non-linear functions used in Neural Networks, MQL5 code for implementation and the use of targeted and correctional offsets.

Building a Candlestick Trend Constraint Model (Part 10): Strategic Golden and Death Cross (EA)

Did you know that the Golden Cross and Death Cross strategies, based on moving average crossovers, are some of the most reliable indicators for identifying long-term market trends? A Golden Cross signals a bullish trend when a shorter moving average crosses above a longer one, while a Death Cross indicates a bearish trend when the shorter average moves below. Despite their simplicity and effectiveness, manually applying these strategies often leads to missed opportunities or delayed trades.

Category Theory in MQL5 (Part 7): Multi, Relative and Indexed Domains

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Developing a Replay System (Part 48): Understanding the concept of a service

How about learning something new? In this article, you will learn how to convert scripts into services and why it is useful to do so.

Developing a Replay System (Part 26): Expert Advisor project — C_Terminal class

We can now start creating an Expert Advisor for use in the replay/simulation system. However, we need something improved, not a random solution. Despite this, we should not be intimidated by the initial complexity. It's important to start somewhere, otherwise we end up ruminating about the difficulty of a task without even trying to overcome it. That's what programming is all about: overcoming obstacles through learning, testing, and extensive research.

Developing a Replay System (Part 74): New Chart Trade (I)

In this article, we will modify the last code shown in this series about Chart Trade. These changes are necessary to adapt the code to the current replay/simulation system model. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

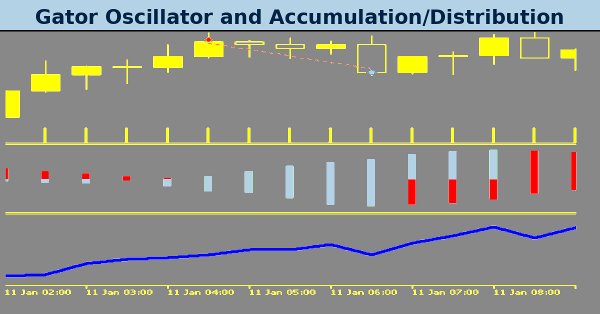

MQL5 Wizard Techniques you should know (Part 77): Using Gator Oscillator and the Accumulation/Distribution Oscillator

The Gator Oscillator by Bill Williams and the Accumulation/Distribution Oscillator are another indicator pairing that could be used harmoniously within an MQL5 Expert Advisor. We use the Gator Oscillator for its ability to affirm trends, while the A/D is used to provide confirmation of the trends via checks on volume. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Category Theory in MQL5 (Part 13): Calendar Events with Database Schemas

This article, that follows Category Theory implementation of Orders in MQL5, considers how database schemas can be incorporated for classification in MQL5. We take an introductory look at how database schema concepts could be married with category theory when identifying trade relevant text(string) information. Calendar events are the focus.

MQL5 Wizard Techniques you should know (Part 37): Gaussian Process Regression with Linear and Matérn Kernels

Linear Kernels are the simplest matrix of its kind used in machine learning for linear regression and support vector machines. The Matérn kernel on the other hand is a more versatile version of the Radial Basis Function we looked at in an earlier article, and it is adept at mapping functions that are not as smooth as the RBF would assume. We build a custom signal class that utilizes both kernels in forecasting long and short conditions.

Archery Algorithm (AA)

The article takes a detailed look at the archery-inspired optimization algorithm, with an emphasis on using the roulette method as a mechanism for selecting promising areas for "arrows". The method allows evaluating the quality of solutions and selecting the most promising positions for further study.

Category Theory in MQL5 (Part 5): Equalizers

Category Theory is a diverse and expanding branch of Mathematics which is only recently getting some coverage in the MQL5 community. These series of articles look to explore and examine some of its concepts & axioms with the overall goal of establishing an open library that provides insight while also hopefully furthering the use of this remarkable field in Traders' strategy development.

Developing a Replay System — Market simulation (Part 14): Birth of the SIMULATOR (IV)

In this article we will continue the simulator development stage. this time we will see how to effectively create a RANDOM WALK type movement. This type of movement is very intriguing because it forms the basis of everything that happens in the capital market. In addition, we will begin to understand some concepts that are fundamental to those conducting market analysis.

Artificial Electric Field Algorithm (AEFA)

The article presents an artificial electric field algorithm (AEFA) inspired by Coulomb's law of electrostatic force. The algorithm simulates electrical phenomena to solve complex optimization problems using charged particles and their interactions. AEFA exhibits unique properties in the context of other algorithms related to laws of nature.

Developing a Replay System — Market simulation (Part 11): Birth of the SIMULATOR (I)

In order to use the data that forms the bars, we must abandon replay and start developing a simulator. We will use 1 minute bars because they offer the least amount of difficulty.

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

Developing a Replay System — Market simulation (Part 09): Custom events

Here we'll see how custom events are triggered and how the indicator reports the state of the replay/simulation service.

Developing a Replay System — Market simulation (Part 10): Using only real data for Replay

Here we will look at how we can use more reliable data (traded ticks) in the replay system without worrying about whether it is adjusted or not.

Custom Indicator: Plotting Partial Entry, Exit and Reversal Deals for Netting Accounts

In this article, we will look at a non-standard way of creating an indicator in MQL5. Instead of focusing on a trend or chart pattern, our goal will be to manage our own positions, including partial entries and exits. We will make extensive use of dynamic matrices and some trading functions related to trade history and open positions to indicate on the chart where these trades were made.

Developing a multi-currency Expert Advisor (Part 15): Preparing EA for real trading

As we gradually approach to obtaining a ready-made EA, we need to pay attention to issues that seem secondary at the stage of testing a trading strategy, but become important when moving on to real trading.

Market Simulation (Part 06): Transferring Information from MetaTrader 5 to Excel

Many people, especially non=programmers, find it very difficult to transfer information between MetaTrader 5 and other programs. One such program is Excel. Many use Excel as a way to manage and maintain their risk control. It is an excellent program and easy to learn, even for those who are not VBA programmers. Here we will look at how to establish a connection between MetaTrader 5 and Excel (a very simple method).

Developing a Replay System — Market simulation (Part 08): Locking the indicator

In this article, we will look at how to lock the indicator while simply using the MQL5 language, and we will do it in a very interesting and amazing way.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

Price Action Analysis Toolkit Development (Part 57): Developing a Market State Classification Module in MQL5

This article develops a market state classification module for MQL5 that interprets price behavior using completed price data. By examining volatility contraction, expansion, and structural consistency, the tool classifies market conditions as compression, transition, expansion, or trend, providing a clear contextual framework for price action analysis.

Developing a multi-currency Expert Advisor (Part 8): Load testing and handling a new bar

As we progressed, we used more and more simultaneously running instances of trading strategies in one EA. Let's try to figure out how many instances we can get to before we hit resource limitations.

Developing a multi-currency Expert Advisor (Part 16): Impact of different quote histories on test results

The EA under development is expected to show good results when trading with different brokers. But for now we have been using quotes from a MetaQuotes demo account to perform tests. Let's see if our EA is ready to work on a trading account with different quotes compared to those used during testing and optimization.

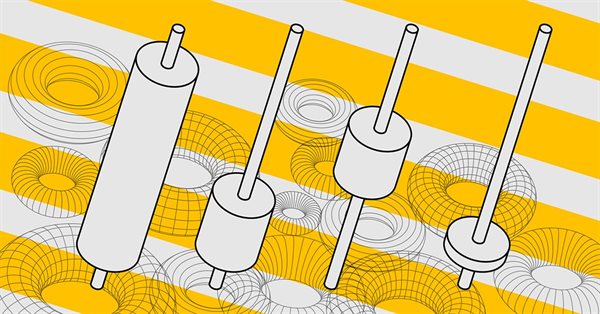

Atomic Orbital Search (AOS) algorithm

The article considers the Atomic Orbital Search (AOS) algorithm, which uses the concepts of the atomic orbital model to simulate the search for solutions. The algorithm is based on probability distributions and the dynamics of interactions in the atom. The article discusses in detail the mathematical aspects of AOS, including updating the positions of candidate solutions and the mechanisms of energy absorption and release. AOS opens new horizons for applying quantum principles to computing problems by offering an innovative approach to optimization.