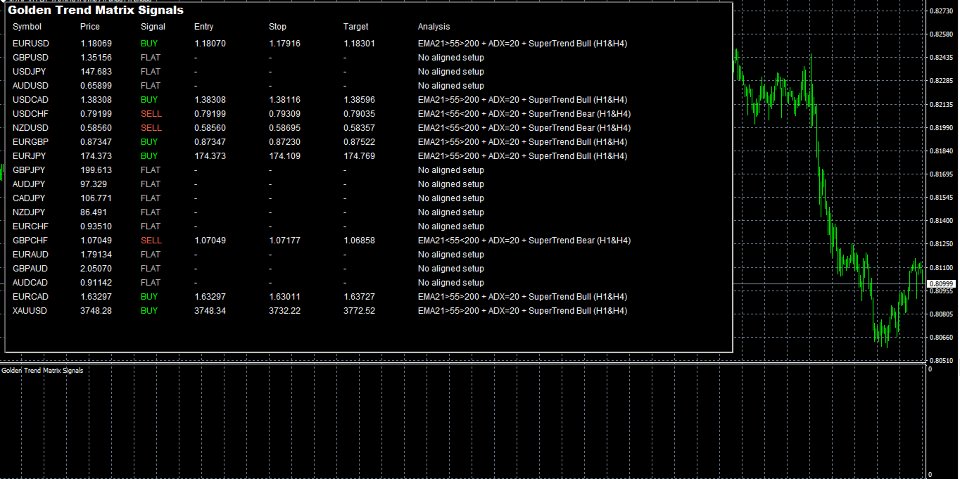

Golden Trend Matrix Signals

- Indikatoren

- Sivakumar Subbaiya

- Version: 1.5

- Aktivierungen: 20

Super Signal Serie - V19 PRO

Golden Trend Matrix Signals- Multi-Filter Trend & Momentum Indikator (H1/H4)

MT4 Gold EA

XAU Trend Matrix EA - Im Wert von $150 : Siehe den EAhttps://www.mql5.com/en/market/product/162870MT5 Gold EA

XAU Steady Gain Pro - Im Wert von $150 : Siehe den EAhttps://www.mql5.com/en/market/product/162861

Gesamter Bonuswert: $300

Verwandeln Sie verrauschte Charts in saubere, handelbare Signale. Golden Trend Matrix Signals vereint 20 bewährte Tools in einem professionellen Dashboard und einer Signal-Engine, die für Swing-Style-Einstiege auf H1/H4 mit disziplinierten Ausstiegen entwickelt wurde.

Was es kann-

Findet starke, aufeinander abgestimmte Trends anhand der EMA-Struktur (21/55/200).

-

Bestätigt das Momentum mit der ADX(14)-Stärke und der SuperTrend-Richtung.

-

Zeitliche Abstimmung der Einstiege mit der Volatilität und dem Kontext der Mittelwertumkehr (BB, Keltner, Donchian, VWAP).

-

Verwaltet Ausstiege über PSAR-Flip oder ATR(14)-Trailing-Stop - nach Ihrer Wahl.

-

Filtert Rauschen mit RSI, MACD, Stoch, CCI, TDI, Ichimoku-Bias, Fraktalen, Heiken-Ashi, Renko-Overlay-Ansicht.

-

Versendet sofortige Warnungen (Popup, Ton, Push, E-Mail) mit Einstiegs-/Ausstiegshinweisen und SL/TP.

Einstieg = EMA-Ausrichtung + ADX-Stärke + SuperTrend-Bestätigung

-

EMA-Ausrichtung:

-

Long: EMA21 > EMA55 > EMA200

-

Leerverkauf: EMA21 < EMA55 < EMA200

-

-

ADX(14): Über dem vom Benutzer eingestellten Schwellenwert (z. B. 18-25), um Trendstärke zu gewährleisten.

-

SuperTrend: Muss mit der Richtung des EMA-Setups zur Bestätigung übereinstimmen.

-

Optionale Kontextprüfungen (umschaltbar): BB/Keltner-Squeeze/Expansion, Donchian-Break, VWAP-Bias, MACD/RSI/Stoch-Harmonie, Ichimoku-Trend-Bias.

Ausstieg = PSAR-Flip oder ATR-Trail

-

Wählen Sie PSAR für einen schnellen Schutz oder ATR(14)-Multiple für eine sanftere Trendfolge.

-

Optionale Teilübernahme in der Donchian-Mitte/BB-Mitte oder auf der gegenüberliegenden VWAP-Seite.

-

KAUFEN: EMA Bull Stack + ADX ≥ Threshold + SuperTrend Bull → Kerzenschlussbestätigung.

-

VERKAUF: EMA bear stack + ADX ≥ Threshold + SuperTrend Bear → Kerzenschlussbestätigung.

-

EXITS: PSAR-Flip-Alarm, ATR-Trail-Treffer, oder optionales Gegensignal.

EMA(21/55/200), ADX(14), RSI(14), MACD, Bollinger Bands, Keltner Channel, SuperTrend, Ichimoku Cloud, Donchian Channel, VWAP, CCI(20), Stochastic(14,3,3), PSAR, ATR(14), Heiken Ashi, Renko Overlay (visuell), Fraktale, TDI.

Empfehlungen:

Paare: EURUSD, GBPUSD, USDJPY, AUDUSD, USDCAD, USDCHF, NZDUSD, EURGBP, EURJPY, GBPJPY, AUDJPY, CADJPY, NZDJPY, EURCHF, GBPCHF, EURAUD, GBPAUD, AUDCAD, EURCAD, XAUUSD.

- Zeitrahmen: M5 , M30 , H1 .

- Konten-Typ: Jedes ECN, Konto mit niedrigem Spread.

- Losgröße: 0.01 für 100 USD Eigenkapital

Dieser Indikator ist nur zu Informations- und Analysezwecken gedacht. Er bietet keine Garantie für Gewinne oder finanziellen Erfolg. Der Handel an den Finanzmärkten ist mit erheblichen Risiken verbunden, und es kann zu Verlusten kommen. Benutzer sollten Vorsicht walten lassen, ihre eigenen Analysen durchführen und ein angemessenes Risiko- und Geldmanagement betreiben.