LSTM Ensemble

- Experts

- Evgeniy Scherbina

- Versão: 2.3

- Atualizado: 5 fevereiro 2026

- Ativações: 10

LSTM Ensemble is a professional trading expert built on an ensemble of 12 independent LSTM models, each of which represents a separate trading strategy. Instead of a single “ideal” model trained using the classic 80/20 scheme, the expert uses a collective decision approach, where the final trading signal is formed based on the consensus of multiple neural networks

Key idea: an ensemble instead of a single model

The traditional approach to training neural networks in trading is: one model → one training → one opinion about the market. Even with careful data splitting (80% training / 20% testing), such a model inevitably adapts to a specific historical period. The market changes — and the model starts to make mistakes.

LSTM Ensemble solves this problem in a fundamentally different way.

How it works? The expert uses 12 LSTM models. Each model 1) is trained independently on its own historical fold, 2) views the market from a different angle, and 3) has its own strengths and weaknesses.

The final trading decision is the aggregated result of the entire ensemble, not the opinion of a single network.

Why an ensemble may be more stable than 80/20 training

The main advantage of an ensemble is robustness.

- An error in one model does not determine the final signal

- Local overfitting effects are smoothed out

- Random market anomalies do not lead to sharp drawdowns

- The expert adapts better to changes in market phases

This makes the strategy more predictable, stable, and resilient in real trading, not just in the strategy tester.

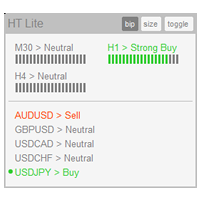

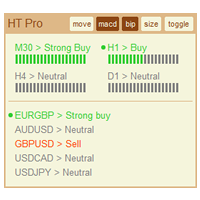

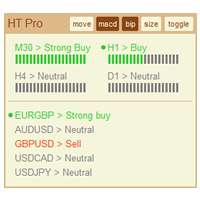

Main timeframe: H6 >> An optimal balance between market noise and signal lag.

The expert regularly reassesses market conditions and updates decisions as new data arrives.

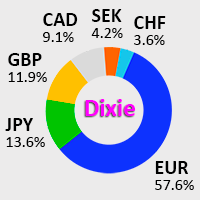

Multi-currency mode: simultaneous trading on 6 currency pairs.

Input parameters

=== Advanced Settings ===

Max positions per symbol – Maximum number of positions per symbol.

Range between positions (points) – Minimum distance between additional positions.

Risk per trade (%) – Risk per trade as a percentage of the deposit (automatic lot calculation).

Spread max – Maximum allowed spread for market entry.

Suffix for symbols – Broker symbol suffix (e.g., .m, _i).

=== Standard Settings ===

Comment — Order comment

Magic number — Unique trade identifier

Take profit (points) — Fixed TP

Stop loss (points) — Fixed SL

Trailing stop (points) — Trailing stop (0 — disabled)

=== Misc ===

Draw font color / size — Visual settings

Log messages (min) — How often to print messages to the event log (minutes).

Multi mode — Multi-currency mode (recommended true)

=== Your Symbols ===

Enable or disable trading for each of the 6 available symbols — you can keep only the markets you consider suitable.

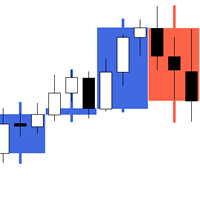

EA paid back it's price in 3 weeks if i didn't close some trades manually it could have been 2 weeks. After i see that i've closed the positions earlier than it supposed to be i let the EA do it's trick. It suprised me this week while markets are shorting the USD.On monday we started to open long positions (to be honest it was earlier than it should be if EA could have hold the positions till tuesday we should be talking about 500-600$ profits now). We had some drawdowns but positions turned positive. Btw i was on a 250$ account with 1:200. The safer approach is 1000$ and author also informs that in the description. For me this EA is by far one of the best buys of 2026. I hope the author can achieve publishing an EA for intraday trade or scalper with LSTM models (it's hard but why not :). Because monitoring every minute is just too boring. Just sit back and trust the process. This EA is definetly for the "PATIENT" traders. EA will hold it's positions for couple of days or even weeks(One of EA's first position was Short USDJPY and finished in 2 weeks). I'm glad that i've found this EA. Best wishes and success to the author.