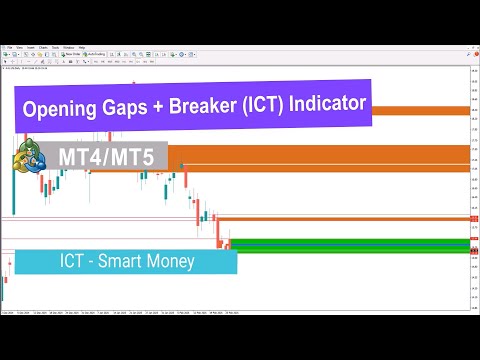

Opening Gaps Breaker Block ICT Indicator MT4

- Индикаторы

- Mehnoosh Karimi

- Версия: 3.1

- Активации: 10

Opening Gaps and Breaker Block ICT Indicator MT4

The Opening Gaps and Breaker Block ICT Indicator for MetaTrader 4 is a sophisticated trading tool designed to identify daily market gaps that function as dynamic support and resistance zones. This indicator is especially effective for spotting critical price areas where potential reversals or continuations may occur.

Support gaps are displayed with green markers, while red markers represent resistance gaps. When price breaks through one of these zones and forms a Breaker Block—where previous support turns into resistance or resistance becomes support—the zone changes to blue, indicating a clear shift in market structure.

Key Features of the Opening Gaps and Breaker Block Indicator

Below is an overview of the main characteristics of this ICT-based indicator:

| Feature | Description |

| Category | ICT – Liquidity – Smart Money Concepts |

| Platform | MetaTrader 4 |

| Skill Level | Advanced |

| Indicator Type | Continuation & Reversal |

| Timeframe | Multi-Timeframe |

| Trading Style | Intraday Trading |

| Markets | Forex, Crypto, Stocks, Commodities |

How the Indicator Works

The Opening Gaps and Breaker Block Indicator detects price gaps that occur due to high-impact economic news, increased volatility, or sudden changes in market sentiment. These gaps often highlight areas of imbalance, offering traders valuable insight into future price behavior.

By combining gap detection with Breaker Block logic, the indicator pinpoints key support and resistance levels. This helps traders enhance entry accuracy, manage risk more effectively, and align their trades with institutional price behavior.

Bullish Market Example

In a bullish scenario, the indicator may mark a resistance gap on the GBP/CHF chart in red. Once price breaks above this zone and holds, the former resistance converts into a Breaker Block and begins acting as support—signaling a bullish shift in market structure.

Bearish Market Example

During a bearish trend, a gap zone can still act as a strong resistance level even if no Breaker Block forms. For instance, on AUD/JPY, price may revisit the identified gap area and get rejected, confirming selling pressure and reinforcing the bearish outlook.

Customization Options

Traders can adjust several parameters to tailor the indicator to their strategy:

- New Day Opening Gap Duration – Defines the time window used to analyze daily gaps

- New Day Opening Gap Display – Enables or disables the current day’s opening gap

- New Week Opening Gap Duration – Sets the analysis period for weekly gaps

- New Week Opening Gap Display – Displays the opening gap at the start of the trading week

Final Overview

The Opening Gaps and Breaker Block ICT Indicator MT4 is a powerful tool for identifying price imbalances and structural shifts in the market. By clearly marking high-probability support and resistance zones, it allows traders to make more precise and data-driven trading decisions.

This indicator is particularly valuable for traders who follow ICT (Inner Circle Trader) methodology and Smart Money Concepts, as it helps refine market analysis and improve overall trade execution.