Grid King MT5

- Эксперты

- Profalgo Limited

- Версия: 9.6

- Обновлено: 19 марта 2021

- Активации: 10

NEW PROMO:

- Only a few copies copies available at 349$

- Next price: 449$

NEW PROMO:

- Only a few copies copies available at 349$

- Next price: 449$

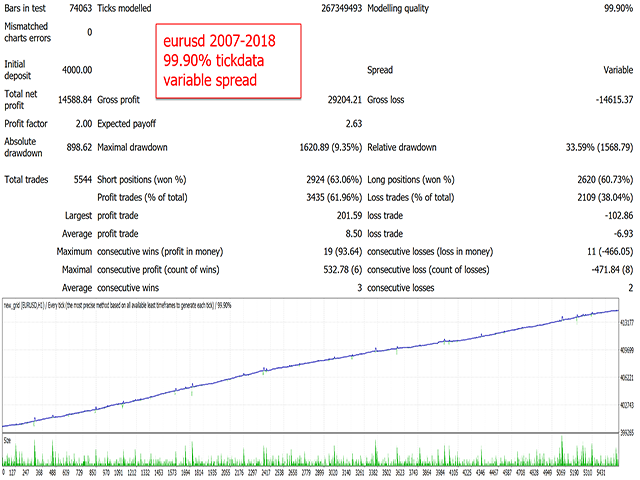

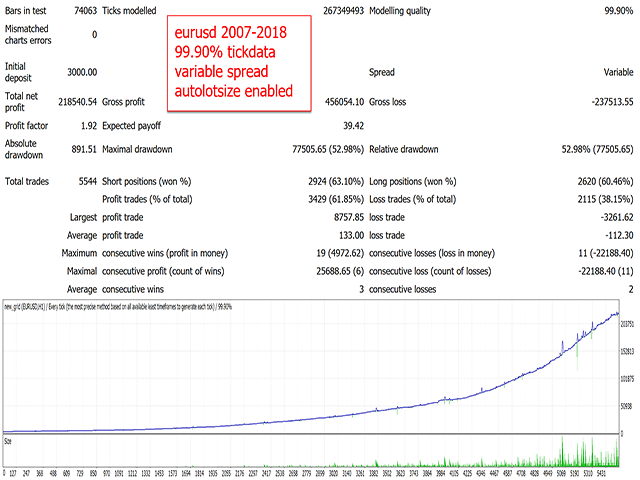

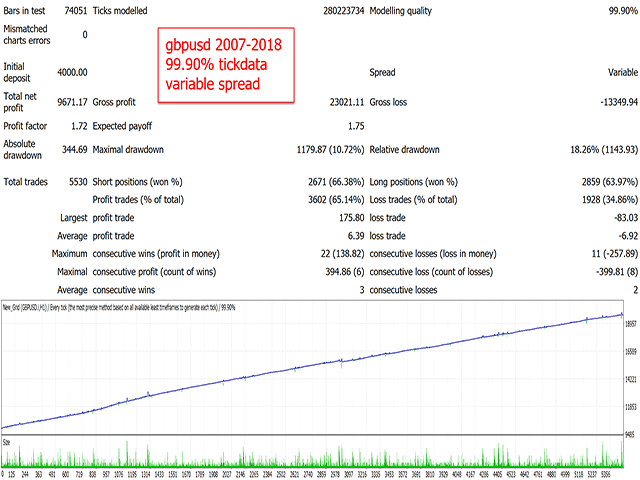

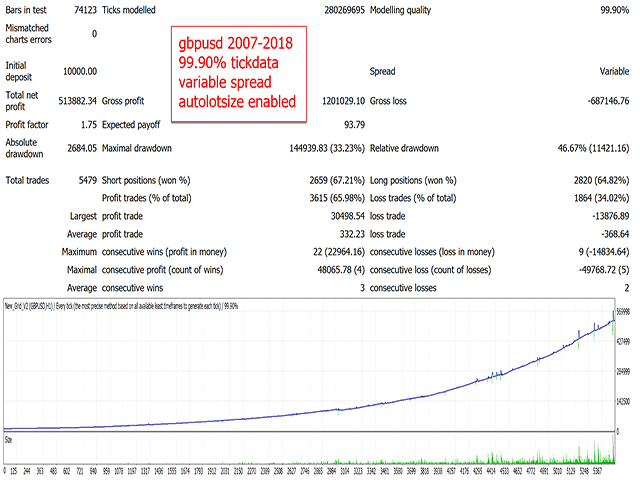

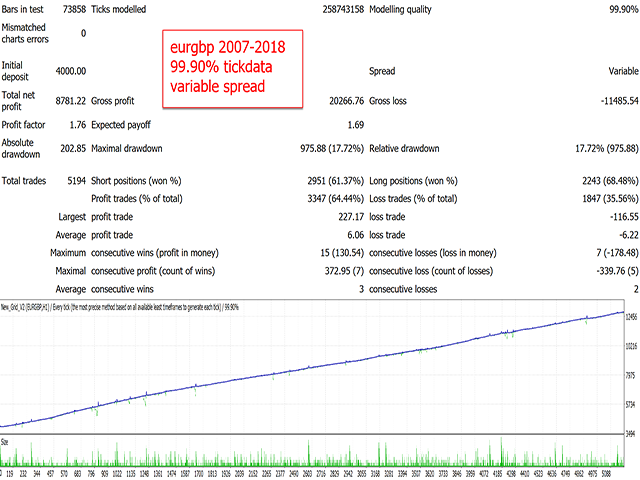

Grid King is a revolution in grid trading. The main focus when developing the EA was safety, by eliminating the margin-call risk which is usually associated with most grid systems on the market. It also strives to achieve much higher returns than the average grid system, by spreading risk amongst multiple pairs and strategies which all have a limited effect on the account-equity. Where almost all grid systems will blow your account when things get bad, Grid King will only take a small loss and recover very fast. More details about this in the blog.

The EA has been stress-tested for a period of 18 years and passes all those years succesfully without any high drawdown.

The EA is also already optimized for 29 pairs.

The EA uses a unique Spread Equalizer Algorithm (S.E.A.), which dramatically decreases the impact of spread and slippage on the stability.

At the moment, 2 strategies are used for entry:

- "Volatility breakout" strategy, where the EA will trade in the direction of strong price movements.

- "Return to Mean" strategy, where the EA will exploit the fact that price always returns to the mean.

Please read the blog before using the EA! -> https://www.mql5.com/en/blogs/post/724854

live results A: -> https://www.mql5.com/en/signals/531880

live results B: -> https://www.mql5.com/en/signals/535006

live results C: -> https://www.mql5.com/en/signals/754363

live results D: -> https://www.mql5.com/en/signals/715438

live results E: -> https://www.mql5.com/en/signals/619924

Key Characteristics:

- Minimum recommended starting capital: 1000$ (run only xauusd and/or eurchf!)

- very stable growth curve as result of smart averaging techniques

- "safety first" approach in development

- optimizable for any market

- ONLY grid-system on the market that passes 18 years of stress-tests on historical data on multiple pairs

- fully automatic

- Not sensitive to spread, commission, or account type, but ofcourse a low spread ECN broker will always work better and is recommended!

- On-Chart visualisation of TP zones

- Optimized pairs: EURUSD, GBPUSD, USDCAD, USDCHF, USDJPY, EURJPY, GBPJPY, AUDUSD, NZDUSD, EURAUD, EURCAD, EURGBP, AUDNZD, EURCHF, AUDCAD, AUDJPY, GBPCHF, AUDCHF, CHFJPY, CADJPY, CADCHF, GBPCAD, NZDCAD, NZDJPY, NZDCHF, GBPNZD, EURNZD, GBPAUD and XAUUSD

- You can use the same magic numbers on different pairs. But the 2 different strategies must use 2 different magicnumbers

- One of a kind S.E.A. (Spread Equalizer Algorithm), which greatly improves stability for bigger spreads and slippages

- Easy Setup: With the OneChartSetup, you can run all pairs from a single chart!

Parameter List:

- Check out the full description here: https://www.mql5.com/en/blogs/post/724854

Recommended Setup:

- Enable autosettings and run only the optimized pairs

- run only on H1 timeframe

- Run 1 chart for each pair or use the OneChartSetup to run all pairs from 1 chart.

- Use leverage of 1:300 or bigger. The EA will need enough free margin from time to time, so a high leverage is necessary.

- works on all brokers (non FIFO only for now)

- All account types are ok (standard, ECN, STP, Micro)

- As with any EA, it is recommended you run it first on a demo account to get to know the trading style of the EA

- Recommended to run on accounts nominated in EUR or USD for best performance of AutoSafety feature.

ACCOUNTSIZE RECOMMENDATIONS:

- balance < 3000$ -> use a cent account with default settings.

- balance between 3000$ and 15000$ -> use default settings

- balance >= 15000$ -> Use 15K set file with GlobalSL

- It is only advised to run "Aggressive" or "Very Aggressive" mode when using the default settings, but not recommended!

- When running all pairs, "Very Conservative" or "Conservative" mode is advised

Never forget that past performance is no guarantee for the future

Excellent EA.I run both simulation and real. Stable returns. Even if stoploss happens. It will pay for itself in 2 or 3 months.Don't be greedy. If you're not looking for 100% return. I'm only looking for 20% a year. The pullback is small, in my portfolio.This EA is very secure. The author is very friendly. Provide timely help. Thank you very much