Building AI-Powered Trading Systems in MQL5 (Part 7): Further Modularization and Automated Trading

In this article, we enhance the AI-powered trading system's modularity by separating UI components into a dedicated include file. The system now automates trade execution based on AI-generated signals, parsing JSON responses for BUY/SELL/NONE with entry/SL/TP, visualizing patterns like engulfing or divergences on charts with arrows, lines, and labels, and optional auto-signal checks on new bars.

Codex Pipelines, from Python to MQL5, for Indicator Selection: A Multi-Quarter Analysis of the XLF ETF with Machine Learning

We continue our look at how the selection of indicators can be pipelined when facing a ‘none-typical’ MetaTrader asset. MetaTrader 5 is primarily used to trade forex, and that is good given the liquidity on offer, however the case for trading outside of this ‘comfort-zone’, is growing bolder with not just the overnight rise of platforms like Robinhood, but also the relentless pursuit of an edge for most traders. We consider the XLF ETF for this article and also cap our revamped pipeline with a simple MLP.

The View and Controller components for tables in the MQL5 MVC paradigm: Resizable elements

In the article, we will add the functionality of resizing controls by dragging edges and corners of the element with the mouse.

From Novice to Expert: Trading the RSI with Market Structure Awareness

In this article, we will explore practical techniques for trading the Relative Strength Index (RSI) oscillator with market structure. Our focus will be on channel price action patterns, how they are typically traded, and how MQL5 can be leveraged to enhance this process. By the end, you will have a rule-based, automated channel-trading system designed to capture trend continuation opportunities with greater precision and consistency.

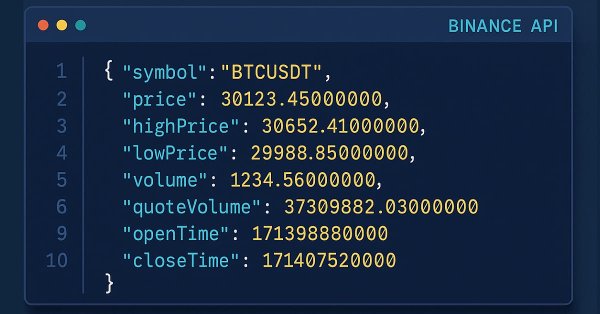

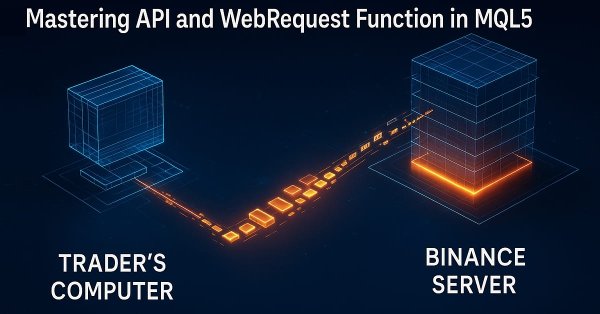

Introduction to MQL5 (Part 31): Mastering API and WebRequest Function in MQL5 (V)

Learn how to use WebRequest and external API calls to retrieve recent candle data, convert each value into a usable type, and save the information neatly in a table format. This step lays the groundwork for building an indicator that visualizes the data in candle format.

Automating Trading Strategies in MQL5 (Part 46): Liquidity Sweep on Break of Structure (BoS)

In this article, we build a Liquidity Sweep on Break of Structure (BoS) system in MQL5 that detects swing highs/lows over a user-defined length, labels them as HH/HL/LH/LL to identify BOS (HH in uptrend or LL in downtrend), and spots liquidity sweeps when price wicks beyond the swing but closes back inside on a bullish/bearish candle.

Automated Risk Management for Passing Prop Firm Challenges

This article explains the design of a prop-firm Expert Advisor for GOLD, featuring breakout filters, multi-timeframe analysis, robust risk management, and strict drawdown protection. The EA helps traders pass prop-firm challenges by avoiding rule breaches and stabilizing trade execution under volatile market conditions.

Codex Pipelines: From Python to MQL5 for Indicator Selection — A Multi-Quarter Analysis of the FXI ETF

We continue our look at how MetaTrader can be used outside its forex trading ‘comfort-zone’ by looking at another tradable asset in the form of the FXI ETF. Unlike in the last article where we tried to do ‘too-much’ by delving into not just indicator selection, but also considering indicator pattern combinations, for this article we will swim slightly upstream by focusing more on indicator selection. Our end product for this is intended as a form of pipeline that can help recommend indicators for various assets, provided we have a reasonable amount of their price history.

Adaptive Smart Money Architecture (ASMA): Merging SMC Logic With Market Sentiment for Dynamic Strategy Switching

This topic explores how to build an Adaptive Smart Money Architecture (ASMA)—an intelligent Expert Advisor that merges Smart Money Concepts (Order Blocks, Break of Structure, Fair Value Gaps) with real-time market sentiment to automatically choose the best trading strategy depending on current market conditions.

Overcoming The Limitation of Machine Learning (Part 9): Correlation-Based Feature Learning in Self-Supervised Finance

Self-supervised learning is a powerful paradigm of statistical learning that searches for supervisory signals generated from the observations themselves. This approach reframes challenging unsupervised learning problems into more familiar supervised ones. This technology has overlooked applications for our objective as a community of algorithmic traders. Our discussion, therefore, aims to give the reader an approachable bridge into the open research area of self-supervised learning and offers practical applications that provide robust and reliable statistical models of financial markets without overfitting to small datasets.

Developing a multi-currency Expert Advisor (Part 24): Adding a new strategy (I)

In this article, we will look at how to connect a new strategy to the auto optimization system we have created. Let's see what kind of EAs we need to create and whether it will be possible to do without changing the EA library files or minimize the necessary changes.

Mastering Kagi Charts in MQL5 (Part 2): Implementing Automated Kagi-Based Trading

Learn how to build a complete Kagi-based trading Expert Advisor in MQL5, from signal construction to order execution, visual markers, and a three-stage trailing stop. Includes full code, testing results, and a downloadable set file.

Fortified Profit Architecture: Multi-Layered Account Protection

In this discussion, we introduce a structured, multi-layered defense system designed to pursue aggressive profit targets while minimizing exposure to catastrophic loss. The focus is on blending offensive trading logic with protective safeguards at every level of the trading pipeline. The idea is to engineer an EA that behaves like a “risk-aware predator”—capable of capturing high-value opportunities, but always with layers of insulation that prevent blindness to sudden market stress.

The View and Controller components for tables in the MQL5 MVC paradigm: Containers

In this article, we will discuss creating a "Container" control that supports scrolling its contents. Within the process, the already implemented classes of graphics library controls will be improved.

Automating Trading Strategies in MQL5 (Part 45): Inverse Fair Value Gap (IFVG)

In this article, we create an Inverse Fair Value Gap (IFVG) detection system in MQL5 that identifies bullish/bearish FVGs on recent bars with minimum gap size filtering, tracks their states as normal/mitigated/inverted based on price interactions (mitigation on far-side breaks, retracement on re-entry, inversion on close beyond far side from inside), and ignores overlaps while limiting tracked FVGs.

Chaos Game Optimization (CGO)

The article presents a new metaheuristic algorithm, Chaos Game Optimization (CGO), which demonstrates a unique ability to maintain high efficiency when dealing with high-dimensional problems. Unlike most optimization algorithms, CGO not only does not lose, but sometimes even increases performance when scaling a problem, which is its key feature.

From Novice to Expert: Developing a Geographic Market Awareness with MQL5 Visualization

Trading without session awareness is like navigating without a compass—you're moving, but not with purpose. Today, we're revolutionizing how traders perceive market timing by transforming ordinary charts into dynamic geographical displays. Using MQL5's powerful visualization capabilities, we'll build a live world map that illuminates active trading sessions in real-time, turning abstract market hours into intuitive visual intelligence. This journey sharpens your trading psychology and reveals professional-grade programming techniques that bridge the gap between complex market structure and practical, actionable insight.

Reimagining Classic Strategies (Part 19): Deep Dive Into Moving Average Crossovers

This article revisits the classic moving average crossover strategy and examines why it often fails in noisy, fast-moving markets. It presents five alternative filtering methods designed to strengthen signal quality and remove weak or unprofitable trades. The discussion highlights how statistical models can learn and correct the errors that human intuition and traditional rules miss. Readers leave with a clearer understanding of how to modernize an outdated strategy and of the pitfalls of relying solely on metrics like RMSE in financial modeling.

Statistical Arbitrage Through Cointegrated Stocks (Part 8): Rolling Windows Eigenvector Comparison for Portfolio Rebalancing

This article proposes using Rolling Windows Eigenvector Comparison for early imbalance diagnostics and portfolio rebalancing in a mean-reversion statistical arbitrage strategy based on cointegrated stocks. It contrasts this technique with traditional In-Sample/Out-of-Sample ADF validation, showing that eigenvector shifts can signal the need for rebalancing even when IS/OOS ADF still indicates a stationary spread. While the method is intended mainly for live trading monitoring, the article concludes that eigenvector comparison could also be integrated into the scoring system—though its actual contribution to performance remains to be tested.

Currency pair strength indicator in pure MQL5

We are going to develop a professional indicator for currency strength analysis in MQL5. This step-by-step guide will show you how to develop a powerful trading tool with a visual dashboard for MetaTrader 5. You will learn how to calculate the strength of currency pairs across multiple timeframes (H1, H4, D1), implement dynamic data updates, and create a user-friendly interface.

Implementing Practical Modules from Other Languages in MQL5 (Part 05): The Logging module from Python, Log Like a Pro

Integrating Python's logging module with MQL5 empowers traders with a systematic logging approach, simplifying the process of monitoring, debugging, and documenting trading activities. This article explains the adaptation process, offering traders a powerful tool for maintaining clarity and organization in trading software development.

The View and Controller components for tables in the MQL5 MVC paradigm: Simple controls

The article covers simple controls as components of more complex graphical elements of the View component within the framework of table implementation in the MVC (Model-View-Controller) paradigm. The basic functionality of the Controller is implemented for interaction of elements with the user and with each other. This is the second article on the View component and the fourth one in a series of articles on creating tables for the MetaTrader 5 client terminal.

From Basic to Intermediate: Structs (II)

In this article, we will try to understand why programming languages like MQL5 have structures, and why in some cases structures are the ideal way to pass values between functions and procedures, while in other cases they may not be the best way to do it.

Capital management in trading and the trader's home accounting program with a database

How can a trader manage capital? How can a trader and investor keep track of expenses, income, assets, and liabilities? I am not just going to introduce you to accounting software; I am going to show you a tool that might become your reliable financial navigator in the stormy sea of trading.

Developing a Trading Strategy: Using a Volume-Bound Approach

In the world of technical analysis, price often takes center stage. Traders meticulously map out support, resistance, and patterns, yet frequently ignore the critical force that drives these movements: volume. This article delves into a novel approach to volume analysis: the Volume Boundary indicator. This transformation, utilizing sophisticated smoothing functions like the butterfly and triple sine curves, allows for clearer interpretation and the development of systematic trading strategies.

Introduction to MQL5 (Part 30): Mastering API and WebRequest Function in MQL5 (IV)

Discover a step-by-step tutorial that simplifies the extraction, conversion, and organization of candle data from API responses within the MQL5 environment. This guide is perfect for newcomers looking to enhance their coding skills and develop robust strategies for managing market data efficiently.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

The MQL5 Standard Library Explorer (Part 5): Multiple Signal Expert

In this session, we will build a sophisticated, multi-signal Expert Advisor using the MQL5 Standard Library. This approach allows us to seamlessly blend built-in signals with our own custom logic, demonstrating how to construct a powerful and flexible trading algorithm. For more, click to read further.

The View component for tables in the MQL5 MVC paradigm: Base graphical element

The article covers the process of developing a base graphical element for the View component as part of the implementation of tables in the MVC (Model-View-Controller) paradigm in MQL5. This is the first article on the View component and the third one in a series of articles on creating tables for the MetaTrader 5 client terminal.

Automating Trading Strategies in MQL5 (Part 43): Adaptive Linear Regression Channel Strategy

In this article, we implement an adaptive Linear Regression Channel system in MQL5 that automatically calculates the regression line and standard deviation channel over a user-defined period, only activates when the slope exceeds a minimum threshold to confirm a clear trend, and dynamically recreates or extends the channel when the price breaks out by a configurable percentage of channel width.

Price Action Analysis Toolkit Development (Part 53): Pattern Density Heatmap for Support and Resistance Zone Discovery

This article introduces the Pattern Density Heatmap, a price‑action mapping tool that transforms repeated candlestick pattern detections into statistically significant support and resistance zones. Rather than treating each signal in isolation, the EA aggregates detections into fixed price bins, scores their density with optional recency weighting, and confirms levels against higher‑timeframe data. The resulting heatmap reveals where the market has historically reacted—levels that can be used proactively for trade timing, risk management, and strategy confidence across any trading style.

Introduction to MQL5 (Part 29): Mastering API and WebRequest Function in MQL5 (III)

In this article, we continue mastering API and WebRequest in MQL5 by retrieving candlestick data from an external source. We focus on splitting the server response, cleaning the data, and extracting essential elements such as opening time and OHLC values for multiple daily candles, preparing the data for further analysis.

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

Today, we use the MQL5 Standard Library to build custom signal classes and let the MQL5 Wizard assemble a professional Expert Advisor for us. This approach simplifies development so that even beginner programmers can create robust EAs without in-depth coding knowledge, focusing instead on tuning inputs and optimizing performance. Join this discussion as we explore the process step by step.

From Basic to Intermediate: Struct (I)

Today we will begin to study structures in a simpler, more practical, and comfortable way. Structures are among the foundations of programming, whether they are structured or not. I know many people think of structures as just collections of data, but I assure you that they are much more than just structures. And here we will begin to explore this new universe in the most didactic way.

Automating Trading Strategies in MQL5 (Part 42): Session-Based Opening Range Breakout (ORB) System

In this article, we create a fully customizable session-based Opening Range Breakout (ORB) system in MQL5 that lets us set any desired session start time and range duration, automatically calculates the high and low of that opening period, and trades only confirmed breakouts in the direction of the move.

MetaTrader 5 Machine Learning Blueprint (Part 6): Engineering a Production-Grade Caching System

Tired of watching progress bars instead of testing trading strategies? Traditional caching fails financial ML, leaving you with lost computations and frustrating restarts. We've engineered a sophisticated caching architecture that understands the unique challenges of financial data—temporal dependencies, complex data structures, and the constant threat of look-ahead bias. Our three-layer system delivers dramatic speed improvements while automatically invalidating stale results and preventing costly data leaks. Stop waiting for computations and start iterating at the pace the markets demand.

Market Positioning Codex for VGT with Kendall's Tau and Distance Correlation

In this article, we look to explore how a complimentary indicator pairing can be used to analyze the recent 5-year history of Vanguard Information Technology Index Fund ETF. By considering two options of algorithms, Kendall’s Tau and Distance-Correlation, we look to select not just an ideal indicator pair for trading the VGT, but also suitable signal-pattern pairings of these two indicators.

Developing a multi-currency Expert Advisor (Part 23): Putting in order the conveyor of automatic project optimization stages (II)

We aim to create a system for automatic periodic optimization of trading strategies used in one final EA. As the system evolves, it becomes increasingly complex, so it is necessary to look at it as a whole from time to time in order to identify bottlenecks and suboptimal solutions.

Market Simulation (Part 07): Sockets (I)

Sockets. Do you know what they are for or how to use them in MetaTrader 5? If the answer is no, let's start by studying them. In today's article, we'll cover the basics. Since there are several ways to do the same thing, and we are always interested in the result, I want to show that there is indeed a simple way to transfer data from MetaTrader 5 to other programs, such as Excel. However, the main idea is not to transfer data from MetaTrader 5 to Excel, but the opposite, that is, to transfer data from Excel or any other program to MetaTrader 5.